ConocoPhillips (NYSE:COP) — conducts its business in 15 countries and produces daily 1,588 million barrels of oil with total proven reserves in 4,5 billion barrels at the end of 2020. The company received its current name after the merger of two companies at the end of 2001.: Conoco Inc. and Phillips Petroleum Company.

About company

ConocoPhillips' core business is oil and natural gas exploration and production.. The company's business is divided into the following segments.

Lower 48. Key segment, consisting of deposits in the United States and the Gulf of Mexico. In 2021, ConocoPhillips announced two M deals.&A, which made it possible to increase production capacities in the Permian Basin. At the beginning of the year, competitor Concho Resources was bought., conducting operations in New Mexico and West Texas, and later 20 September, the Board of Directors announced the acquisition of Shell's assets in the United States.

Alaska. ConocoPhillips in this region is the largest producer of crude oil, which it produces from the two largest fields in North America, located on the northern slope of Alaska: Prudhoe Bay and Kuparuq. This includes another oil section., located on the western slope: Alpine Field.

Europe, Middle East and North Africa. The segment consists of assets, located in the Norwegian sector of the North Sea, Norwegian Sea, Qatar and Libya.

Asian-Pacific area. Here ConocoPhillips operates in China, Indonesia, Malaysia and Australia.

Canada. The company is developing two fields — Montney in British Columbia and Surmont oil sands in Alberta..

Other countries. The segment consists of assets in Colombia, Argentina, Chile, Ecuador and Venezuela.

Corporate and other expenses. This segment includes marketing activities, energy partnership and own oil technology programs.

ConocoPhillips Revenue Structure, billion dollars

| Revenue | Share in the overall result | |

|---|---|---|

| Lower 48 | 5,887 | 62% |

| Alaska | 1,418 | 15% |

| Europe, Middle East and North Africa | 1,165 | 12% |

| Asian-Pacific area | 0,630 | 6% |

| Canada | 0,450 | 5% |

| Other countries | 0,002 | 0% |

| Corporate and other expenses | 0,004 | 0% |

ConocoPhillips sales structure by country, billion dollars

| Revenue | Share in the overall result | |

|---|---|---|

| USA | 7,308 | 76% |

| Norway | 0,618 | 6% |

| Canada | 0,450 | 5% |

| Libya | 0,290 | 3% |

| United Kingdom | 0,257 | 3% |

| Malaysia | 0,252 | 3% |

| Indonesia | 0,207 | 2% |

| China | 0,171 | 2% |

| Other countries | 0,003 | 0% |

ConocoPhillips Energy Sales Structure, billion dollars

| Revenue | Share in the overall result | |

|---|---|---|

| Oil | 5,797 | 61% |

| Gas | 2,812 | 29% |

| Bitumen | 0,622 | 7% |

| Liquefied natural gas | 0,325 | 3% |

ConocoPhillips Strategy 2022–2031

At the end of June 2021 Board of Directors Announces New Ten-Year Development Plan until 2031, the purpose for which in September the company increased additionally after the purchase of Shell's American assets in the Permian Basin.

Main points:

- After the acquisition of Concho Resources, management plans to save up to a billion dollars annually through synergy..

- ConocoPhillips calculates, that during the next 10 years will receive operating income of ~ $ 165 billion and free cash flow of ~ $ 80 billion, if the average price per barrel of WTI crude oil is 50 $.

- The company expects, that capital expenditures in the next ten years will average about 8 billion dollars a year, which will lead to a cumulative annual increase in production by about 3%. Forecast for 2021 on capital expenditures — 5,3 billion dollars.

- Management plans to return order to its shareholders by 2031 75 billion dollars from cash from operating activities. In 2021, the board of directors will send for these purposes 6 billion dollars: 2,3 billion dollars through the payment of dividends, the rest is through buyback. Current annual yield — 7%.

- The company assumes, that roCE's return on invested capital will grow by 1-2 percentage points per year and increase from current values 6% to 13% in 2026 and up to 20% in 2031.

- Leadership expects, that the company's debt burden until 2031 will remain below one annual CFO. If the average price per barrel of WTI crude oil is 50 $, the net debt/CFO value will fall from 1× in 2022 to 0.4× in 2026 year and up to 0.3× in 2031.

- ConocoPhillips expects to reach zero emissions by 2050.

This ten-year program is designed to, in the opinion of management, increase the efficiency of ConocoPhillips and help to fulfill the three main medium-term goals of the company: provide the world with affordable energy by investing in resources at the lowest cost, show competitive financial results and demonstrate leadership in the ESG agenda.

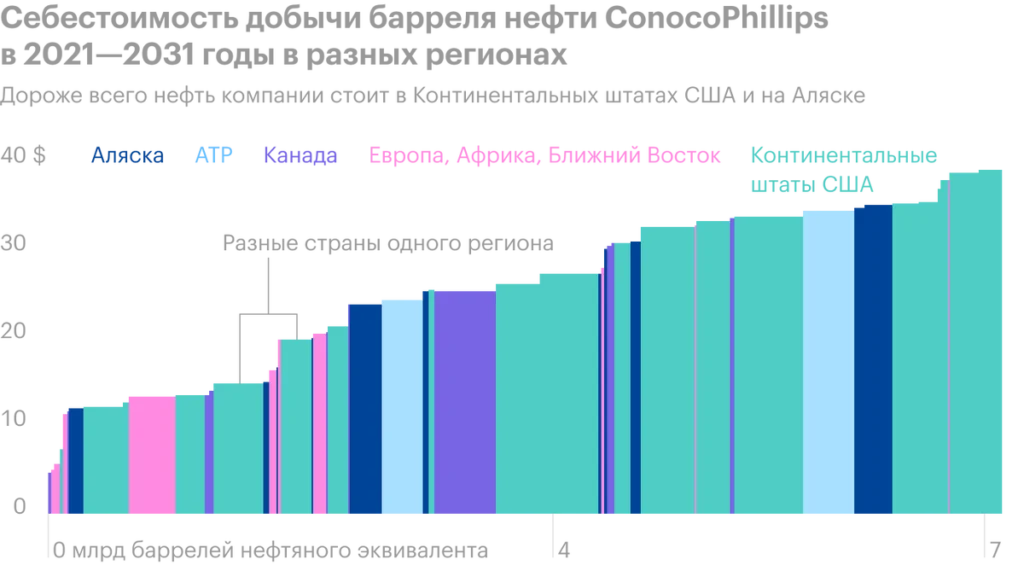

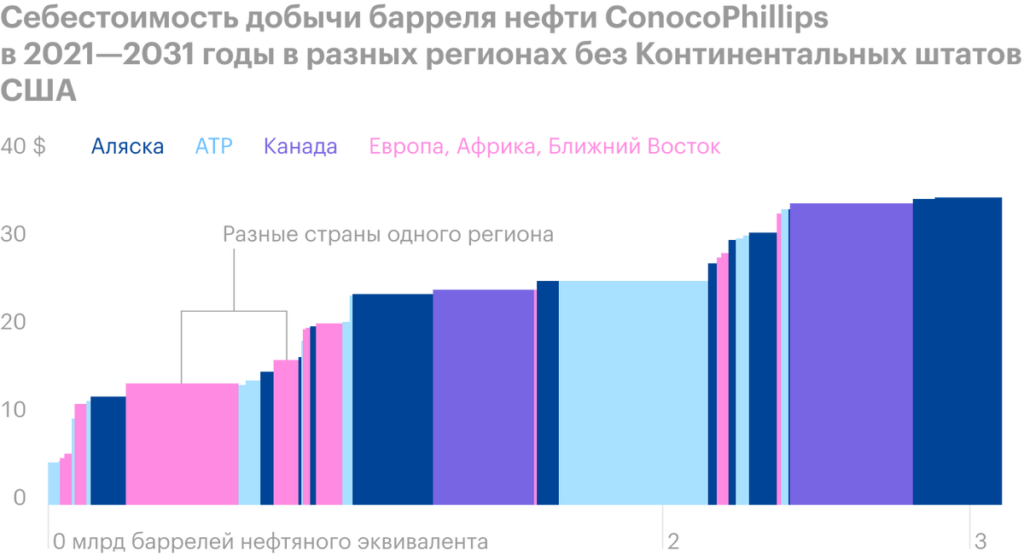

Besides, strategy 2022-2031 should lead to a decrease in the cost of oil production from the current 30 $ up to less than 28 $ on average for all departments and up to less than 25 $ on average for all departments, but without Lower 48.

Dividends and buyback

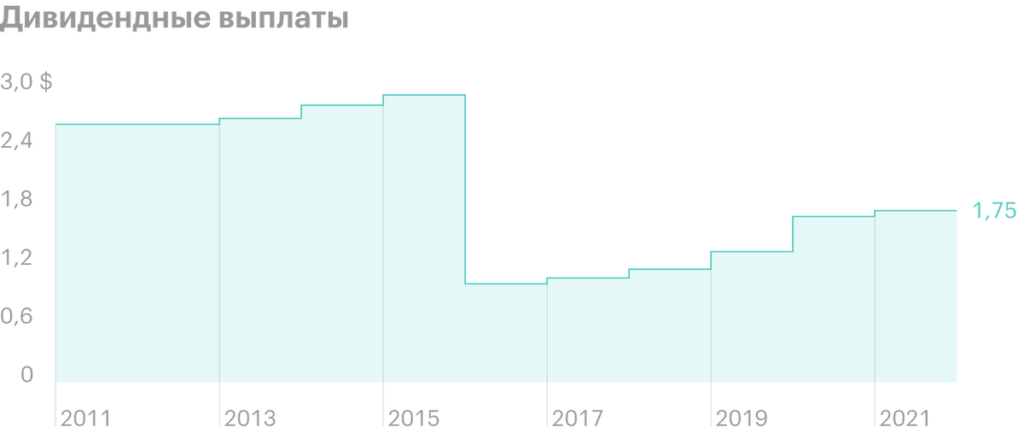

ConocoPhillips runs a fairly heterogeneous profit sharing program. In 2012, the board of directors spun off the oil refining business into a separate company, Phillips. 66. After that, management decided not to reduce dividend payments and not to reduce capital expenditures., and reduce only the buyback to 0. All this happened due to strong market conditions.: prices for WTI crude oil in those days were higher 100 $.

But three years later, oil prices fell by half to 50 $, and the company's debt burden began to grow. Seeing these negative data, management has moved out of high-cost areas of business and reoriented to investments with a shorter cycle. This led to the fact that, that in 2016 the Board of Directors reduced annual dividend payments by 76% to 1 $, capital expenditures — on 52% up to ~ $5 billion, but in return returned the buyback.

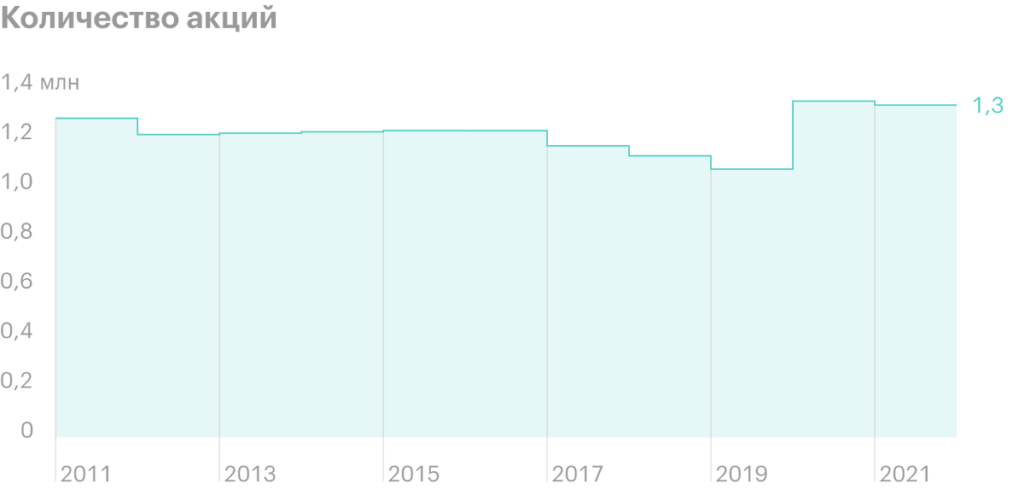

Another important event for the company is the recent acquisition of a competitor, which increased the authorized capital of the oil giant. At the end of 2020, ConocoPhillips and Concho Resources announced the deal., according to which 1 stock the last company was exchanged for 1,46 ConocoPhillips shares.

Current results

ConocoPhillips in recent 5 years can not boast of stable financial indicators - all the fault of unstable oil prices. In 2016, prices fell below 30 $ against the background of the lack of balance in the market due to the shale revolution in the United States. IN 2017 The company conducted a huge one-time write-off in 6,6 billion dollars due to impairment of assets in the US and Australia. In 2020, the pandemic and quarantine restrictions have lowered oil prices below 10 $.

Financial results for the last 5 years, billion dollars

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2016 | 24,360 | 3,532 | −3,615 | 23,665 |

| 2017 | 32,584 | 4,230 | −0,855 | 13,378 |

| 2018 | 38,727 | 15,929 | 6,257 | 9,053 |

| 2019 | 36,670 | 15,614 | 7,189 | 9,807 |

| 2020 | 19,256 | 2,381 | −2,701 | 12,378 |

| 6м2021 | 20,770 | 8,547 | 3,073 | 13,402 |

Comparison with competitors

| EV / EBITDA | P / E | P / BV | net debt / EBITDA | |

|---|---|---|---|---|

| ConocoPhillips | 9,07 | 41,29 | 1,73 | 1,35 |

| Exxon Mobil | 10,11 | Otric. | 1,43 | 2,03 |

| Chevron | 9,55 | 51,1 | 1,38 | 1,55 |

| Royal Dutch Shell | 5,69 | 29,11 | 0,96 | 1,65 |

| TotalEnergies | 5,51 | 17,32 | 1,07 | 0,98 |

Arguments for

Low cost of oil production. The company shows strong results in comparison with other companies. At the moment, the cost of ConocoPhillips is equal to 30 $ vs. 36.5—45 $ industry average, by 2031, management plans to reduce this value to 28 $.

High level of profit sharing. According to the company's strategy 2022-2031, the company in the next ten years will return to shareholders of the order 75 billion dollars. On average, an amount of 7,5 billion dollars, at the current capitalization in 76 billion dollars turns out to be a yield of about 10%.

Top 15. ConocoPhillips is a significant player not only in the US energy sector, but also in the global. By capitalization, the company is included in 15 the largest oil and gas companies in the world.

net debt. Due to its low debt load, it has financial stability, which is what the crisis year 2020 demonstrated., when many commodity companies reset their dividend payments, ConocoPhillips at this time continued to pay. At the moment, the company's net debt is 13,402 billion dollars, and the net debt/EBITDA multiple is 1,35.

M&A-transactions. Through new acquisitions in 2021 — Concho Resources and Shell's U.S. assets — the company increased its own investment goals through 2031 and increased its current quarterly dividend from 0,43 to 0,46 $.

Arguments against

Oil business. Such a business carries reputational risks: the oil industry is polluting our planet. Unfortunately, ConocoPhillips could not pass by this problem and got into the anti-rating of companies, which for the last 45 years emitted the largest amount of carbon dioxide into the atmosphere.

Legislative initiatives in the United States. By 2035, the mayor of New York and the governor of California want to ban the sale of gasoline-powered cars.. Considering, that the company's main mining assets are located in the United States and America occupies more than 75% in the sales structure of ConocoPhillips, this law clouds the long-term prospects of the company.

Evaluation. When compared to U.S. oil leaders., then ConocoPhillips is a little cheaper, but if you look at European competitors – Royal Dutch Shell and TotalEnergies, then they are traded at multiples, which are almost in 2 times lower, than the company in question.

What's the bottom line?

ConocoPhillips is a major oil company, which in the following 10 years can be returned annually to shareholders 10%. This should interest those, who believes, that the peak of oil demand is yet to come and the current drawdown of energy companies is a good reason to buy.