Online broker Robinhood (NASDAQ: HOOD) plans to go public 29 July. And although the date of the IPO may still change, we decided to disassemble the company's business on the eve of this event.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

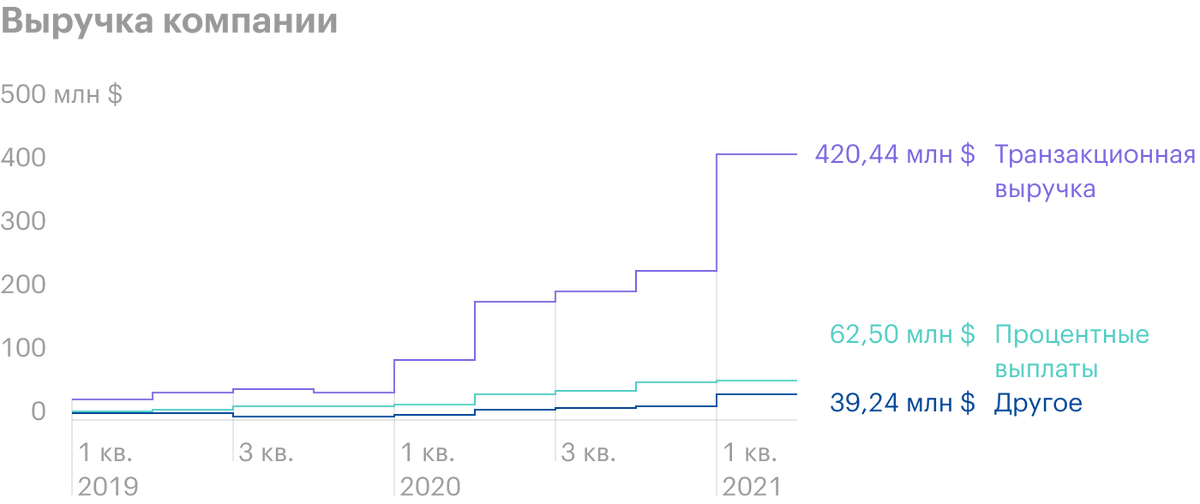

Our main source of information about the company will be the latest version of its registration prospectus, full of beautiful illustrations in the spirit of the works of the French comics artist Jean Giraud, also known as Möbius. According to the prospectus, the company's revenue is split as follows.

Transactional revenue — 75,1%. This is what, what the company receives from users from their transactions with shares, options and cryptocurrencies. The platform does not charge a commission from users, and the income here comes from the fee for the flow of orders.

Robinhood sells customer transaction data to large financial companies, trading on the stock exchange, for example Virtu. Receiving data on the movement of requests for shares, these companies get the opportunity to earn, predicting price movement. Robinhood here gets a percentage of the difference between the bid price and the bid price..

If you think, what smells like cheating users here, it's not just you who think so.. Really, the company earns the most, when the difference between prices turns out to be the most disadvantageous for the client.

In the first quarter 2021 year, the segment's revenue was divided by type of instrument as follows:

- Options — 47,08%.

- Promotions — 31,72%.

- Cryptocurrencies — 20,84%.

- The mysterious "other" 0,36%.

Interest payments — 18,5%. Here the company earns on customer deposits and providing them with leverage. In the first quarter 2021 year, the segment's revenue was divided by type of income as follows:

- Giving shares on loan — 57%.

- Interest income from issuing loans to customers — 44,37%.

- Interest income from money on deposit and shares — 1,77%.

- Other interest income — 1,32%.

The total amount exceeds 100%, and that's okay.: from this the company deducts the share of its counterparties, providing credit, and in the final revenue you get round 100%.

Other — 6,4%. This is a paid subscription to Robinhood Gold, which gives advanced options for replenishing deposits, Analytics, access to market data and margin trading, and these are various commissions from users and transfers-refunds, which the company receives.

Robinhood so far works only in the US.

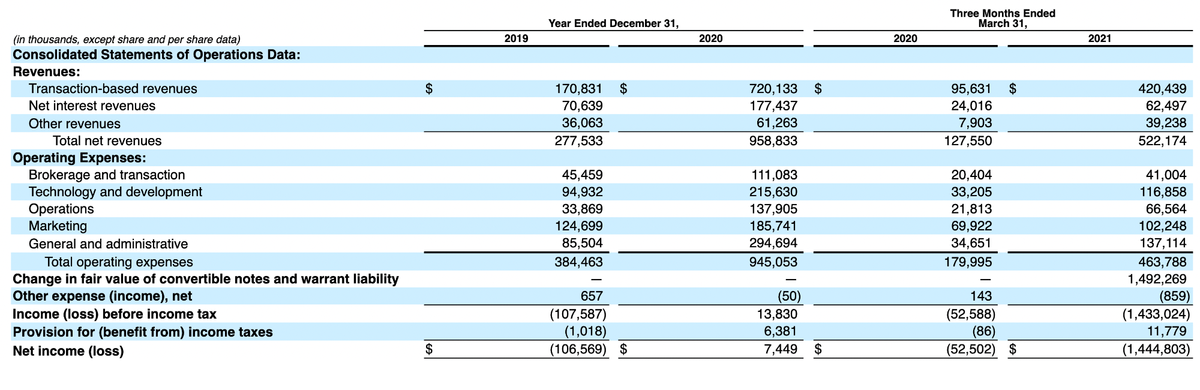

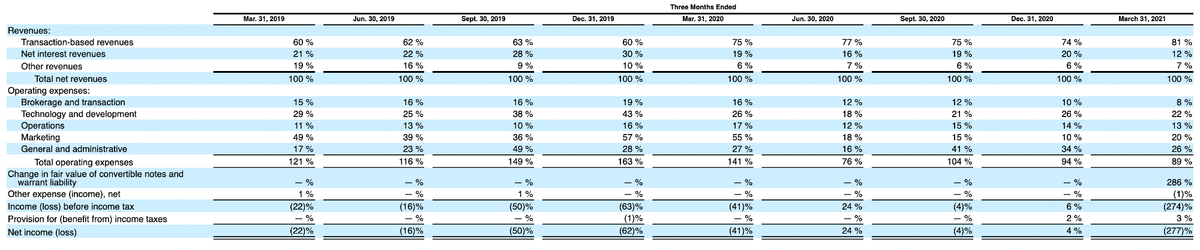

The company's profitability jumps, but in general you can say, that it is rather unprofitable. 2020 she finished the year with a final margin 0,77% by receiving a one-time tax deduction, operating margin was 1,44% from proceeds, but in the first quarter, it made a big loss..

Value in the eyes of the payer

Robinhood shares will be in the range of 38-42 during the IPO $, which implies capitalization in the area 35 billion dollars. Let's figure it out, how justified is this assessment.

It is important to understand, that the company is unprofitable. In this quarter, it predicts a loss in the region of 487-537 million, what will be less, than in 1 quarter, - then the losses amounted to 1,4 billion dollars. Unprofitability is already a fat minus for any company on the eve of raising rates and rising borrowing prices..

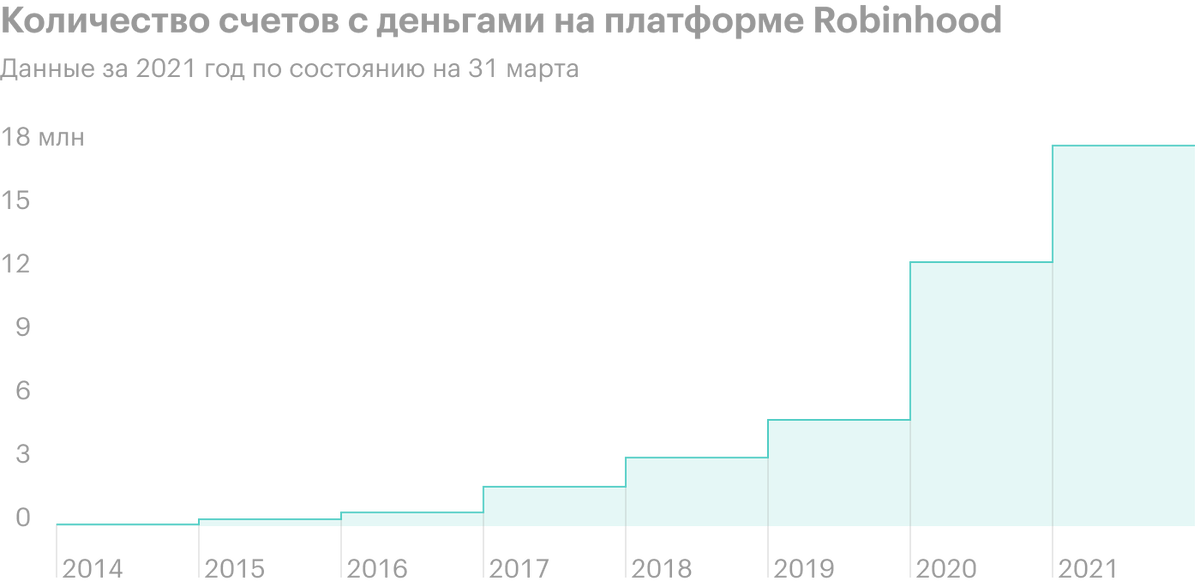

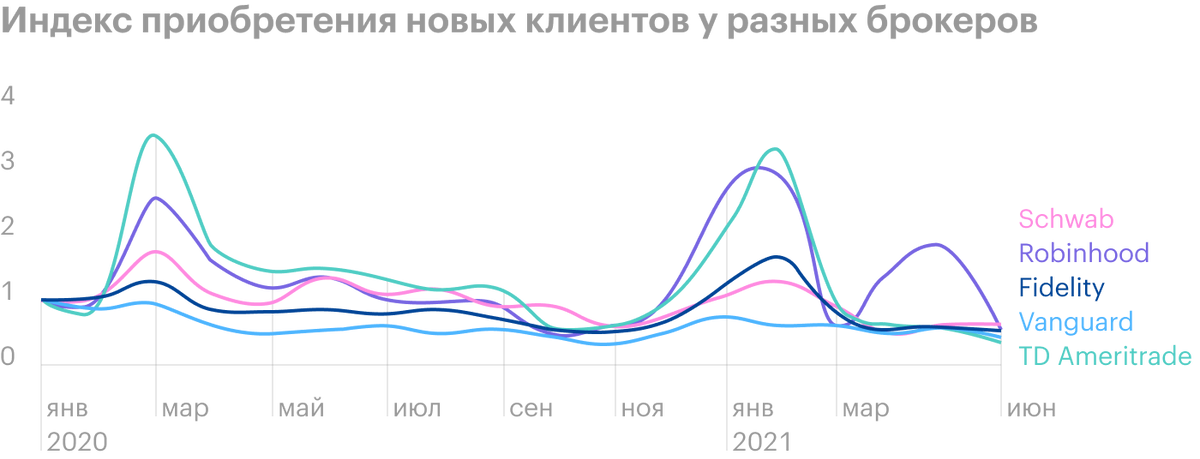

If you compare Robinhood with the largest competitors, then it is not so far from them in terms of the number of customers: у Charles Schwab 32,3 million active accounts, Fidelity has about 29 million, and in Robinhood - 22,5 million. That's quite a lot, Considering, that Robinhood is much younger than these companies.

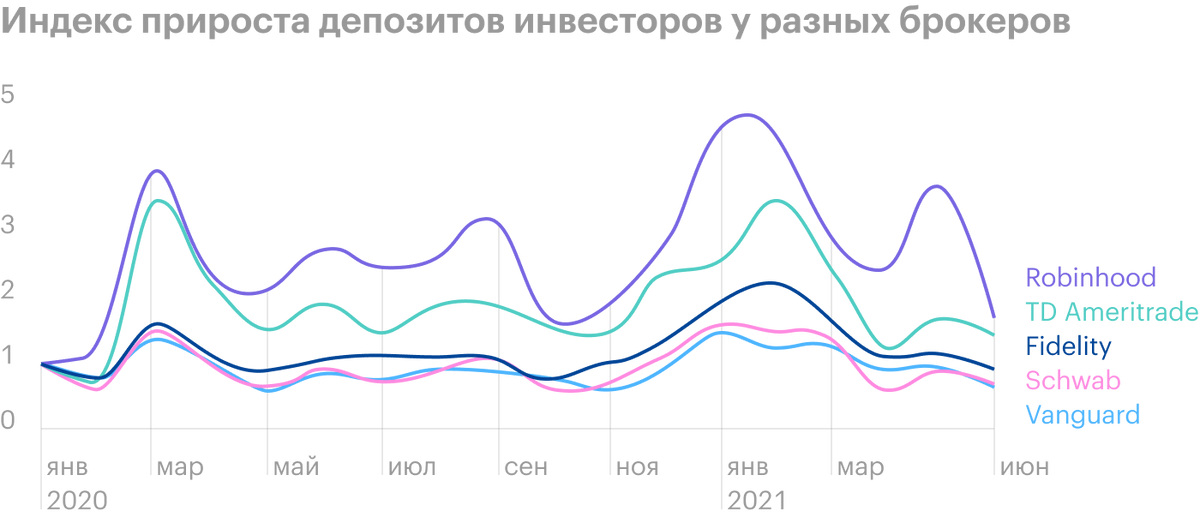

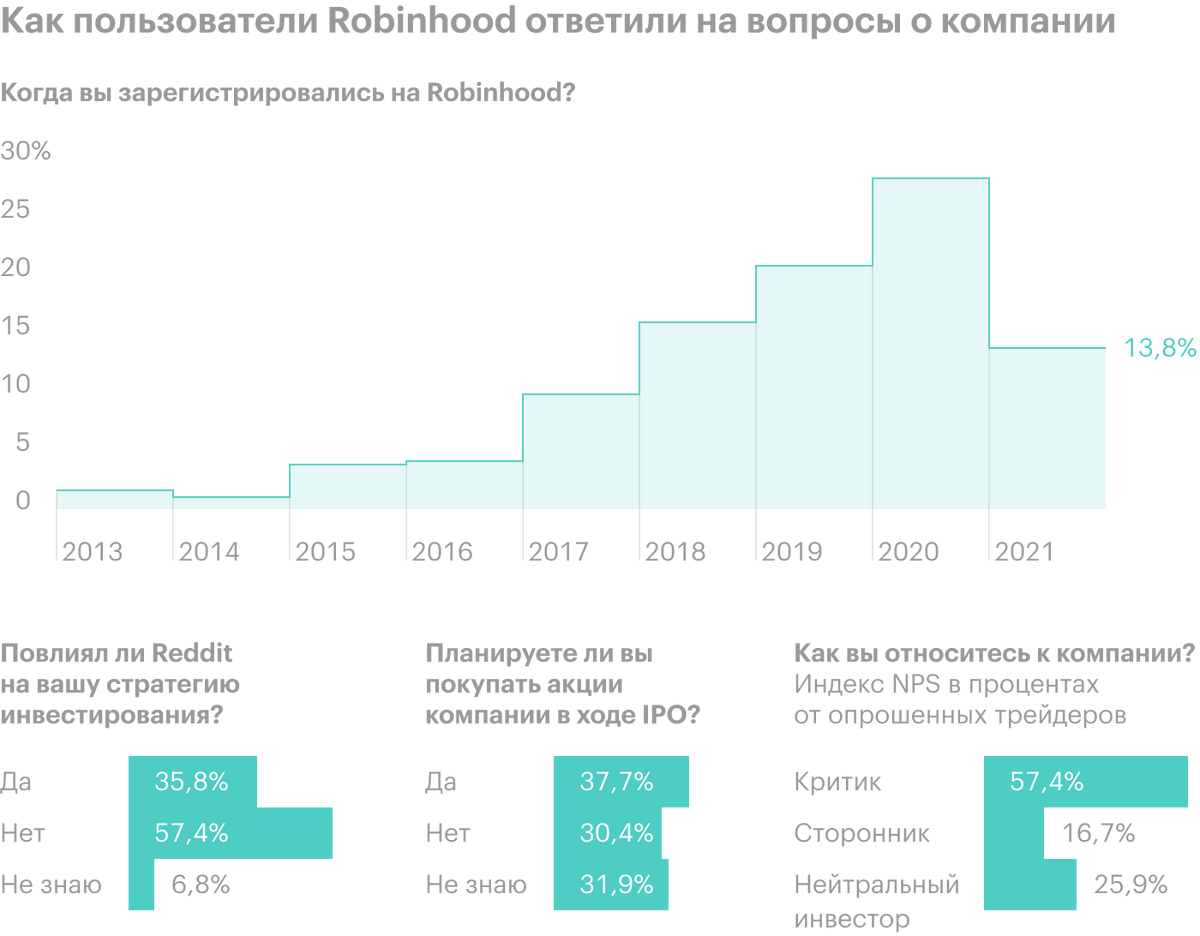

Robinhood was born in 2013 year, and at the end 2020 the company had 12,5 million active accounts. And the growth dynamics of Robinhood are really impressive..

Yes, this is wonderful, but. The growth of the company is impressive, but there are caveats here: Robinhood doesn't benefit from a fast growing customer base, as it might initially seem. Robinhood approximately 69,65% from the number of Schwab customers, but the company's revenue is only 9,2% from the Schwab level. In other words, Schwab is more efficient in terms of extracting money from its customer base, even if it's not growing at the same insane rate., like Robinhood.

Will Robinhood be able to maintain the same growth rate in the future?? There are some doubts here.

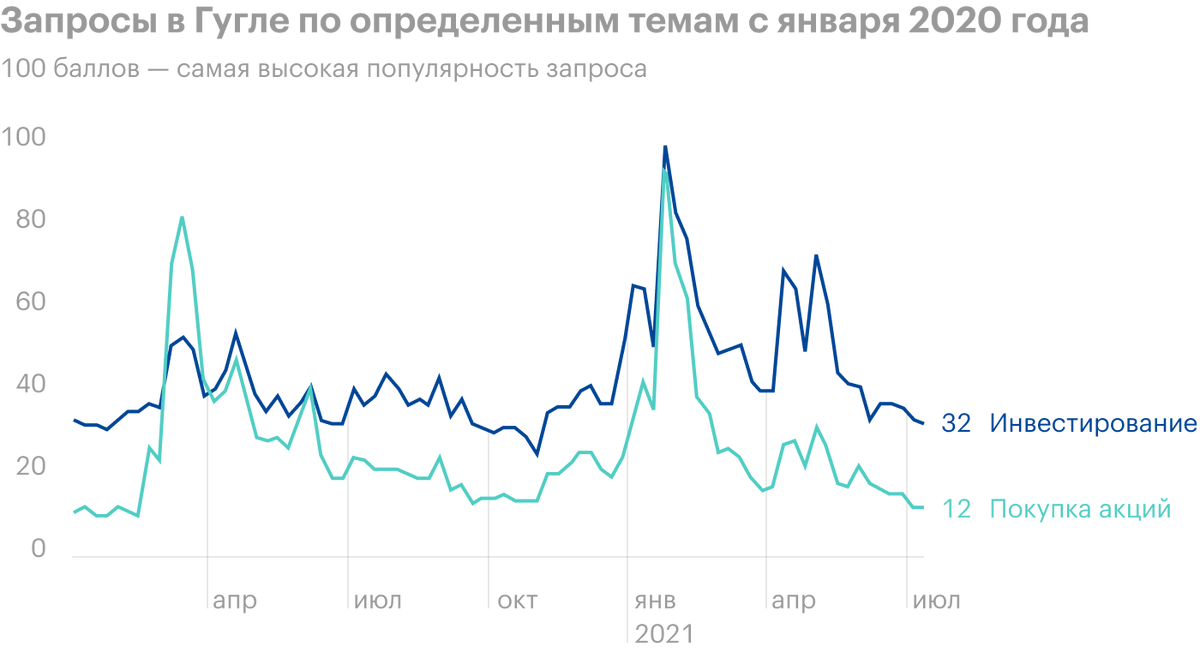

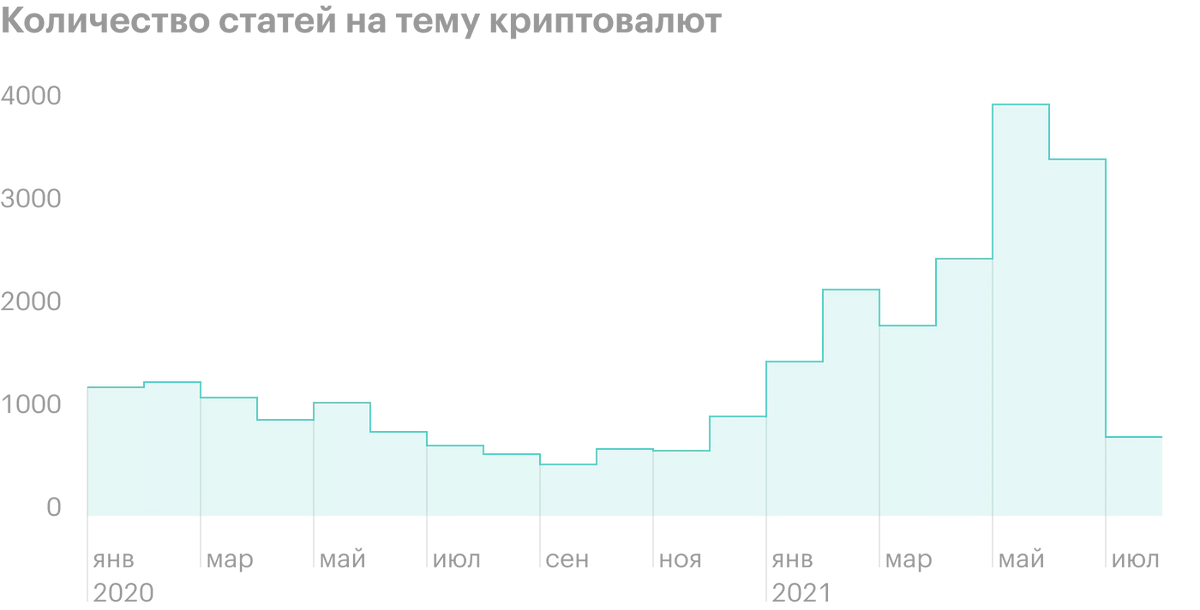

Judging by some indirect signs: decrease in requests in Google about stocks and a decrease in media attention to cryptocurrencies, – the growth rate of activity on the company's platform may noticeably decrease in the coming months – although here I would like to be mistaken.

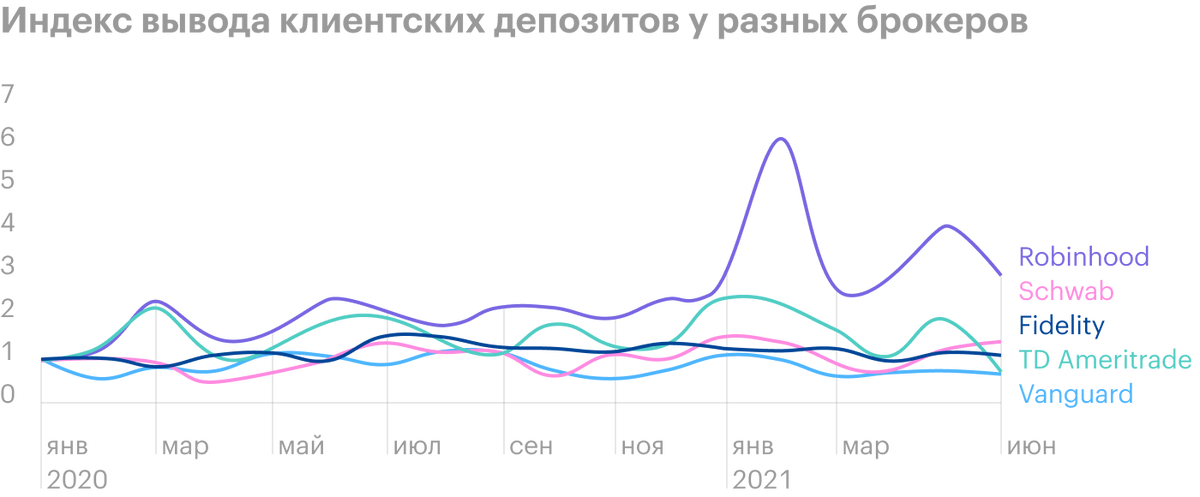

However, if you look at such metrics, how to withdraw money from the account and monthly increase in new customers, then you can see, that now the platform is no longer as popular, like before.

Robinhood's share in the retail investment niche has not grown much over the past year and a half., although it is quite noticeable - 37% from the market.

Need more gold and ziggurats

Usually, in the case of different growing startups, the company has the opportunity to, that someone bigger will buy it. But in the case of Robinhood, this seems dubious - if you mean the purchase of the company at a price higher 35 billion dollars. It's just not as effective in making money from users compared to its peers or competitors..

If you look in quarterly context, then TD Ameritrade and E-Trade, when they were independent companies, each received a 500 $ proceeds from the client, Schwab gets on 600 $ revenue per user, and Robinhood - only 137 $. It will not be enough! If you evaluate the expected capitalization of Robinhood from the position of "how much is a client account worth", then it looks overvalued given the low profitability of these accounts: 1,5—1.6 thousand dollars from Robinhood - compare with 1,8 thousands of dollars at the expense of E-Trade - such profitability was hers, when it was bought by Morgan Stanley. Obviously, that E-Trade was worth its money, because I extracted a lot more money from client accounts. Robinhood's customers are significantly less profitable..

Robinhood's limited technical and financial capabilities should also be taken into account., which led to, that in the first half of this year, the company let down users: its application restricted user transactions with securities of interest to them. And there were a number of crashes and software errors., which led to losses for many users. As a result, the company had to pay fines and compensations for almost 70 million dollars. Think, that with the expansion of the company, the risks of recurrence of such cases increase - and the scale of damage will certainly increase.

Flow to the wrong place

Payment for the flow of orders from the company gives too large a percentage of revenue - almost 3/4 of the total. Charles Schwab only has 5% proceeds. And that's a big problem..

Due to obvious conflict of interest: broker motivated to give clients the least favorable prices, to earn on the difference, - This practice is reasonably considered to be, to put it mildly, Ambiguous.

Now in the United States there are talks about restrictive measures in this direction, up to and including prohibition. Here you should take into account, that in other countries of the Anglosphere - Great Britain, Canada and Australia – fees for the flow of orders from brokers are prohibited. How could it not turn out that way?, that the same thing will happen in the US. Then Robinhood will lose its main source of revenue.

But even if it doesn't., the structure of the business itself, built on the sale of information about the flow of orders of its customers, vulnerable to changes in market conditions. Information of this kind has value mainly during periods of volatility.. This volatility, along with the interest of retail investors, may fall - then the demand for Robinhood information will fall.. Certainly, the company develops other sources of income, but it takes time and money.

However, the impoverishment of a significant part of Americans will make speculation on the stock exchange the norm and the increased level of volatility in the long term will continue. So that, I think, money for data on the flow of orders will pay good – unless this business is banned or restricted by law. This, however, does not negate the, that in the interval of one or two quarters, the market can be relatively calm, what can slow down the growth of Robinhood's financial performance and, respectively, lead to a fall in shares.

And they can shave on the throat with a razor.

The average Robinhood user has about 240 $ - far less, than the user of the same Charles Schwab, - there are users on average 320 thousand in the account. But with such an audience, the company has occupied a good niche.: a crowd of greedy and not so wealthy investors began to play a big role in the market largely thanks to Robinhood.. And that connection., seem to be, may become even stronger after the company enters the stock exchange.

Poll, robinhood users use the company application in ascending order for the following operations:

- Trading in stocks and ETF.

- Cryptocurrency trading.

- Share trading.

- Options trading.

- Receiving income from money on deposit.

Ash 35% from shares, which Robinhood plans to put up for IPO, reserve separately for sales to the company's customers. It's more, than is usually the case in such cases: in the course of an IPO, companies usually reserve about 10% Shares, the rest is received by banks and funds.

It's hard to say now, how will it turn out, because in similar examples the outcome was very different. Stocks can both rise, and fall - depending on the behavior of investors and the level of technical implementation of the idea. For example, During the IPO, Facebook allocated about 25% shares in 2012 and the shares fell on the day of the IPO. Although in the long run, this does not play a big role.: the same Facebook for the past 9 years rode very far from the IPO price.

Another option is possible with a strong drop in shares from the short by the users themselves.. Incidents with the restriction of operations with popular shares and the shutdown of the service at the wrong time are perceived by some of them as an attempt by Robinhood to help its large institutional investors reduce losses., which they suffered from the raids of retail investors on "meme" shares. So it kind of doesn't work out., that angry Robinhood users will start shorting its shares. However, stocks can and do rise: anyway, popular and advertised platform.

Conspiracy to divide classes

As usual with startups, the company will have two classes of shares - A and B. Class A, which will be traded on the IPO, gives a vote per share. Class B shares, which are in the possession of the company's management, give more votes per share. The management of the company - and these people are also its founders - will have 55,3% of votes. This can be a problem, as they can make decisions, which will go against the interests of the majority of minority shareholders. For example, they may refuse to sell the company or may get involved in a string of expensive purchases to expand Robinhood's business..

Teddy bear joke

A very important point to understand: according to the prospectus, in the first quarter 2021 of the year 34% of the company's proceeds from transactions with cryptocurrency gave customers transactions with Dogecoin cryptocurrency, i.e 6% of the company's total revenue in that quarter. The company warns investors about, that if the interest of users in Dogecoin falls and this fall will not be balanced by the growth of transactions with another currency, then revenue can be seriously affected.

Resume

The company is expensive, and its prospects look dubious., considering the structure of the business. In my opinion, these shares would be of greater interest if, if they cost twice as much. That does not negate the possibility of, that the Robinhood IPO will make good money, if the speculative demand for these securities is high enough. For example, even in a worse situation Airbnb IPO went quite well.