Now we have a uniformly speculative thought: take stock of Vizio's streaming business, to receive income on the growth of interest of financiers in this area.

Growth potential and duration : fifteen percent for 13 Months; forty percent in three years; eleven percent a year for fifteen years.

Why stocks can go up: popular sector.

How do we act: take shares at the moment 19,94 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

Vizio sells TVs under its own brand and with an integrated SmartCast operating system. The company only recently entered an IPO - in the spring of 2021. Therefore, the main information source about her for us will be her registration prospectus. In accordance with it, the company's revenue is divided in the following way.

Devices — 92,8 % proceeds. The company designs and sells home appliances: smart TVs and speakers, - but other organizations are engaged in the creation. Sector Gross Margin — 9,7 % from its proceeds.

Site + — 7,2 % proceeds. These are all SmartCast features on TV company. The sector's gross margin is seventy-six percent of its revenue. The company's earnings of these functions looks as follows:

- Advertising on the site - 48,74 % of the sector's revenue.

- Data Licensing. The report does not show percentage of revenue.. Fees from marketing companies for the implementation of data from Vizio devices and the site.

- Spread of information, operations and promotion. These are various subscriptions, viewing certain information for money, installation of buttons on control panels for special companies and convenient location of the program for the user inside the operating system. The report does not include a percentage of revenue..

Unfortunately, there is no division of sales by regions in the report, although the company definitely has foreign sales.

Arguments in favor of the company

Fell down. Shares are now even cheaper than IPO placement prices, when they cost 21 $, and almost to 30% cheaper than their historical highs, achieved in May this year. So we can take them with a rebound in mind.

Streaming is cool. The company will grow for the same reasons, as the business of the similar company Roku. Streaming services will have more users and more advertising money, thanks to which these companies will be able to earn as intermediaries. So here I would hope as for the growth of Vizio's financial performance over time, so and for that, that retail investors will crowd into its shares, who consider streaming a promising topic. Vizio has a small capitalization - 3.68 billion dollars, so the factor of the influx of investors is seen here as an even more weighty argument, than the real financial result.

In any case, a steady increase in the number of users of different streaming services, for example in Disney, favored by Vizio.

The company can be bought. Small capitalization and a promising sector can lead to a buyer's company. They can be anyone, but Sony seems to be the most likely purchaser of Vizio.

The Japanese conglomerate occupies a serious position both in the sale of home appliances - 33% Sony revenue, - and in film production and media business - these are collectively 12,23% proceeds. However, Sony does not have its own streaming service., although her content is highly sought after across all platforms. Buying a Vizio for Sony would be a logical decision: all businesses intersect there, acquaintances of the Japanese company, and there is an opportunity to capitalize on the growth of streaming, without spending money on developing your own platform, similar to Netflix. However, this is just an assumption - anyone can be a Vizio buyer.

What can get in the way

Comparison with Roku in favor of Roku. Roku has a similar business system: the consumer buys the device and on it brings the company the main profit in the service segment. Therefore, Roku looks more competitive.: her clients buy a prefix, and Vizio customers buy a TV. As you yourself understand, it is a little easier to buy a set-top box, how to buy a new TV, - this may slow down Vizio's business in the future. Actually, already slows down: sales of Vizio devices fell last quarter, and at Roku they grew up, albeit slightly.

Concentration. У Vice, according to the prospectus, most of the shipments come from four unnamed companies. The largest supplier 44% supplies, the rest - 29, 8 And 1%. Vizio also has a large concentration among buyers: five unnamed companies account for most of the sales − 49, 12, 11, 10 And 10%.

Given the big problems with rising labor costs, increase in delivery time and lack of components, you can be afraid, that logistics will spoil Vizio's reporting this year. The cost of TVs and their delivery may rise for the company, and delivery times may be disrupted.

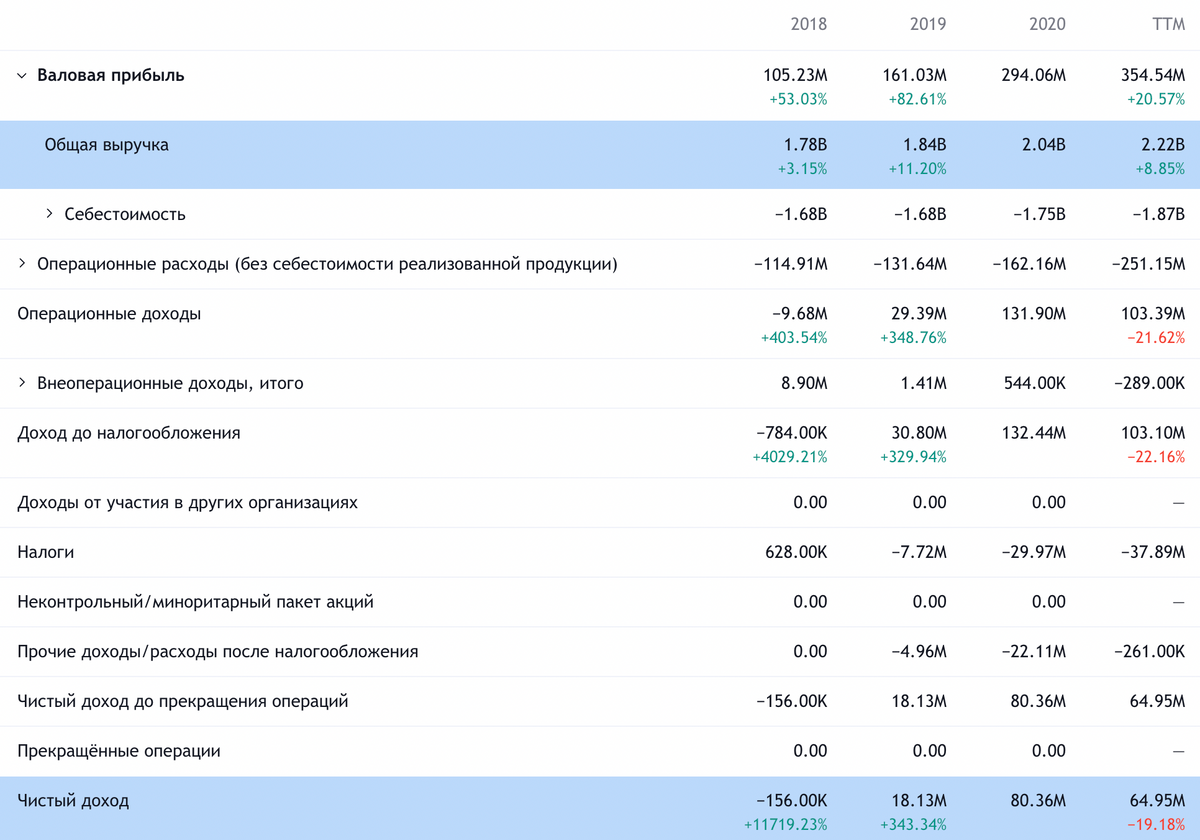

Uneven bookkeeping. Vizio is not a chronically unprofitable company, but last quarter it recorded a loss due to a sharp increase in costs. Investors are now not very good at unprofitable companies due to the expectation of a rise in the cost of loans., so stocks can still shake. Actually, due to losses higher than expected stocks and fell.

The conjuncture is not everything. Roku noted, that in the last quarter the number of hours, that users spend on its platform, began to decline as, how quarantine was weakened everywhere. Vizio has the same problem: although the figures are still higher, than a year ago, in 2021 2 quarter, users began to spend less time on the Vizio platform compared to 1 quarter. This could negatively impact her business in the short term.: the less time users spend on the platform, the less money Vizio gets.

In the foreseeable future, the situation for the company will develop quite positively., as the numerous restrictions on population mobility around the world, seem to be, stay for a long time, which means, consumers will spend more time in front of screens. But seasonal bursts of mobility can negatively affect the company's reporting and quotes.: For investors, the streaming business is more or less strongly associated with quarantine and staying at home..

What's the bottom line?

You can take shares now by 19,94 $. Then there are three options:

- wait for the price 23 $. Think, that we can reach this level in the next 13 Months;

- wait for quotes to return to 28 $, their historical maximum. Here, probably, will have to wait 3 of the year;

- keep shares next 15 years in sorrow and joy.