Rosneft (MCX, LSE: GROW) - the largest oil company in Russia. We have already reviewed the business of her public daughters: Saratov Refinery and Bashneft, now let's consider the business of Rosneft itself.

About company

Rosneft is a vertically integrated oil and gas company, the largest in Russia and one of the largest in the world. It conducts business in 78 regions of Russia and in 23 countries of the world.

The company was founded in 1993, actually on the basis of the disbanded profile ministry. During the 1990s, various assets were withdrawn and privatized from its composition., from which large companies were formed, such as "Sidanko", TNC, Sibneft and others. But in the 21st century, this process has reversed.: Rosneft began to actively conclude deals M&A. Among them is the acquisition of the former assets of Yukos, purchase of TNK-BP and a controlling stake in Bashneft.

Rosneft's business is huge: at the end of 2020, it accounted for 6% of global oil production. In terms of revenue, Rosneft was ahead of all Russian oil companies, most - several times. According to these indicators, as prey, reserves and extraction costs, Rosneft was ahead of the main oil majors. The company distinguishes in the reporting two operating segments.

Exploration and production. Exploration and production of oil and gas. At the end of 2020, proven reserves of liquid hydrocarbons amount to 25.8 billion barrels of oil and 2.1 trillion cubic meters of gas. At the same time, proven gas reserves have generally been growing in recent years and the vast majority of reserves are located in Western Siberia.. At the end of 2020, 204.5 million tons of liquid hydrocarbons and 62.8 billion cubic meters of gas were produced. Certainly, these values were less, than in pre-crisis years, but before that, production volumes grew.

Processing, commerce and logistics. Rosneft is engaged in oil- and gas processing, petrochemistry, production of catalysts, wholesale and retail sales of raw materials and processed products.

In the oil refining subsegment, the company has 13 plants in Russia, large stakes in three plants in Germany, share of indirect ownership of 21% of the plant in Belarus and share in 49% in the Indian company Nayara Energy, which owns a factory in India. The company's assets also include three petrochemical, five gas processing assets and three catalyst manufacturing plants. Rosneft also participates in joint ventures for the construction of oil refineries and petrochemical plants in Indonesia and China.

By the end of 2020, the company refined 104 million tons of oil and produced 101.4 million tons of refined products. Refining volume has been falling in the last two years. The refining depth and yield of light petroleum products are approximately at the same levels in recent years and by the end of 2020 amounted to 74.5 and 57,1%.

In the sales sub-segment, Rosneft sells almost all oil and two-thirds of refined products abroad, and almost all gas is in Russia. At the same time, 35% of oil sold abroad goes to China via pipelines under long-term contracts.. In total, 121 and 104 million tons of oil and refined products were sold in 2020. It is less, than in previous years, but before that the trend was growing. Also sold 68 billion cubic meters of gas.

The company sells fuel at its filling stations, the number of which is growing and already exceeds 3 thousand. The company also indirectly owns a network of filling stations in India through Nayara Energy.. In addition to automotive fuel, Rosneft supplies aviation and bunker fuel, lubricants, bitumen.

Separately, it is worth mentioning the company's growth project - "Vostok-oil", which Rosneft started to implement in 2020. This is a project to develop a new oil and gas province in Russia, located on the Taimyr Peninsula in the Arctic zone. The project includes more than 50 license areas with huge proven reserves, estimated at 6 billion tons of liquid hydrocarbons.

Oil, which will be mined in this project, Premium, low sulfur. Since the project is strategic and will contribute to the development and loading of the Northern Sea Route (SMP), the state will provide him with serious tax breaks. Vostok-Oil plans to ensure a cargo flow of 100 million tons along the NSR by 2030. The project already has international investors: the fate of 10% acquired oil trader Trafigura, and share in 5% - Vitol and Mercantile consortium & Maritime.

By the way, about sea routes: Rosneft is a co-owner of the Far Eastern shipbuilding complex Zvezda, on which ships are built for the company itself and to order - for example, for LNG projects of Novatek.

Revenue of the largest oil companies in Russia for 2020, billion rubles

| Rosneft | 5757 |

| Lukoil | 5639 |

| Gazprom Neft | 2000 |

| Surgutneftegaz | 1182 |

| "Tatneft" | 721 |

| Bashneft | 527 |

5757

Indicators of the world's largest oil companies for 2020

| Extraction of hydrocarbons, million boe per day | Extraction costs, $ on BNE | Hydrocarbon reserves, billion boe | |

|---|---|---|---|

| Rosneft | 5,2 | 2,8 | 152 |

| PetroChina | 4,4 | 11,1 | 45 |

| Exxon Mobil | 3,8 | 11,6 | 59 |

| BP | 3,5 | 6,4 | 54 |

| Royal Dutch Shell | 3,4 | 8,5 | 45 |

| Chevron | 3,0 | 10,1 | 54 |

Proved reserves of the company by years

| Liquid hydrocarbons, million barrels | Market gas, billion cubic meters | |

|---|---|---|

| 2016 | 26 956 | 1714 |

| 2017 | 28 034 | 1949 |

| 2018 | 28 853 | 2065 |

| 2019 | 29 114 | 2119 |

| 2020 | 25 816 | 2106 |

The structure of the company's proven reserves by regions for 2020

| Liquid hydrocarbons | Market gas | |

|---|---|---|

| Western Siberia | 73% | 88% |

| Ural-Volga region | 15% | 1% |

| Eastern Siberia | 10% | 7% |

| Timan-Pechora | 1% | 0% |

| South of Russia | 1% | 1% |

| Abroad | 0% | 2% |

| Shelf | 0% | 1% |

Company's production by years

| Liquid hydrocarbons, million tons | Gas, billion cubic meters | |

|---|---|---|

| 2016 | 210,0 | 67,1 |

| 2017 | 225,5 | 68,4 |

| 2018 | 230,2 | 67,3 |

| 2019 | 230,2 | 67,0 |

| 2020 | 204,5 | 62,8 |

Oil refining volume by years, million tons

| Oil refining | Production of petroleum products and petrochemicals | |

|---|---|---|

| 2016 | 100,3 | 98,2 |

| 2017 | 112,8 | 109,1 |

| 2018 | 115,0 | 111,7 |

| 2019 | 110,2 | 107,5 |

| 2020 | 104,0 | 101,4 |

Oil refining indicators by years

| Processing depth | Light oil product yield | |

|---|---|---|

| 2016 | 72,0% | 56,6% |

| 2017 | 75,2% | 58,4% |

| 2018 | 75,1% | 58,1% |

| 2019 | 74,4% | 57,6% |

| 2020 | 74,5% | 57,1% |

Oil sales volume, processed products and gas by years

| Oil, million tons | Processing products, million tons | Gas, billion cubic meters | |

|---|---|---|---|

| 2016 | 120,6 | 101,9 | 65,0 |

| 2017 | 128,7 | 112,4 | 74,0 |

| 2018 | 129,1 | 115,9 | 71,3 |

| 2019 | 155,0 | 115,0 | 63,0 |

| 2020 | 121,0 | 104,0 | 68,0 |

Number of filling stations of the company by years

| 2016 | 2897 |

| 2017 | 2966 |

| 2018 | 2963 |

| 2019 | 3069 |

| 2020 | 3057 |

2897

Financial indicators

Revenue, net profit and free cash flow of the company vary significantly from year to year, because it is highly dependent on the context: hydrocarbon prices, production restrictions under OPEC+ agreements and other factors, such as exchange rate differences. Results for 1H 2021 show, that Rosneft's business has significantly recovered after the shock of 2020: revenue is already two-thirds of last year's revenue, and net income and free cash flow even exceeded last year's figures.

Not the strongest side of the company is a rather large debt load: Yes, net debt decreased significantly in 2018, but since then it has been gradually growing and now amounts to a rather significant 3.8 trillion rubles.

The structure of revenue shows, that Rosneft earns more than half of the money from the sale of petroleum products, about 40% more - for the sale of oil, the rest of the income items do not affect the overall picture significantly.

Revenue, net profit, free cash flow and net debt by year, billion rubles

| Revenue | Net profit | free cash flow | net debt | |

|---|---|---|---|---|

| 2017 | 6011 | 222 | 245 | 5012 |

| 2018 | 8238 | 549 | 1133 | 3559 |

| 2019 | 8676 | 705 | 884 | 3600 |

| 2020 | 5757 | 147 | 425 | 3785 |

| 1п2021 | 3904 | 233 | 515 | 3804 |

Revenue by business segments for 2020

| Petroleum products | 54% |

| Oil | 39% |

| Gas | 4% |

| Petrochemistry | 1% |

| Other | 2% |

54%

Share capital

Rosneft was originally a fully state-owned company, but over time it had several large shareholders: in 2013, as part of the deal to purchase TNK-BP, BP became the owner of a 19.5% stake, and in 2016, the same block of shares was sold to a joint venture of the Qatar Sovereign Fund (QIA) and Swiss oil trader Glencore.

In 2018, QIA bought out a stake in Rosneft in 14,16% from a joint venture, and the most interesting changes occurred in March 2020: to get out of US sanctions, Rosneft transferred its Venezuelan assets to the company, owned by the Russian government, in exchange for 9.6% of its shares. So now the company has no controlling shareholder, but there is a large block of quasi-treasury shares. The company also has a rather low free float - only about 10.7%, because of which it has a small weight in the main stock indices: only 3.16% in the Moscow Exchange and RTS indices and 2,96% в MSCI Russia.

Since 2018, Rosneft has been implementing a share buyback program of up to $ 2 billion, or up to 340 million shares, until the end of 2020, extended until the end of 2021.

Equity structure

| Shareholder | Beneficiary | share |

|---|---|---|

| Rosneftegaz | the Russian Federation | 40,40% |

| BP Russian Investments Limited | BP | 19,75% |

| QH Oil Investments LLC | QIA, Glencore | 18,46% |

| RN-Neftkapitalinvest LLC | Rosneft | 9,60% |

| LLC RN-Capital is the operator of the share buyback program | Rosneft | 0,76% |

| Rosimushchestvo | the Russian Federation | 1 stock |

| Other shareholders | Individuals and legal entities | 0,33% |

| Free float | 10,70% |

Dividends and dividend policy

Rosneft has had a dividend policy since 2015, according to which the company plans to pay out at least 50% of IFRS net profit in the form of dividends at least twice a year. The company adheres to the dividend policy, the only moment: in the crisis year 2020, the payment was only at the end of the year, since the first half of the year the company worked at a loss. The dividend yield of the company's shares is rather modest..

Dividends and dividend yield of Rosneft by years

| Dividends, rubles per share | Dividend yield | |

|---|---|---|

| 2017 | 10,48 | 3,6% |

| 2018 | 25,91 | 6,0% |

| 2019 | 33,41 | 7,4% |

| 2020 | 6,94 | 1,3% |

| 1п2021 | 18,03 | 3,4% |

Why stocks can go up

A giant exporter with growth prospects. Rosneft is the leader of Russia and one of the largest companies in the world in the oil industry. Its business is quite diversified by segments, sales markets and by revenue currency. This helped the company survive even a terrible year for the industry with dignity., without falling into losses. Despite the gigantic scale of the business, the company has a significant point of growth in the form of the Vostok-oil project. It can provide both the growth of the company's production performance, which will pull up financial indicators, and serve as a driver for the revaluation of the capitalization of Rosneft, for example, when selling shares in it.

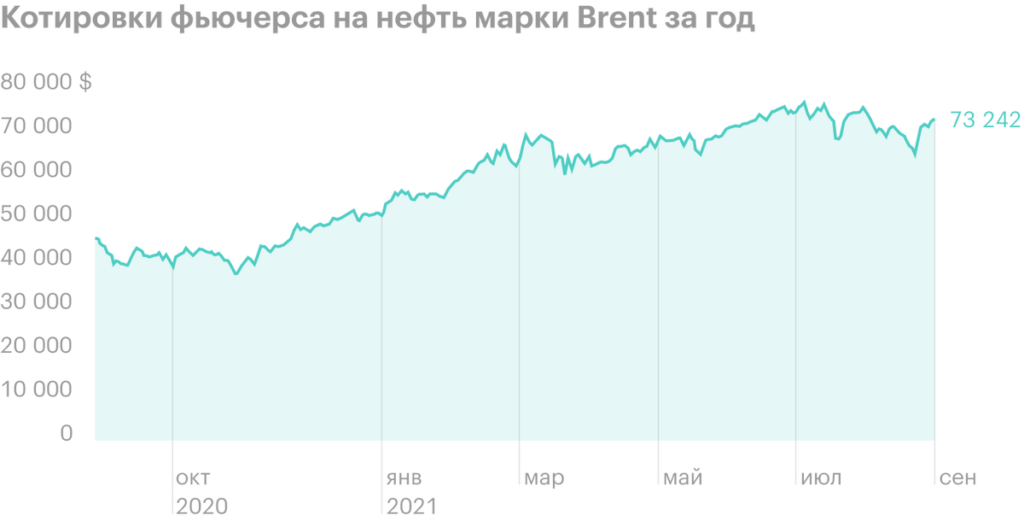

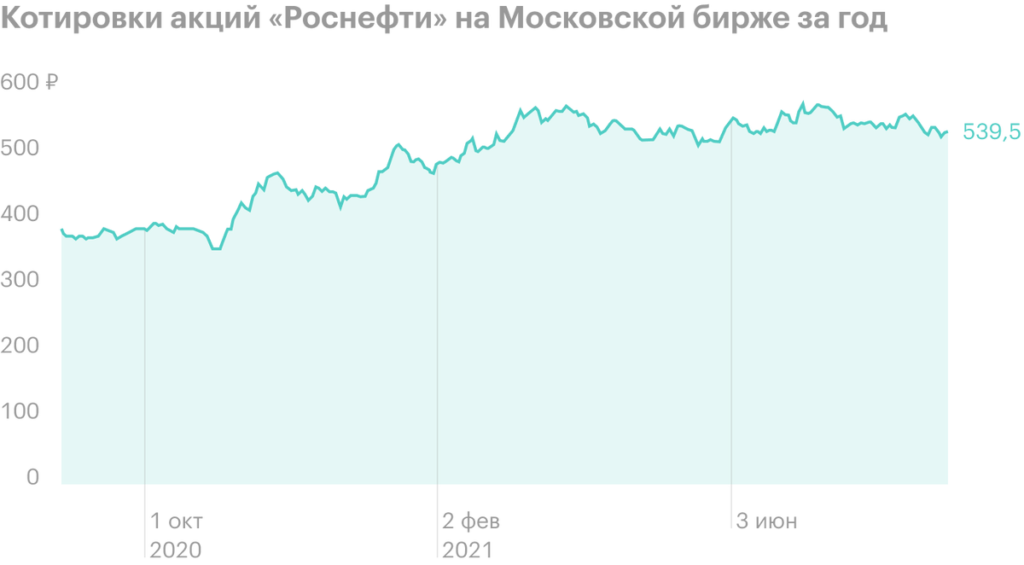

Good business environment. Oil prices in 2021 please oil companies: they stay higher most of the time 60 $ per barrel of Brent crude, OPEC+ intends to raise monthly production in August, and inflation does not subside.

Speaking of long term prospects, then in the review of Lukoil we have already discussed in detail the idea, that oil, probably, will be needed for a long time. At the same time, in recent years there has been a systematic underinvestment in the industry.. All this together can lead to a chronic shortage of oil supply and, respectively, constantly high prices.

Possible actions with quasi-treasury shares. As a result of transactions and the buyback of shares, Rosneft has accumulated a huge block of quasi-treasury shares - about 10,5% share capital, - which is almost equal to the number of shares, in free circulation. If the company decides to pay them off, then the share of each shareholder will increase significantly. If he decides to place on the stock exchange, then this will significantly increase the free float, which will help the company to seriously increase its weight in stock indices. It is also possible to sell a block of shares to another strategic investor, which should bring Rosneft a significant amount. All these possible options should have a positive impact on the company's stock quotes..

Why stocks might fall

Dependence on market conditions. Like any commodity company, Rosneft's business is highly dependent on market conditions - on demand and oil prices. In the short term, they may be adversely affected by a possible next wave of coronavirus cases and the quarantines caused by it - just the autumn-winter period is coming, — or OPEC+ could overdo it with higher production. In the long term, technological breakthroughs in the field of green energy are seen as a possible threat.

ESG. T—W have already discussed the history of hedge fund Engine No. 1, who is trying to put Exxon Mobil on the path to clean energy. Yes, and a major shareholder of Rosneft, BP, hit the world back in 2020 with its strategy to achieve zero emissions.. And banks are starting to take into account climate criteria when lending.

It is hard to say, how will it all end, but, probably, the life of oil and gas companies will be complicated: will have to spend money on research in the field of clean energy and, in general, on creating an image of those actively advocating for the environment. At the same time, stock quotes may fall due to sales, carried out for ideological reasons.

Not particularly attractive to minority shareholders. Not to tell, to make Rosneft stand out in some way relative to competitors in the sector from the point of view of a simple minority shareholder. In terms of cost and profitability multiples, it is comparable to major competitors, but it has a significantly higher debt burden. Lukoil's dividend policy also looks more attractive, than Rosneft, and in general, the dividend yield of the company is quite modest by the standards of companies from the Moscow exchange index.

Multipliers of Rosneft by years

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 8,07 | 10,6% | 3,58 |

| 2018 | 5,54 | 20,4% | 1,71 |

| 2019 | 5,20 | 20,3% | 1,71 |

| 2020 | 15,8 | 6,9% | 3,13 |

| 1п2021 | 7,05 | 14,6% | 2,18 |

Multipliers of the largest oil companies in Russia for 1 half year 2021

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| Rosneft | 7,05 | 14,6% | 2,18 |

| Lukoil | 9,82 | 9,9% | 0,07 |

| Gazprom Neft | 6,21 | 14,6% | 0,61 |

| "Tatneft" | 7,37 | 17,3% | 0,04 |

Eventually

Rosneft is the leader of the Russian oil industry. The company has a huge diversified business, which will become even larger as the promising Vostok-Oil project is implemented. Rosneft also has several options, how to deal with a huge block of quasi-treasury shares, which should have a positive impact on their quotes.

At the same time, the company has a significant debt burden and not the most attractive dividend yield., and possible advances in green energy and ESG pressure on the oil industry could negatively impact its business.