Why Amazon it is worth splitting into two companies? Why Shell shouldn't split into two companies? How convicts affect the US labor market?

Disclaimer: when we talk about, that something has grown, we mean a comparison with the same quarter a year earlier. Since all issuers are from the USA, then all results in dollars. When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

Stolen, drank, to work: what else contributes to the rise in labor costs in the United States

The recent US reporting season showed, how problematic has the growth of employee salaries become for employers, labor shortage. This problem could be partly solved at the expense of a whole pool of unemployed Americans..

Recently, a scientific article “Felon history and change in U.S.. employment rates», where we analyzed the impact of the growth in the number of convicts on labor market indicators. The authors of the article found out, that an increase in the number of people with a criminal record is at least 1% within one state entails an increase in unemployment rates by 0,3% among the population aged from 18 to 54 years.

In 2019, there were approximately 24 million people with a criminal record in the US. In other words, the above study explains, why, with sufficiently high unemployment in the United States, everyone complains about the lack of workers: 4,8 against 3,5% at the time the pandemic began in February 2020. Yes, employers want to find new employees, but the presence of a criminal record in the applicant creates risks in their eyes, which outweigh the cons, that the vacancy remains open.

It cannot be said, that convicted people are discriminated against in the labor market: many of them found work in conditions of a shortage of workers in 2018. But, it seems to me, the pandemic caused a jump in labor efficiency in the US and other countries due to the forced digitalization of a significant part of business processes and worsened the position of people with a criminal record in the labor market.

Many of them, who had to serve a long time in prison, often no skills, in demand on the labor market. Here, for example, extreme, but still an example: Rick Vershey, who was filmed great movie, after his release, he could hardly understand, how to use the internet.

Many of those convicted often can only count on unskilled and low-paid work.. Many of them were released from prison on parole., which imposes significant restrictions on them in terms of mobility, - and all more or less highly paid jobs often involve the possibility of relocation, for example, to a company branch on the other side of the country.

Currently, there is no significant progress towards, to make this situation change: if American employers were generally open to the idea of hiring convicts, then we would have seen it, but it hasn't happened yet.

Most likely, convicted will replenish the most sensitive to wage increases and low-margin sectors such as courier delivery and taxi aggregators. These industries are currently suffering from, that they almost completely drained the pool of labor available to them from among applicants without a criminal record, and will hire people, ready to work for pennies in difficult conditions.

But this already poses a risk, that new workers from among the convicts will break down on customers, which may lead to additional reputational and litigation risks for these companies, because, as the Americans say, "you get that, what are you paying for". Taxi aggregators already have so many problems with lawsuits for sexual harassment - and this can also add a problem with recidivism among convicted couriers and drivers.

Cloud spy and island gebnya: new Amazon contract

Amazon Web Services (AWS), Amazon cloud division (NASDAQ: AMZN), received a contract to serve the main British spy agencies: internal counterintelligence MI5, "James Bond" foreign intelligence agency MI6 and electronic intelligence GCHQ. AWS will serve all three departments - store their top-secret information on their servers, where will it be processed.

This story can and should be interpreted as a sign that, that cloud technologies triumphantly walk the planet. It is also an indicator of, what can and should be invested in this area: because more and more departments and companies will transfer their operations online. But I still think, that this contract is a good reason to talk about AWS.

Amazon's review of the latest report noted, that the main generator of the company's revenue - its retail business - is balancing on the verge between negligible margins and unprofitability, while AWS is a great margin business, through which all retail adventures of the company are financed.

The contract with the British special services itself is not so big, looking at the big picture: it will bring AWS from $ 683M to $ 1.366B over 10 years. This is decent money, but not much in the overall scope of AWS: their revenue in the last quarter alone amounted to $16.11 billion. But, anyway, having such a cool customer adds credibility to AWS.

The combination of news about Amazon's retail business losing money with news of another success for AWS suggests that, what, maybe, It would be in the best interest of Amazon shareholders to split Amazon into two companies: one will deal with online retail, and AWS will be engaged in cloud computing. Because AWS is clearly better than the "mainstream" Amazon, and as a stand-alone company, AWS could bring many benefits to shareholders.

Spinning AWS into a separate company involves, that all Amazon shareholders will receive a certain proportionate number of shares in a "separate" AWS.

One can object, that there is synergy between both divisions of the company, but it's not obvious: AWS Works with Enterprise Customers, who, as legal entities, do not actively use other Amazon services. Extremely doubtful, that the British security forces decided to use AWS servers because, that they liked the ease and convenience of ordering plungers on Amazon.

However, "core" Amazon benefits a lot from AWS, because for sure all the main online operations of Amazon are carried out using AWS and at the expense of AWS - it is unlikely that Amazon pays AWS more, than the cost of these services.

Retail Amazon will look so little promising without AWS, that his shares will go down a lot, - this is the only serious argument against the separation of companies. And they fall so hard, that this cannot be compensated even by the growth of quotations of the now independent AWS, - after all, it is AWS that gives the main success of a single Amazon in terms of profit growth.

However, Amazon's retail business is already pulling the "one company" to the bottom: analysts are justifiably afraid, that Amazon will lose its share of the online commerce market, and the overall result of Amazon is worse than expected just because of the problems of the retail business.

Separately, but equal: Shell may split

Shell oil and gas colossus (NYSE: RDS.A) can split into two companies. Anyway, this is what one large investor wants. The Third Point fund bought Shell shares for about $500 million and began, as a minority shareholder, to demand that the company be split into two:

- Shell's core oil and gas business.

- Subdivision, which will include liquefied natural gas operations (SPG), renewable energy and energy trade. In sum, this will be a business with fewer emissions., than the core business of a single Shell oil and gas.

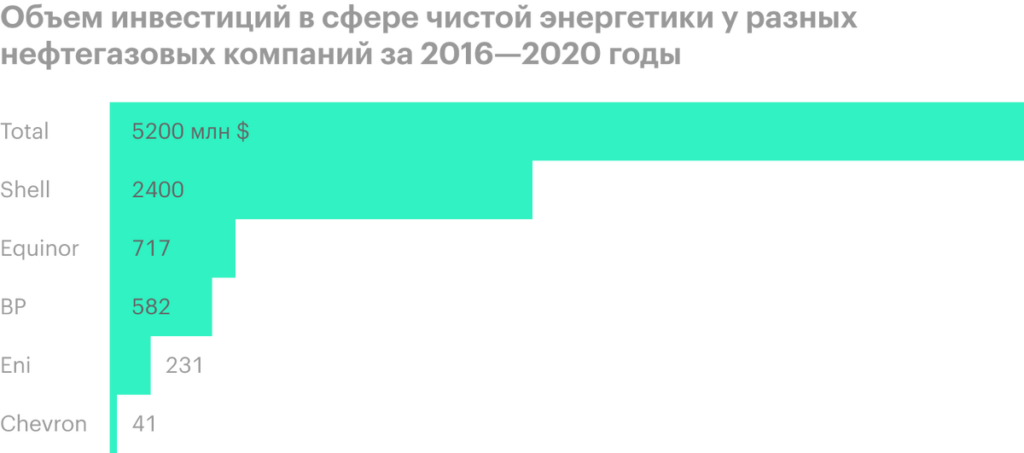

It is unlikely that this plan is being implemented., even if Third Point does a big campaign to break up Shell. After all, the company's projects in the field of clean energy and LNG are financed at the expense of the oil and gas business.. Shell is second only to Total in terms of clean energy investments – no matter what, that the payback periods for these projects are somewhere in the distant future. Following the green agenda keeps Shell quotes afloat due to their support from ESG investors.

The grand design of Total and Shell is clear: both large companies invest a lot in green energy, what inspires other companies, smaller size, also invest in green energy. ESG funds "as a reward" keep the capitalization of Total and Shell afloat at a decent level "for good behavior" and "a positive example" for the entire sector as a whole.

So Shell is better off staying united: hydrocarbon operations work as a single mechanism and bring in the main money, while the renewable energy division allows you to wave a rag under the noses of the greens and avoid bullying the company as investors, as well as from financial institutions.

Many of Shell's institutional shareholders have already spoken out directly or indirectly against the Third Point proposal.. Worth noticing, that the operations of all Shell divisions are highly integrated with each other, and if we forget about projects in the field of clean energy, That, of course, funded by the rest of the company, then dividing the company in two doesn't make much economic sense, since all these businesses work closely with each other.

However, the very fact of such a campaign by Third Point is rather a plus for Shell shareholders. Sharing Shell for the fund is not an end in itself, but the remedy: the fund formulated this proposal as a response to the too slow recovery of Shell quotes after their coronavirus fall, despite the fact that objectively she has a good business, from which you can get more.

Activist investors like Third Point often see a shareholder benefit in a company split, because the shares of a newly minted company can go up in value, justifying separation, — so it was in the case of Synnex.

So that, although Shell is unlikely to share, The management of the company can try to appease shareholders in order to forestall such demands - for example,, raising dividends.