Today we have an extremely speculative idea.: take shares in software and drug development vendor Cryoport (NASDAQ: CYRX), in order to earn on a positive conjuncture for the company.

Growth potential and validity: 21% behind 15 Months; 42% behind 3 of the year.

Why stocks can go up: there is a great demand for the company's solutions.

How do we act: take now 57,44 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

The company supplies its customers with various temperature control solutions.

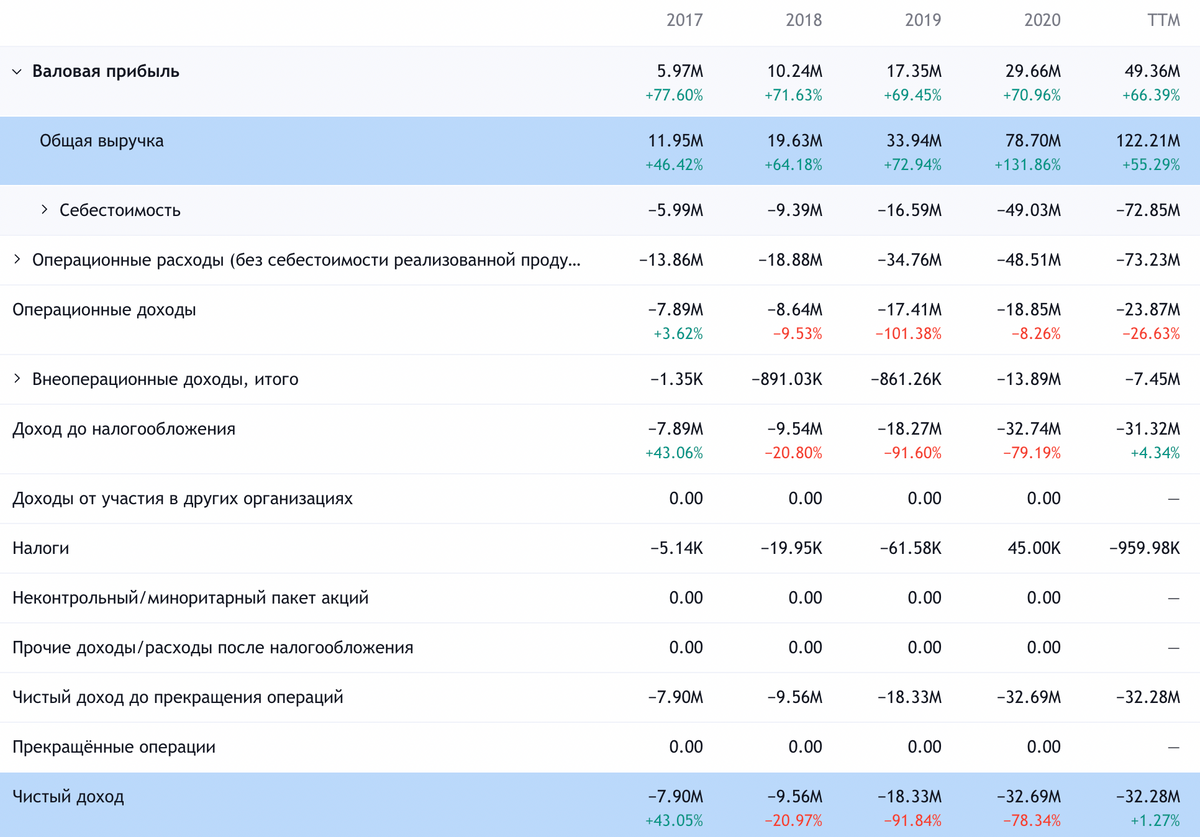

According to the company's annual report, its revenue is divided as follows.

Services — 70,26%. Cloud company platform, which allows you to manage logistics in the field of drug development, ensuring the supply of temperature sensitive materials. The delivery services of such materials are also taken into account here.. Segment gross margin — 46,62% from its proceeds.

Goods — 29,74%. Supply of various goods, required for the storage of temperature sensitive materials. The company itself does not manufacture these goods - third-party firms do it for it in accordance with the specifications, indicated Cryoport.

Segment gross margin — 45,12% from its proceeds.

The main consumers of the company's products are medical institutions. According to the structure of customers, revenue is distributed as follows::

- biotech- and pharmaceutical companies 84,36%;

- veterinary medicine 9,97%;

- reproductive medicine - 5,67%.

By region, the company's revenue is divided as follows::

- America - 63%;

- Europe, Middle East and Africa - 25,8%;

- Asian-Pacific area - 1,2%.

Arguments in favor of the company

As promising. All of the company's major markets are to a greater or lesser extent characterized by good prospects.

The main market - biotech and pharmaceuticals - a priori assumes huge spending on the part of customers to create new drugs. All medicines have a patent expiration date, and when it expires, competitors get the right to produce cheap analogs.

Drug development takes a very long time - until 7 years - and requires a lot of money. Therefore, pharmaceutical companies are forced to spend crazy money on R&D in a constant mode., just so as not to lose in revenue. So Cryoport is doing well on that front..

With veterinary medicine, the growth rate is not so great, but still this market, according to the company's estimates, will grow to 2026 on average by 5,8% in year. With regard to reproductive medicine, here the company expects growth rates in the region 9,8% to 2026.

By the way,, there is a Progyny company, working in the field of reproductive health, and it has a very high revenue growth rate and, together with similar companies, can serve as a good generator of order growth for Cryoport.

Cryoport is a fast growing company. This may overtake the lovers of everything "promising" in her actions.. Considering, that its capitalization is only 2,62 billion dollars, she can easily be pumped up by the chatting efforts of Robinhood users.

Can buy. Given the strong demand for R&D, I think, that the company may well be bought by some Danaher, Fortunately, the company recently released an excellent report. Taking into account the price of Cryoport and the almost two trillion US M&A deals volume this year, buying Cryoport even at the highest price will be a drop in the ocean.

What can get in the way

Unprofitableness. Lack of profit suggests price volatility, and small capitalization is rather a minus here: such stocks may well “walk down” by 30-50% per session.

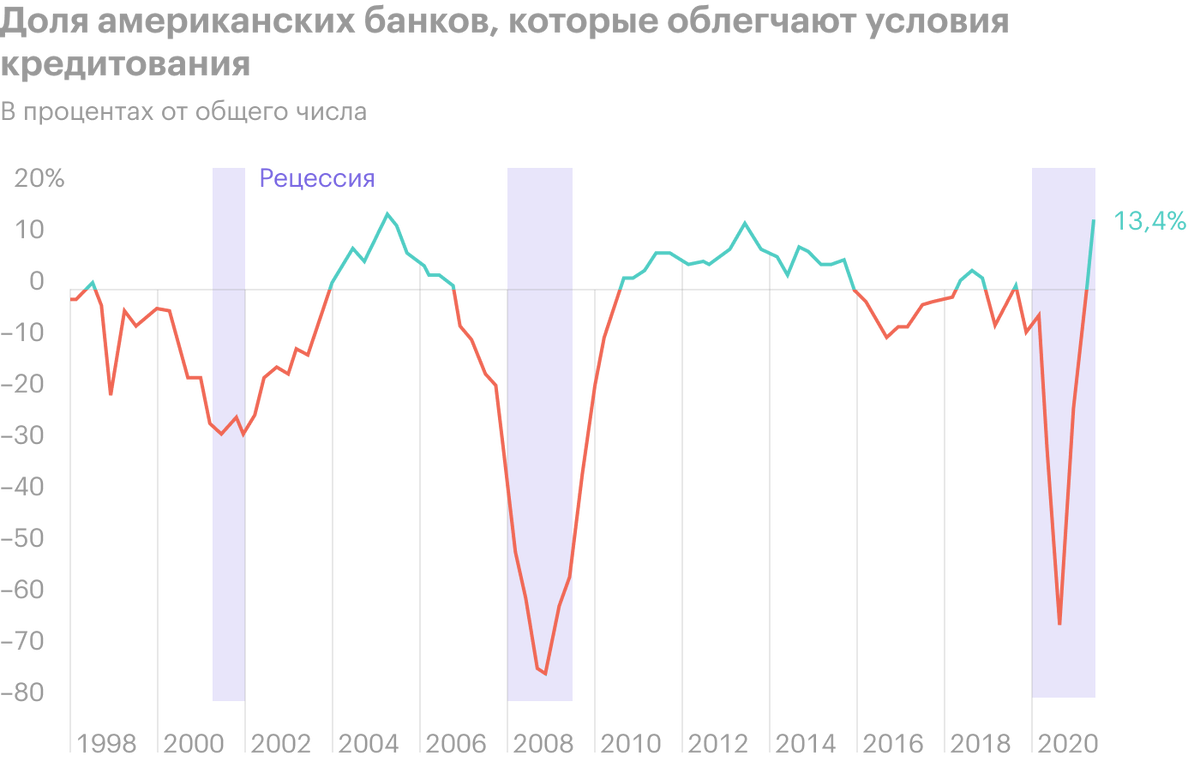

And loss is a big minus, as the rate hike is coming, because this means a rise in the cost of loans. US lending terms are now the most favorable for a very long time, and even a slight deterioration can adversely affect the company's accounting.

It is also possible, what if the company does not go bankrupt, then it will be on the verge of bankruptcy - and then someone will buy it at a reduced price. In this case, we will not earn on these promotions..

What's the bottom line?

We take shares now by 57,44 $. And then there are two options.:

- we wait 70 $ and sell. Think, that the company will reach this level in the next 15 Months;

- we are waiting for the price to return to the indicators of January this year - 82 $. I believe, that this level of quotation is reached in three years.

But still, one should take into account the volatility and riskiness of these stocks..