"Transneft" (MCX: TRNFP) - the world's largest oil pipeline company. In addition to exporting oil and oil products by pipelines, it carries out sea supplies of hydrocarbons through the controlled port operator "NCSP".

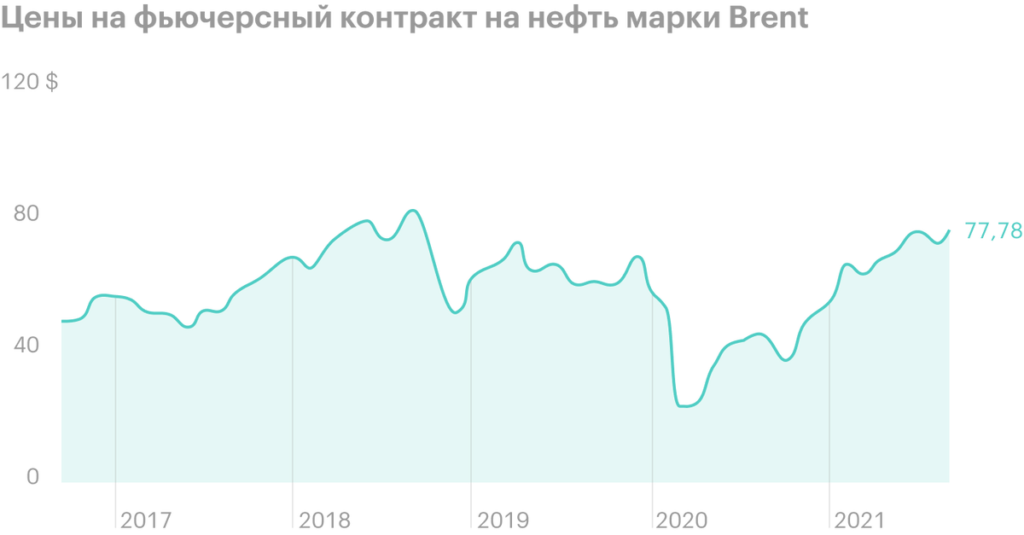

The main income of the company comes from the transportation of oil and oil products. Starting in the second half of last year, the oil industry began to gradually recover from the consequences of the crisis, and as a result, oil prices returned to pre-crisis levels. So, 27 September, the cost of Brent crude for the first time in two years exceeded 75 $.

Against the backdrop of a recovery in demand and prices in the oil market, OPEC + is gradually lifting restrictions on oil production, allowing to increase production by 0,4 million barrels per day monthly. It is beneficial for Transneft, because its income directly depends on the volume of oil pumped through its pipelines. Nevertheless, OPEC+ restrictive measures will continue until the end of 2022., what will hold back the operating performance of the business.

Disclaimer: if we write, that something went up or down by X%, then by default we mean a comparison with the report data for the same period last year, unless otherwise stated.

Dynamics of operating indicators

Transneft is a natural monopoly, therefore, the tariffs for its transport services are regulated by the state represented by the federal antimonopoly service.

The tariff policy for 2021-2030 assumes indexing the cost of the company's services annually from 1 January on 99,9% from the level of the projected consumer price index for the coming year.

IN 2020 year, the Ministry of Economic Development of the Russian Federation predicted, what the consumer price index will be 103,7% at the end of 2021. This value became the basis for calculating the indexation of the Transneft tariff. 99,9% of the forecast index is approximately 103,6%. That is, this year the company could increase tariffs for services, state-regulated, maximum for 3,6%.

For example, if a certain service is at the end 2020 cost a year 100 R, to s 1 January 2021, the price would rise to 103,6 R.

Today we can already state, that the forecast was overly optimistic, and in September this year, the Ministry of Economic Development and Trade raised the inflation forecast for 2021 to 5,8%. That, that real inflation in 2021 significantly exceeds the growth of tariffs for Transneft services, acts as a negative factor for the company.

Indexation of tariffs for oil transportation services through the Transneft system from 1 January

| 2016 | 5,76% |

| 2017 | 3,6% |

| 2018 | 3,77% |

| 2019 | 3,87% |

| 2020 | 3,42% |

| 2021 | 3,6% |

5,76%

At the end of the first half of 2021, Transneft reduced the volume of oil transportation by 5% - to 217,6 million tons, - as usual, due to production restrictions.

Oil exports to non-CIS countries decreased by 13% - to 91,6 million tons. Of them 19,6 million tons exported to China, 17,1 million tons went to Europe through the main oil pipeline "Druzhba", 54,8 million tons — through the seaports of Ust-Luga, Kozmino, Novorossiysk and Primorsk.

Transportation of petroleum products fell by 3% - to 19,2 million tons. Nearly 90% of this volume fell on diesel fuel. The share of exports of petroleum products is 76%, the rest goes to the domestic market.

Transportation volumes for the first half of the year, million tons

| Oil | Petroleum products | |

|---|---|---|

| 2016 | 238,8 | 17,2 |

| 2017 | 237,4 | 16,6 |

| 2018 | 235,3 | 19,7 |

| 2019 | 235,2 | 19,2 |

| 2020 | 229,2 | 19,8 |

| 2021 | 217,6 | 19,2 |

Revenue and profit

Transneft's revenue increased by 8% - to 529,4 billion rubles. About 71,5% the company received revenue for the services of transportation of oil and oil products in Russia and for export. At the same time, revenue growth was due to an increase in pumping in the domestic market, and also due to the recovery of volumes of sales of oil and oil products. Revenue from oil transportation to foreign markets decreased by 7% against the background of a drop in pumping volumes.

Revenues from the sale of crude oil are derived from supplies to China under a 20-year contract from 1 January 2011 for an annual supply of at least 6 million tons of oil. Oil for sale to China is bought from Rosneft, that is, Transneft acts as an intermediary between the producer and the buyer. The increase in revenue in this segment was caused by an increase in the average realized oil price.

Structure of revenue by types of services

| Oil transportation | 64,1% |

| Transportation of petroleum products | 7,4% |

| Sales of oil and oil products | 21,4% |

| Port and fleet services | 4,6% |

| Other | 2,3% |

64,1%

The company's operating expenses excluding depreciation and amortization increased by 20% - to 290,1 RUB bln - due to an increase in the cost of oil sold, increase in the market price of a barrel, as well as increased material costs., wages, pension and insurance contributions.

As a result, operating profit fell by 7% - to 130 billion rubles, — despite record revenue growth.

Besides, the company has recognized a profit of 1,6 billion rubles - against a loss in 21,5 billion rubles - in the line "Other income or expenses". During the revaluation, management reduced the value of the company's main assets against the backdrop of unfavorable market conditions and underloading of certain sections of the highway. This year there was a reverse revaluation due to the recovery in demand and prices in the hydrocarbon market.

The company has a number of subsidiaries and joint ventures, associated with the transportation of oil and petroleum products. This year, against the backdrop of overcoming the crisis, Transneft's profit from participation in joint ventures amounted to 18,9 billion rubles - against a loss of 13,2 billion rubles last year.

Net finance costs increased from 8,4 to 15 billion rubles, which was partly due to the revaluation of exchange rate differences due to the weakening of the ruble.

As a result, net profit of Transneft increased by 49% - to 109,5 billion rubles - and almost returned to the pre-crisis level.

Company financial results for the first half of the year, billion rubles

| Revenue | Operating profit | Net profit | |

|---|---|---|---|

| 2017 | 438,3 | 139,6 | 113,9 |

| 2018 | 463,3 | 121,4 | 92,1 |

| 2019 | 520,3 | 142,3 | 112,7 |

| 2020 | 491,7 | 139,9 | 73,4 |

| 2021 | 529,4 | 130,0 | 109,5 |

Debts

The total debt of Transneft is declining and fell by another 8%, reaching the minimum of recent years. Net debt decreased by 14% - to 454,9 billion rubles - both by reducing the amount of loans and borrowings from 589,5 to 543,4 billion rubles, and by increasing the volume of money in accounts and their equivalents from 62,8 to 88,5 billion rubles. As a result, the net debt / EBITDA ratio was 1.05× - against 1.19× at the beginning of this year.

Debt dynamics, billion rubles

| Total debt | net debt | Net Debt / EBITDA | |

|---|---|---|---|

| 2017 | 688,9 | 612,7 | 1,5× |

| 2018 | 673 | 571,14 | 1,32× |

| 2019 | 637,4 | 553,8 | 1,14× |

| 2020 | 589,5 | 526,7 | 1,19× |

| 1п2021 | 543,4 | 454,9 | 1,05× |

Dividends

The company's charter prescribes special conditions for dividend payments for preferred shares., which are traded on the stock market. All ordinary shares are owned by the state. Not less than 10% from net profit. In this case, the payment per preferred share cannot be less than, than one ordinary.

As a guideline, the dividend policy states, that at least 25% from consolidated net income, adjusted for non-recurring and non-cash items. In recent years, the company has paid shareholders about 50% from the adjusted net profit under the current regulations on the payment of dividends by companies with state participation.

Dynamics of dividend payments per preferred share

| 2015 | 823 R |

| 2016 | 4296 R |

| 2017 | 11 454 R |

| 2018 | 10 706 R |

| 2019 | 11 612 R |

| 2020 | 9224 R |

823 R

What's the bottom line?

Operational and financial results of Transneft indicate a gradual recovery of the situation in the hydrocarbon industry. At the same time, the domestic market is recovering faster, and oil supplies to Russian refineries have already exceeded the same indicators of last year. OPEC+ restrictions to continue until at least the end of 2022, which will limit the operating performance of the oil pipeline operator. But the current agreement provides for a monthly increase in production by 0,4 million barrels per day, which gives grounds to expect an increase in the volume of pumping.

The downside for shareholders is, that the company's tariffs are tightly tied to the inflation forecast. This year, forecasts have diverged significantly from reality., due to which prices for Transneft services were poorly indexed. This led to a decrease in operating profit, despite record earnings.

In general, in the coming 12 months, we can expect a moderate growth in the operating and financial indicators of the company, if the OPEC + agreement is not revised in one direction or another, due to a change in the balance of supply and demand in the oil market.