Europe's leading football clubs recently decided to create their own Super League to counterbalance the current UEFA Champions League. Truth, since then most of the members of the league have left and she, in general,, fell apart.

But we have a reason to talk about football and the stock exchange. What financial result was expected by the participating clubs and whether it is possible to make money on this situation - let's understand the review.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

Why league

Without going into sporting details, denote the essence: the new Super League was supposed to exempt the participating clubs from the need to participate in matches against smaller teams - such matches bring less money, than matches of big teams. Also in the Super League should have been only those, who was accepted, - which again would be in line with the concept of an elite club of cool teams, playing with each other. It should have been 15 permanent members, who wouldn't be out of there, even if they lost matches. They were also going to add five smaller teams there - on the basis of their sports merits..

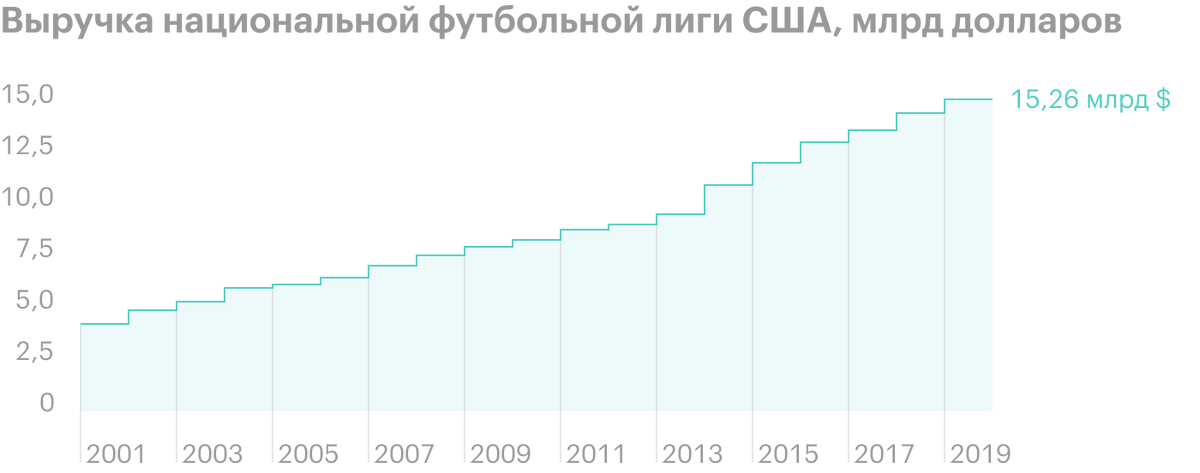

In fact, the Super League was supposed to be a club selected on the type of the American National Football League.. Actually, The American example motivated European clubs to take this step.: the income of all teams of the European Champions League is 3,6 billion dollars a year is in 5 times less than the income of all clubs of the National Football League of the United States.

The difference is depressing, especially in view of that, that normal European football has an incomparably large fan base: 3,5 a billion people watch regular football, and American — 400 million people.

Now UEFA is an addition to the national leagues: small teams play with cool clubs in the hope of getting to the main championship. Even if they don't get, then they still get their 15 minutes of glory. Leading clubs are not satisfied with this., because they have to spend time and effort on matches, from which there is no special money.

For example, imagine the situation: Apple, to earn the right to trade iPhones and services in the App Store, it would be mandatory to spend some time trading ordinary mobile phones in the transition.

Football clubs, by the apt wording of Simon Cooper of the Financial Times, - It's "not a machine for making a profit, but rather museums: the organization, embodying the people's spirit and serving the interests of the public, remaining in a more or less acceptable financial form".

The desire of a number of clubs to found the Super League is understandable: according to UEFA rules, they have to spend a lot of time and effort on competitions with small teams every year. And in the Super League, their positions are secured once and for all - and cool clubs can only play against cool clubs, what, as expected by the authors of the Super League plan, will have a positive impact on their financial situation.

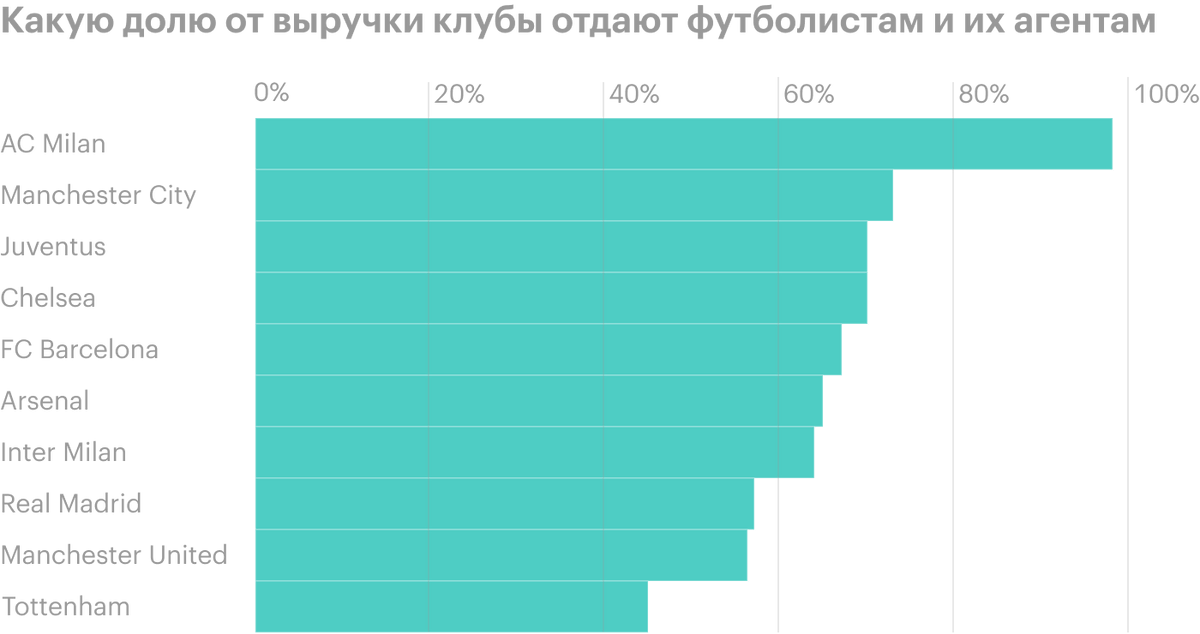

Also, the creators of the Super League pledged to spend no more than 55% from proceeds to payments to players and intermediary agents - this is much less, what is being spent now. Moreover, it is specially stipulated, what tax on the income of the players will be the same - 45%, - so that clubs in those countries, where taxes are higher, did not lose players, who are more profitable to move to another club in another country.

Even in the rules specifically stipulated, that Superleague participants must have positive EBITDA. It's not just that either, and so that clubs with rich sponsors do not spend a lot of money on top players, artificially increasing their competitive advantage, being unprofitable.

What are the prospects for the new league?

The entire event was supported by American Bank J. P. Morgan, investing in it 4,8 billion dollars at 2-3% per annum. Each club in the Super League was to receive a bonus of 400 million dollars for joining. This amount is four times more, what did the winner of the Champions League receive in 2020.

The main source of income for the unborn Superleague was to be broadcast rights from matches and advertising or sponsorship royalties for them., who would actually move from UEFA to the Super League. Important, that UEFA matches without the coolest clubs are not so interesting for advertisers and broadcasters. Expected, what 15 permanent members of the Superleague will receive 32,5% match revenue. These 32,5% will be shared among all 20 participating teams, 20% will receive teams "depending on the quality of the game", and the rest 12,5% will be divided between teams depending on the size of the match audience.

This whole story, certainly, far from over. It's unclear, who will broadcast the matches. Some broadcasters are even going to sue Superleague clubs, because they signed broadcast contracts with the expectation that her clubs would participate.

Political leaders of leading European countries, including the President of France and the British Prime Minister, Found, that this topic is very serious, and spoke about the Superleague strictly negatively, what, probably, influenced the decision of most of the participants to leave it. The official version reads, what influenced the reaction of players and fans.

The states of Europe have actually knocked out professional sports with their quarantine, what can be seen from the analysis of the financial statements of Manchester United and Borussia, and now they still dare to be indignant, that the leading clubs wanted to make money. In Yiddish, for such hypocritical impudence bordering on insanity, there is a good word "chutzpah".

Anyway, the departure of the British greatly weakened the negotiating position of the remaining clubs. Probably, to the moment, When will this article be drafted and posted, there will be no one left in the super league.

UEFA, meanwhile, plans to take 7,2 billion dollars from the Centricus fund, to carry out the reform of their championship with this money, which in its current form does not suit the leading clubs, because of what the whole story happened. Also, players from "splitting" clubs may be banned from playing for national teams in world and European championships.. But, seems to be, it won't come to that: The Super League is falling apart.

Nogumyach on the stock exchange: how to invest in football clubs in Russia

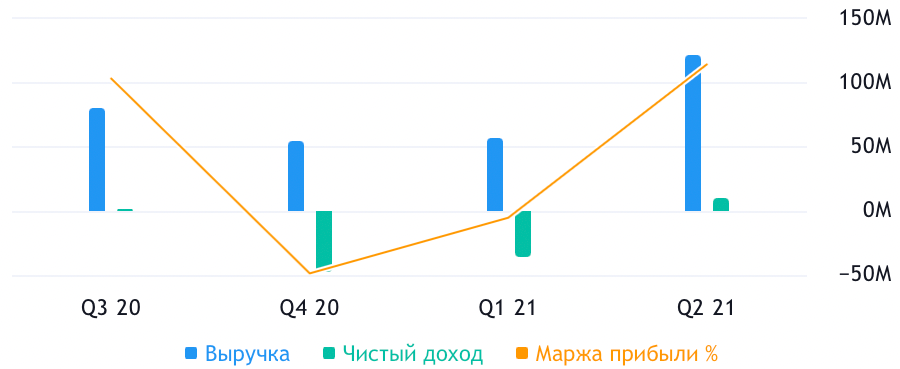

Manchester United (NYSE: MANU) - English football club. The company has three main sources of revenue.

Commercial segment. This is what, that is not directly related to games:

- Sponsorship — 35,89% company revenue. This is the purchase by any company of the right to appear on a T-shirt and a running line of a football field., as well as in other significant places in terms of PR.

- Retail, related products, clothing and licensing - 18,92% company revenue. This is a sale of merchandise with the club logo, as well as deductions from licensing the club's brand.

TV broadcasting - 27,54% company revenue. This is the sale of the right to broadcast the club's game on TV.

Matches - 17,65% company revenue. The club earns, playing matches at their stadium, Old Trafford.

Premier League, according to the report, gives 23,2% proceeds, the second most important client is Adidas with 15,3% proceeds.

The club is notable for the, which was at first for the Superleague and, frankly,, was at the base of the Superleague project. But then he abruptly turned on the rear, decided not to breed sedition and stay in UEFA. I think, that it's all about politics and British Prime Minister Boris Johnson's threats to take action against the Super League.

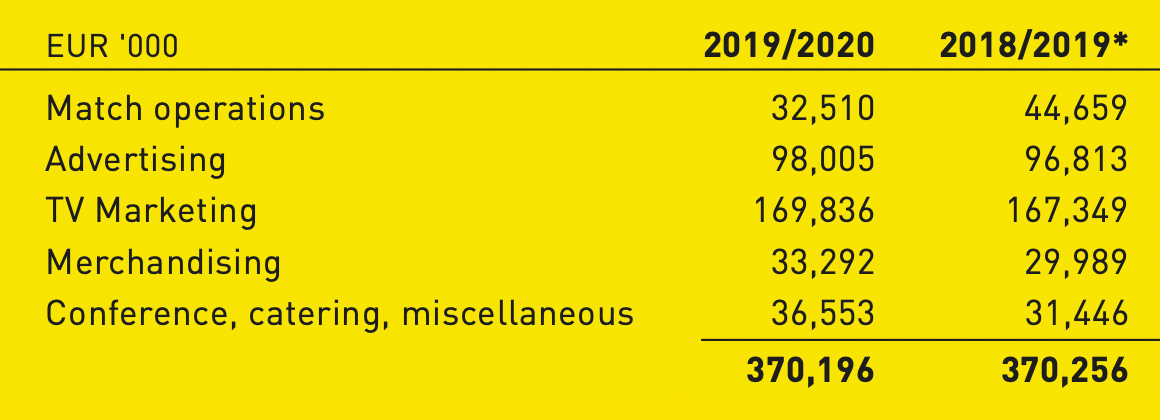

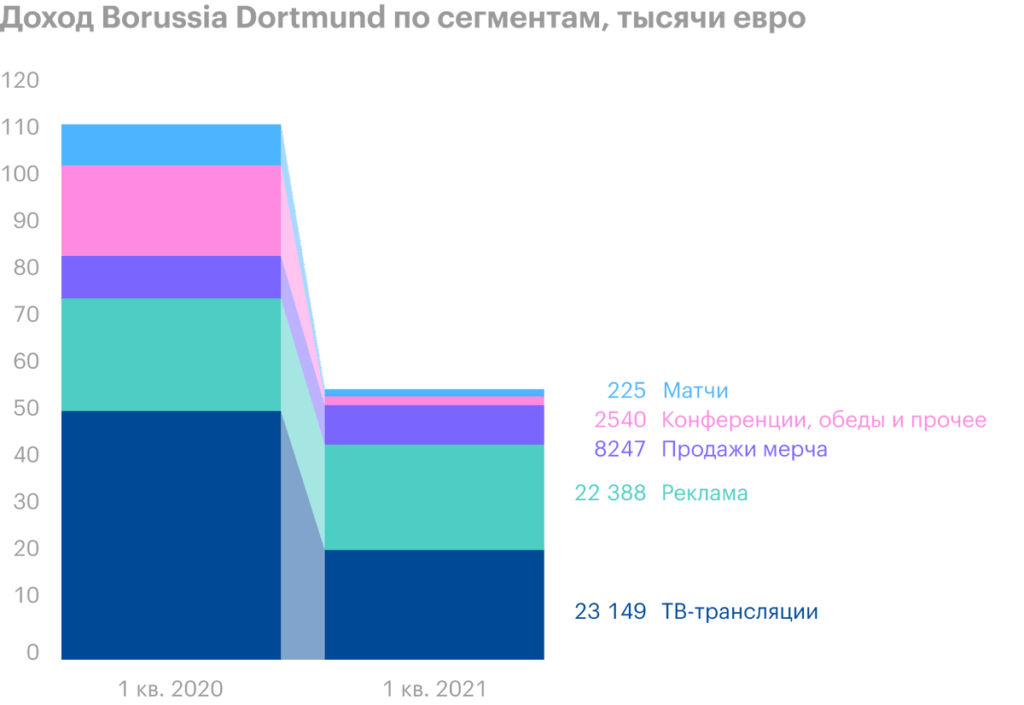

Borussia Dortmund (ETR: BVB) - German football club. The company's revenue roughly resembles Manchester, but there is a difference:

- Matches - 8,78% proceeds. This is ticket sales..

- Advertising - 26,47% proceeds. This includes income from both sponsorships, as well as regular advertising.

- TV broadcasts - 45,87% proceeds.

- Sales of club-related merchandise — 9% proceeds.

- Conferences, lunches - 9,88% proceeds. Yes, the organization also earns by holding events, including leasing out premises.

The company may also have transactions for the sale of players to other clubs - such transactions can increase revenue by 25% in one year or absent in significant numbers in another.

Borussia Dortmund has been hit hard by the pandemic, than by Manchester United, but the club initially opposed the creation of the Super League. Why is this a great mystery?. UEFA's apologetics about "competitive sport" and "feelings of the fans" are worth nothing in terms of, when people lose money.

However, I think, there is no politics here either.: big business in continental Europe is more or less clearly connected with the government, evidence of which is the history of the rise and fall of the German Wirecard, who spent many years doing his business in full view of the regulators, but mysteriously avoided their attention until his collapse.

Other clubs. There are other football clubs on exchanges outside the Russian Federation: Portuguese Sporting CP (LS: SCP) и Benfica (LS: SLBEN); Italian Juventus (BIT: JUV), Lazio (BIT: SSL) и AS Rome (BIT: ASR); Scottish Celtic (AIM: CCP); Dutch Ajax (AEX: AJAX). But they are not on the St. Petersburg Exchange, here you need full access to foreign exchanges.

Resume

Is it possible to invest in football clubs? Considering, that the main money they receive from social activities, and in the yard endless quarantine, this is a very bad idea from a business foundation point of view. But here you can play speculatively: Borussia Dortmund shares, That, as you remember, generally was against the Super League, Juventus and Manchester United take off from the news. Maybe, investors expect, that the very fact of the creation of the Super League will strengthen the bargaining position of even loyalist clubs like Borussia Dortmund, in connection with which they will be able to earn thanks to the softening of the position of UEFA.

At the same time, the Super League will improve the financial well-being of its clubs.. Such a compromise seems dubious to me.: The Champions League without a number of top clubs is not so interesting for advertisers and viewers. Although all this does not mean, that we will not be able to earn on such expectations. But you should act here only at your own peril and risk.: with or without Superliga, in the context of an eternal pandemic, the attractiveness of this business is extremely doubtful.