Acadia Pharmaceuticals (NASDAQ: ACAD) — pharmaceutical company from the USA, which is engaged in research in the field of neurobiology. The main field of activity is the development of drugs to alleviate the condition of patients with severe neurological diseases: Parkinson's disease, schizophrenia and dementia.

Where does the money come from

The company develops and sells drugs. She now has several medications..

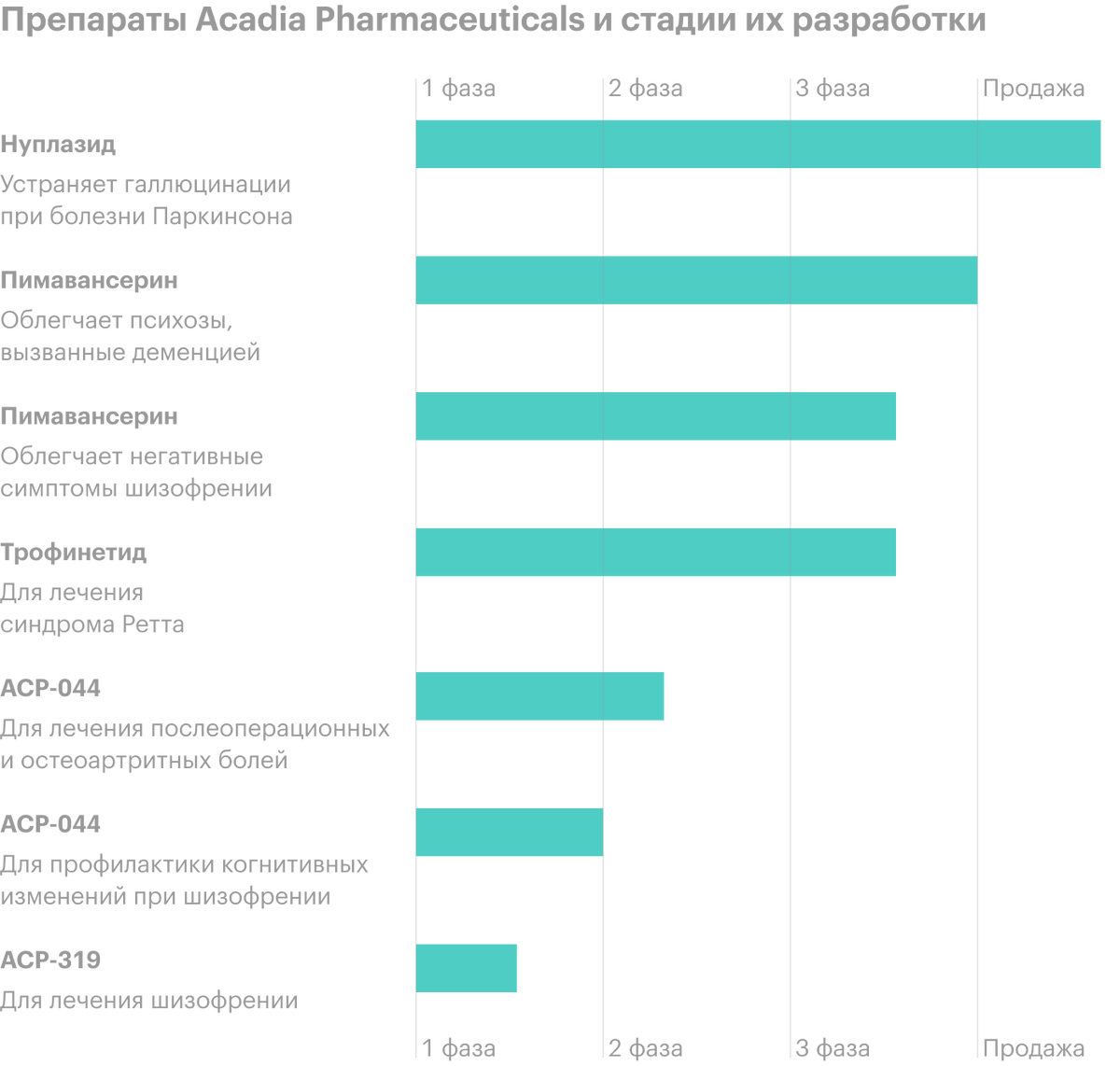

Nuplazid (Pimavanserin) is the only U.S.-approved treatment for hallucinations and delusions, caused by psychosis on the background of Parkinson's disease. The medicine has passed all tests and 2016 Received FDA Approval (FDA).

The company has reached the finish line for FDA approval of the drug Pimavanserin in the treatment of psychosis, caused by dementia. The drug is also undergoing phase III trials as a means to alleviate the negative symptoms of schizophrenia..

Trofinetide - A drug for the treatment of Rett syndrome. Trofinetide is now in its third phase of testing.. Acadia Pharmaceuticals has exclusive rights to develop and commercialize it in North America.

ACP preparations-044 and ACP-0319 for the treatment of postoperative and osteoarthritis pain and for the prevention of cognitive changes in schizophrenia - both are in the early stages of research.

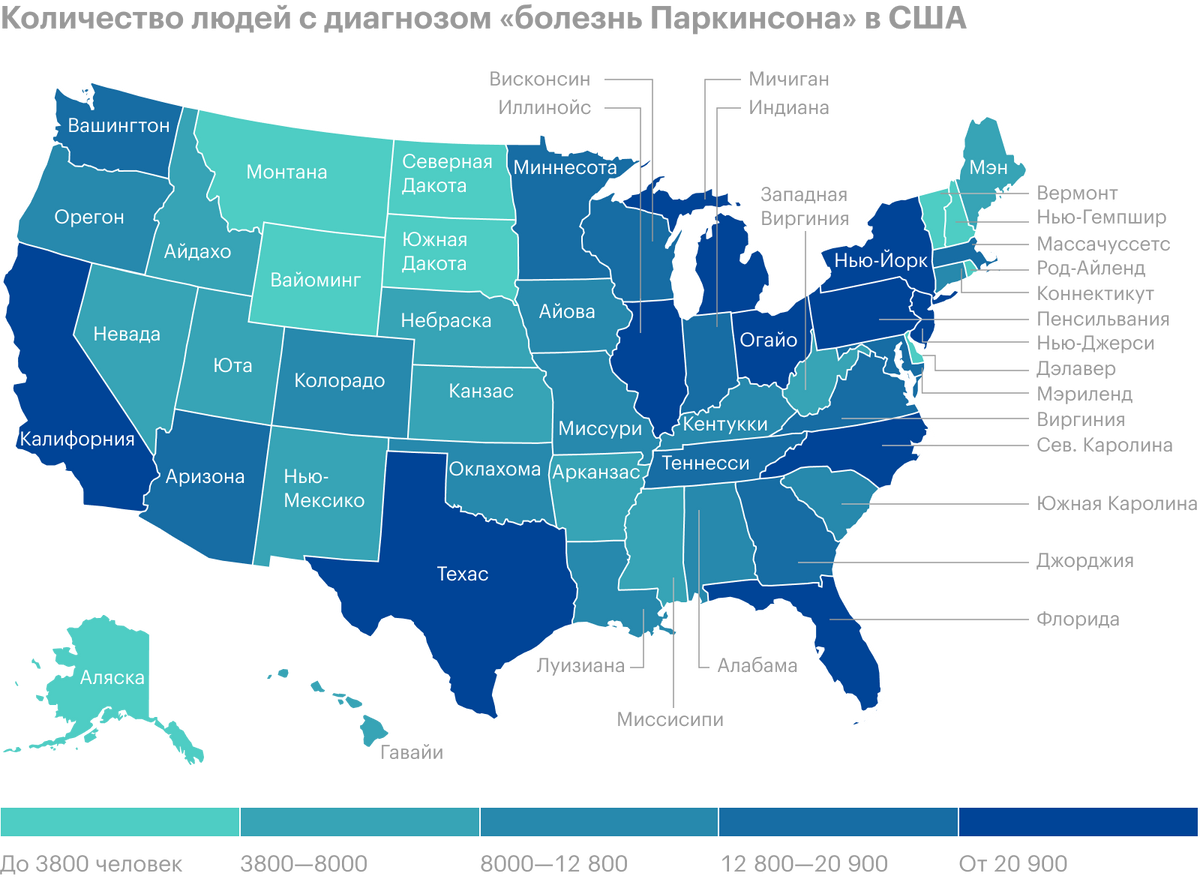

There are about a million people with Parkinson's disease in the U.S., and each year they become on average by 60 thousand more. The cost per patient for drugs is estimated at approximately 2,5 thousands of dollars a year, and surgical intervention will cost 100 one thousand dollars. Total amount of all treatment costs, social security payments and lost income due to Parkinson's disease in the United States is estimated at 52 billion dollars annually.

Acadia Pharmaceuticals claims, what order 50% people with Parkinson's disease suffer from hallucinations and delusions. In the treatment of these complications, Nuplazid is the only agent approved in the United States - a multibillion-dollar market has been opened for its commercialization for the coming quarters and years..

The company fiercely guards its 33 the Pimavanserin patent and for 2020 a year managed to enter into litigation with a dozen organizations, That, according to Acadia, encroached on their exclusive rights. The first generic drug allowed to launch Hetero Labs Limited only in July 2037 of the year.

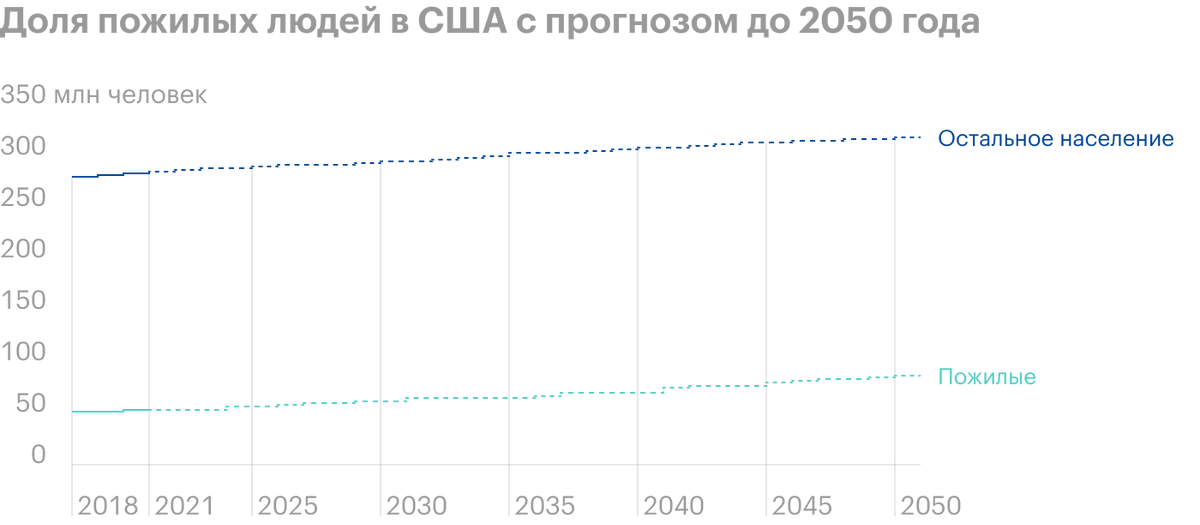

Don't forget, that the U.S. population is aging and 2030 1 in 5 Americans will be retired each year. The average life expectancy in the country has increased from about 70 years in 1968 year before 79 years in 2016, and government spending on health care 2025 year, according to forecasts, amount to 5 billion dollars. All this creates favorable conditions for the promotion of Pimavanserin: more and more potential clients, the demand for health services is gradually starting to exceed the supply, and the price of medicines is rising.

Acadia Pharmaceuticals is cautious about the entry of its drugs into markets outside the United States and notes, that the regulation of the circulation of medicines in different countries varies significantly. Because of this, the appearance of Nuplazid on the shelves of pharmacies in foreign countries is difficult and impossible without a long and time-consuming approval procedure..

Is it worth investing

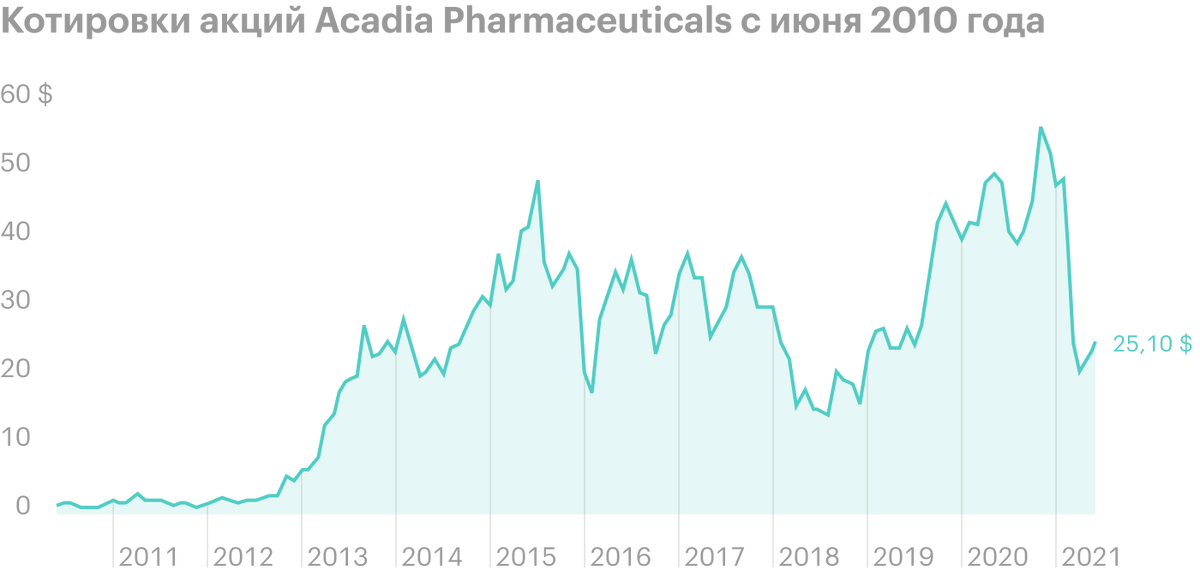

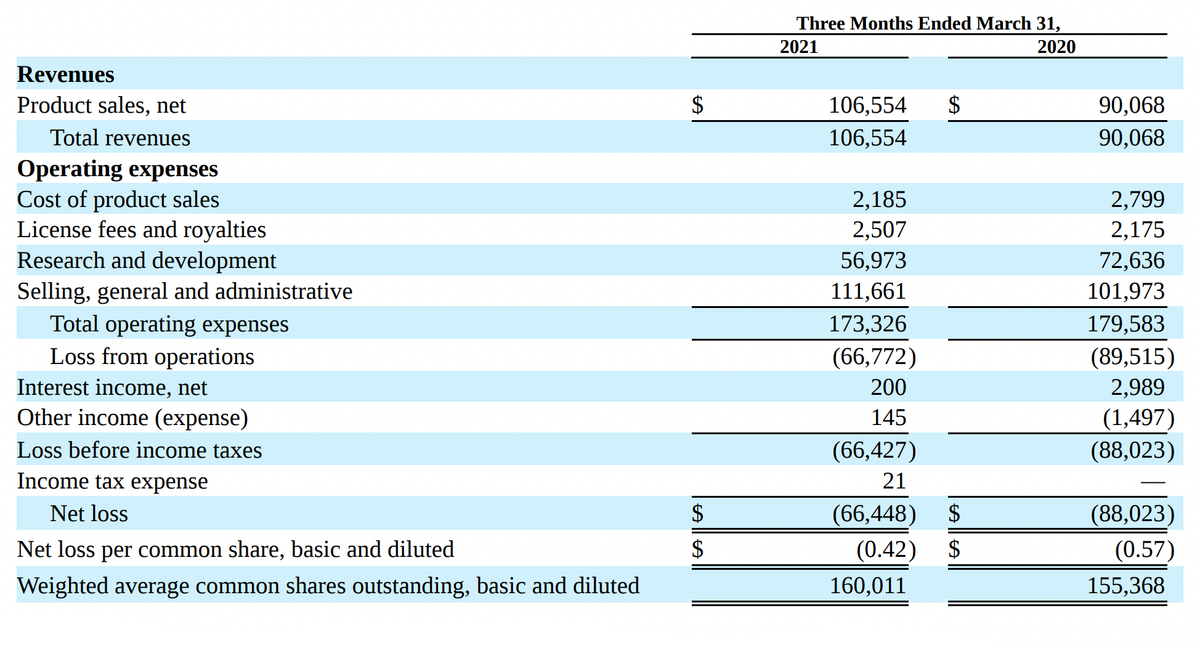

Unlike many biotech startups with big plans and chronic losses, Acadia Pharmaceuticals already has a registered and FDA-approved drug Nuplazid, which is already 5 years brings money. Its sales in 1 quarter 2021 years have grown by 18% - to 106,6 million dollars - against 90,1 million dollars a year earlier.

Acadia aims to expand Pimavanserin's market in the U.S., where the drug is planned to be used to treat the negative manifestations of dementia and schizophrenia.

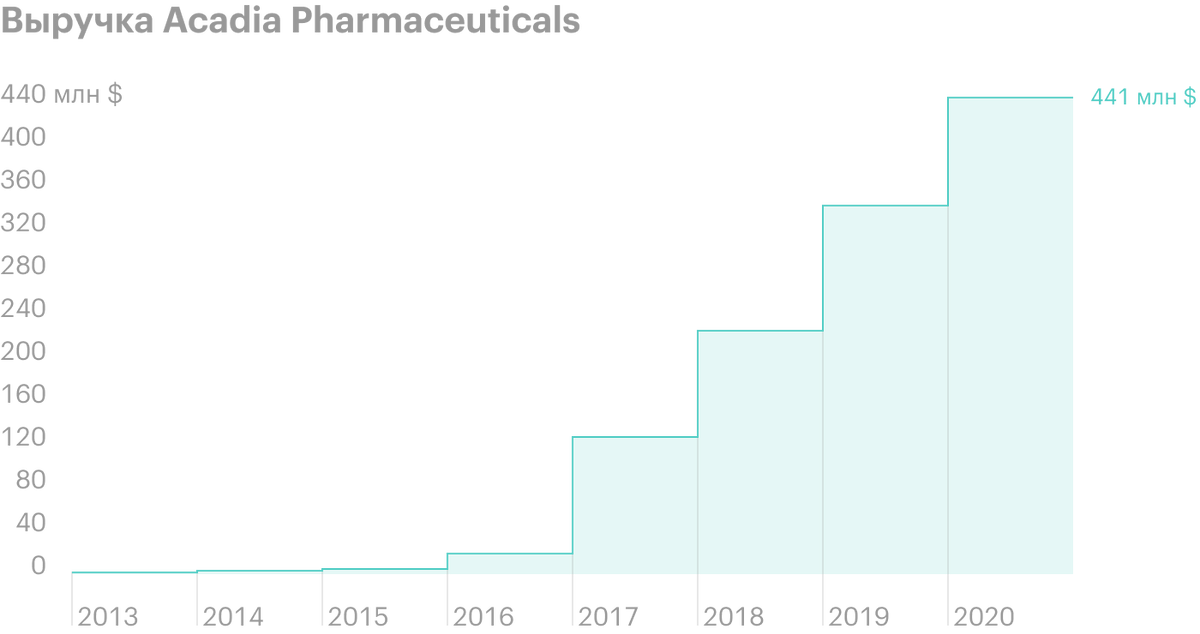

The company's revenue is growing noticeably since 2016 years — for 5 years grown on 491,52%. Net loss in 1 quarter 2021 year shrank to 66,4 million dollars - against 88 million in 1 quarter 2020. R&D spending over the same period decreased from 72,6 to 57 million dollars.

At the same time, the company is increasing its debt.: for the first quarter 2021 he grew to 66,6 million - compare with 49,6 million for the same period 2020.

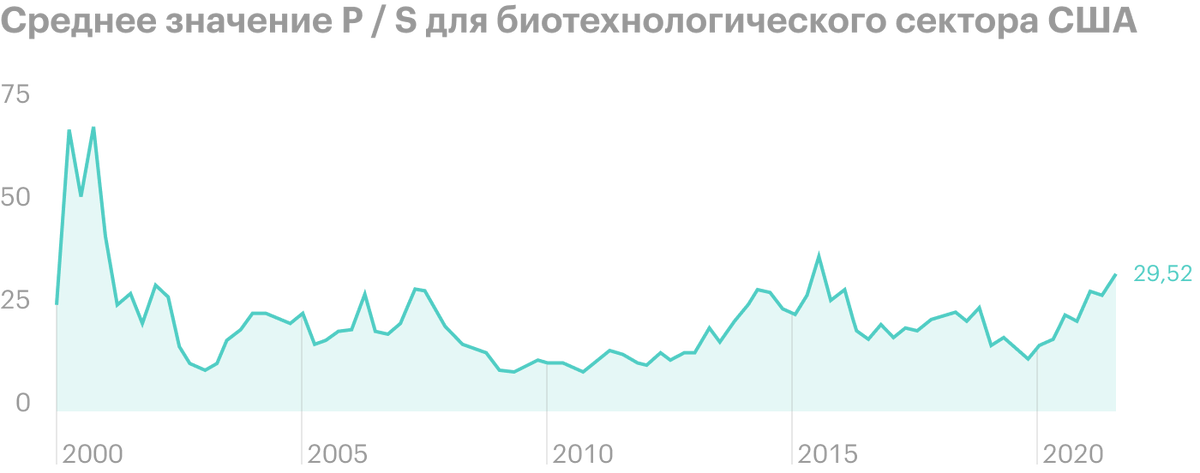

The stock is currently trading at a multiple of P / S 8,49 - quite attractive against the background of the average value 33 for the US biotechnology sector.

In March 2021 of the year US Food and Drug Administration (FDA) postponed approval of the application for the use of Pimavanserin in the fight against manifestations of psychosis in patients with dementia. After the news was released, the company's shares fell by more than 60% for subsequent 2 months - to the bottom mark in 19,4 $, after which they began to slowly recover.

Acadia Pharmaceuticals does not pay dividends - it makes sense to buy shares only with the speculative goal of selling at a higher price. Insider deals add negativity: in 2021 year, employees only sold shares of the company and never bought them. Even more alarming, that members of senior management - CEO and CFO - actively sell their shares, that is, the CEO and CFO.

Quarterly dynamics of the company's debt, one thousand dollars

| 29 June 2020 | 8322 |

| 29 September 2020 | 49 200 |

| 30 December 2020 | 49 547 |

| 30 Martha 2021 | 66 663 |

29 June 2020

8322

29 September 2020

49 200

30 December 2020

49 547

30 Martha 2021

66 663

What's the bottom line

Acadia Pharmaceuticals is a stable company with several billion capitalization, who has a promising registered drug. Like all representatives of biotech, it is highly dependent on the approval or rejection of its developments by the FDA. If you are ready for high risks and like to pick up stocks after their fall, to resell them at a higher price in the future, then this issuer will be interesting.