Today we have a very speculative idea: take shares of a company, working in the field of fertilization, - Progins (NASDAQ: PGNY), - to capitalize on the growth in demand for its services.

Growth potential and validity: 18% for 14 months; 11% per year for 15 years.

Why stocks can go up: demand for the company's services will only grow.

How do we act: take now 57,64 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

The company name is a modified version of progeny, which in English means "offspring".

The company is a provider of solutions in the field of reproductive medicine: from insurance to advising on these issues and selling medicines. Maybe, one might say, what is this insurance business. This is what the company does:

- draws up individual insurance plans in the field of reproductive medicine;

- gives access to consultants, including online, providing medical advice and psychological support;

- gives access to a network of clinics and specialists in the relevant field;

- gives access to a system of appropriate drugs, outstanding prescription;

- provides access to analytics and data in the field of reproductive medicine.

At the same time, it is important to understand, that the company itself does not produce anything. For the most part, Progyny services are used by corporate customers., providing appropriate insurance options to their employees. Progyny earns, when women, participating in the insurance program, use her services - they freeze the egg, and so on.

The company's annual report is practically useless: there is no segmentation.

The company operates only in the USA.

Arguments in favor of the company

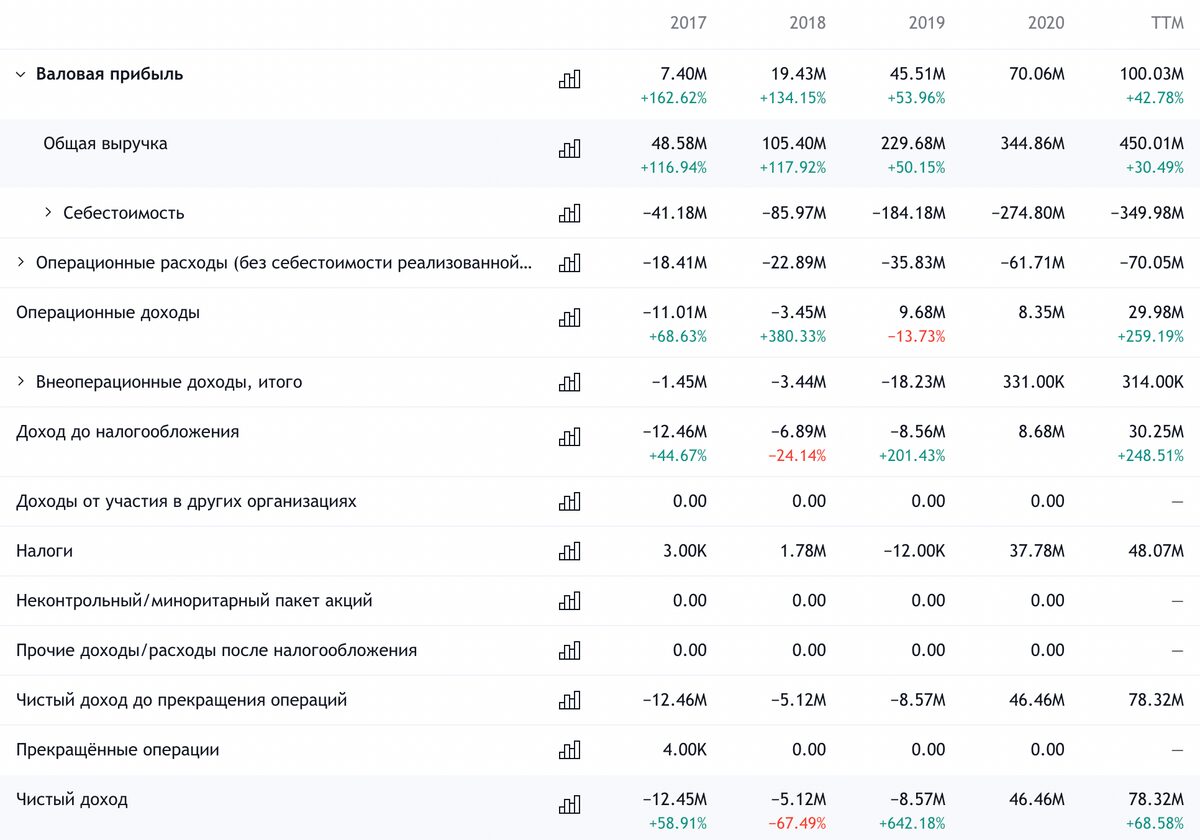

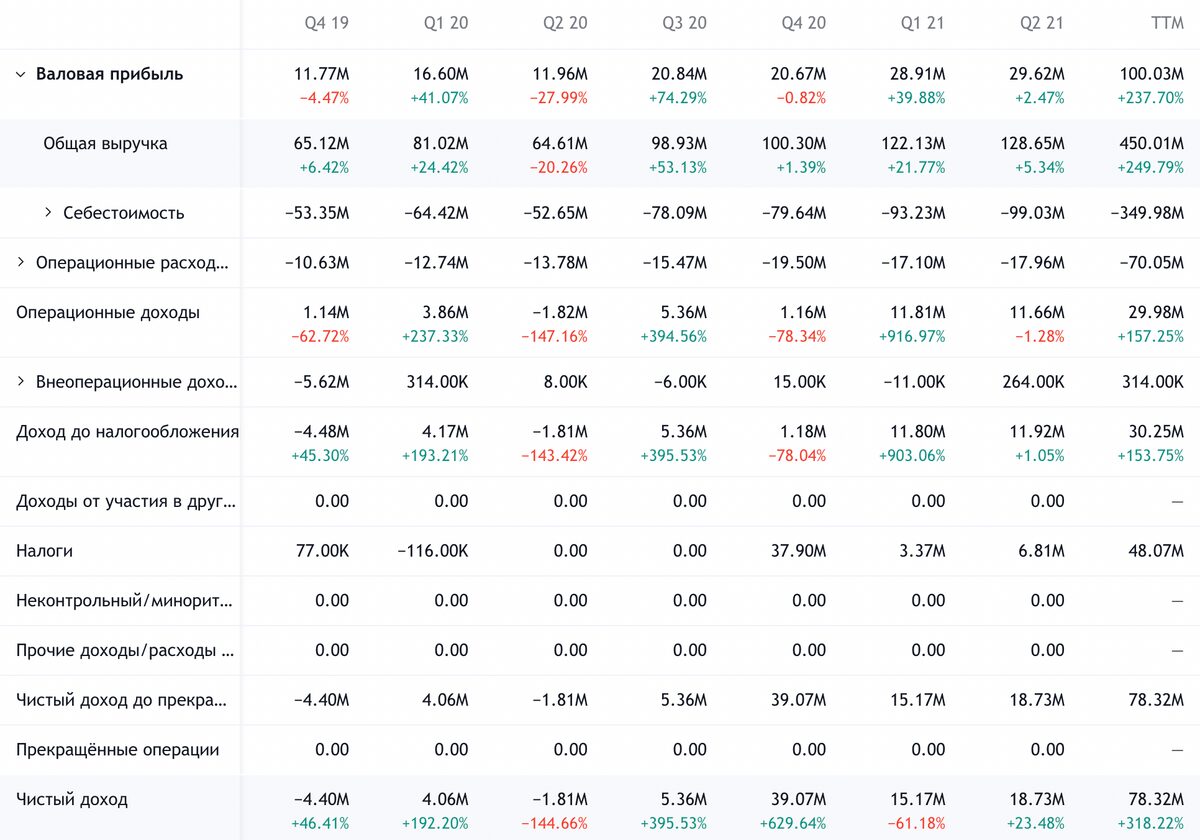

It's alive! Living! The company is profitable, let it also have a large P / E — 73,5, she makes money, And it's not a loss making startup.. This alone makes it attractive to many investors., because its market is considered very promising. In other words, better high P / E, than the absence of P / E.

Conjuncture. I don't see the preconditions for explosive growth here., as in the case of cloud computing or cybersecurity. But in general, the situation for the company is positive.: The average age of women in childbirth is on the rise in the United States., which automatically guarantees difficulties with conception. The reasons for this are economic: life in the usa, and in Western countries in general, for most it gets harder and harder, you have to work more and more - because the birth of a child is often pushed back in time. The pandemic hasn't made childbearing more attractive — and, may be, it will even have wide implications in the future: unclear, how the virus itself and vaccines will affect pregnancy.

In the future, I would expect an increase in demand for Progyny services, albeit not so rapid, as in IT industries. And also that, that investors will run into the company's shares, counting, that this is an "extremely promising industry". In absolute terms, the company is not very expensive - $ 5.15 billion, - so the effect of such an influx will be serious.

Labor market. In the US, there is a shortage of workers on all fronts and many companies are increasing benefits and wages.. It would be logical to lure workers with "reproductive insurance". So Progyny may well have a seasonal influx of customers much higher than usual..

Accounting. All debts of the company are more than covered by the money at its disposal.. In anticipation of higher rates and more expensive loans, this will increase the attractiveness of the company in the eyes of many investors.

Can buy. The halo of prospects and the low cost of the company can attract a buyer from among large insurance companies: they have a lot of money, but with business growth points, everything is not so good. Progyny in this context would be a good acquisition for them.

What can get in the way

Your math is off. According to the calculations of the company itself, its target market in the US is $7 billion. Progyny takes 6,42% their market, but it stands as 73,57%. Expensive!

Actual P / E company - in the area 100 or more, because a third of her "profit" in the past quarter was tax deductions, and in 2020 tax deductions were given 80% arrived. All in all, these stocks are asking for a correction.

No rest. According to company report, 65% her clients came to her after, how they refused the services of its competitors. Basically, this is a good indicator, but it also tells us about the competition in this area. A better competitor Progyny may appear, because, as Qui-Gon Jinn said, "There is always a bigger fish".

One bend and you're dead. Business in such a delicate and intimate area is very vulnerable to reputational risks. In the United States, stories about pervert doctors in various fields constantly pop up.: from rhythmic gymnastics to the treatment of former military. At all, if you read the New York Times every day, then you can solve, that one in three doctors in the US is a sex maniac. Obviously, it's a really big problem in the US.

If suddenly Progyny is involved in such a story, then her business may falter: corporate clients may well boycott the company. But long before that, the company's quotes will fly to hell.: she's obviously overrated.

"Good n-n-planchik". The US medical system is monstrously overcomplicated, it has a lot of pitfalls. Any changes in medical legislation and amendments to acts may adversely affect the company's business.

Pandemic of our anxiety. New large-scale quarantine may well force many women to postpone trying to conceive, so here the company is a hostage of fortune.

Unclear, what is this all for. Progyny is dependent on the inclusion of reproductive medicine in the insurance plans of various employers. But in the long term, the corporate sector in the US may well start cutting costs and reducing spending on it..

What's the bottom line?

The company's shares can be taken now by 57,64 $. And then there are two options:

- wait until they grow 68 $ - slightly higher than their June highs in 64,5 $. Think, we will reach this level in the next 14 months;

- hold shares for the next 15 years, to witness that, how the company will become Allianz from the world of reproductive medicine.

Due to the overvaluation of the company, you should be mentally prepared for volatility. In which case console yourself with the words of Democritus: “Raising children is a risky business.. For in case of success, the latter is acquired at the cost of great labor and care., in case of failure, grief is incomparable with any other..