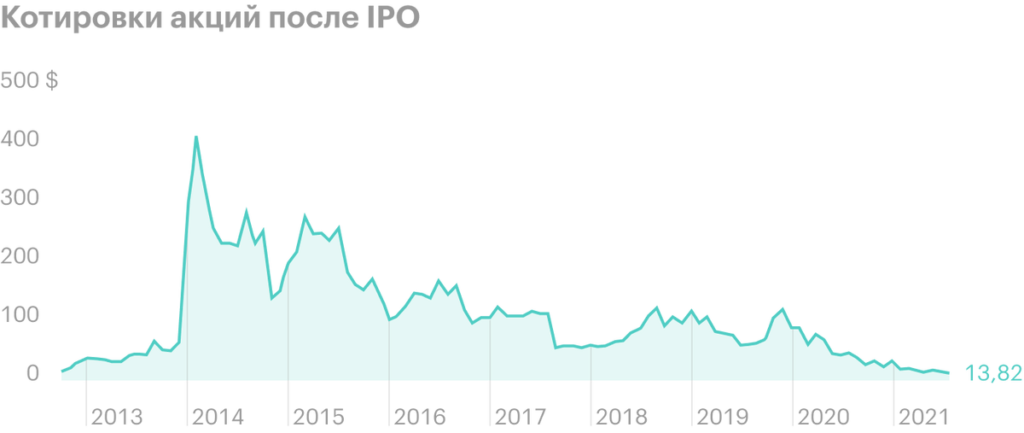

Intercept Pharmaceuticals (NASDAQ: ICPT) - a biotechnology company from the USA, which in her research focuses on solving the problems of liver diseases. The business was founded in 2002 and listed its shares on the Nasdaq in 2012 - now they are trading close to the all-time low in the area 15 $.

Where does the money come from

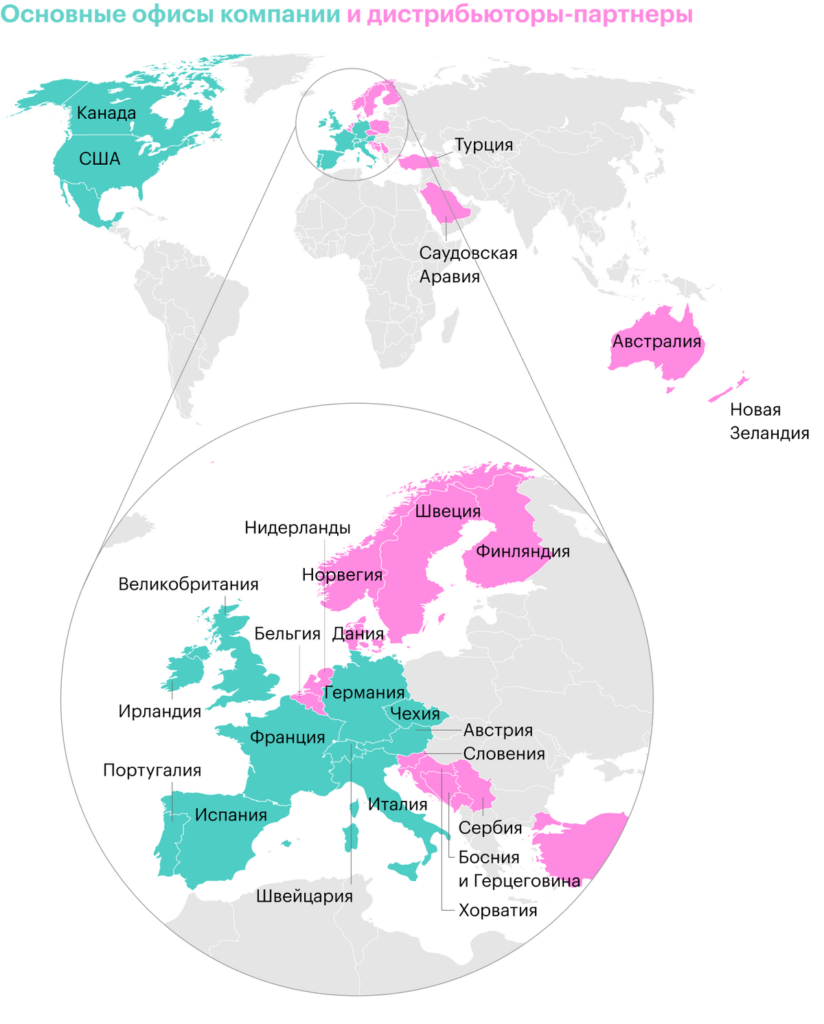

Like most biotechs, the company develops medicines and prepares them for commercialization in the US markets, Canada and Europe. Intercept Pharmaceuticals plans to produce synthetic analogs of bile acids, which will be used in the treatment of chronic liver diseases, such as primary biliary cholangitis, non-alcoholic steatohepatitis, cirrhosis of the liver and others.

Portfolio of drugs under development

The main developments of the company are based on obeticholic acid (OCA). The drug "Okaliva" based on it was approved by the Food and Drug Administration (FDA) in May 2016 and is prescribed by prescription for the treatment of primary biliary cholangitis.

Intercept Pharmaceuticals plans to expand its sales market:

- filed for FDA approval for fibrosis, associated with non-alcoholic steatohepatitis;

- the third phase of clinical trials of the drug for use in the treatment of cirrhosis is underway, caused by non-alcoholic steatohepatitis;

- the second phase of clinical trials is underway for the combination of obeticholic acid and bezofibrate in the treatment of primary biliary cholangitis.

The company has also begun preclinical development of a new generation of farnesoid receptor agonists. (FXR).

What's wrong

Volume of short positions in company shares, according to Finviz, exceeds 30%, which puts strong pressure on prices, which have reached historic lows this year.

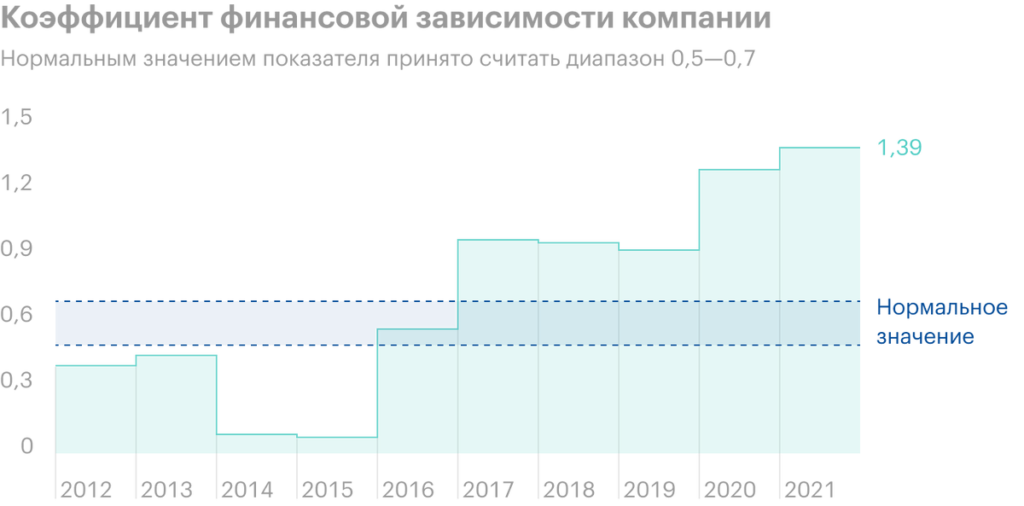

Commitments have been growing since 2019 and as of August 2021 are 139% from business assets. The greater the debt, the more money will be spent on servicing it - in the event of an increase in the interest rate in the United States, this will create additional financial problems for Intercept.

Joe Biden's administration plans to cut the cost of prescription drugs, what page 24 of the 2022 budget plan is talking about.

Prospects for approval of the company's drug for the treatment of other liver diseases, except cholangitis, Many Consider Doubtful - August 20 Goldman Sachs Downgrades Intercept Pharmaceuticals Share Price Forecast from 17 to 10 $. Bank analyst thinks, that the future of Okaliva remains vague and the issuer's shares lack short-term growth drivers.

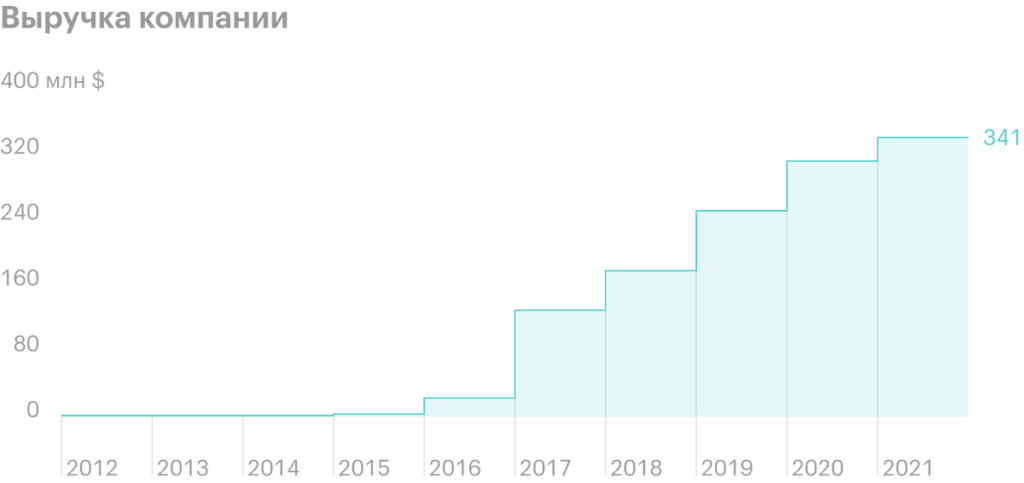

What good

The company has revenue, and it keeps growing. In August, the company announced a share buyback program at 16,75 $, on which he will spend 75 million dollars. This will positively affect the share price of Intercept Pharmaceuticals.

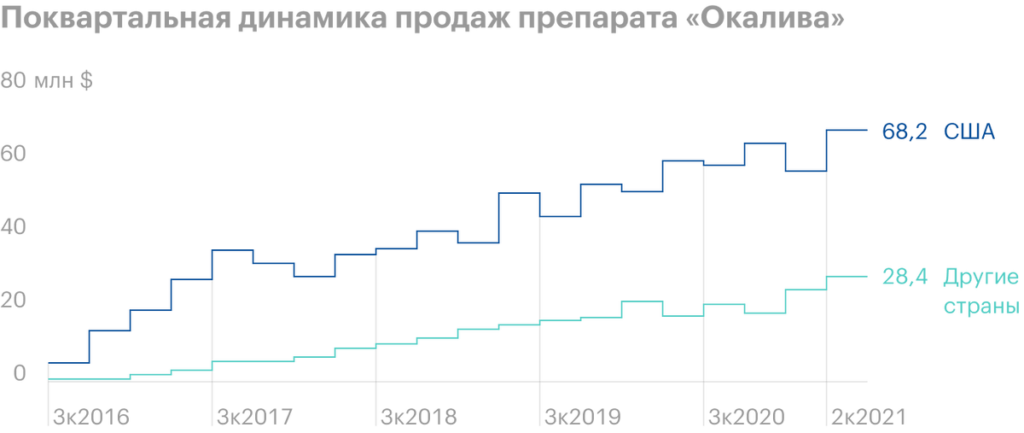

Demand for Okaliva is growing. The percentage of patients with primary biliary cholangitis in the United States is increasing every year, which ultimately increases the number of prescribed prescriptions for the company's drug.

US $ 6 Trillion 2022 Budget Plan Imposes Significant Increases in Healthcare Spending, what is good for everyone in the sector, including drug manufacturers.

What's the bottom line?

Intercept Pharmaceuticals is a rather speculative investment idea. Despite the fact that the company is growing revenue, there are good prospects and an approved drug, in its shares, at the same time, you can find an alarming volume of short positions, and politics, the news background and periodic forecasts do not always add optimism.

On the other hand, you can always hope for the success of medical research, approval of new drugs or even that, that the Wallstreetbets community will be interested in the company and decide to organize a short squeeze, significantly accelerating the share price, - but these are all just assumptions, not guarantees.