Coupang (NYSE: CPNG) conducted an IPO 11 Martha 2021 of the year. On the first trading day, the company's quotes soared from 35 to 65 $ per share, but then quickly corrected to a range of 40-50 $, currently traded. The share price still remains above the price, which was at the initial placement.

About company

Coupang is a South Korean e-commerce platform with sales over 12 billion dollars at the end 2020 and growth by 91%. Coupang's goal is to impress customers and make them think.: "How did I even live without a Coupang??»

Coupang has complete control over its logistics network, which they built from scratch. The client orders absolutely any product, and it is delivered the same day or the next morning, if the order was received after midnight.

According to the latest data, for March 2021 of the year has the best-in-class Android mobile e-commerce app. The level of Internet penetration in South Korea is very high, more 95% of the population owns smartphones, And, hence, people have access to Coupang.

To increase the number of customers, Coupang launched a paid subscription Rocket Wow, Similar Amazon Prime with free shipping and discounts. The company is also actively developing a fresh food delivery service., allowing people to distance themselves from each other during COVID-19. Subscribers can choose to receive products in environmentally friendly packages, for which Coupang has repeatedly received praise from conservationists.

Among the third-party services, it is worth noting the food delivery service, the growth of which is noted year-on-year. And since December 2020 launched Coupang Play - streaming service video by subscription.

The company has its own payment service Coupang Pay, which provides installments for customers, and also allows sites to accept payments.

No dividends. The company is unprofitable and expects continued losses, because it invests in the growth of infrastructure and delivery services. The total debt is 1,8 billion dollars, all the company has 4,33 billion in accounts.

Custom app reach, as a percentage of the total

| Coupang | 46,2% |

| Daangn Market | 36,1% |

| 11st | 22,8% |

| Gmarket | 17,7% |

| WeMakePrice | 15% |

| TMON | 14,2% |

| Auction | 12,4% |

| GS Shop | 10,5% |

| Today’s House — Interior app | 9,3% |

| Home & Shopping | 8,4% |

Revenue distribution by segment, million dollars

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Retail | 3,8 | 5,79 | 11,05 |

| Service | 254,46 | 486,17 | 922,24 |

Financial performance of the company by year, billion dollars

| Revenue | Losses | |

|---|---|---|

| 2018 | 4,054 | −1,098 |

| 2019 | 6,723 | −0,699 |

| 2020 | 12 | −0,475 |

| 1 neighborhood 2021 | 4,207 | −0,295 |

Major shareholders

| SoftBank | 36,47% |

| Greenoaks Capital Partners | 18,03% |

| Maveric Capital | 7,10% |

| BlackRock | 2,45% |

Market and competitors

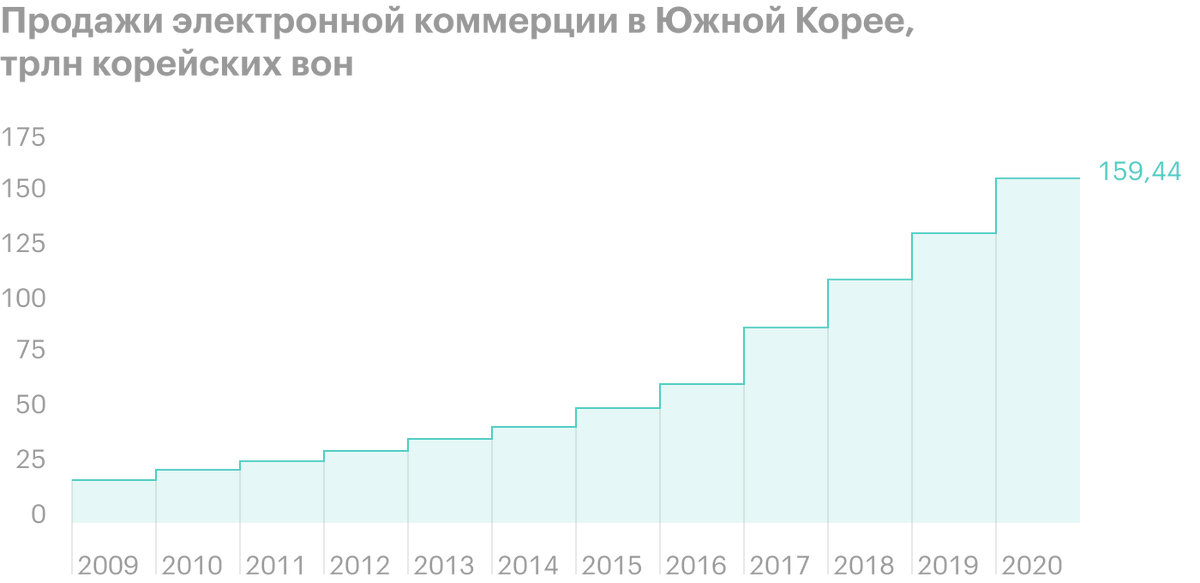

South Korea's e-commerce market shows no signs of slowing down, since it grew at an average annual rate of 20,4% with 2009 on 2020. Besides, revenue growth from 2019 on 2020 made up 17,9%, and with 2018 on 2019 — 18,9%. This clearly shows, that there has not been a sharp increase in income due to COVID-19, because Koreans have already been well adapted to online shopping.

Countries with the highest percentage of online purchases

| South Korea | 35,8% |

| China | 27,3% |

| United Kingdom | 24,2% |

| USA | 20,3% |

| Indonesia | 19,9% |

Assessment of indicators among competitors for 2020 year, billion dollars

| Date of foundation | Capitalization | Revenue | Gross income | |

|---|---|---|---|---|

| Coupang | 2010 | 73 | 12 | 2 |

| Alibaba | 1999 | 574 | 78,7 | 35 |

| eBay | 1995 | 46,3 | 10,3 | 7,8 |

| Amazon | 1994 | 1850 | 386 | 152,8 |

Why stocks can go up

Sales growth in South Korea. The e-commerce market in the country is growing. South Korea is one of the most densely populated countries in the world, so the Coupang service model thrives and covers customer needs in no time.

Ecosystem growth. Revenue from third-party services, developed by Coupang, is still modest 8%, but continues to grow with overall revenue figures. Maybe, the company will be able to build an ecosystem around itself and this will encourage customers to spend more inside Coupang.

Entering other markets and supporting investors. Recently, the company announces the opening of representative offices in Singapore and Japan. Singapore is an important logistics point for expansion due to its similarity to South Korea. It's an equally densely populated country with a tech-savvy population.. Coupang notes, what 70% clients live within 11 km from distribution centers, which is much less distance, which must pass the goods from Amazon.

Japan's address market is about 125 million people, and even a small percentage of market share will provide Coupang with good profits. Japanese holding company SoftBank owns 37% Coupang and financed the latter for a billion dollars in 2015 year and on 2 billion dollars through Vision Fund SoftBank in 2018 year. SoftBank Chairman Masayoshi Son has already stated, that it is considering providing Coupang services in its home country.

Why stocks might fall

Unsuccessful expansion. Coupang achieves amazing results in its homeland, but the market is limited, and revenue growth may slow. The management understands this well and therefore is negotiating the opening of new markets.. At the same time, the service model, which is so loved by customers in South Korea, can be difficult to implement in other countries.

Firstly, there is a six-day working week in the country, and in Coupang work both day and night. Whether such a hard-working staff will be hired by a company in another market is a big question.. Secondly, despite the manufacturability, Japan's population is much older, than in South Korea. And large cities are scattered from each other at a greater distance., because of what to deliver the goods for 12 hours can be difficult. And finally, such monsters of commerce are already operating in these markets., like Amazon and Alibaba, therefore, you will have to take your place in the sun with a fight.

Rising capital expenditures and large losses. Expansion abroad involves not only a potential increase in revenue, but also a significant increase in capital costs for the construction of logistics centers and hiring personnel. All this can be reflected in the company's reports for subsequent periods and disappoint investors.. Moreover, the company is not yet profitable.

Accidents and proceedings. Coupang workers have repeatedly complained about harsh working conditions.. According to them, management forced them to work in a windowless room even after positive tests for COVID-19. 18 June 2021 a fire broke out at one of the distribution centers, due to which part of the stored goods was severely damaged.

Results

Coupang, undoubtedly, an interesting issuer with long-term growth potential. Extremely attractive customer service model is gaining popularity, and the company comes from a very developed country. From the outside there is a very strong support of investors and management, interested in the development of the company.

But all further expansion plans will incur large capital expenditures., what, maybe, will not please all investors. The company just recently went public, and it will remain very volatile in the near future.. If you decide to invest in Coupang, then keep that in mind.