In 2020, the company's share price rose by almost 7 once: with 95 $ in January 2020 until 643 $ in December 2020.

Many investors believe, that this is a huge financial bubble and the company is waiting for a collapse. In this article I will tell, what risks and advantages Tesla has for investors and whether it is worth investing in the company after such growth.

I collected information from different sources – figures, charts, opinions of analysts and investors. And at the same time, she tried not to draw direct conclusions and take a neutral position..

Why electric cars are good for the environment

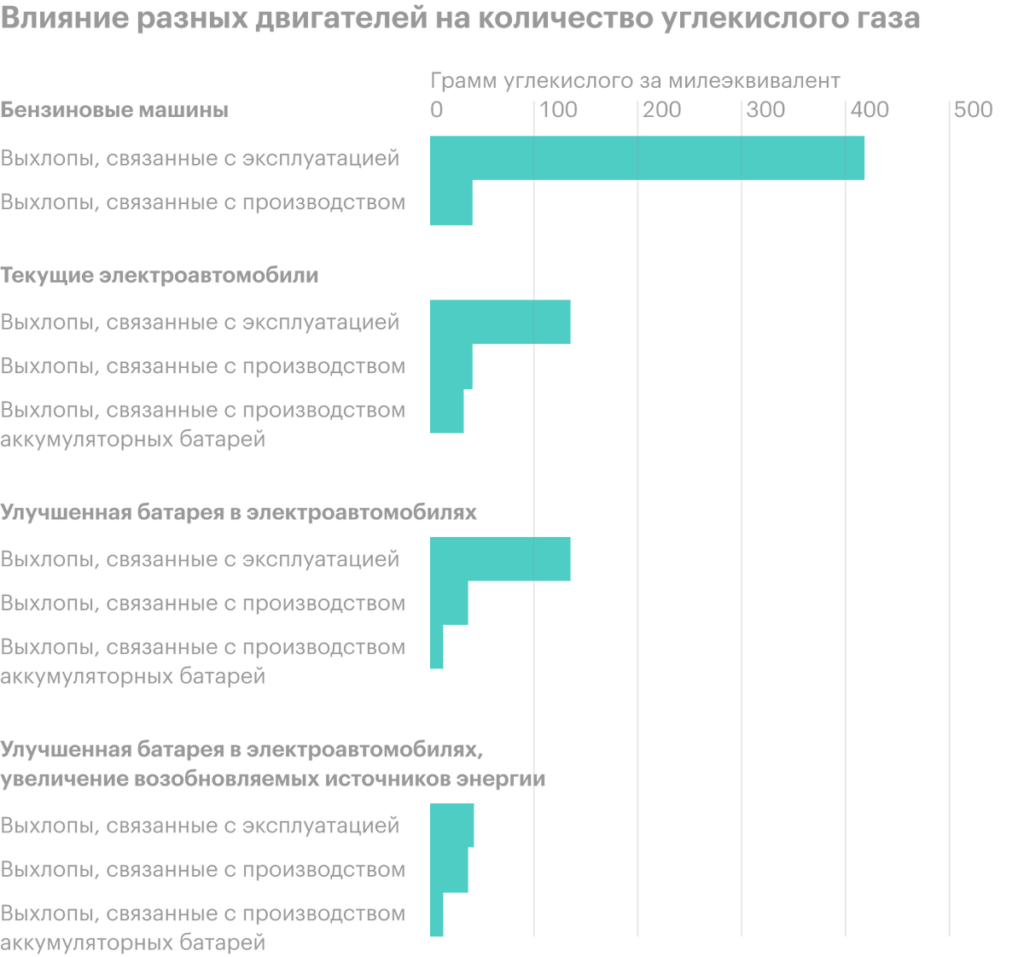

Internal combustion engines emit 90% all CO2 emissions. Electric vehicles do not directly emit CO2. When creating and operating electric vehicles there are harmful emissions, but about 55% less, than from gasoline cars. And if you actively use renewable energy sources in the production and charging, then emissions can be reduced to 70% compared to conventional cars. And the more renewable energy sources to use, the less exhaust will be.

Electric vehicles need powerful batteries. To date, such batteries consist of nickel, cobalt, aluminum, graphite. More 50% world production of lithium and cobalt goes to the production of batteries.

Mining can harm people and the environment. In order not to increase the production of these components, need to recycle them. If you recycle 95% batteries and optimize their chemical composition, The United States can provide 30-40% of the necessary materials by 2035. Now most of the batteries are produced in the Asia-Pacific region. USA exports raw materials for batteries or batteries themselves.

Precise battery composition affects durability, cost and power. As in all devices, car batteries have a limited lifespan. Over time, their performance decreases and the car can not go on a single charge for a long time..

Due to the development of technology for the production of batteries over the past 10 years, their average cost has decreased, a distance, which motorist can drive on a single charge, increased. Analysts predict, that the cost of batteries will continue to decline and electric cars will become more affordable. According to Wright's Law, when production is doubled, costs decrease. Therefore, the more electric vehicles, the cheaper their production.

Lithium, million metric tons

| Chile | 51% |

| Australia | 16% |

| Argentina | 10% |

| China | 6% |

| USA | 4% |

| The rest of the world | 13% |

51%

Cobalt, million metric tons

| Democratic Republic of the Congo | 51% | ||

| Australia | 17% | ||

| Cuba | 7% | ||

| USA | 50% in China and > 50% in the U.S. by 2030 | Volkswagen accelerates! | |

| General Motors | Annual sales | 1 million by 2025 | Corporate news |

| Stellantis | Annual sales | > 400 thousands in 2021 | Address from CEO Carlos Tavares (Presentation) |

| Honda | Share of sales | 40% sales by 2030 | Honda Global CEO Inaugural Press Conference |

| Ford Motors | Annual sales | 800 thousands by 2030 | Delivering Ford+ presentation |

| Nissan | Annual sales | > 1 million by 2023 | Corporate news |

| Hyundai | Annual sales | 1 million by 2025 | Hyundai Motor Group Chairman Calls Year 2021 |

| Renault | Annual sales | 30% sales by 2025 | Renaulution plan |

| Daimler | Share of sales | 25% sales by 2025 > 50% sales by 2030 |

Daimler Annual Report 2020 |

| That | Annual sales | 560 thousands by 2026 880 thousands by 2030 |

2021 Kia CEO Investor Day |

| BMW | Cumulative sales | 2 million by the end of 2025 7 million by the end of 2030 |

2021 investor presentation |

| Tesla | Annual sales | 20 million by 2030 | Tesla Battery Day |

Prices and battery power of existing electric vehicles

| Number of miles on a single charge | 0—30 000 $ | 30 000—40 000 $ | 40 00—70 000 $ | 70 000 $+ |

|---|---|---|---|---|

| 0—150 | Kandi K27, Kandi K23, Mini Cooper SE | — | — | — |

| 150—250 | Nissan Leaf | Hyundai IONIQ, Kia Niro EV, Chevrolet Bolt EUV, WORLD E6, Volkswagen ID 4, Fisker Ocean, Tesla Cybertruck | BMW I3, Jaguar I-Pace, Volvo XC 40, Volvo Polestar 2, Audi e-tron, Mercedes EQC, Tesla Model Y, Ford Mach-e, Lordstown Endurance, Volvo c40 Recharge | — |

| 250+ | — | Chevrolet Bolt, Hyundai Kona, Tesla Model 3 | Nissan Ariya, Rivian RIT, Tesla Model S, Cadillac LYRIQ, Lucid Air, Atlis XT | Tesla Model X, Rivian RIS, Hummer SUV, Audi e-tron GT |

The number of premium electric vehicles sold in China in the first 6 months of 2021

| Tesla Model 3 | 85 194 |

| Tesla Model Y | 46 570 |

| XPENG P7 | 19 366 |

| NIO ES6 | 17 561 |

| NIO EC6 | 14 740 |

| NIO ES8 | 8802 |

| BMW IX3 | 7330 |

| Porshe Taycan | 3463 |

| Mercedes EQC | 3149 |

| Audi e-tron | 1475 |

85 194

Key growth drivers for Tesla

New or increased tax breaks and incentives for buyers of electric vehicles in the United States - until the end of 2021.

Increase in production capacity up to 2 million vehicles after the start of the plant in Germany - the fourth quarter of 2021.

New models. Release of the new model of the electric car Cybertruck in the third and fourth quarter of 2023 – there are already more than 1.2 million pre-orders for this car. Release of the Tesla Semi electric truck before the end of 2022 – there are already more than 2,000 corporate pre-orders from Walmart for this car, Pepsi, FedEx, Sysco and others. Release of the budget Tesla Model 2 / A for 25 000 $ until the end of 2023. The appearance of the new Roadster model in 2022.

FSD. Increase sales and profitability by deploying FSD and providing FSDs to other car manufacturers.

Optimize batteries and infrastructure – increasing the range and reducing the price after the launch of its own electric battery plant. Providing Tesla charging stations to other EV brands could generate $ 25 billion in annual revenue.

Share capital increased from 10 billion to 25 billion, and the debt decreased from 8.5 billion to 4 billion. Operating lever means, that Tesla on existing production lines was able to increase production and thus reduce costs.

Stock Price Forecasts and Risks

Katie Wood predicts, that Tesla shares will be worth by 2025 4000 $ under the best of circumstances, 3000 $ with a neutral course of events and 1500 $ in the worst case scenario. Last time, even before the split, Katie was right in her predictions..

Analysts disagree. As of September 2021, after the release of the report for the second quarter, the average target price for the next six months to a year is 690 $. At the same time, twelve analysts advise buying, seven to sell and seven to hold stocks in the portfolio. Highest target price for analysts - 1200 $, the smallest - 150 $.

Main risks for shareholders:

- growing competition from other automakers;

- State Regulation in China – Restrictions, rule changes;

- inflated expectations of investors and analysts;

- investments in bitcoin – if it depreciates, the company is losing money;

- Elon Musk's departure from the company;

- violation of the terms and conditions of release;

- FUD - media misrepresentation of Tesla, because the company does not have a PR department.

Tesla capitalization significantly exceeds the number of cars sold.

What's the bottom line?

Tesla is not a bubble, a real and profitable company. It's not a pure car manufacturer — Tesla makes software and develops AI., therefore, comparing it only with automakers is inefficient.. Such a comparison may lead to false conclusions..

Except Tesla, there are other interesting manufacturers of electric vehicles. This industry will grow and expand in the coming 10 years. Also, investors may be interested in related industries., e.g. production and recycling of batteries or robotaxis.