Applied Materials (Nasdaq: AMAT) и Entegris (Nasdaq: ENTG) - US organizations, who work in the field of semiconductors. Both companies are extremely similar comrade to friend, and both are positive. And the likely difficulties are also similar.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. The idea for a review of these companies was suggested by our reader Knock Knock in the comments to the KLA review.. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

How does Applied Materials make money?(AMAT)

The company is a supplier of products, suitable for the production of difficult electronics. AMAT itself is mainly engaged in the design and assembly of the aforementioned products from components, which are carried out by other companies. The company's revenue is divided into subsequent segments.

Semiconductor systems - sixty six percent. The sector's operating margin is 32,7 % from its proceeds. In this sector, the main users of AMAT products are companies, who work in a clear sector. This product category includes a variety of items., needed for the production of chips. Fifty-nine percent of the sector's revenue comes from foundry companies,20 % gives DRAM, the other twenty-one percent is flash memory.

Applied global systems - twenty four percent. The sector's operating margin is 27,1 % from its proceeds. Products and services to improve and automate high-tech manufacturing.

Monitors and related markets - nine percent. The sector's operating margin is 18,1 % from its proceeds. Products for the production and testing of monitors. By the way,,84 % sector revenue comes from China.

Corporate payments and more - one percent. This is not a sector, and an accounting quirk - just settlements between company departments were taken to a certain sector.

Company revenue by state and region

| China | thirty two percent |

| Taiwan | twenty three percent |

| South Korea | eighteen percent |

| Japan | eleven percent |

| USA | ten percent |

| Europe | four percent |

| Southeast Asia | Two Percent |

China

thirty two percent

Taiwan

twenty three percent

South Korea

eighteen percent

Japan

eleven percent

USA

ten percent

Europe

four percent

Southeast Asia

Two Percent

How does Entegris make money? (ENTG)

The company supplies various solutions for the production of complex technological products. According to the annual report, The company's revenue is divided into the following segments.

Specialty chemicals and engineering products — 32,78%. These are goods and solutions for the actual chemical-technological aspect of the production of high-tech products. Segment profit - 20,99% from its proceeds.

Microcontamination control — 39,91%. Solutions for highly specialized chemical processes in the production of semiconductors and other complex technical products. Segment profit - 33,53% from its proceeds.

Management of complex elements — 27,31%. Monitoring solutions, protection and transportation of chemical components, necessary for high-tech production. Segment profit - 20,61% from its proceeds.

Revenue by country and region

| North America | 25% |

| Taiwan | 20% |

| South Korea | 15% |

| Japan | 13% |

| China | 13% |

| Europe | 8% |

| Southeast Asia | 5% |

North America

25%

Taiwan

20%

South Korea

15%

Japan

13%

China

13%

Europe

8%

Southeast Asia

5%

Semi-sinners

Today in the world there is a shortage of semiconductors, which logically creates a strong demand for goods and services of both issuers.

There are three reasons for the shortage.

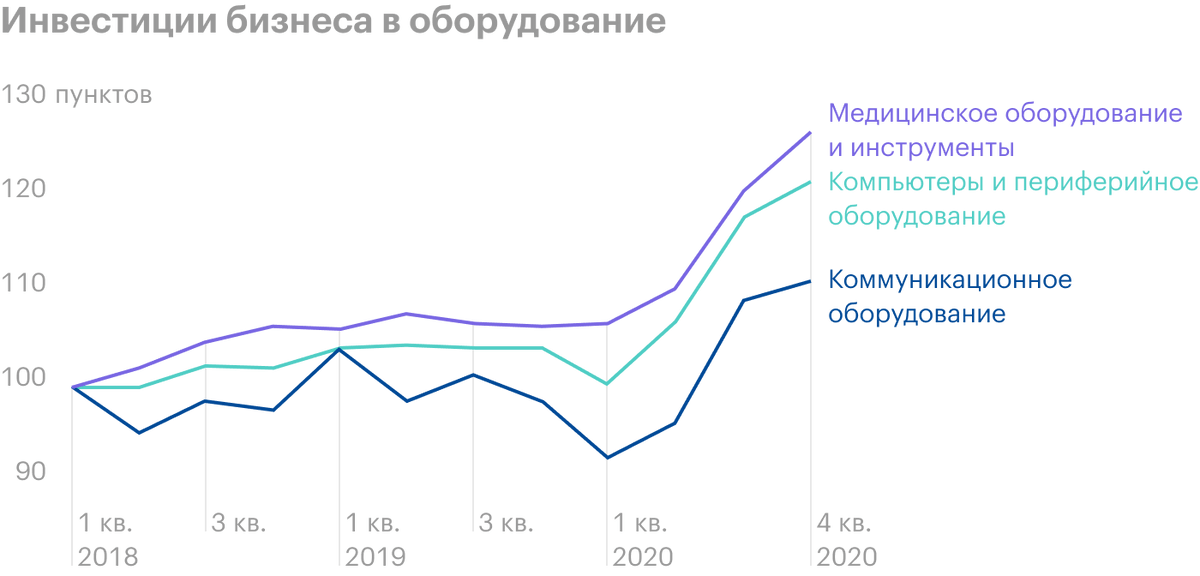

The first is the drop in the level of investment in the expansion of production in this area in previous years., which led to a lack of production capacity.

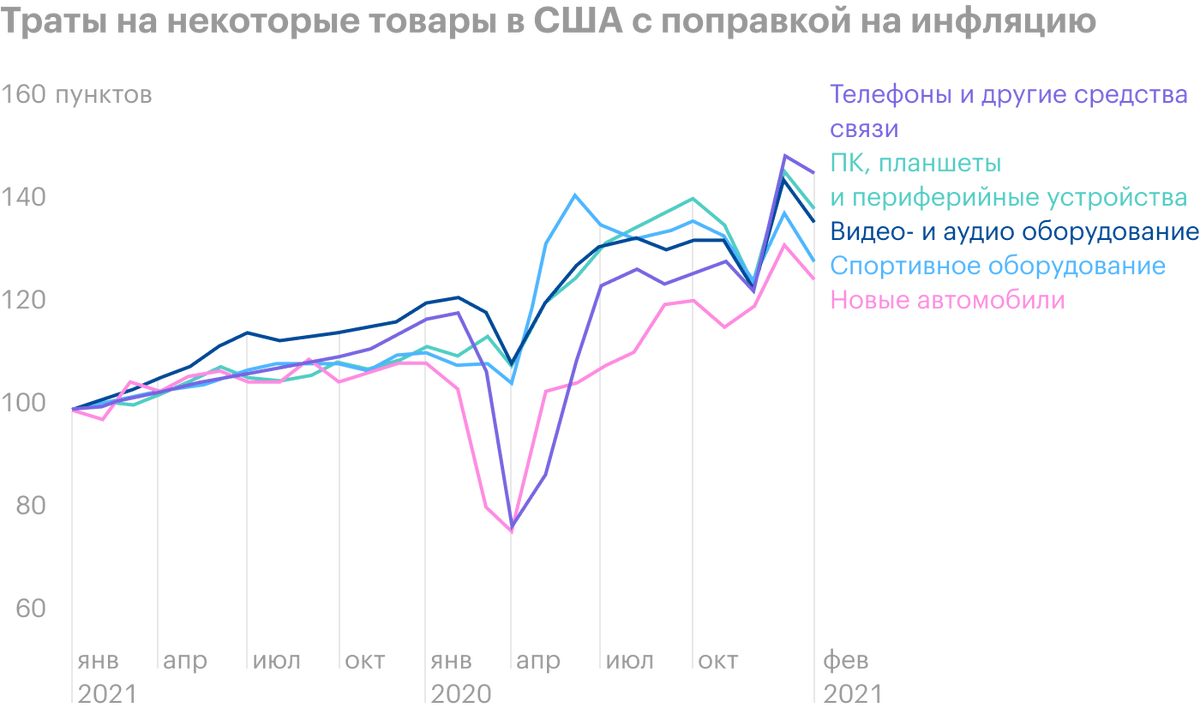

The second is that there is a consumer boom in the US today., and electronic devices and cars are especially popular, for the production of which semiconductors are needed.

Third - the pandemic caused a wave of digitalization of business activity, in connection with which the volume of investments of enterprises in computers and others has increased. This, how did you guess, also contributes to the growth of demand for semiconductors.

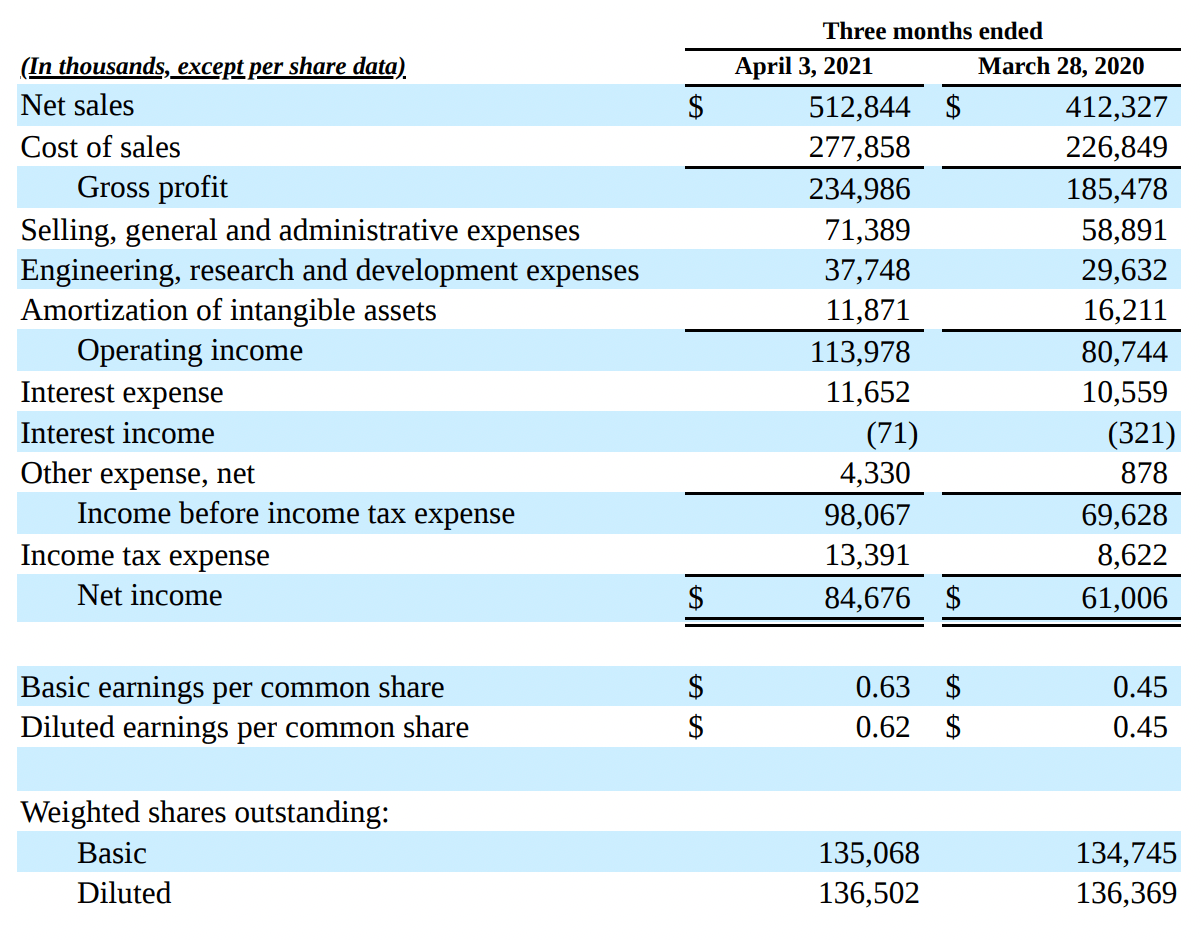

This has already had the best effect on ENTG reporting.: and profit, and revenue increased significantly (cm. table below). Well, competitors of AMAT from ASML have doubled their forecast for growth of financial indicators for this year - which, I guess, can be considered a good indicator that, that AMAT can count on at least a couple of good quarters.

By the way, given the difference in size and commonality of interests, I think, which is a very realistic scenario, at which a large AMAT will buy a relatively small ENTG to integrate it into its own production chains. The option is very realistic, Considering, that the semiconductor industry spends a lot of money on R&D. And I even think, that the market will react to this news in general positively: AMT and ENTG are strong businesses in a very promising area, that don't look obscenely expensive (in AMAT P / E equal 30,79, у ENTG — 46,58).

So the conjuncture for both companies looks very positive., and the companies themselves are quite promising.

R&D as a percentage of revenue across industries

| Biotech | 20,8% |

| Semiconductors | 16,4% |

| Software | 14,3% |

| Media | 8,9% |

| Technological equipment | 6,9% |

| Telecom | 6,5% |

| Financial services | 5,6% |

Biotech

20,8%

Semiconductors

16,4%

Software

14,3%

Media

8,9%

Technological equipment

6,9%

Telecom

6,5%

Financial services

5,6%

Concentration

AMAT's two largest customers generate a disproportionate percentage of revenue: on 18% accounts for Samsung and Taiwan Semiconductor Manufacturing.

The same customers are also the largest for ENTG: Taiwan Semiconductor Manufacturing дает 11,18% proceeds, а Samsung — 8,83%.

Reviewing relationships with one or worse - with both customers can negatively affect the reporting of both companies. Although in the case of AMAT, the possible risks are greater due to the higher concentration.

Dividends

AMAT pays 0,96 $ per share per year, what it takes 880 million a year. Debts of the company for 11.832 billion, of which 4.504 billion must be repaid during the year. Basically, The company must have enough money for everything: only on the accounts of the company there are 6.213 billion and more than 3 billion debts of counterparties.

ENTG pays 0,24 $ per share per year, what the company spends 43.5 million a year on. Debts of the company for 1.5 billion, of which 266.271 million must be repaid during the year. She has enough money for everything.: there are 548.52 million in accounts and over 280 million in debts of counterparties.

Both companies spend less than a third of their profits on dividends., but still be aware of the possibility of force majeure, because of which companies can cut dividends. Or maybe, they decide to invest in expanding production capacity, and the payment will be cut precisely for this noble reason. Stocks from this can fall, but I still hope, that it won't happen.

However, a more realistic reason for the company's dividend cut, I see a possible reassessment of the semiconductor shortage by major manufacturing companies. Now they are investing heavily in the expansion of production, which can lead to overproduction in the next one and a half to two years. Then AMAT and ENTG products and services may fall in price, because at this stage, both companies are paid extra or overpaid for urgency.

Resume

AMAT and ENTG look very interesting for investing in a year and a half, as long as there will be a shortage of semiconductors. So here we have the right to expect growth as business indicators of the considered issuers, as well as their quotes.