Today we have a moderately speculative idea with a conservative touch: take shares of EnerSys industrial business (NYSE: TO US), in order to capitalize on the industrial boom in the USA.

Growth potential and validity: 12% behind 14 Months; 25% behind 2 of the year.

Why stocks can go up: US industrial boom.

How do we act: we take shares now by 78,64 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

The company is engaged in the production of solutions in the field of energy storage and distribution.. According to the annual report, revenue is distributed as follows:

- Energy systems - 46,3%. Power systems and solutions in this area - mainly for industrial customers, but also for telecoms and energy. Segment operating margin — 4,9% from its proceeds.

- driving force - 39,1%. Forklift Power Solutions, rail transport, as well as for mining equipment.

- Segment operating margin — 12,3% from its proceeds.

- Special Solutions - 14,6%. These are solutions for turning on appliances and lighting in such industries, how defense, aerospace industry, medicine, security and others.

Segment operating margin — 10,6% from its proceeds.

Geographically, the company's revenue is divided as follows: 59,8% — USA, 40,2% - other, unnamed countries, none of which gives more 10% of the entire revenue of the company.

Arguments in favor of the company

There is where and why to grow. In the words of William Blake, The satanic mills of the American economy keep turning—and they're doing it in the right direction.. The industrial part of EnerSys business will grow, while the American real sector is showing growth, he shows growth, despite problems with logistics and lack of workers and raw materials.

With EnerSys forklifts, luck smiles too: from companies around the world, but especially in the US, we should expect an increase in investments in storage capacity. In the long term, the US corporate sector is expected to increase investments in the renovation of factories and the state or the private sector in the renovation of the US infrastructure - this also plays into the hands of the company..

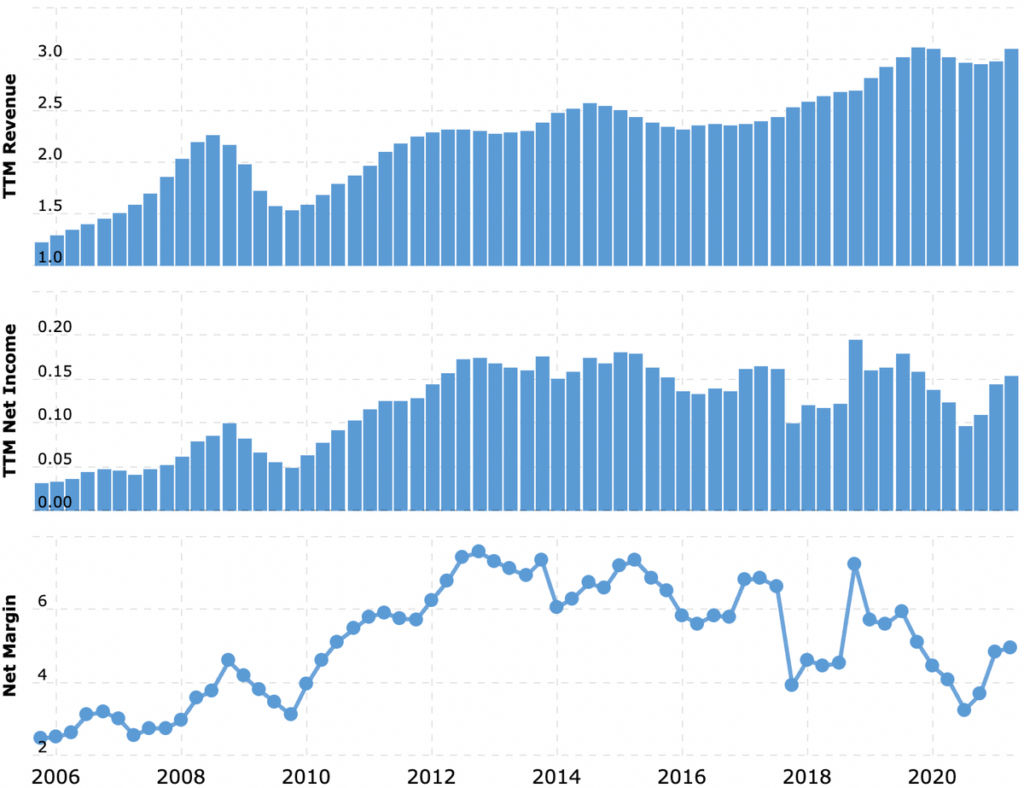

Worth it normally. P / S at the company 1,11 - this is very little. P / E she has 22,5 - not very little, but not much. The company occupies about a third of its market - and costs about a third of it. So you can't call it overrated.. And if you take into account, that thanks to the company's investments in business development, its market will soon increase by one and a half times - up to $ 16 billion, then we can expect the growth of its financial indicators and quotes.

Why not buy. Considering all of the above, EnerSys may well buy. Its capitalization is only 3.36 billion dollars, so that it may well be included in some large conglomerate.

What can get in the way

Standard pains. Like the entire industrial sector, EnerSys will suffer from material shortages, rising labor costs and logistical problems. Chances are high, that the increase in revenue in the reporting will be leveled by the increase in expenses. Or that EnerSys will have a massive increase in backlogs. You should also take into account the permanent risks of the new quarantine., which will spoil the company's reporting for at least one or two quarters.

Accounting. The company pays 0,7 $ dividends per share per year - approximately 0,88% per annum. It takes her about $ 30 million a year to do this - or 20% from her profits for the past 12 Months. The likelihood of cut payments seems to me very low - as well as the likelihood of a strong fall in stocks from such a cut, this is unlikely to provoke a massive exodus of investors, they love the company not for this.

Another thing, that the company has a very high level of debt: 1,905 billion, of which 604.7 million must be repaid during the year. There is enough money at the disposal of the company to close all urgent debts and pay dividends: 406,23 million on accounts and 580.96 million debts of counterparties.

But it's worth remembering that, what does EnerSys have, like many industrial enterprises, large investment needs in the renewal of fixed assets, - so it is unlikely that EnerSys debt will decrease in the coming years. May be, the company will continue to spend on expansion and the debt will increase. Big debt in an era of more expensive loans will scare away some investors.

What's the bottom line?

We take shares now by 78,64 $, and then there are two options:

- we wait, when will the shares be worth 88,1 $, which is much less, than they asked for back in August of this year. Think, we will reach this level in the next 14 Months;

- we wait, until stocks hit August level 99 $. Probably, it will happen in 2 of the year.