We continue the series of articles about Rosneft and its public subsidiaries. In the last article, we reviewed the Saratov Oil Refinery, next in line Bashneft.

About company

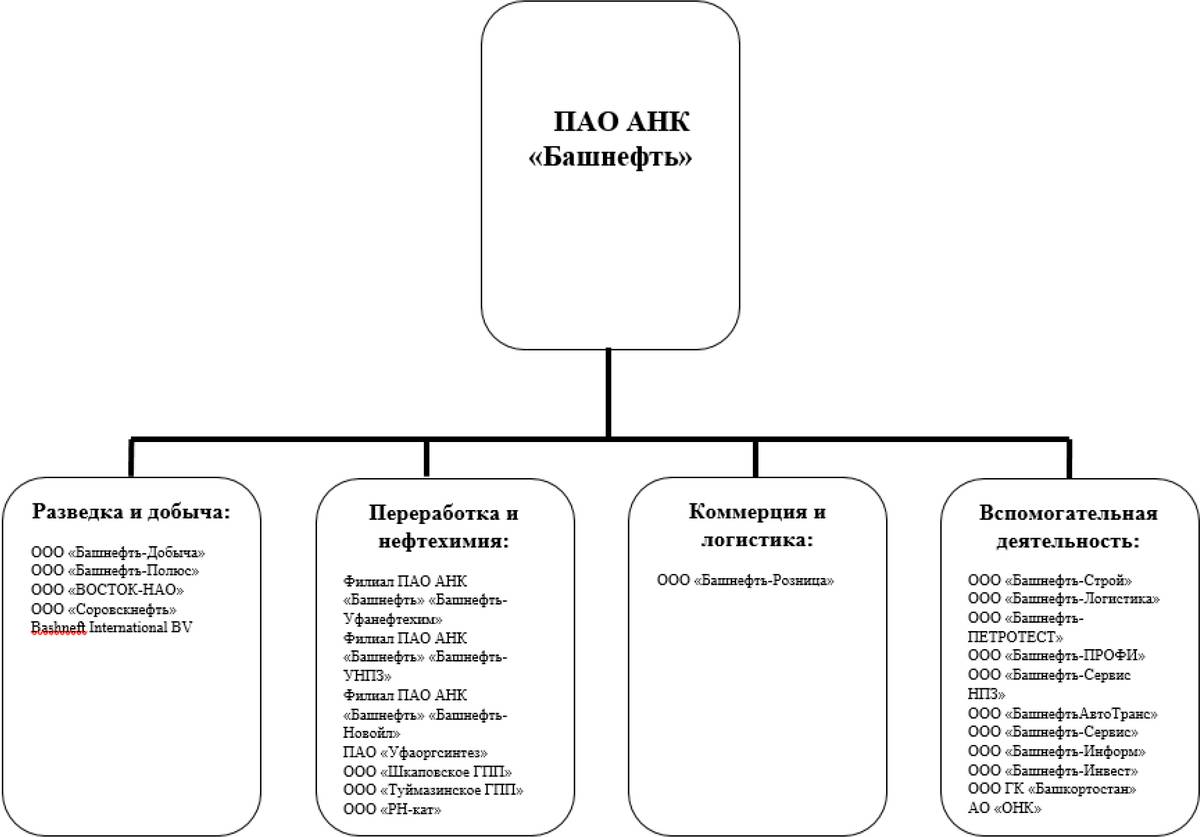

Bashneft (MCX: BANE) — a large vertically integrated oil and gas company. Its history began with the creation of the trust of the same name in 1935.. The company is engaged in exploration and production of oil and gas, oil- and gas processing, petrochemistry, sale of raw materials and processed products wholesale and retail. The main assets of the company are located in the Republic of Bashkortostan. Bashneft is significantly inferior in size to the industry's flagships: for example, Gazprom Neft's revenue is about 4 times more, Lukoil - 10 times, and the parent Rosneft for 2020 - 11 times. Let's take a closer look at the operating segments of the company's business.

Exploration and production. The company's fields are concentrated in the republics of Bashkortostan and Tatarstan, Khanty-Mansiysk and Nenets Autonomous Okrugs, as well as in the Orenburg region. Bashneft also conducts geological exploration abroad - in Iran and Myanmar. As of the end of 2020, proven reserves were estimated at 328.8 million tonnes of oil. NS., gradually increasing year by year.

The number of licenses and deposits is gradually growing, under development, at the end of 2020 - 268 licenses and 188 fields. A significant part of Bashneft's oil is produced at mature fields, which is not very good, as it is usually more difficult and costly. In general, oil production is falling year by year, gas production has been growing in the last couple of years, but not to say that at a fast pace. In addition, the volume of production for 2020 is less, than for 2017.

Oil refining and petrochemical industry. In this segment, the company is engaged in the processing of hydrocarbons at its three refineries, two gas chemical and one petrochemical plants. The main products of oil refining are motor oils, and petrochemicals - polypropylene, polyethylene, phenol, acetone and others.

The total capacity of oil refineries is 23.5 million tons per year, and the volume of processing is significantly lower: in 2020 it amounted to only 15.5 million tons, last years averaged 18.5 million tons.

The volume of output of oil products repeats the dynamics of refining volumes and amounted to 14.3 million tons in 2020, about 17.2 million tons on average over the past years. The volume of output of petrochemical products is stable and amounts to about 0.8 million tons per year.

Refining depth in 2020 was 86%, this significantly exceeds the values of the last three years, but only slightly above 2017 values. The yield of light oil products is gradually decreasing: from 67,4% in 2016 to 65,7% in 2020.

Commerce and logistics. The company is engaged in the sale of oil, oil products and petrochemical products in Russia and abroad. The main part of processed products is sold on the domestic market. The retail network is represented by 542 gas stations in 15 regions of the country. The number of gas stations has remained virtually unchanged in recent years..

Revenue of the largest oil and gas companies in Russia for 2020, billion rubles

| Gazprom | 6321 |

| Rosneft | 5757 |

| Lukoil | 5639 |

| Gazprom Neft | 2000 |

| Surgutneftegaz | 1182 |

| "Tatneft" | 721 |

| Novatek | 712 |

| Bashneft | 527 |

6321

Proven reserves, licenses and deposits by years

| Proved oil reserves, million tons | Licenses, things | Place of Birth, things | |

|---|---|---|---|

| 2016 | 333,9 | 216 | 182 |

| 2017 | 327,3 | 263 | 182 |

| 2018 | 328,2 | 266 | 184 |

| 2019 | 328,3 | 266 | 188 |

| 2020 | 328,8 | 268 | 188 |

Gas and oil production

| Mature oil fields | Total oil, million tonnes of oil equivalent | Gas production, million cubic meters | |

|---|---|---|---|

| 2017 | 16,6 | 20,6 | 31,6 |

| 2018 | 16,4 | 18,9 | 27,5 |

| 2019 | 16,3 | 18,7 | 28,7 |

| 2020 | 11,2 | 12,9 | 29,1 |

Indicators of oil refining and petrochemicals by years, million tons

| Primary processing | Release of petroleum products | Release of petrochemical products | |

|---|---|---|---|

| 2016 | 18,3 | 16,6 | 0,8 |

| 2017 | 18,9 | 17,6 | 0,7 |

| 2018 | 18,2 | 16,9 | 0,8 |

| 2019 | 18,7 | 17,3 | 0,8 |

| 2020 | 15,5 | 14,3 | 0,8 |

Depth of processing and output of light oil products in percent

| Processing depth | Light oil product yield | |

|---|---|---|

| 2016 | 85,8 | 67,4 |

| 2017 | 81,9 | 66,0 |

| 2018 | 82,7 | 65,5 |

| 2019 | 81,0 | 65,4 |

| 2020 | 86,0 | 65,7 |

Number of filling stations of the company by years

| 2016 | 536 |

| 2017 | 543 |

| 2018 | 544 |

| 2019 | 543 |

| 2020 | 542 |

536

Financial indicators

Revenue and net profit of Bashneft are quite volatile due to dependence on the situation in the oil market, and in general there is an unpleasant downward trend. Net debt is gradually increasing, as well as accounts receivable, - there is a repetition of the story with the Saratov refinery.

The geographical structure of the company's revenue shows, that she earns more than half of her money in the domestic market, but there is also a significant proportion of buyers abroad - there is foreign exchange earnings.

Revenue, net profit, net debt and receivables by year, billion rubles

| Revenue | Net profit | net debt | Receivables | |

|---|---|---|---|---|

| 2017 | 671,0 | 143,0 | 97,6 | 164,1 |

| 2018 | 860,2 | 98,4 | 70,1 | 130,0 |

| 2019 | 848,3 | 76,8 | 96,5 | 163,5 |

| 2020 | 527,2 | −11,1 | 122,8 | 140,9 |

| 2021, 1 half a year | 357,7 | 27,2 | 133,3 | 202,9 |

Geographical structure of revenue for 1H 2021 in percent

| Domestic market | 55 |

| Foreign countries without CIS countries | 42 |

| CIS countries | 3 |

55

Share capital

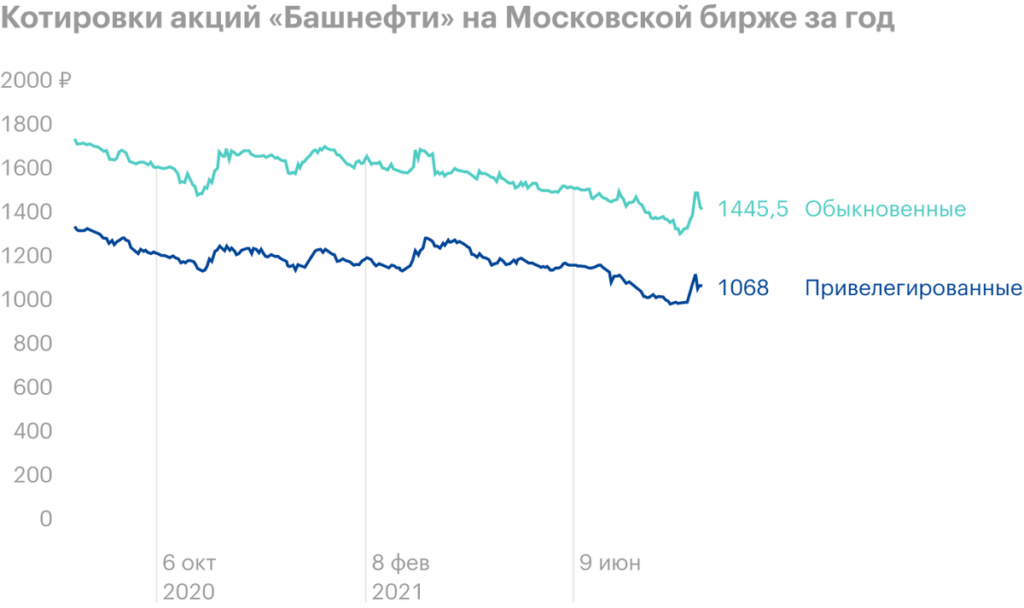

The share capital of Bashneft consists of two types of shares: ordinary and privileged. There is an unusual story here: due to the low free float of common shares, they are less liquid, than privileged. And in the history of the company there were many outstanding moments, associated with its major shareholders.

The company became an open joint stock company in 1995. In 2002, Bashkir fuel assets were privatized by several companies, That, as it is considered, were associated with the family of the then President of Bashkortostan. Back in 2003, the Accounts Chamber had many questions about these transactions.

In 2005, the shares of companies that own Bashkir fuel assets were bought by AFK Sistema, in 2009 became the owner of their controlling stakes, and then consolidated all enterprises on the basis of Bashneft. But in 2014, the case of illegal privatization was resumed, this resulted in the transfer of the Bashneft stake to state ownership by a court decision.

In 2015, the package in 25% a plus stock the company was transferred from federal property to the Republic of Bashkortostan, and in 2016 they announced a tender for the privatization of the remaining state-owned stake in the company - and it was won by the state oil and gas company Rosneft.

But that's the history of litigation, associated with Bashneft, not over: in 2017 Rosneft, as the controlling shareholder of Bashneft, filed a lawsuit against AFK Sistema for inefficient management of the company and causing damage to it. The result was a settlement agreement and the payment of 100 billion rubles to AFK Sistema as part of the settlement of disputes in favor of Bashneft - from there the company's huge net profit for 2017.

Since then, the composition of Bashneft's shareholders has not fundamentally changed.: the controlling stake is held by Rosneft, and blocking - in the Republic of Bashkortostan. Also, a considerable 4.4% of the share capital of quasi-treasury.

Equity structure

| Shareholder | share |

|---|---|

| Rosneft | 57,7% |

| Republic of Bashkortostan | 25,0% |

| Quasi-treasury shares | 4,4% |

| Free float | 12,9% |

share

Dividends and dividend policy

Bashneft has a dividend policy, adopted back in 2015. According to her, it is planned to pay out at least 25% of net profit under IFRS, if the multiplier value is net debt / EBITDA does not exceed 2.

The company adheres to the dividend policy, but the trend here is not the most pleasant for shareholders: profit percentage, paid out as dividends, gradually decreasing. In 2020, due to the resulting loss, no dividends were paid on ordinary shares at all, and for preferred ones they amounted to a symbolic 10 kopecks per share. Generally, the payout for common and preferred shares was the same..

Dividends, dividend yield and profit share of Bashneft, paid in the form of dividends, on years

| Dividend per share, rubles | Div. profitability about. Shares | Dividends on pref. share, rubles | Div. profitability pref. Shares | Profit share on dividends | |

|---|---|---|---|---|---|

| 2016 | 0 | 0,0% | 0,1 | 0,0% | 0% |

| 2017 | 307,26 | 13,5% | 307,26 | 22,7% | 38% |

| 2018 | 158,95 | 8,5% | 158,95 | 8,9% | 29% |

| 2019 | 107,81 | 5,6% | 107,81 | 6,3% | 25% |

| 2020 | 0 | 0,0% | 0,1 | 0,0% | 0% |

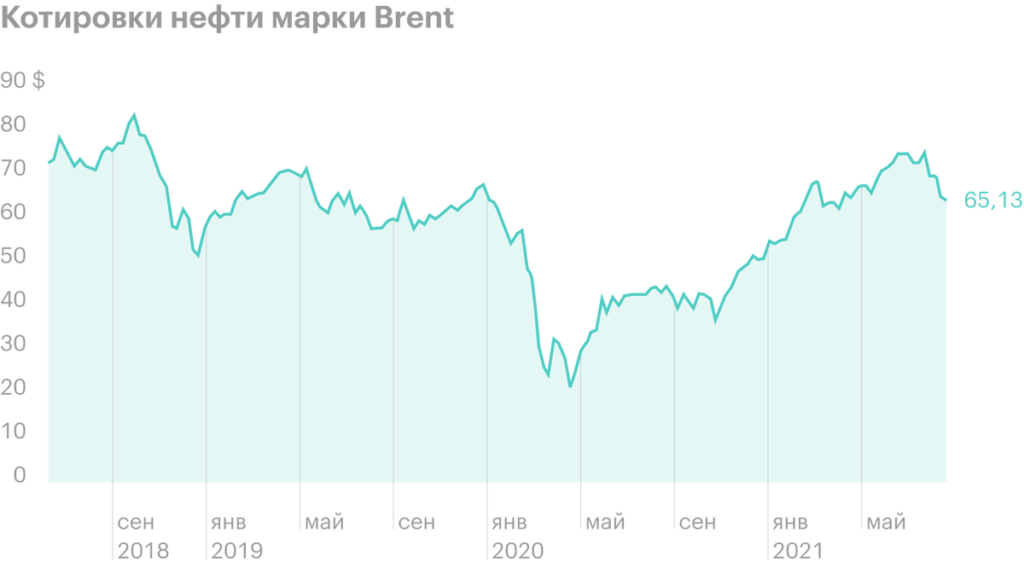

Why stocks can go up

Improving the business environment. In the article about Lukoil, we have already said, how difficult 2020 was for the oil and gas industry and that the situation is now improving: vaccination is in progress, quarantine measures are weakening. This gave OPEC + the opportunity to gradually increase oil production, Plus, oil prices are much higher now., than last year. All this has a positive effect on the financial performance of oil and gas companies., including Bashneft. Based on the results of 1 half of 2021 the company became profitable again.

Dreams of the best. If there are positive changes in the company, for example, production indicators will start to grow, or receivables will start to decrease, or dividends will rise to the government-approved standard in 50% adjusted net income, then the investment attractiveness of Bashneft will seriously increase. This should cause a significant increase in its stock prices..

Why stocks might fall

"We're going somewhere else". The dynamics of indicators that are important for the investment attractiveness of Bashneft in recent years is unpleasant: receivables and debts are growing, and revenue, net profit, her share, paid in the form of dividends, and the dividends themselves are falling. Certainly, to a large extent, this was influenced by the conjuncture of the oil market, but the company itself did not particularly succeed in leveling the market negative.

Now it's not so cheap. Before the 2020 crisis, the company had very decent multipliers: she was quite effective, poorly leveraged and cost significantly cheaper than competitors. Now the recovery of Bashneft is clearly going harder, than industry leaders. According to the results 1 half of 2021, according to value multipliers, the company is estimated at a high price in relation to its performance in recent years, and relatively larger and more efficient companies.

Bashneft multipliers by years

| P / E | ROE | Net debt / EBITDA | EV / EBITDA | |

|---|---|---|---|---|

| 2017 | 2,63 | 37,7% | 0,64 | 3,12 |

| 2018 | 3,35 | 21,8% | 0,41 | 2,33 |

| 2019 | 4,38 | 15,3% | 0,58 | 2,60 |

| 2020 | Lesion | Lesion | 3,82 | 11,5 |

| 2021, 1 half a year | 10,9 | 4,5% | 2,76 | 7,84 |

Multipliers of Russian oil companies for the 1st quarter of 2021

| P / E | ROE | Net debt / EBITDA | EV / EBITDA | |

|---|---|---|---|---|

| Rosneft | 12,7 | 9,0% | 2,86 | 7,07 |

| Lukoil | 20,2 | 5,1% | 0,20 | 4,90 |

| Gazprom Neft | 9,45 | 10,0% | 1,12 | 4,58 |

| "Tatneft" | 10,1 | 14,1% | −0,12 | 6,29 |

| Bashneft | Lesion | Lesion | 2,98 | 9,01 |

Eventually

Bashneft is a fairly large oil and gas company, controlled by Rosneft, as the main shareholder. Production indicators of Bashneft stagnate, and financial - fall, what pulls dividends and stock prices down.

The crisis of 2020 hit the company very hard, recovery is also slower, than competitors. As a result, Bashneft is now priced too expensive relative to its average values in recent years, and relative to the flagships of the industry.

The same negative trends can be traced in Bashneft's indicators, as with another public subsidiary of Rosneft - the Saratov Oil Refinery, which reduces the attractiveness of the company for investors, but at the same time it can serve as a driver for the rapid growth of stock prices, if the situation starts to change for the better.

For those who decide to invest in Bashneft, its preferred shares will be the preferred option due to higher liquidity and dividend yield, than ordinary.