Carrier Global (NYSE: CARR) - American supplier of goods and services in the field of air temperature control. The company's business has been affected by the corona crisis, but it didn't affect the quotes.. The main problem is the situation in the field of commercial real estate.

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. The idea to review Carrier Global was suggested by our reader Mr. Oleg A. Andreev in the comments to the Nike review. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

The company manufactures goods and provides services in the field of air temperature control. According to the annual report, the company's revenue is formed as follows.

Ventilation, heating and air conditioning — 54,29%. The name speaks for itself, there is nothing to add. 86,14% segment sales are goods, 13,86% - services. Segment operating margin — 26% from its proceeds.

Fire safety and home security — 28,55%. These are fire alarms, smoke detectors, fire extinguishing systems, Motion Sensor, control systems video. 71,91% sales in the segment give goods, 28,09% - services. Segment operating margin — 11,7% from its proceeds.

Freezing — 17,16%. These are cargo cooling systems for commercial vehicles. All in all, it's all, what is needed for the transportation of chilled products. 87,81% sales in the segment are goods, 12,19% - services. Segment operating margin — 10,7% from its proceeds.

In the US, the company makes 52%, the rest goes to other countries, who remained unnamed, - known only, what 28,27% of the company's revenue is made in Europe, and 15,2% - in the countries of the Asia-Pacific region.

Managed crisis

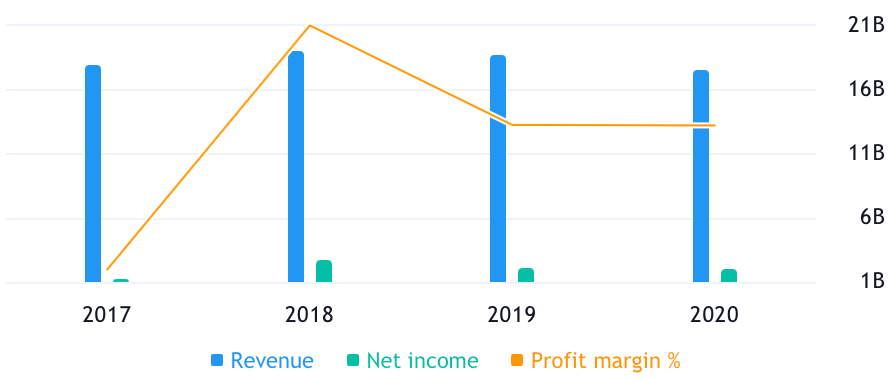

The slight drop in the company's sales and revenue in 2020 was caused to a lesser extent by a drop in demand and to a greater extent by Carrier's quarantine measures.. The company closed part of the factories for the period of quarantine and greatly reduced production during this period. As soon as the factories opened in the second half 2020, sales figures are back to normal. However, I would not say, that the resulting damage from the coronavirus for the company was terrible. But as for its future prospects, then everything is not so clear here.

The company does not provide information about, what percentage of sales in the first two segments are commercial real estate, and which one - for residential, therefore, we cannot predict the sales situation in this area.

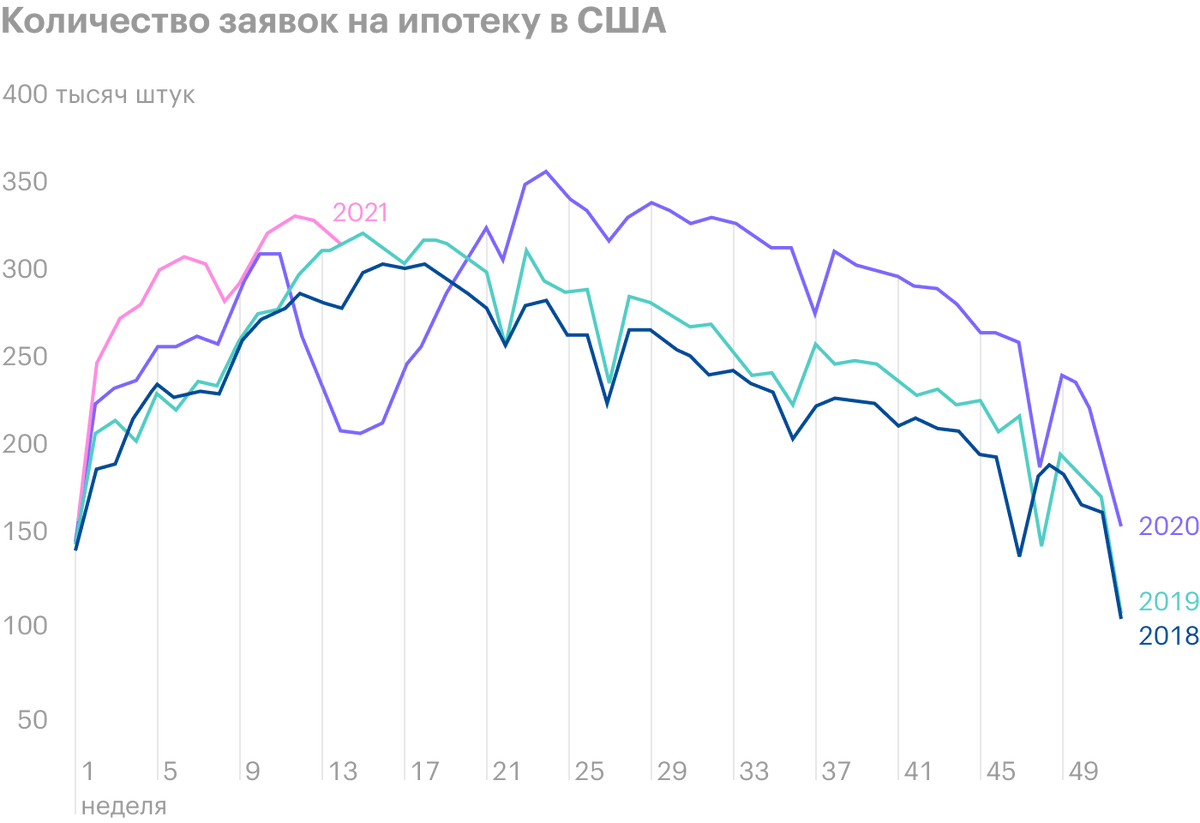

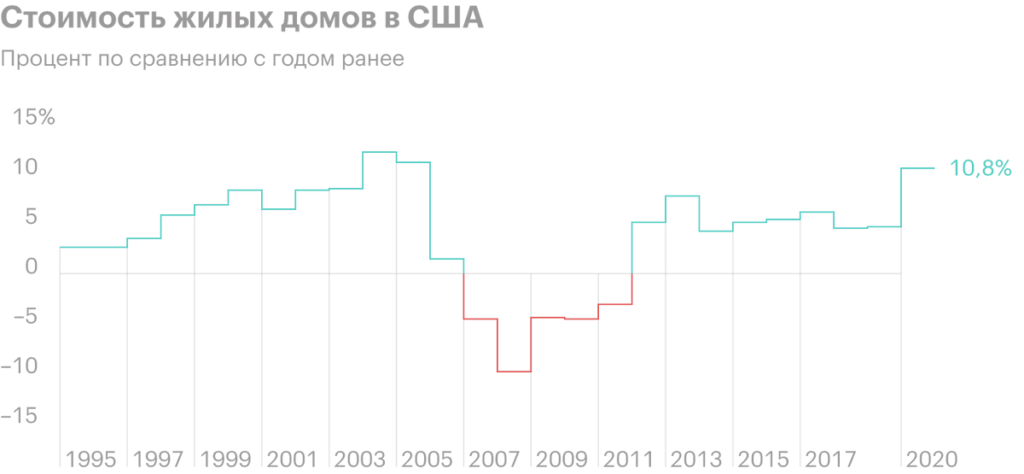

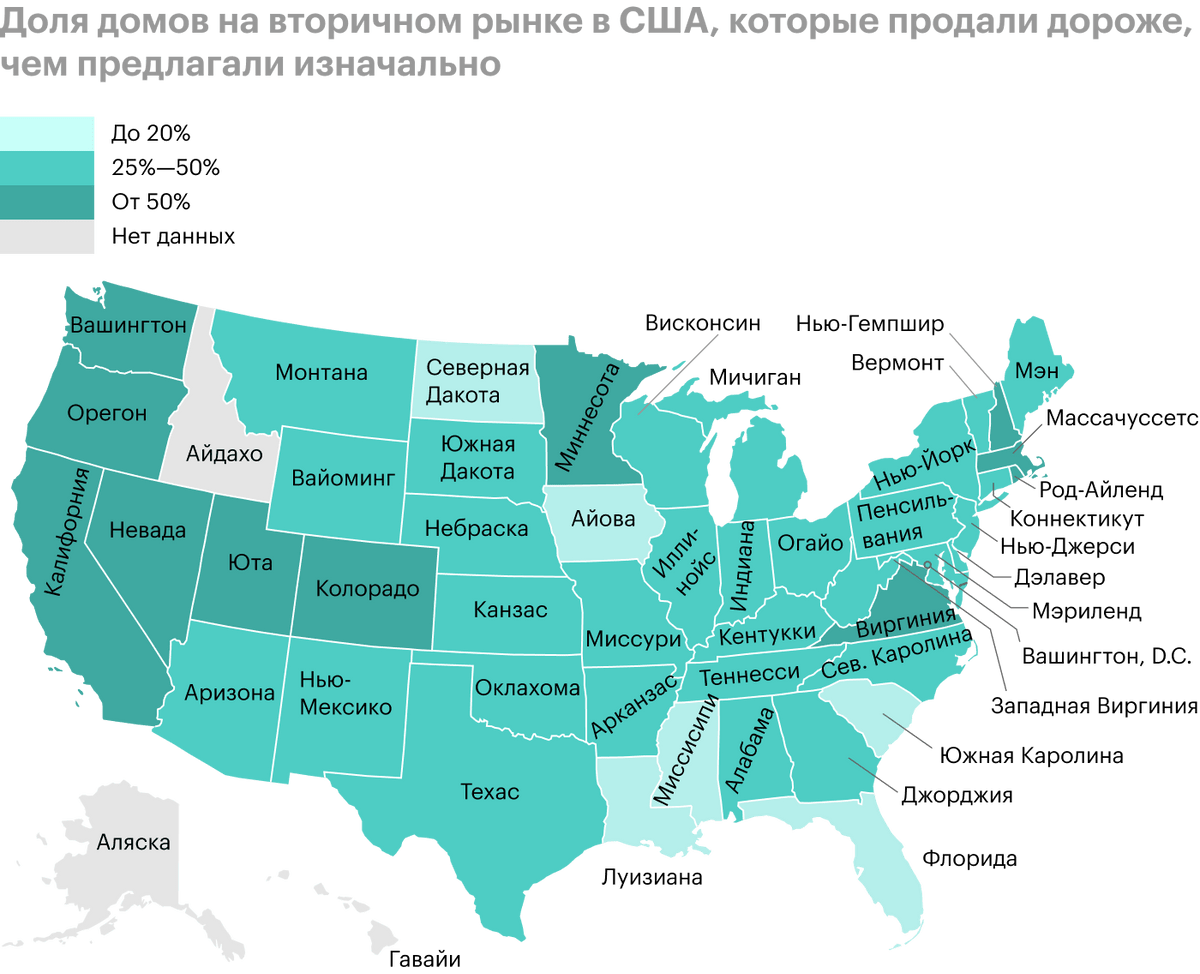

If most of the sales there are for residential buildings, then everything is fine. As we said in the AppFolio review, US housing market is experiencing a rebirth. The demand is just crazy: House prices have skyrocketed on rising consumer demand, and large investors came to the construction of houses, who want to work in this sector.

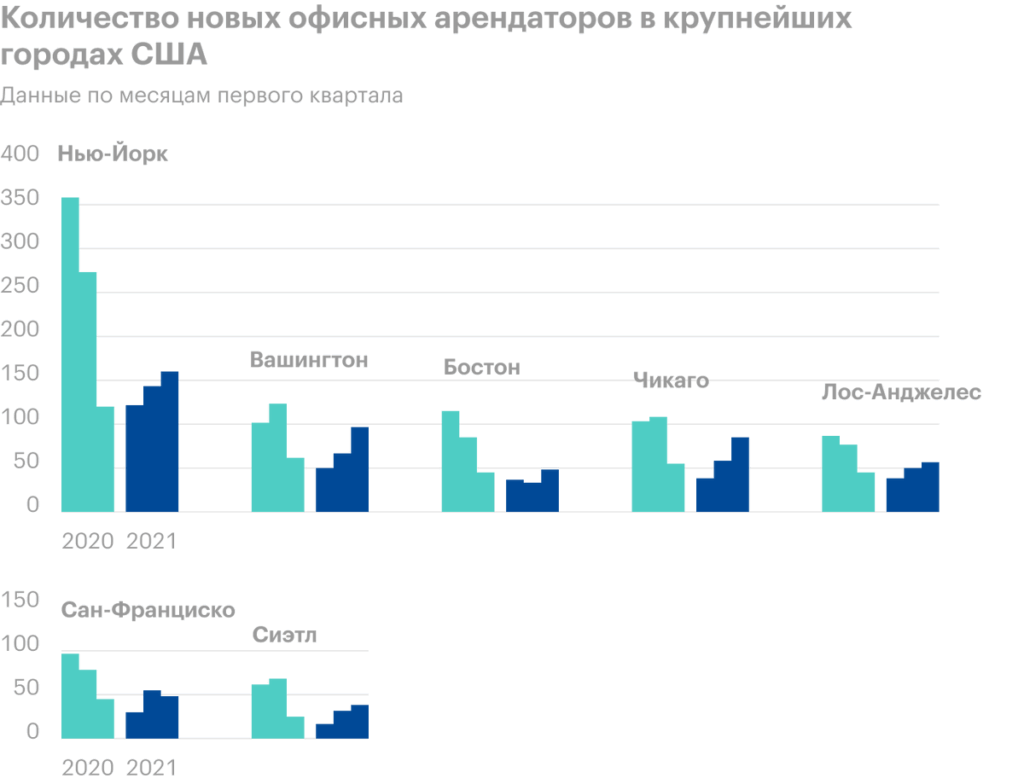

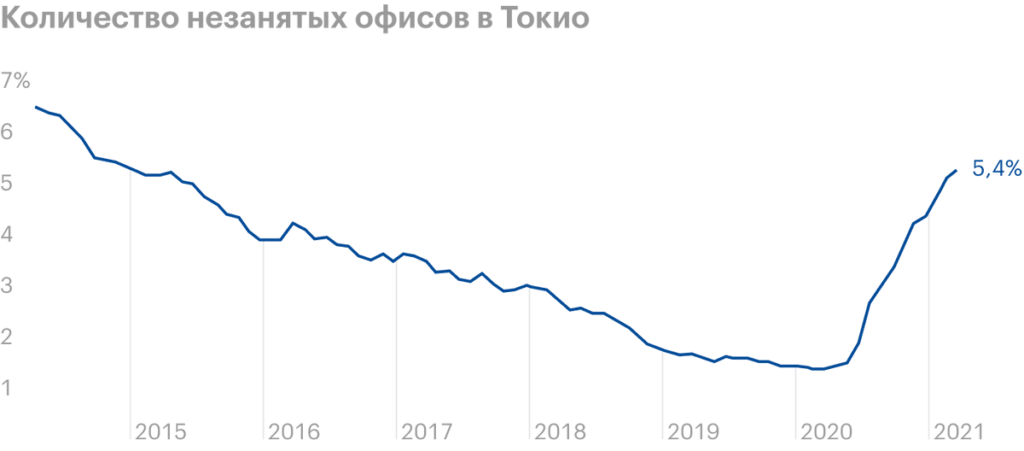

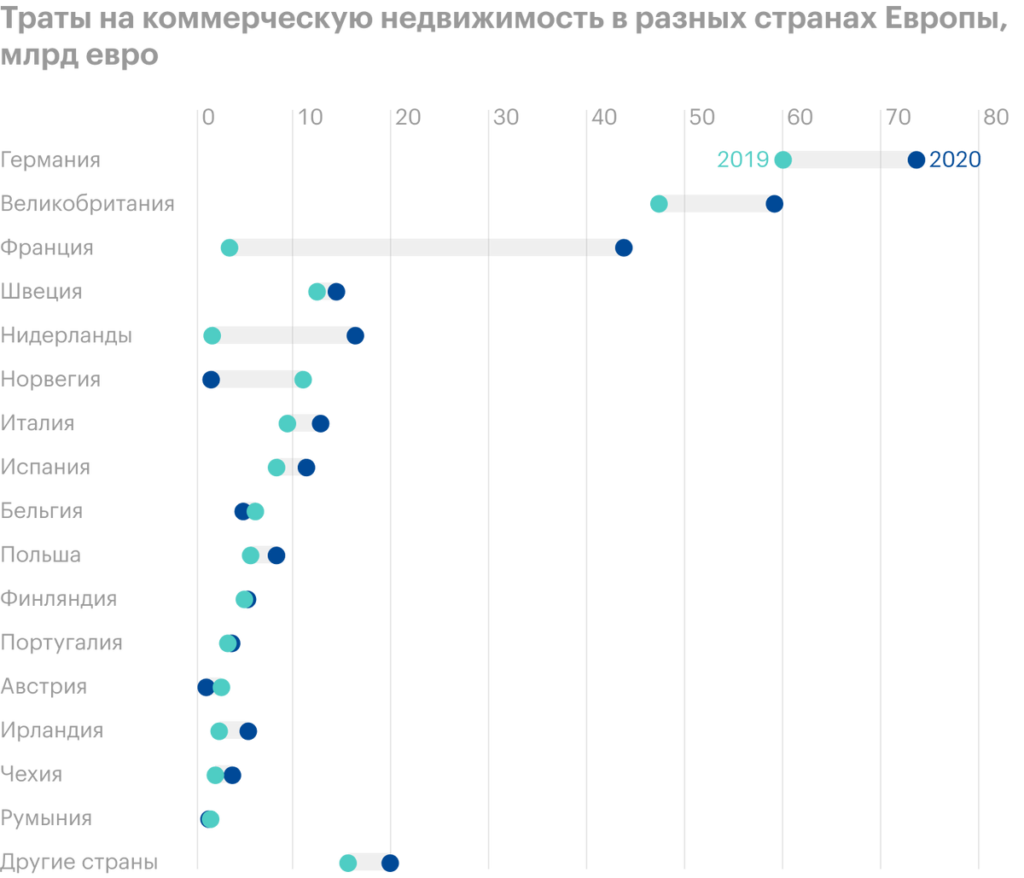

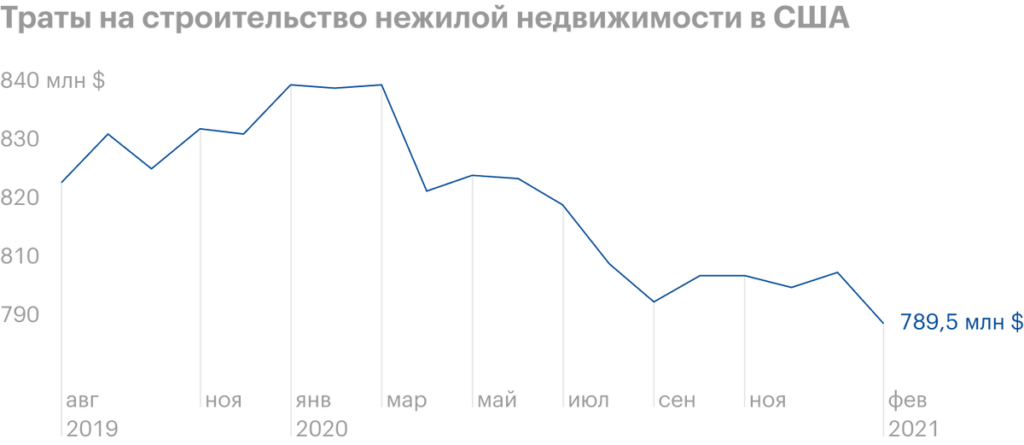

And if a significant percentage of sales there are commercial real estate, then it's very bad. US office occupancy rate, and not only in the USA, fell seriously, which calls into question the feasibility of investing in new commercial real estate: if the old ones are not completely filled, why build new? Therefore, here I would be afraid of a possible drop in Carrier sales. Actually, investment in commercial real estate in the United States and Europe has already begun to fall - and will certainly begin to fall in other regions.

But, because we do not know the percentage of commercial real estate in Carrier orders, let's not rush to pessimistic conclusions. According to some indirect signs, one can say, that the fall in investment in office real estate Carrier did not hurt: by the end of 2020, when the fall in investment in office buildings has already been recorded, the company's sales significantly exceeded the indicators 2019 - in the "ventilation" segment, for example, sales increased by 60%.

Motley Fool has an analysis of the distribution of the company's revenue by type of customer, but this data is taken from nowhere. According to this article, in the segment "Ventilation, heating and air conditioning " 60% revenue is provided by commercial real estate - this can mean, that the company calmly survived the drop in demand in this area and successfully refocused on residential real estate.

But with the third segment, "Transportation of chilled products", the company was lucky: Coronavirus has led to a sharp increase in online grocery sales. In this regard, there has been an increase in investment in warehouses in the United States, where chilled food is stored. Expected, that by 2027, revenue in this market will grow from today's $7 billion to $18.6 billion. In Europe and Asia, online product sales are also on the rise., which creates the same positive preconditions for the refrigerated transport industry. Think, here Carrier will be loaded with work.

Things to Keep in Mind

The company pays 0,48 $ dividend per share per year, what gives 1,12% per annum. The company spends about $200 million a year on this.. Basically, it's a little about 10% from her annual profit. But here it is necessary to take into account the situation in the accounting department of the company..

According to the latest report, Carrier has $18.5 billion in debt, of which 5.1 billion must be repaid within a year. Basically, Carrier should have enough money for everything: 3,115 billion in accounts and 2.781 billion debts of counterparties. Yes, and those digging, which Carrier pays, not very conducive to a strong fall in stocks in the event of a hypothetical cancellation or reduction in payments. But it's worth keeping this point in mind..

But the growth of these shares by 205% over the past year, when the company not only did not earn more, but even began to earn less. Certainly, sales have skyrocketed in recent quarters. But here it is necessary to take into account, that construction activity at the end of 2020 increased also because, that companies sought to catch up during the quarantine period. This means, that maintaining demand at the same level is not at all guaranteed. However, if you look at the price of the company - P / E 18,99, - then she does not look insanely overrated.

Resume

Carrier Global weathered the coronavirus crisis well, and she has a strong business foundation, although the situation with commercial real estate may play a deplorable role in the near future. Therefore, these stocks look like a very good option for investing in the medium term..