LSR Group is one of the leading construction organizations in the Russian Federation with a stay in St. Petersburg, Moscow and Yekaterinburg. The company was founded in St. Petersburg in 1993. LSR is a vertically built-in company with its own resource base and the creation of building materials.

About company

The business group consists of 2 main parts:

- Real estate and construction.

- Creation and sale of building materials.

The company builds real estate in the main- and business class and focuses on the middle class of residents and more economically successful regions.

The building materials sector consists of concrete divisions, bricks, aerated concrete, rubble, Sand, reinforced concrete structures, there is a branch, providing services of construction of cranes.

Most of the mining and production of building materials is carried out in St. Petersburg and the Leningrad Region. Companies permit their production, not counting sales of building materials to outside buyers, also keep under control the full chains of production - from the extraction of non-metallic materials to the construction and sale of finished real estate.

The company receives a huge part of its revenue in St. Petersburg, where he is also developing a new large project for the construction of a residential complex on the Vasilyevsky Peninsula. In September 2020, LSR Group received the right to build an area of 143 hectares. Before the start of construction, a preparatory alluvium of sand will be made to raise the height and normalize the territory. Implied, that this work will take 3 to four years, the entire project is scheduled to be completed by 2034. Apartments area, preparatory estimates, will be 700 thousand square meters.

The company earns a significant part of its revenue in the capital of Russia, where the flagship projects are the residential complexes "Zilart" and "Luchi" - 62 and twenty percent in the amount of sales in the Moscow region for 2020.

Revenue by sector

| Real estate and construction | eighty one percent |

| Building materials | fifteen percent |

| Other | four percent |

Real estate and construction

eighty one percent

Building materials

fifteen percent

Other

four percent

Distribution of real estate by the price of parts

| Mass market | forty three percent |

| Business sector | thirty five percent |

| Top Sector | twelve percent |

| Commercial real estate | eight percent |

| Business centers | Two Percent |

Mass market

forty three percent

Business sector

thirty five percent

Top Sector

twelve percent

Commercial real estate

eight percent

Business centers

Two Percent

Revenue by region, billion rubles

| St. Petersburg | 55 385 |

| Moscow | 31 593 |

| Ekaterinburg | 9036 |

St. Petersburg

55 385

Moscow

31 593

Ekaterinburg

9036

Monetary characteristics

Revenue grew until 2018, when the company reached the peak implementation of the main projects, then there was a certain decline. In 2020, despite a severe epidemic, the company was able to demonstrate decent performance: impacted by rising real estate prices and the subsidized mortgage loan program.

The company's net debt has been declining over the previous three years and generally remains at a comfortable level.. Management flexibly manages debt overload and keeps it under control.

Company characteristics

| Revenue, billion rubles | Unsullied profits, billion rubles | Unsullied debt, billion rubles | Unsullied Debt / EBITDA | |

|---|---|---|---|---|

| 2015 | 86 830 | 10 646 | 12 584 | 0,68 |

| 2016 | 98 072 | 9163 | 30 065 | 1,56 |

| 2017 | 138 494 | 15 871 | 43 073 | 1,17 |

| 2018 | 146 376 | 16 230 | 30 290 | 0,83 |

| 2019 | 110 438 | 7469 | 22 760 | 1,08 |

| 2020 | 118 052 | 12 025 | 16 830 | 0,61 |

2015

Revenue, billion rubles

86 830

Net profit, billion rubles

10 646

net debt, billion rubles

12 584

Net Debt / EBITDA

0,68

2016

Revenue, billion rubles

98 072

Net profit, billion rubles

9163

net debt, billion rubles

30 065

Net Debt / EBITDA

1,56

2017

Revenue, billion rubles

138 494

Net profit, billion rubles

15 871

net debt, billion rubles

43 073

Net Debt / EBITDA

1,17

2018

Revenue, billion rubles

146 376

Net profit, billion rubles

16 230

net debt, billion rubles

30 290

Net Debt / EBITDA

0,83

2019

Revenue, billion rubles

110 438

Net profit, billion rubles

7469

net debt, billion rubles

22 760

Net Debt / EBITDA

1,08

2020

Revenue, billion rubles

118 052

Net profit, billion rubles

12 025

net debt, billion rubles

16 830

Net Debt / EBITDA

0,61

Dividends

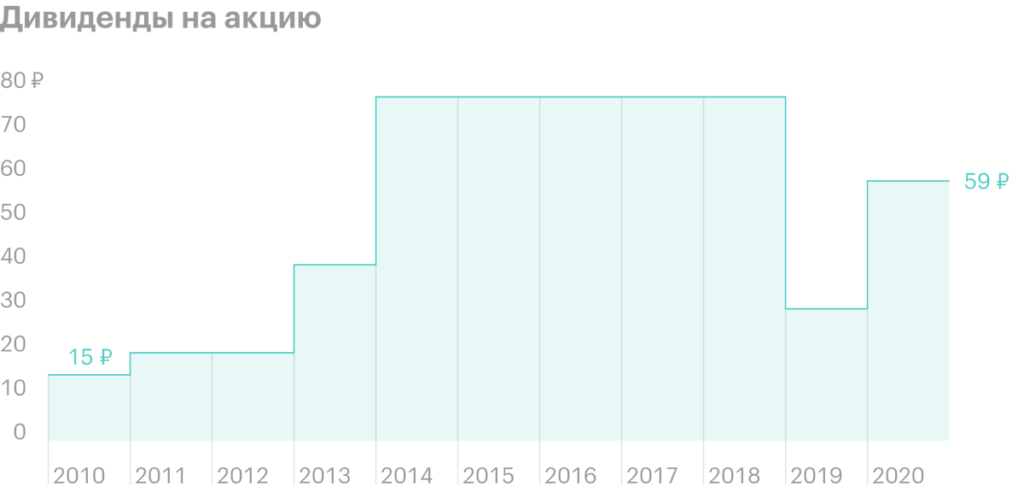

For a long time, the company paid for 78 P annual dividends per share, then in 2019 reduced them to 30 R. IN 2020 the trend towards an increase in dividends has reappeared, in addition, they announced a share buyback program for up to RUB 5 billion.

According to dividend policy, the company pays shareholders at least 20% of net profit under IFRS. In reality, 6 billion rubles were paid out in 2020 with a net profit of 12 billion, what constitutes 50%, or 59 P per share.

Shareholder structure

A significant share of the shares belongs to the CEO of the company Andrey Molchanov, there are also small stakes of other managers and treasury shares.

The percentage of shares in free float is quite large for the Russian market, this makes the shares attractive to minority shareholders: this reduces the likelihood of price manipulation or forced buyouts at an unfair price, and also increases the chance of hitting different indexes.

Position in the industry

In terms of housing commissioning in 2020, LSR Group ranked third. In St. Petersburg, LSR Group took second place, in Moscow - the seventeenth, in the Sverdlovsk region - the third. The company's position in the construction markets in St. Petersburg and the Urals is high, in Moscow, she is not among the leaders.

The volume of housing commissioned in 2020 by region

| Region | Housing volume of LSR Group, thousand sq.. meters | The volume of housing at the leader of the region, thousand sq.. meters | Place of LSR Group in terms of housing volume in the region |

|---|---|---|---|

| St. Petersburg | 362 | 703 — Setl Group | 2 |

| Moscow | 82 | 1023 — SPEED | 17 |

| Sverdlovsk region | 94 | 144 — "Atomstroykompleks" | 3 |

| Russia | 538 | 2340 — SPEED | 3 |

St. Petersburg

Housing volume of LSR Group, thousand sq.. meters

362

The volume of housing at the leader of the region, thousand sq.. meters

703 — Setl Group

Place of LSR Group in terms of housing volume in the region

2

Moscow

Housing volume of LSR Group, thousand sq.. meters

82

The volume of housing at the leader of the region, thousand sq.. meters

1023 — SPEED

Place of LSR Group in terms of housing volume in the region

17

Sverdlovsk region

Housing volume of LSR Group, thousand sq.. meters

94

The volume of housing at the leader of the region, thousand sq.. meters

144 — "Atomstroykompleks"

Place of LSR Group in terms of housing volume in the region

3

Russia

Housing volume of LSR Group, thousand sq.. meters

538

The volume of housing at the leader of the region, thousand sq.. meters

2340 — SPEED

Place of LSR Group in terms of housing volume in the region

3

Possible drivers of stock growth

Rising property prices. As of July 2021, real estate prices in Moscow continue to grow, in Saint Petersburg too.

Extension of the preferential mortgage program. Preferential mortgage program extended until July 2022. As the company notes in its 2020 operating report, the share of apartments purchased using a mortgage increased to 64 with 47% in 2019.

The volume of commissioning of new housing is growing. The state sets a goal to commission 120 million square meters of housing by 2030. 80 million square meters commissioned in 2019. It turns out the predicted growth by 50%.

Consolidation construction industry amid the introduction of escrow accounts. Until July 2018, the client's money went directly to the developer. Because of this, there were many small players on the market.. Their bankruptcy led to the problem of deceived equity holders, to prevent which the state introduced escrow accounts: money from them could only be used for the construction of facilities. From July 2019 the rate, for which the developer company can take a loan from a bank, linked to the amount of escrow accounts - it will be more difficult for smaller players to get funding.

Population growth in Moscow and St. Petersburg. According to the forecast of Mosstat, until 2036, the population of Moscow will grow every year and by 2036 will grow by about 1,6%.

According to Petrostat's forecast, the population of St. Petersburg by 2036 will grow by about 3%, and the population of the Leningrad region - by 12,5%.

Implementation of current and new major projects. The company's land bank is more than 8.2 million square meters of net sellable area with a market value of about 276 billion rubles.. 62% projects are at the concept or design stage.

Potential risks

Deterioration of the population's ability to pay. Real incomes of the population decreased from 2014 to 2017 by about 2,15% in year, behind 2018 and 2019 showed insignificant growth - by 0,1 And 1% respectively. In 2020, there was a drop in 3,5%, which had a lot to do with the pandemic. Rapid growth in real incomes of the population is not expected in the near future.

Demographic crisis. After 1985, the birth rate began to decline, after the collapse of the USSR in the 90s, it intensified. In 2021 people, who were born after 1985, turned from 20 to 35 years - at this age, many buy their first apartment for themselves and their families. A reduced proportion of the population of this age may affect the demand for real estate.

Rising interest rates and reduced attractiveness of mortgages. A new cycle of growth of the key rate has begun in Russia. From minimum values in 4,25% rate increased to 5%. Mortgage rates may rise as interest rates rise, what will reduce the demand for apartments in new buildings.

According to the results 1 quarter of 2021, LSR has outlined a slight decrease in operating indicators. Decrease in sales on 14% year-on-year, the company's management explains the completion of large projects "Shuvalovsky" and "Novaya Okhta" in St. Petersburg.

Eventually

LSR Group is one of the leaders in the construction sector in Russia in general and the developer market in St. Petersburg in particular. The company shows solid financial results, but investing in it carries global risks for the entire construction sector.