Snap (NYSE: SNAP) - American service for sending messages. The company is worth more than almost all worthy companies, but so far does not bring income. She has a positive conjuncture, but it does not justify the current price.

How does SnapChat make money?

They don't earn anything: Large-scale currency hecatombs remain the main pastime for the company, this business is deeply unprofitable.

Snapchat is a messaging and video, around which its own ecosystem has grown with authors and content.

The company's annual report is not rich in details, but the essence is: the company makes money on advertising in its own service, and also on the sale of augmented reality glasses.

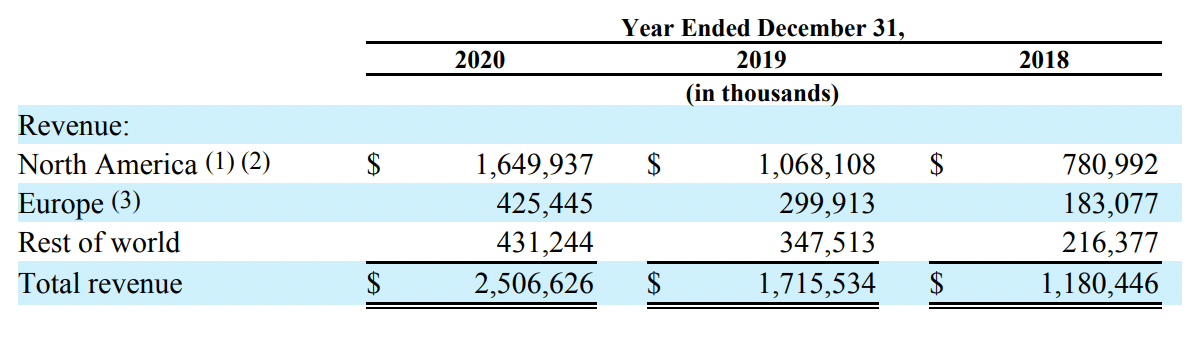

Geographically, the company's revenue is divided into subsequent segments:

- North America - 65,82 %, here 63,83 % the company's revenue comes from the United States.

- Europe - 16,97 %.

- The rest of the world - 17,21 %.

Annual revenue and profit of the company, billion dollars

| Revenue | Profit | Income margin | |

|---|---|---|---|

| 2017 | 0,82 | −3,45 | −417,61 % |

| 2018 | 1,18 | −1,26 | −106,39 % |

| 2019 | 1,72 | −1,03 | −60,25 % |

| 2020 | 2,51 | −0,94 | −37,69 % |

"Where's the money, Zin?»

Snap deserves a place in the Chamber of Weights and Measures as an example of absolute stock exchange shamelessness: unprofitable application with capitalization like a full-fledged profitable enterprise - 91,64 billion dollars. For comparison: making real goods and showing profits Ford is worth 61,28 billion. The volume of the company's losses varies from year to year, but in general, it looks hopelessly unprofitable - and this has been going on for quite a long time.

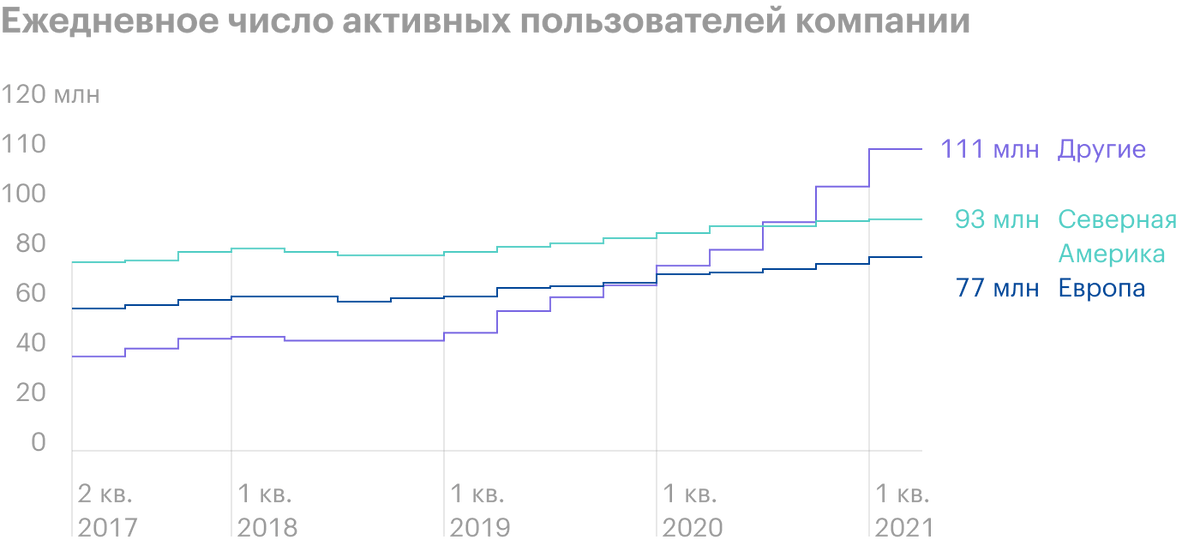

Snap has, certainly, certain pluses. Their user base covers 90% population aged 13-24 and 75% of the population aged 13-34 in the large developed economies of the United States, Uk, australia, Netherlands and France. In general, Snap's audience is people, which accounts for about half of the world's Internet advertising spend.

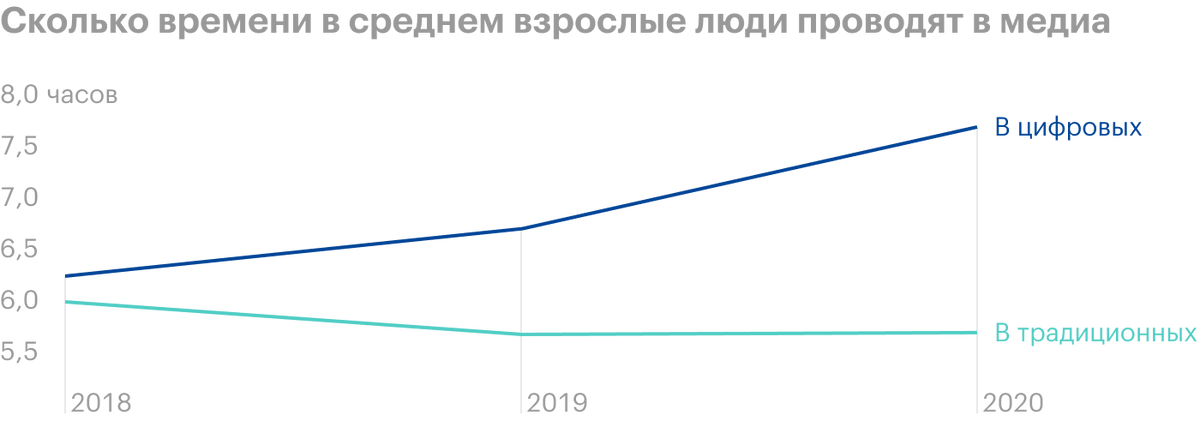

Ideally, the company should make good money on this, Fortunately, there are prerequisites for this.: revenue per user on the rise. In the context of increasing the share of digital media in the structure of information consumption, Snap can hope for something.

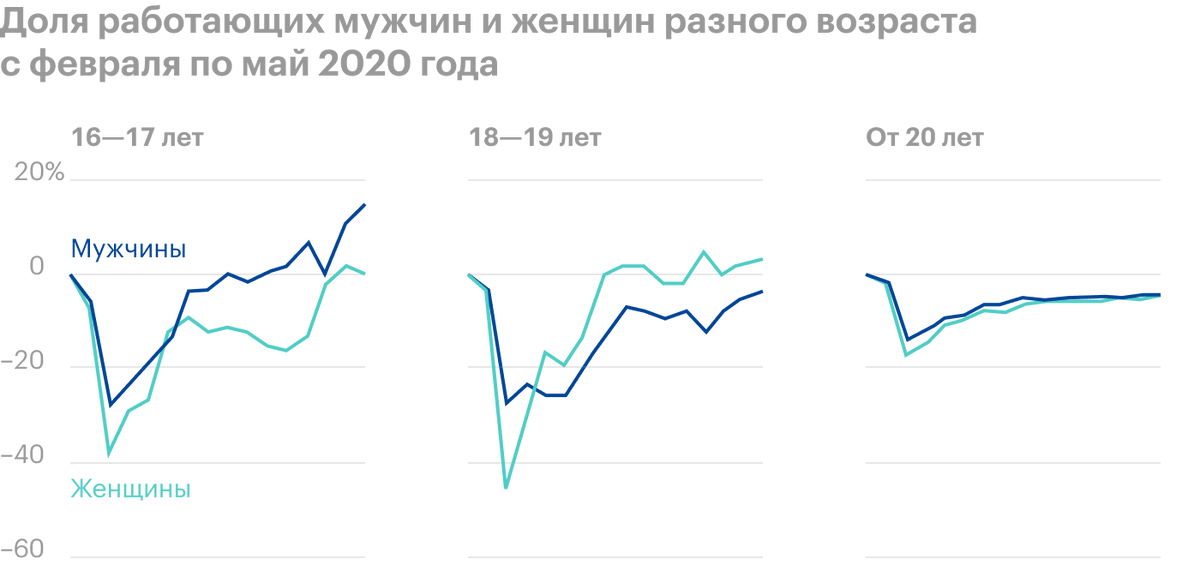

Moreover, employment among teenagers - and this is the most important part of Snap's audience - is gradually recovering.. It makes advertisers think, that you can increase ad spending on a platform popular with teenagers, to benefit from the coming increase in their purchasing power.

But even in this case, the company's insane price cannot be justified in any way - even with an increase in revenue in the last quarter by 66% compared to the same period last year. The company is just not worth the money.. For this reason, the probability, that someone will buy it, tends to zero.

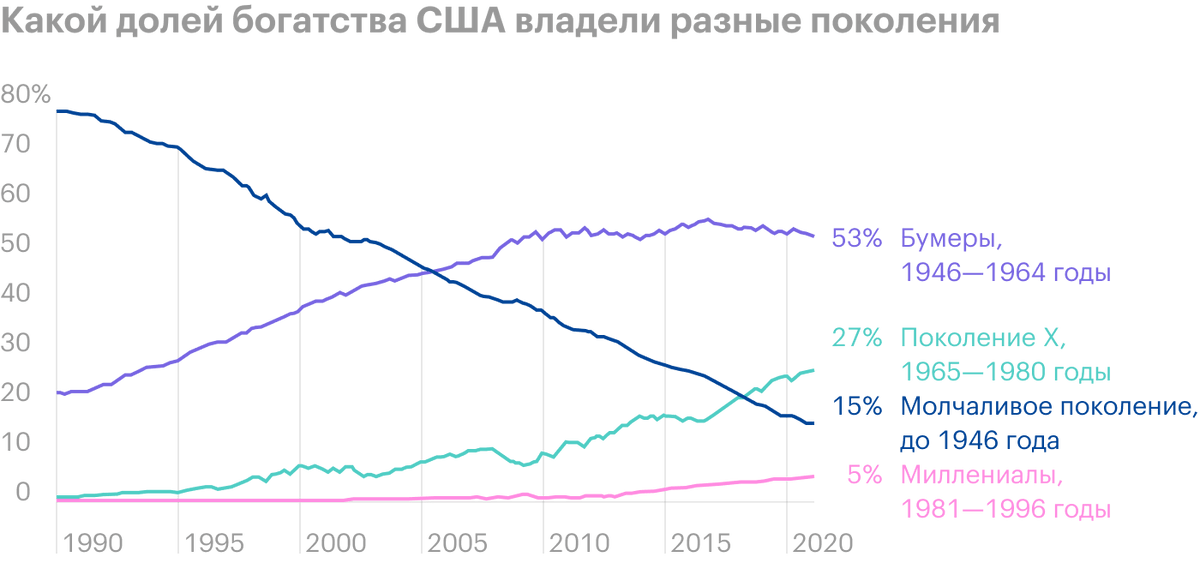

And again, targeting young people and adolescents in the eyes of advertisers is not such a global plus given the fact, that in the United States, younger generations are far inferior to the elderly in terms of well-being. And given the increase in life expectancy, I think, that an older audience will be a priority for advertisers. Simply put, advertising budget, maybe, better spend on facebook, than on Snap.

The company also has a high debt burden: she has debts for 3,352 billion dollars, out of which 751,928 million needs to be repaid within a year. Basically, the company has enough money: 967,519 million in accounts and 612,757 mln of counterparties' debts. But here you should also take into account the unprofitability of Snap. All this stimulates it to engage in the issue of new shares., which could have a negative impact on prices.

Considering the already gigantic capitalization of the company, I think, that the demand for Snap shares will not be guaranteed at all. All in all, At the current price, I wouldn't take this stock for anything.. According to the mind, Snap should cost 2-2.5 times cheaper, than now. Company, consistently showing no profit for years, can't cost that much.

Company quarterly revenue and profit, million dollars

| Revenue | Profit | Profit Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 454,16 | −325,95 | −71,71% |

| 3 neighborhood 2020 | 678,67 | −199,85 | −29,45% |

| 4 neighborhood 2020 | 911,32 | −113,10 | −12,41% |

| 1 neighborhood 2021 | 769,58 | −286,88 | −37,28% |

Average revenue per user

| 2018 | 6,29 $ |

| 2019 | 8,29 $ |

| 2020 | 10,09 $ |

Snap compared to competitors in North America

| Platform age, years | Active users per day, million people | Average revenue per user | |

|---|---|---|---|

| 17 | 195 | 213 $ | |

| 15 | 37 | 58 $ | |

| Snap | 9 | 92 | 20 $ |

Resume

If u take these shares, then only after falling to 20-30 $ waiting for a rebound. At the current price and with the current business foundation - more precisely, the lack of one in this unprofitable company - investing in Snap can only be advised to the crazy brave.