Types of risks

There are risks in any financial transactions, there are quite a lot of varieties.

For example:

- market risk - the risk of an unfavorable change in the value of an asset;

- credit risk - the risk of bankruptcy of the cryptocurrency issuer or failure to fulfill its payment obligations;

- liquidity risk - the risk of being unable to convert the entire position volume into fiduciary currency (or equivalents) at the best prices;

- operational risk - the risk of being unable to perform trading operations or deposit / withdrawal of assets.

These and many other risks affect the operation and stability of financial markets and individual participants.. When a financial institution or corporation defaults, suffer losses from transactions in financial assets or in operating activities, this negatively affects the prices of the respective assets. This state of affairs usually goes against the interests of stakeholders..

Depending on the complexity and number of such events, this can lead to the collapse of the system and cause a financial crisis.. We saw one such example of mismanagement of risk in 1995 year, when one of the oldest banks, Barings, went bankrupt in a series of transactions by a trader, who speculated in derivatives on the Nikkei. According to this trader Nick Leeson's memoir 1999 year was filmed worthy of attention movie "Scammer". Also, the bankruptcy of the American investment bank Lehman Brothers is often called the starting point of the global financial crisis of the late 2000s..

There are a huge number of similar examples of the severe and far-reaching consequences of ineffective risk management.. However, back to the classification of risks.

Hereinafter, we will consider financial risk in a narrower sense., namely how investment. Such risk represents the likelihood of loss or loss of profit as a result of financial transactions.. Worth emphasizing, what if we cannot influence the systemic risk in any way, then the investment can and should be taken into account when working with cryptoassets.

Actually, there are a huge number of different classifications of risks, ways to record and manage them in various economic areas. For example, in the field of banking supervision the most complete document, regulating, including risk management, called Basel III.

Quite possible, that over time, similar guidelines will be developed for the cryptoindustry.

Basic principles of investment risk management

First, what a market participant should do, he is investing or speculating, is to allocate so much money, which he can lose completely with peace of mind. Psychologically, this mark is at the level 10% from monthly income. If you plan to continue to professionally engage in this type of activity, then in no case trade with borrowed money, taken from relatives, friends or banks. Margin trading should be approached with the utmost care, since in this case, the extraction of potentially high profits is associated with a significant risk.

And here we come to a basic and fairly logical principle:

Риск↑Прибыль

Risk and reward are directly related to each other. In other words, increased risk should bring high returns, and vice versa. The conclusion from this simple principle is also quite obvious.: if we risk too much, to earn the same (or even less), then such an investment should be abandoned.

The next principle, which is widely used in risk management is diversification of investments. It is about the skills of creating a balanced investment portfolio.. However, before its formation, diversification should start with reducing operational risks. The distribution of available capital between several trading platforms will reduce possible losses due to hacking or closing of one of them..

In trading, this is expressed in the form of a correct calculation of the position to be opened., and also closely related to the money management model in general (with money management). An extreme case and a common mistake for many beginners is to take risks. 100% capital per trade/position. Do not put all your eggs in one basket This proverb perfectly describes this situation..

In both cases, it all comes down to determining the maximum acceptable risk for each individual operation..

rules 2% And 6% from A. Eldera. Limiting risks per session

Standard, basic guidelines for risk management are found in many books on trading. One fairly popular risk management methodology was described in his works by Alexander Elder. It can and should be applied at the initial stage., until its own system for determining risks in trading is formed.

"Sharks" in trade and rule 2%. The above error of a beginner with the risk of loss 100% of funds has a variety - the investor takes risks at the moment 30-50% deposit and more. Elder called this situation "the risk of being eaten by a shark.", when, as a result of several large losses, capital zero may occur. To protect against this risk, the size of one position should not exceed 2% from available funds. This is the very "two percent rule".

"Piranhas" in trade and the rule 6%. Sometimes it happens, what trader for one reason or another (more often psychological) for reasons cannot stop a series of unprofitable trades, which Elder compared to a pack of predatory piranhas, which cut off the prey piece by piece. If there are many such deals, then the capital will be in the high-risk zone.

The rule 6% limits the maximum used share of funds in the trading moment. In other words, it sets the maximum acceptable risk per session. If the loss of capital is more than 6% - you need to stop trading for a while (People recommend 1-2 weeks). Firstly, to analyze the situation, Secondly, to avoid psychological mistakes.

In this way, Elder recommends opening no more than three deals at a time, at the same time limit each to two percent of the capital. Of course, these rules can be modified over time to suit your trading strategy, change the percentage and time spent on analysis, however, the general concept is recommended to be left intact.

Correct position calculation

It is necessary to make it a rule to count everything as a percentage.. Risk can be characterized as the likelihood of an unfavorable outcome. Also, risk is understood as the level of possible financial loss.. In this way, risk is a two-dimensional quantity, characterizing the probability and volume of losses (of total capital). All these values are measured in percent..

When calculating, it is very important to take into account the various fees on crypto exchanges.. They may be as follows:

- money transaction, deposit and withdrawal;

- opening a position (and closing with another position);

- for using margin leverage (landing page percentage or swaps) and t. d.

Leverage and its impact on risks

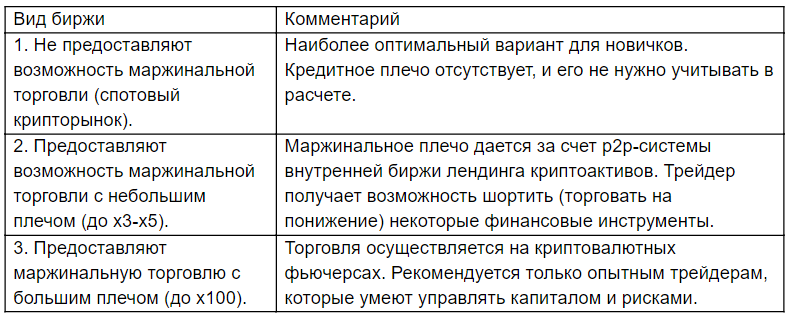

Cryptocurrency exchanges can be roughly divided into several types:

The important point here is, that leverage increases position size, however, increases the risk by the same amount. For example, movement in the opposite direction from the opening point to 1% with leverage x100 will give a loss -100% and margin колл (in fact - even earlier, due to commissions and exchange mechanics).

Position control

To manage positions, you must use stop loss pending orders (SL) и Take profit (TP). We introduce the value:

C = A / B

Where is:

C - the ratio of profit to loss;

A - profit when TP order is triggered;

B - loss when the SL order is triggered.

Trading literature often recommends using trading strategies and entry points with a calculated value of C from 2 to 3. In other words, the potential profit from the transaction must exceed the possible loss by several times.

Some traders do not use SL in trading, preferring to "sit out" the drawdown. This makes it harder to control risk (the fall may continue). Especially you shouldn't do this when trading on margin..

All beginners are strongly encouraged to use SL in leveraged trading.

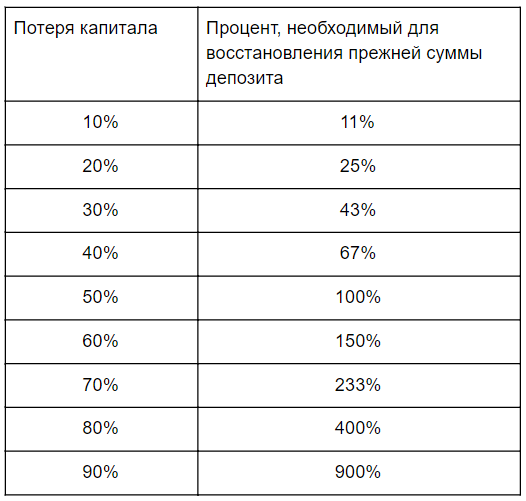

Below is a table, illustrating the percentage of capital gains, required to break even at different volumes of losses:

As seen from the table data, position size management plays a key role - the more loss the trader fixes, the more difficult it is for him to recover the original amount of trading capital.

For example, deposit in $1000 after a series of losing trades turned into $100. Now, to return the original amount of capital, the trader needs to increase the amount in $100 on 900%.

Without proper risk management, trading on the stock exchange turns into something like playing in a casino.

Calculation of position using the Kelly formula

Many investors use the Kelly formula for risk management. It serves to determine the maximum allowable percentage of capital, which can be used for operation.

The percentage of capital is calculated by the formula:

f = x/K

Where is

x - the amount of the operation / deal;

K - the amount of available capital.

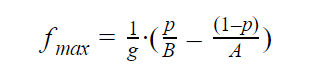

Kelly's formula defines the limit value f:

Where is

p – probability of a positive outcome on the trading strategy;

A - profit when TP order is triggered;

B - loss, when an SL order is triggered;

g - used leverage (equally 1, if the shoulder is not used).

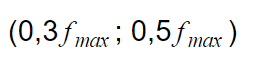

It is not recommended to use maximum fmax values, calculated by the Kelly formula.

Optimal Range for Reducing Assessed Risks:

There is additional risk at this stage., misdetermined probability.

Working with probability

There are several different approaches to determining the likelihood of a positive investment outcome.:

- if the source of forecasting is external, then the average percentage of successful signals can be taken as a guideline. However, it should be borne in mind, what, for example, numerous groups / chats in messengers (mostly, в Telegram) can distort real statistics;

- if a trader / investor independently applies a trading strategy, keeps records of transactions and has reliable and complete statistical data (or has the ability to test his strategy on history), then:

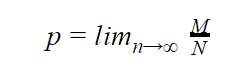

Where is

p — probability of a positive outcome on the trading strategy / conversion of positive deals;

M - the number of profitable trades;

N - the total number of deals for the strategy.

Need to understand, that in any case, trade diary data (Statement) will not give a static result - there will always be errors and scatter of values. When working with historical data, there is always a risk of a change in market conditions, which leads to a decrease in the effectiveness of the strategy in the future.

Conclusion

As we said at the beginning of the special project, there are risks in any financial transactions. And the main task of the investor is not to refuse risk at all, and the choice of a solution - to what extent does it make sense to take this risk.

With any type of investment, it is necessary to be able to determine the risks in advance and correctly. In other words, it should be understood what potential profit we expect and what loss we are ready to make. Also, all the above recommendations will not give a result without systemic trading., implying accounting, calculation and analysis of all open positions.

A truly successful trader is not the same, who made millions, and that one, who managed not to lose and stayed on the market.

A source: https://forklog.com/osnovy-risk-menedzhmenta-pri-torgovle-kriptovalyutami/