Today we have a conservative idea: take stock of defense contractor BWX Technologies (NYSE: BWXT), to capitalize on rising tensions in the China area.

Growth potential and validity: 10,5% behind 12 months excluding dividends; 21% behind 20 months excluding dividends; 8,5% per annum during 10 years including dividends.

Why stocks can go up: business stable, but the situation in Asia is not.

How do we act: we take shares on 55,2 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

BWX Technologies produces spare parts and fuel for nuclear enterprises - mainly defense.

According to the company's annual report, the company's revenue is divided as follows.

Nuclear operations — 77,52%. In fact, this is the production of nuclear reactors and fuel for military submarines and the navy.. 94% segment revenue is provided directly by the US government. Segment operating margin — 19,8% from its proceeds.

Nuclear energy — 17,48%. This is the production of solutions for the commercial sector in the field of nuclear energy. Segment operating margin — 14% from its proceeds.

Nuclear services — 5%. These are materials processing services in the nuclear field, as well as enterprise management. Services here are provided mainly to the US government., which accounts for 87% segment revenue. Segment operating margin — 19,4% from its proceeds.

Revenue by country:

- USA - 83,83%.

- Canada - 14,58%.

- Other, unnamed countries - 1,58%.

Arguments in favor of the company

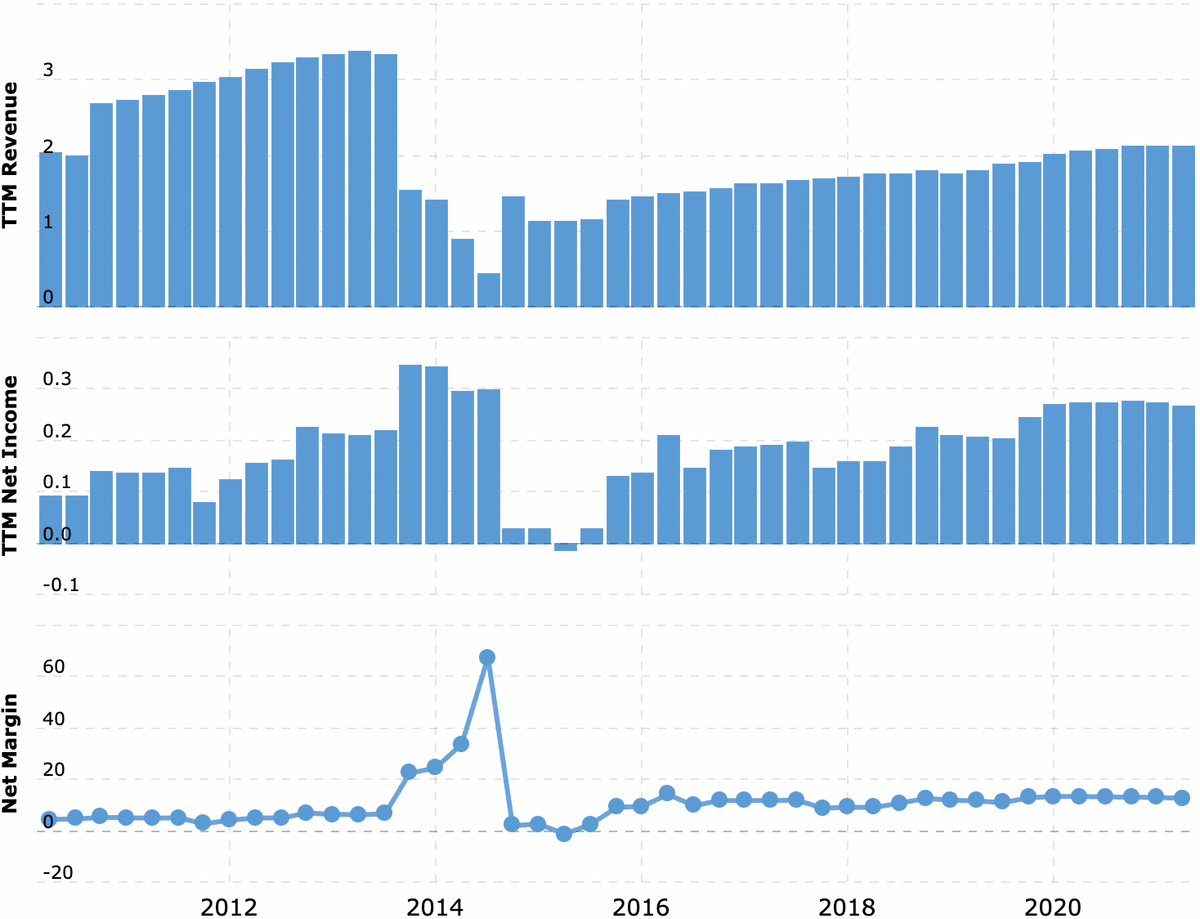

Reliability. According to the report, 77% BWX revenue comes from the US government. This alone makes the company's business quite stable and stable., what can attract a lot of investors to these stocks, - good with P / E 19.69 the company does not look overvalued.

More romance. Last week, Australia signed a massive agreement with the Americans and the British to build their own fleet of nuclear submarines.. Americans and British are expected, that they will share technology with Australia. Therefore, in the foreseeable future, BWX may get a couple of fat contracts. And even if it doesn't fall, it is very likely, that investors will soon pump up BWX quotes in anticipation of the materialization of contracts. The company has a very small capitalization - $ 5.25 billion, therefore, the effect of the influx of ordinary investors can be very serious.

Dividends. The company pays 84 cent dividend per share per year, which gives approximately 1,52% per annum. It's not much, but more than the dividend yield S&P 500 c 1,3% per annum. Above average dividend yield when making an investment decision by the average market participant may tip the balance towards BWX.

Can buy. Given the low price and stability of the company's business, it may well be bought by some private foundation or even another defense company. In light of the Australian events, the "submarine" Huntington Ingalls is seen as the most likely buyer. But in general, anyone can buy BWX.

What can get in the way

Something with ESG. From an ethical investment point of view, nuclear power is a highly controversial topic.. On the one side, the environmental friendliness of nuclear energy is beyond doubt. On the other hand, after Fukushima, many projects in this area were curtailed for safety reasons. So it's not clear here, how stable will the company's commercial nuclear segment be. AND, what is even more important, no answer to the main question: how the powerful ESG lobby will treat "nuclear" actions - will they ostracize them or remain at least neutral.

Expenses. Like other manufacturing companies, BWX is now suffering from rising cost of raw materials, logistics and labor workers. This is clearly seen in a recent BWX report.: small revenue growth was offset by significant cost increases. As a result, profits fell.

Don't be bold. The company spends about $ 80.65 million on dividends per year - about 31,94% from her profits for the past 12 Months. At the same time, BWX has 1.857 billion debts, of which 801 million must be repaid within a year. The company doesn't have a lot of money.: 193,752 mln on accounts and 98.8 mln counterparties in arrears. So she can completely cut payments to close debts in which case.

However, the company's business is very stable, so "what", probably, won't happen. But let's keep this in mind, after all, the idea is largely based on the dividend factor - cutting payments can lead to a significant drop in quotes.

What's the bottom line?

Shares can be taken now by 55,2 $. And then there are the following options:

- wait 61 $. Think, that we will reach this level in the next 12 Months;

- wait for the price 67 $. So much for the shares asked back in April, so I think, that, taking into account all the positive aspects of this level, we will achieve 20 Months;

- hold shares 10 years, receiving dividends. And in the long run, certainly, the likelihood of buying the company by someone larger increases greatly.

Well, look at the news section of the company's website: suddenly it will be possible to get rid of shares on the St. Petersburg stock exchange before, how the market will react to a change in dividend policy.