Now we have a very speculative thought: take stocks of the Skillz cellular playground (NYSE: SKLZ), to earn income on their rebound.

Growth potential and duration : thirty three percent 15 Months; ninety percent in four years; 309% ten years.

Why stocks can go up: they fell very much, and the sector of the company is promising.

How do we act: take shares at the moment 10,5 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

Skillz on the exchange not so long ago - since December 2020. This is a platform for online mobile games, in which players from all parts of the world can compete for funds. Games are made by third-party creators, while Skillz makes money, receiving a percentage of the amounts, which players pay into the prize pool before participating in the competition. Skillz share - 16-20 percent of the amount paid.

How the site itself is arranged, You can watch it on YouTube channel Skillz. The company report contains virtually no fascinating information., no sector breakdown.

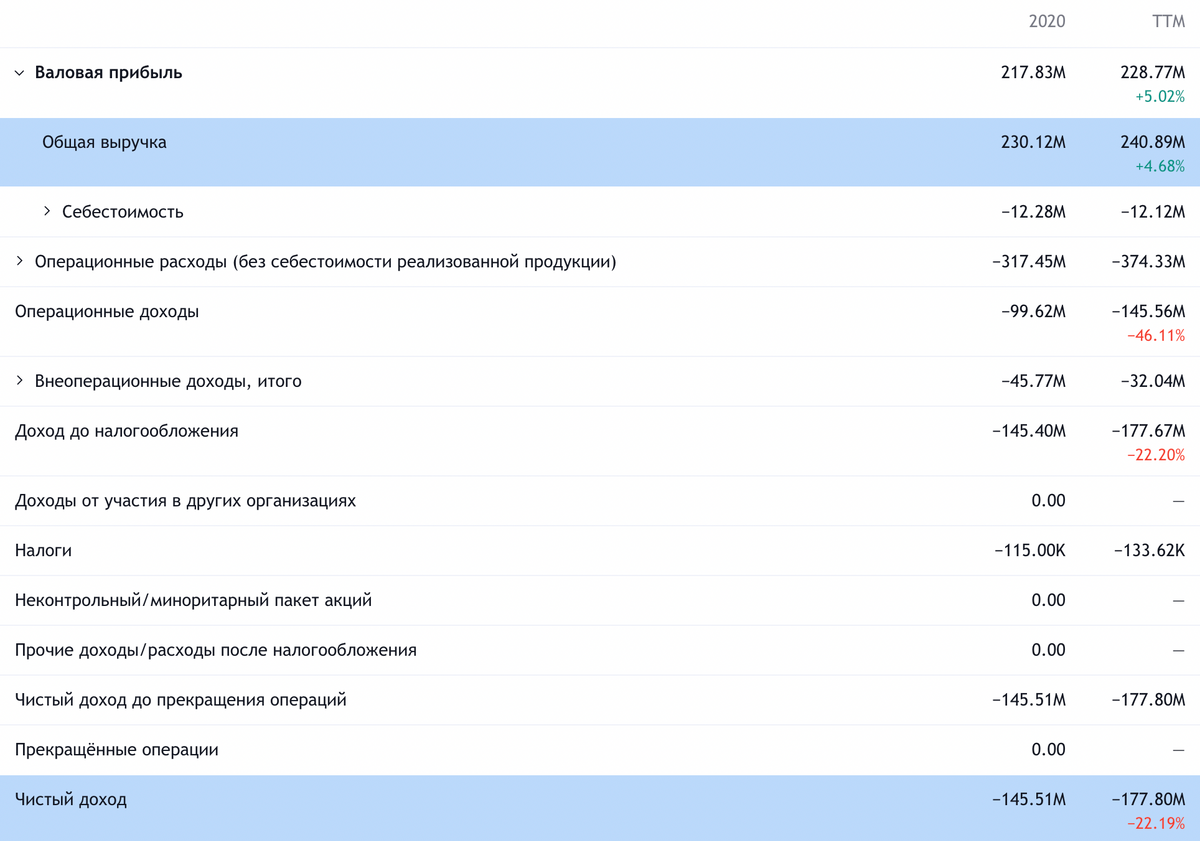

The company makes a huge part of its revenue in the USA., about unspecified other states only, that they give less than ten percent of the revenue, without interest order. The company is unprofitable.

Arguments in favor of the company

Dropped - select. This year, stocks have fallen 76%, so you can pick them up now in anticipation of the rebound.

The first player to be sad. If you look at the statistics on topics, who plays video games in the usa, then the data on them is approximately:

- 227 million people play games;

- 58% less of them 40 years;

- 57% playing games on smartphones;

- 89% don't play alone, and in multiplayer mode;

- about 78% play more than three hours a week.

Statistics on Skillz users are about the same, and in other countries the situation is very similar. In economic terms, these young generations are the most unpromising: they will have less money, than their parents, and more expenses.

Platforms like Skillz even give players the ability to "make" money, occupying them: something similar could be seen in the TV series "Black Mirror", where people turned bikes and got bonus points for it, which could be exchanged for real goods. This is the same "work" that awaits a significant part of the world's population in the future - as, how the work of many enterprises will be automated and an increasing number of office and industrial workers will be reduced.

We've already seen it all in 2020: tens of millions of people were deprived of the right to work, driven into apartments, leaving only the opportunity to play games and watch TV shows, while companies have automated business processes.

By the way,, Thanks to the same model, Roblox also works. So Skillz has every reason to hope for revenue growth.. Truth, there is no certainty, that Skillz will ever turn a profit. But I think, that its shares will still be pumped up like large, and retail investors. Large - for the same reason, like Uber with Lyft: logical continuation of the experiment with pauperization of workers. And retail - because, that "bright and promising". Skillz has a small capitalization of $4.23 billion, therefore, quotes will be very sensitive to the injection of funds from investors of all sizes.

Gross margin at Skillz is 95% from proceeds, which roughly corresponds to the metrics, recently listed by Goldman Sachs as an important parameter when choosing stocks. There are a lot of inexperienced investors on the stock exchange, who are really guided by the, that "Goldman Sachs says so", and due to only such investors, Skillz shares can grow well.

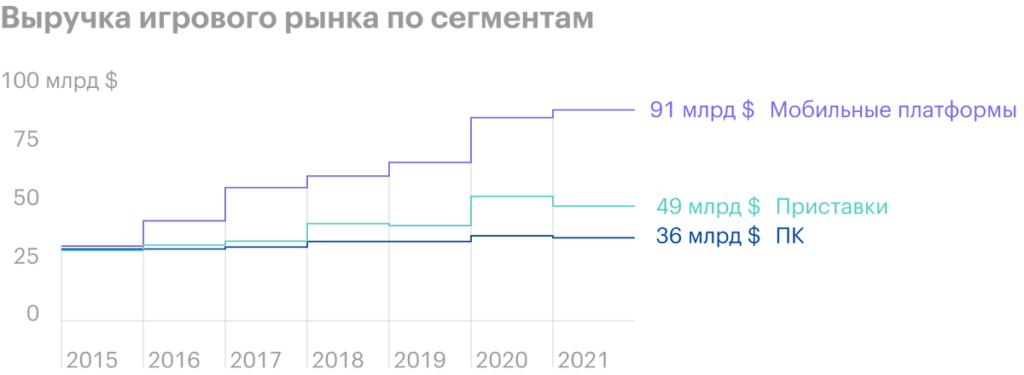

Can buy. A strong drop in quotes and a small cost, along with unprofitability, may lead Skillz to be bought by one of the major game manufacturers.. The reasons for this are quite simple.: console and PC games market stagnating and shrinking, and in the mobile segment, against, there is a tangible growth. So I wouldn't be too surprised, having learned, what Skillz buy. Moreover, such an outcome is very likely.

What can get in the way

This is SPAC. Skillz appeared on the stock exchange not as a result of a full-fledged IPO, and as a result of the merger with a shell company. This poses several problems at once.. Firstly, holders of options on Skillz shares since, when was it SPAC, can these options use. This can lead to a dilution of existing stocks and a drop in their value.. Secondly, this is a possibility of fraud. Many private lawsuits have been filed against the company now: the facts of concealment by the management of important information and distortion of accounting were revealed. For example, about that, that revenue from its most popular games began to fall. The second moment can be fatal and, in general,, increases the risks of bankruptcy of the company.

Founders. The founder of the company, Andrew Paradise, has a controlling stake - 84% of votes. Usually, founders with such influence in the company can make decisions not in favor of minority shareholders like you and me.. For example, such management may refuse to sell the company at a bargain price just for the sake of "building an empire".

Glitch in the Matrix. Temporary easing of quarantine led to a reduction in time, which users spend in front of screens like TVs, as well as phones. The company dropped a number of metrics: from the number of monthly paying users to average revenue per user. In the long run, these figures will have to grow., but investors are very badly affected by news of a slowdown in growth: startups are expected to constantly grow their performance, not their seasonal fluctuations.

Developer concentration. According to company report, most of the games on its platform are created by two developers - 59 And 28% games respectively. So a change in relations with one of them can have an extremely negative impact on the company's financial statements..

China. China is one of the most promising potential markets for Skillz, but the company is not represented there yet. At the same time, the recent campaign of pressure on the gaming industry in China by the Chinese government somewhat limits the likely profit from a possible expansion in China.. Furthermore, Other Asian countries may follow the example of the Chinese government. Overall, this is not a terrible negative for Skillz - rather, it slightly narrows the company's revenue growth space..

Unprofitableness. Lack of profitability guarantees the volatility of Skillz quotes. Moreover, recently the shares of unprofitable technology companies have been performing worse than the market.. And with unprofitability, the threat of bankruptcy is always nearby..

What's the bottom line?

We take shares now by 10,5 $, then there are three options:

- wait 14 $, who asked for these actions back in July. Think, that we will reach this level in the next 15 Months;

- take courage and wait 20 $. It seems to me, what will have to wait 4 of the year;

- become insolent and wait for stocks to return to their all-time high in 43 $, achieved last February. Here you should prepare to wait 10 years.

In my opinion, the threat of bankruptcy of the company is present in equal proportions in all three cases, as well as the probability of buying the company by someone bigger. But it's important to understand, that this is an extremely speculative idea and only that money can be allocated for it, which you don't mind. If you are not ready to tolerate stock volatility, you shouldn't even get close to Skillz.