Exchange, as a startup. Sounds pretty unusual. A huge number of legal issues immediately come to mind, regulatory turmoil, etc.. It would seem that, just don't start like that.

But, as many people know, there are successful attempts to resist the bureaucracy of the financial world. The history of this confrontation is, of course, largely a virtual component - electronic payment systems. And as we well know, world of software, albeit virtual, with due skill and perseverance, it is quite realistically monetized.

The history of the development of such a confrontation / addition can be painted for a long time. But we will focus on one of the extreme events of this front: cryptocurrencies. And even narrow the narrative even further: cryptocurrency exchanges.

I'll tell you right away, to fully understand the material, albeit carefully written in common language, все же придется потрудиться и ознакомиться с .

.

Exchange

Roughly speaking, exchange is an exchange for ECN-principle of pricing. At this stage, the market for cryptocurrency exchanges is quite young.. AND, respectively, developing rapidly. The prospects are huge, if you know how to calculate at least one step forward. Therefore, we must pay tribute to the guys, who created exchanges even a year ago - then it was necessary to think over more, than one step ahead. AND, certainly, the creators of the cryptocurrencies themselves cannot admire their asocial non-stereotypical thinking. How unparadox it is, few people in the world understand, what is money and currency ...

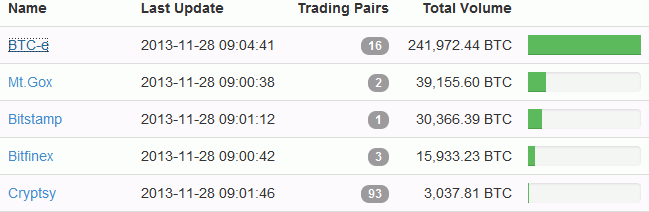

Посмотрим состояние биржевого рынка :

This is a ranked table of daily turnovers of cryptocurrency exchanges.. Maybe, someone will be pleased to see the exchange of Russian origin - BTC-E in the first place by a significant margin. Just a month or two ago, there was no such separation. More than that, BTC-E dangled somewhere in the top five.

This table is missing a fairly large Chinese exchange BTCChina. But believe me, its turnover is not so high, as many Western resources show, they cannot count correctly.

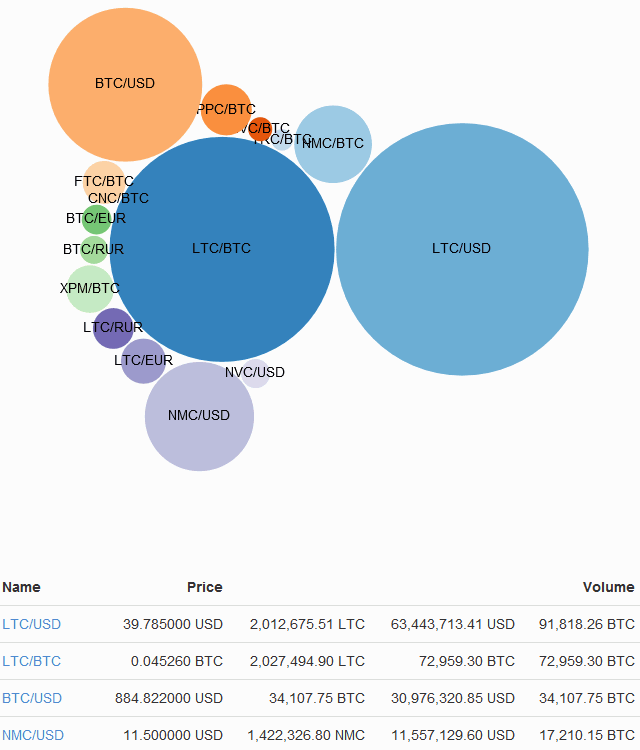

What was the reason for such a rapid rise in BTC-E turnover compared to competitors? let's , what their turnover consists of:

It is seen, that BTC-E made a strategically correct move, making it possible to trade many cryptocurrencies at once, not just bitcoin, как многие другие. Such foresight made it possible to shoot in just a month., because. bitcoin began to be seen by many as slightly overheated.

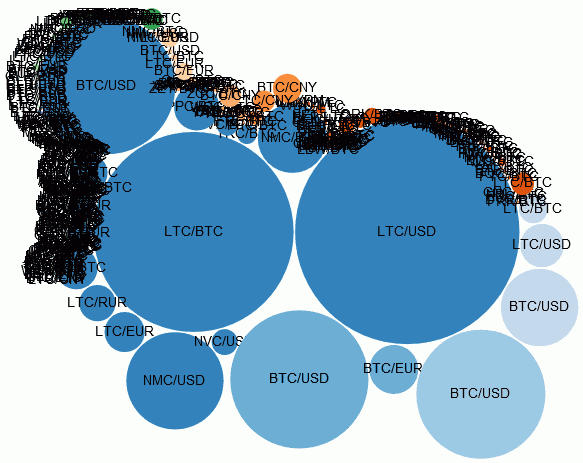

Довольно серьезный срез децентрализованного мирового рынка обмена валют выглядит :

Не стал делать video из обновляемых скринов этой наглядной визуализации. Think, it will be interesting for you to observe, how the picture dynamically changes from day to day, sometimes visiting this page.

Reasons for development

A lot of them, I will describe only one, but also substantial: how to start trading on a cryptocurrency exchange?

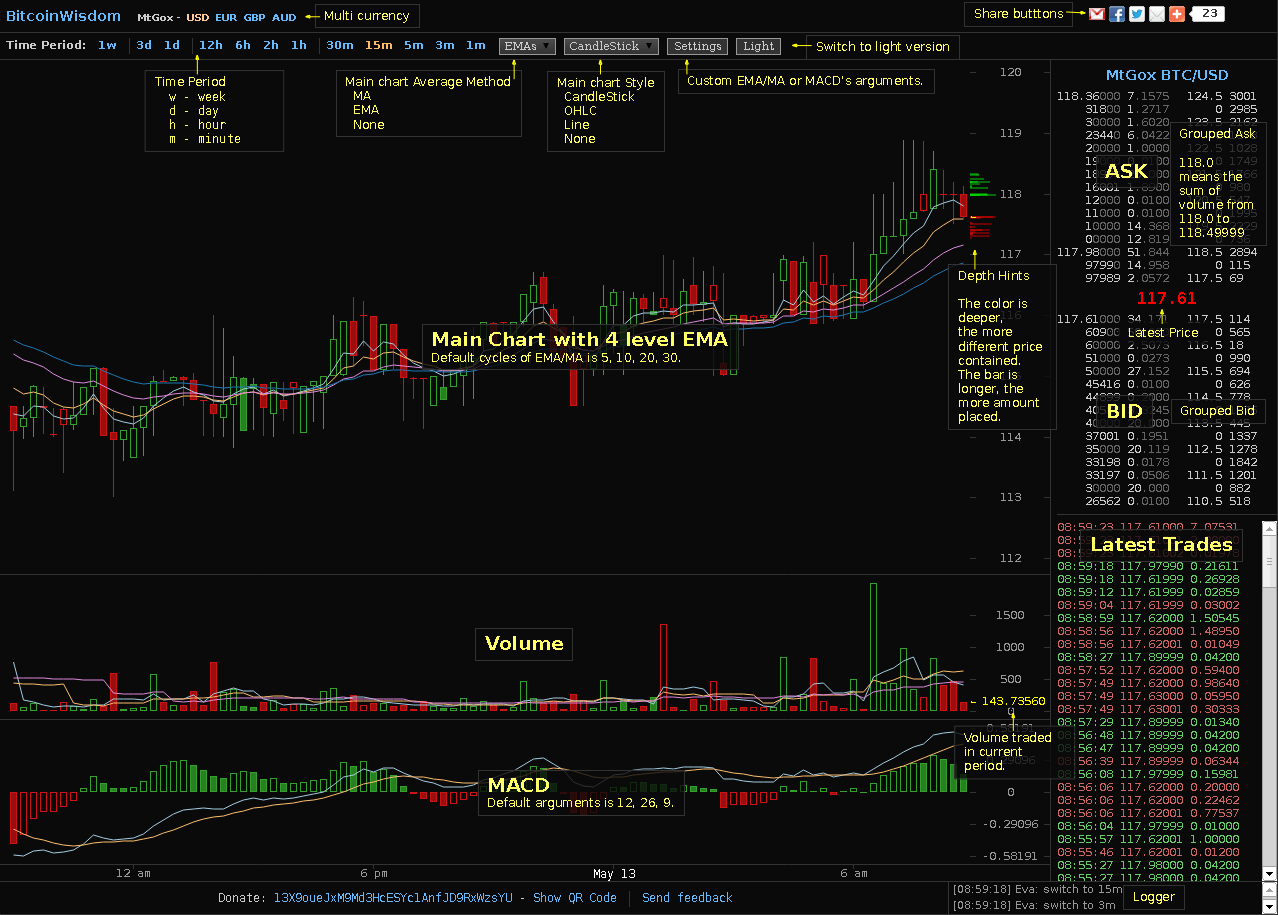

Everything is reduced to a minimum of bureaucracy. More precisely, she just doesn't exist. You are ANONYMOUSLY registering, transfer money and trade. Everything. Сам реальный процесс торговли в великолепной для веба лаконичной визуализации можно посмотреть здесь:

Monetization

Has the exchange startup paid off? Сейчас можно видеть, that the daily turnover of the same BTC-E is about 200 000 BTC. That at the current rate is somewhere around $200 million. BTC-E has one of the smallest fees in the industry - 0.2%. Multiplying one by the other, then double (commission is taken from both sides of the transaction) and we get daily exhaust in $800 000. Who did not understand, $800 000 an exchange startup is already making money a day. Turnover changes rapidly by tens of percent, therefore, the actual exhaust must be watched by yourself (data on the screen and calculations lose accuracy, respectively).

Have to, certainly, compare it with someone. For example, with FOREX and the Russian currency exchange on FORTS.

На FOREX, for the same ECN / STP site, to achieve such indicators, need to have, least, daily turnover in $20 billion. Units in the world have something similar (especially in retail). And they have been building their business for more than one year.. Not to mention the cost difference.

FORTS - the reader himself can calculate and, if desired, post the obtained data in the comments. I will only say, that FORTS looks dull, especially against the backdrop of the prospects for the development of cryptocurrency trading and that, that she, unlike the same FORTS and FOREX, has no days off. Ie. cryptocurrency exchanges work without interruptions at all: 365/7/24.

Development prospects

They are huge. Respectively, and the competition is considerable. Almost every week there is an announcement of the next exchange startup.. The most active are the Chinese. And this is due not only to their number., but also understanding that, that they can jump out of the tight regulation of the yuan. What is the cost of transferring large Chinese online stores to the possibility of payment in bitcoins?. Basically, well done.

The future of the industry

Understandably, that the turnover will grow. What were, there are and will be for some time fraudulent cryptocurrency exchanges: pretended, what trade was, while they themselves ran away with the money of investors / speculators. But how will everything really develop?

What is now?

Almost all exchanges now operate on web technologies that are terribly slow for the modern understanding of electronic market trading.. Until this bottleneck is felt strongly. But as its popularity grows, it will increasingly remind of itself..

New rails

Technologically, trading engines will be improved. FIX API and other more advanced trading protocols will appear. Who can calculate a few steps ahead, is already making such a transition. Because. according to the laws of the genre, all current exchanges, which are based on web technologies, will be devoured by more technologically advanced. How it happens, описано в . Briefly - via ECN / STP scheme. Ie. there will be a serious centralization of the market. There will be several large trading platforms. The rest will "die".

Traders

Miners are setting the big tone now, сбрасывая mined goldmined cryptocurrencies on exchanges. Algo traders minimum. Mostly clickers. To some extent, algorithmic traders are constrained by mistrust of the new industry and technologically weak trading engines.

Current opportunities for algorithmic trading

Market making

Shear meat, who has never even seen predators, just for now. Yes, это очень отдаленное напоминание , because. it's not about the fight for microseconds and the physical length of the wire. And about many hundreds of milliseconds (costs of web engines). But from this those. the insider in this context does not cease to be. You can live. Certainly, the exchange commission is too big. But far-sighted exchanges will lower it and even make special. offers for market makers in the form of rebates (negative commission).

Arbitration

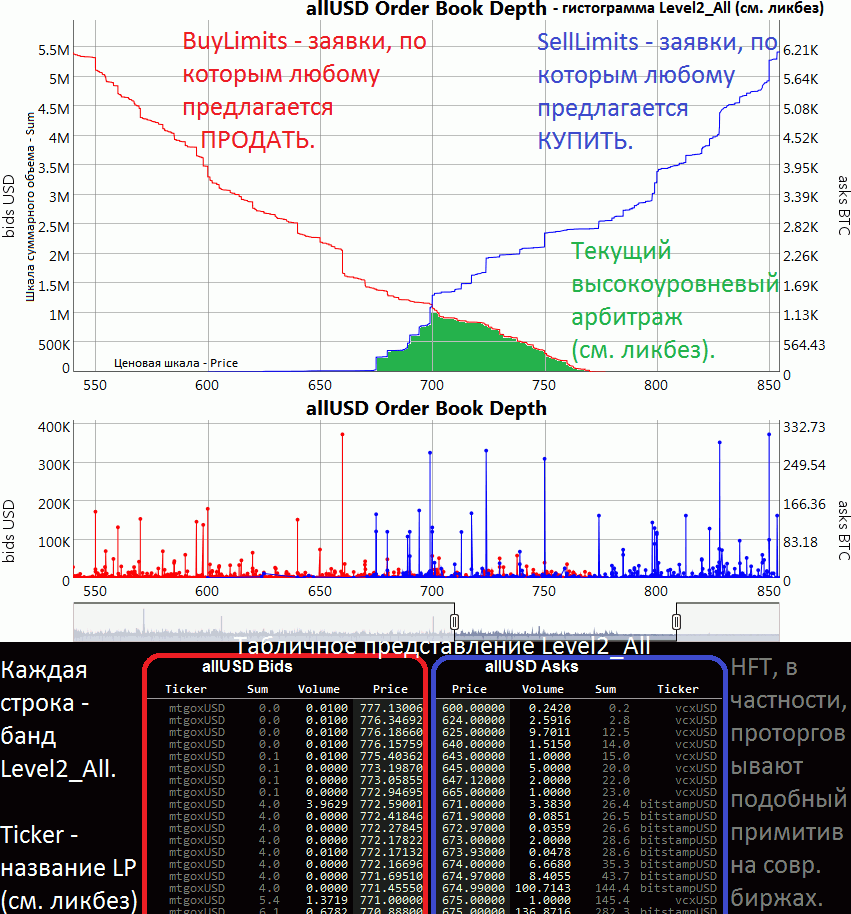

Текущее состояние межбиржевого арбитража без подводных камней можно увидеть здесь:

There are a lot of pitfalls. But as the industry develops, there will be less and less of them.. The new generation of ECN / STP aggregators will definitely show themselves, creating a kind of analogs of darkpools, where several exchanges will act as LP at once. So the life of affiliate marketers gets easier. Their ranks will grow. And exchanges at their prices, finally, align.

Market inefficiencies

Их море. This is an emerging market, which is always accompanied by such inefficiencies. Yes, not much liquidity yet, to interest the largest algo funds. But a million or two USD of profit for a simple algorithmic trader, able to research the market in many ways even with simple classical methods, - good extra. income.

As a boltological example, one of the simple models, applied to bitcoin:

Green - BTC / USD rate. Red - model, sampled between vertical lines. Out of Sample. While frighteningly close to reality (you can continue the green line on the current data). Certainly, that's a coincidence.

Or another boltological example

Industry satellites

The development of a near-exchange service is also logical. This, usually, resources for convenient presentation of material: real-time delivery of correct exchange feeds and their storage, visualization of various stock indicators, etc..

Historical significance

The uniqueness of cryptocurrency exchanges lies in the ability to observe the stages of the formation of an exchange from the very inception of a new real commodity-money market. Ie. a significant part of the millennial financial development of mankind can be more than just mathematically modeled, but corrected based on observations of the real experience of quickly playing the same story in a short period of time.

All this allows you to check existing economic theories for consistency.. Build more adequate socio-economic causal relationships. Such opportunities for fast scrolling through one of the important processes in the history of mankind are provided by orders of magnitude reduced latency of information delivery compared to, what was tens-hundreds-thousands of years ago.

At the moment, data from such a history of development almost from the inception of cryptocurrency trading is available., thanks to one of the oldest crypto-exchanges - MtGox:

https://data.mtgox.com/api/2/BTCUSD/money/trades/fetch?since=ID, где ID - номер транзакции (единица - первая), с которой отдавать данные. This is many gigabytes of data about, how were the transactions on the mutual exchange of BTC <-> USD. Exploration of this almost Big Data layer can play a huge role in understanding us: sociology, economy, etc.

P.S.

It turned out messy, because. written in one breath. That's why, естесственно, many moments are missed and not covered. If you wish, add / specify.

Original