Old Dominion Freight Line (Nasdaq: ODFL) - American carrier. Good business environment for the company: growing demand for transportation within the United States. However, the same prerequisites make it possible for the company to increase its costs for drivers and warehouses..

What happens here

Readers have been asking us for a long time to start looking into the accounts and business foundations of US issuers.. The idea to review Old Dominion Freight Line was proposed by our reader Dmitry Nazimov in the comments to the review of Renewable Energy Group. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

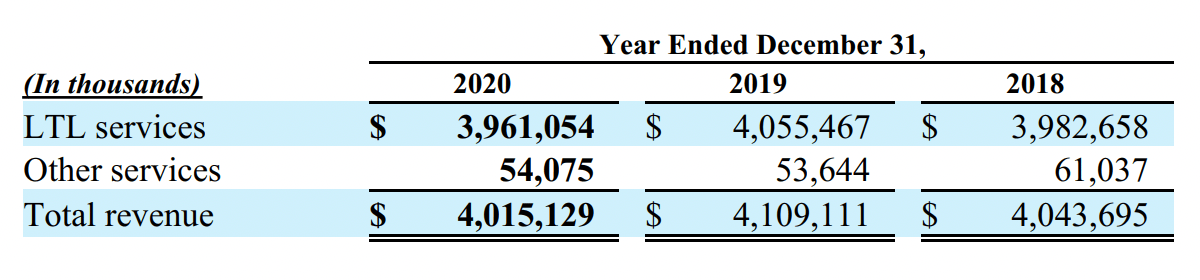

What do they earn

In fact, all the funds the company makes, transporting small loads across America. Services provide quite a bit of revenue: small pebbles of containers, freight forwarder services, intermediary services in the field of cargo transportation and advice on logistics issues.

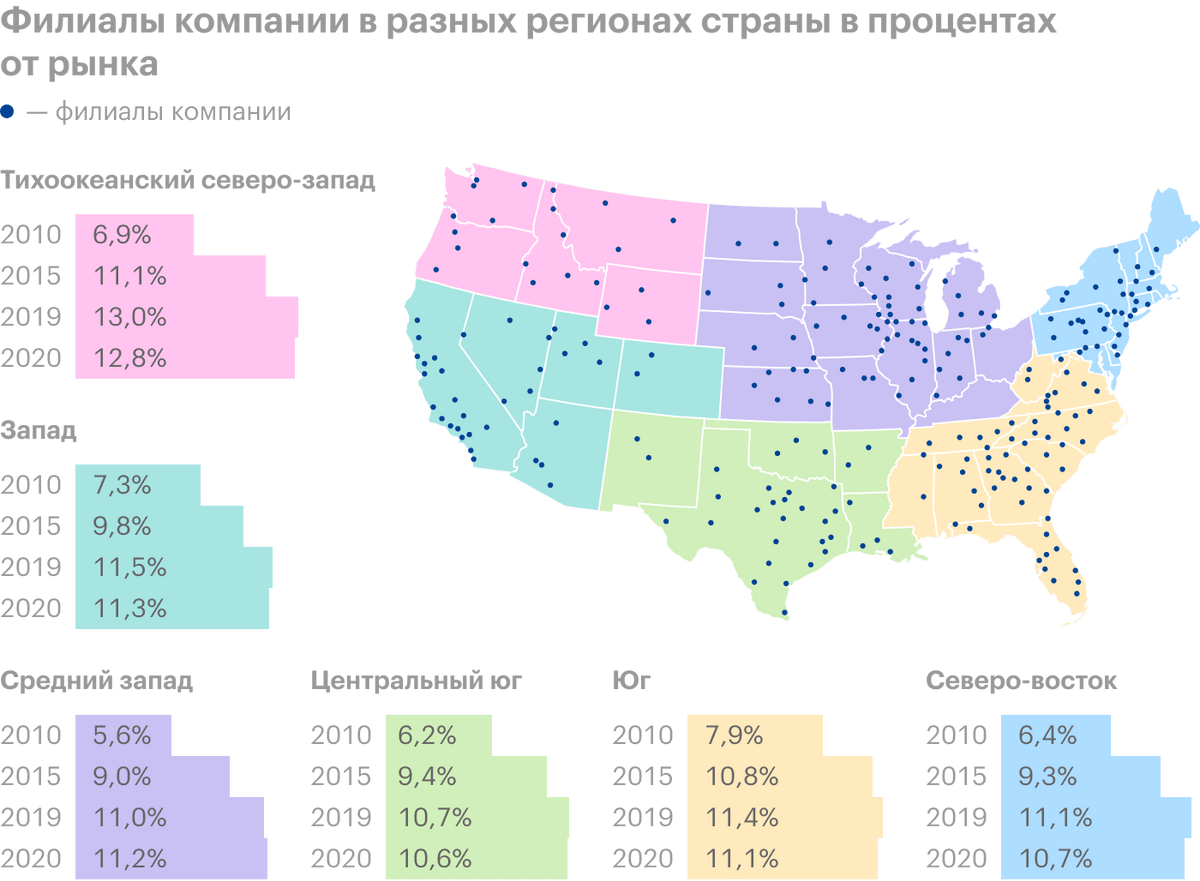

The company operates only in the USA.

“Ekarny Babay, Click!»

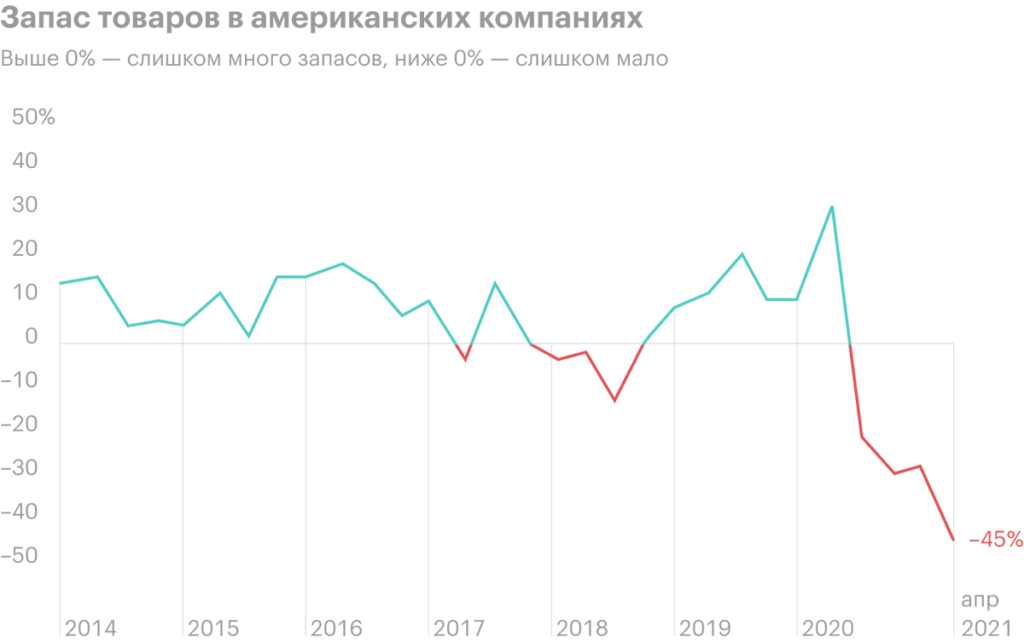

At the end of 2020, after a strong recession in the coronavirus in the spring of the same year, in the US, manufacturers ran out of stocks and sellers of goods began to increase the demand for transportation.

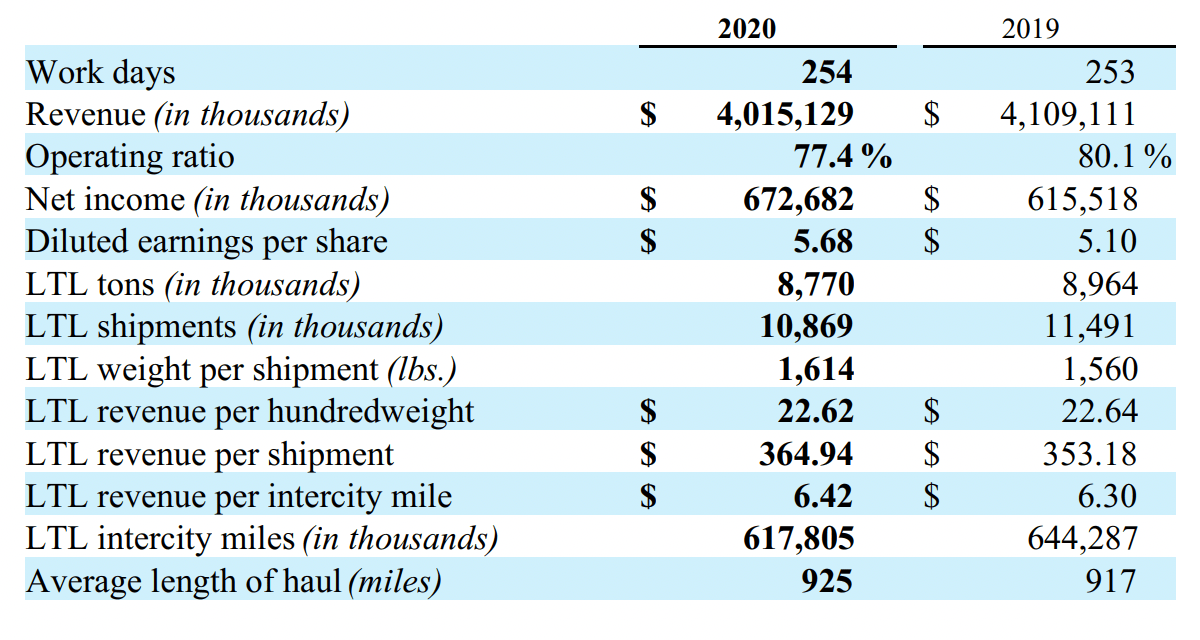

All this, Certainly, had the best impact on ODFL reporting. The company recently released its quarterly report., where, together with an increase in 8,3% cargo tonnage, revenue growth was recorded by 14,1% and arrived at 49,7%.

ODFl can count on the "continuation of the banquet", since there are a number of indirect indicators, indicating the continuation of the logistics boom in the United States. ODFL Freight Colleagues Knight-Swift Transportation Holdings (NYSE: KNX) expect, that the results of 2021 will be better, than previously predicted, and auction prices for used trucks for truckers in the United States increased by 22% due to lack of supply and excess demand. So the situation for the company is positive..

Strong foundations for a lasting relationship

In my opinion, ODFL, even without an increase in demand for cargo transportation, deserves close attention of investors for a number of reasons..

The fact deserves mention and respect, that none of the company's clients gives it more 5% proceeds. It is very good, because in the conditions of logistical hype, this strengthens the negotiating position of ODFL and allows the company to dictate its prices to customers.

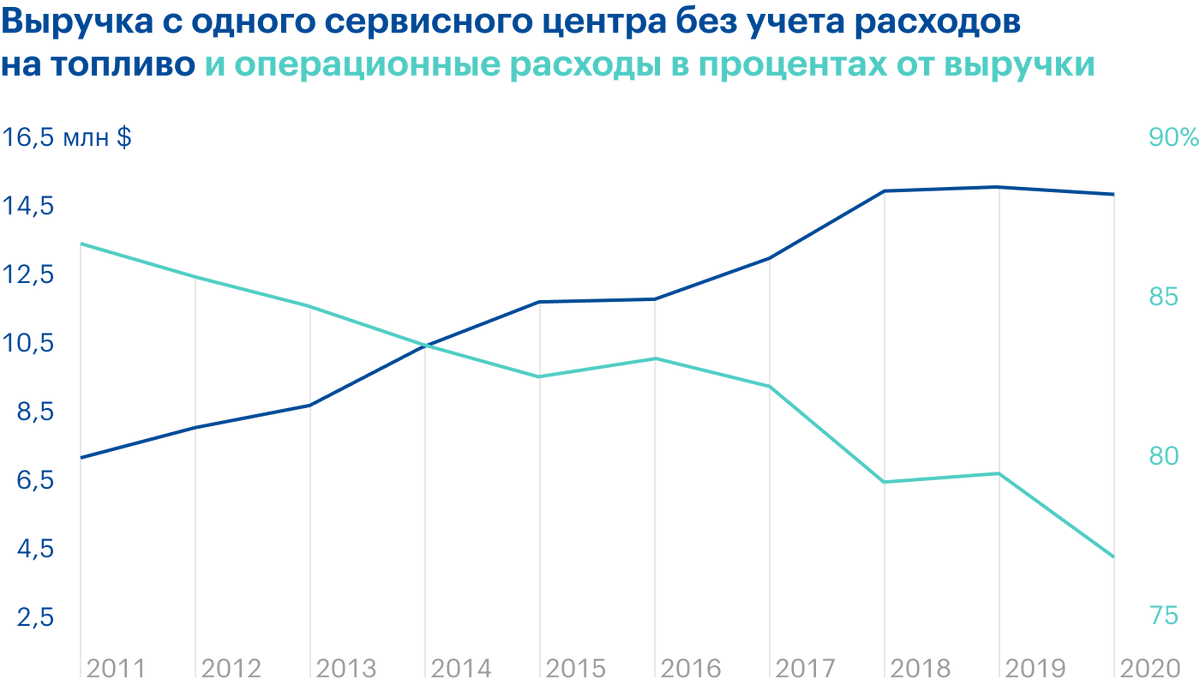

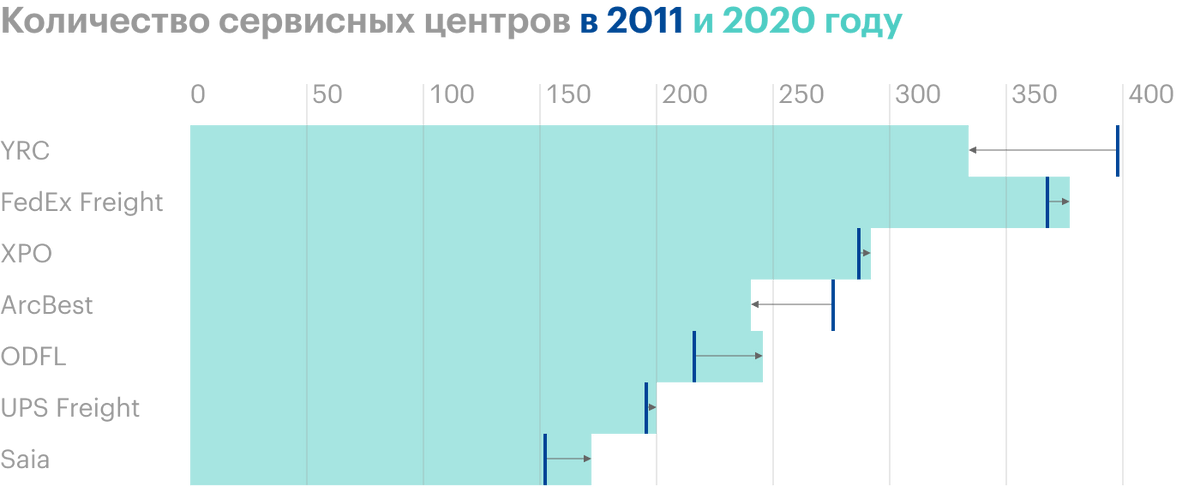

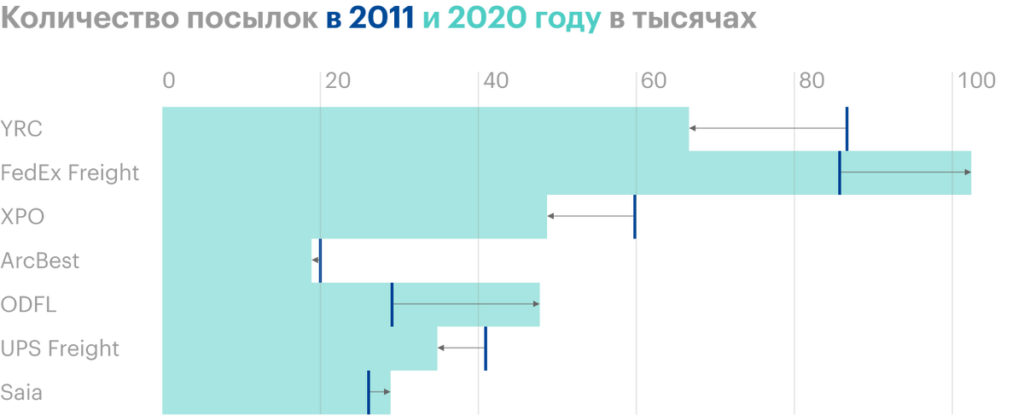

ODFL's business efficiency is constantly growing - and faster, than competitors. The company has many branches in all regions of the country, which allows it to take full advantage of all the benefits of growth in freight traffic within the United States.

"One-two, Black, Red, gas, Remember?»

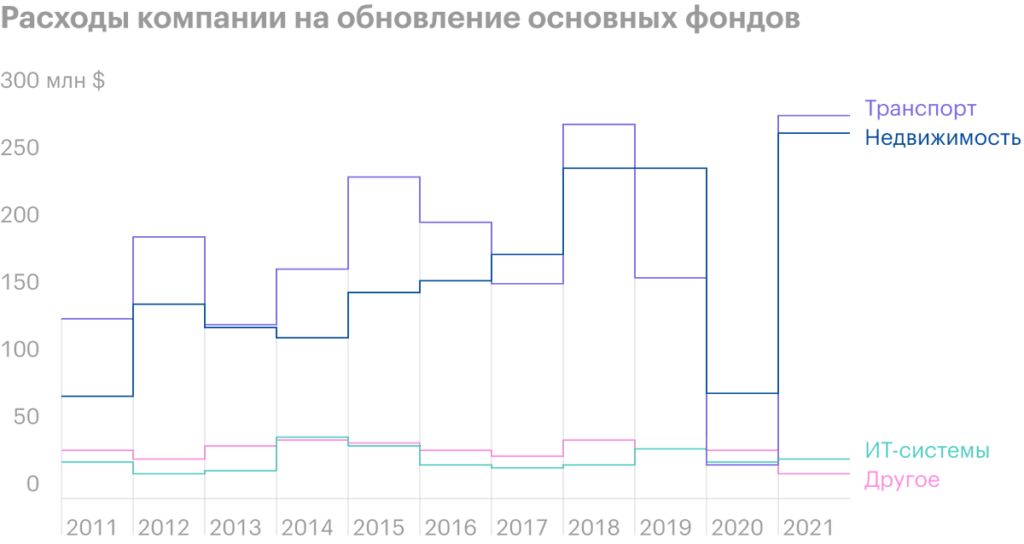

However, not everything is so good.. The company's fleet is not insanely old, but not the youngest. Cars of this type in the USA "live" for 10-15 years, depending on the intensity of use and quality of roads. Therefore, the company has to seriously spend money on updating the main fund..

Another important cost item is storage space.. As you remember, the idea with Prologis, here, too, we should expect an increase in spending due to limited supply in this market. The demand is huge, and there are few suitable warehouses, and new ones are being built very slowly.

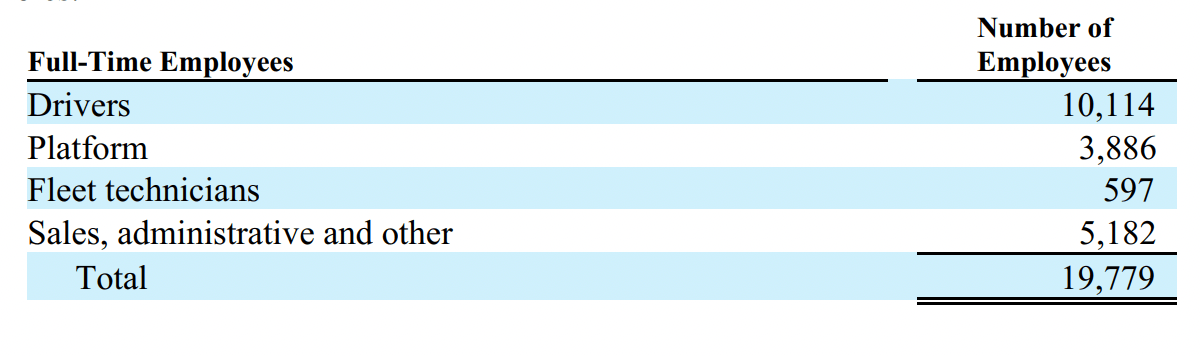

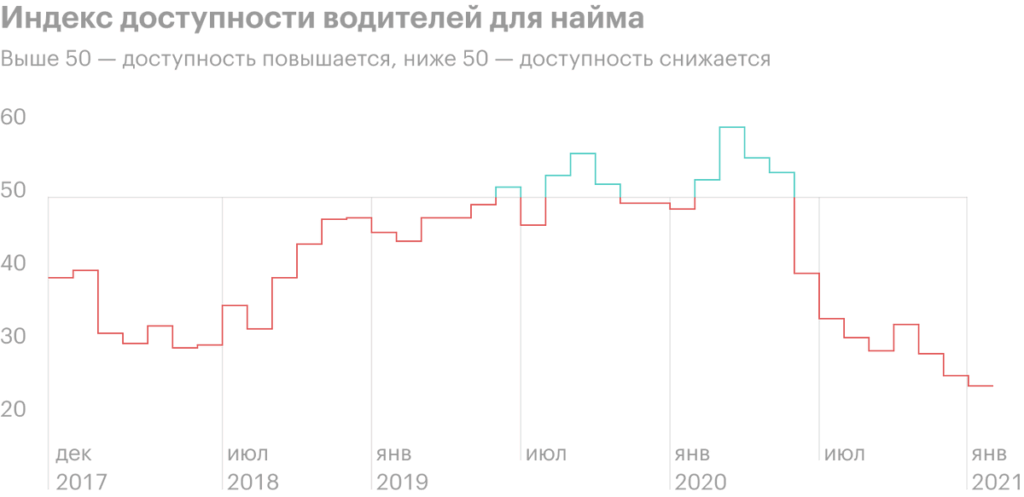

There is also a shortage of truck drivers in the US, this entails the problem of increasing the cost of labor of the company's employees.

There is every reason to expect an increase in ODFL costs - and this is a problem. The company pays dividends: 60 cents per share per year, or 0,32% per annum. It's not that much, Total 10,55% from her profits over the past year, but the huge investment needs of the company should be taken into account, as well as debt situation.

According to the latest report, the company has $1.159 billion in debt, of which 513.862 million must be repaid during the year, and the money in the accounts is 351.9 million. Basically, do not think, that the company will have problems, to borrow the required amount to close debts. But, taking into account the expected increase in costs for the renewal of fixed assets and staff recruitment, and the wages of employees are 48,4% from the company's revenue, i would be afraid, that payments will cut.

Company machinery park

| Quantity | Average age | |

|---|---|---|

| Semitrailer tractors | 9288 | 4,7 |

| Box trucks | 24 583 | 7,9 |

| Wagons | 12 067 | 7,4 |

Semitrailer tractors

Quantity

9288

Average age

4,7

Box trucks

Quantity

24 583

Average age

7,9

Wagons

Quantity

12 067

Average age

7,4

Resume

ODFL is a great option for investing in US freight. P / E at the company, at first sight, tall - 43,46, but in absolute terms, the company is not very expensive, capitalization - 28.85 billion dollars. And more importantly, it is a very efficient and successful business with high margins.. That's why, in my opinion, the company is worthy of the attention of investors. However, one should not forget that, that she will have to increase expenses.