Risk averse financiers, for whom a measured income is important, often choose companies paying income from securities. Such investments allow you to receive income even during a general decline in the securities market.. but, as the last crisis showed, and there are no guarantees: companies can reduce or completely cancel income from securities.

A popular method to select dividend stocks is to look at the list of dividend aristocrats.. The list includes companies, who have been increasing their dividend payments for at least twenty-five years. Over this long period, there have been many recessions and financial downturns., because financiers value the stability of dividend aristocrats.

But the founder of Capital Wealth Planning Kevin Simpson thinks, that it is not necessary to go deep into history: "I do not think, that you should specifically select companies, that increase income from securities 25 or fifty years. We look at a five-year period and elect companies, which during this period of time increased income from securities by 10-15 percent. In this case, you will have a really good portfolio.”.

According to Simpson, the suspension of dividend payments in 2020 does not have to be a “red flag” for financiers. “Smart management will not try to increase income from securities simply because, that they did it all the time. If the company has lowered or stopped the payment of dividends, we remove it from our satchel. Later, if the company restores payments, we can bring it back", - said Simpson.

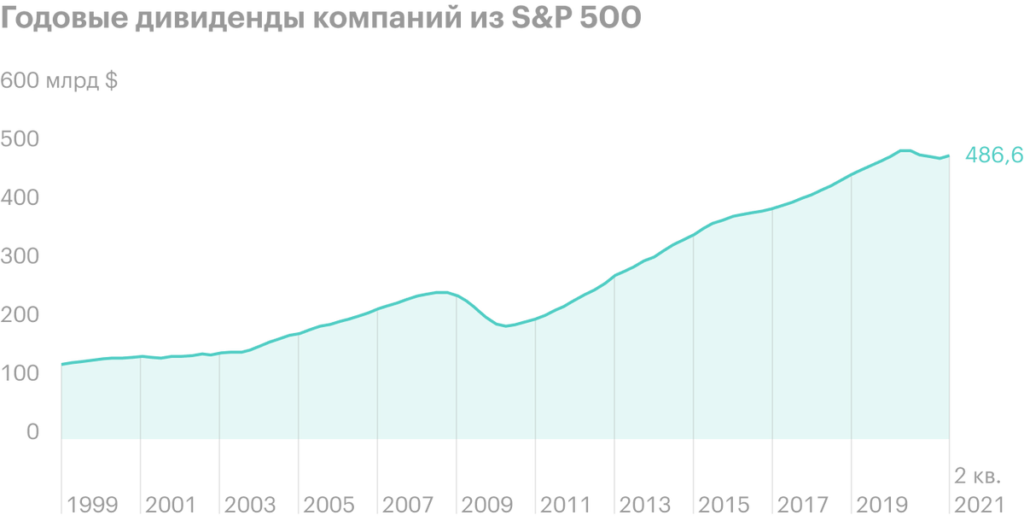

According to the management company Janus Henderson, in 2021, companies worldwide will pay back $1.4 trillion in securities earnings. This is just three percent below the pre-pandemic peak.. "Most likely, in the following 12 months, dividends will return to the level, previous pandemic ", - said one of the analysts Janus Henderson.

Capital Wealth's dividend portfolio includes:, как Chevron, Nike, Johnson & Johnson, as well as Apple and Microsoft. The company considers, stocks with low dividend yields from the technology sector help to diversify the portfolio and increase overall returns.

Capital Wealth has no minimum dividend yield threshold. Fast growing companies, who are now directing free cash flow to business development, may start increasing dividend payments in the future. But companies with abnormally high profitability should be wary: management may cancel payments, and stocks will fall.

Another way to choose dividend stocks is to study the composition of a large fund.. So, The Vanguard Dividend Appreciation Fund includes companies, who are rapidly increasing their dividends: Visa, UnitedHealth, Home Depot and others.

Large dividend companies with the prospect of profit growth, according to FactSet estimates, billion dollars

| Ticker | Capitalization | Yield | |

|---|---|---|---|

| Exxon Mobil | XOM | 223 | 6,6% |

| Chevron | CVX | 182 | 5,7% |

| Philip Morris | PM | 158 | 4,7% |

| IBM | IBM | 124 | 4,7% |

| U. S. Bancorp | USB | 82 | 3,3% |

| Truist Financial | TFC | 73 | 3,2% |

| Broadcom | AVGO | 194 | 3,0% |

| Citigroup | C | 142 | 2,9% |

| PNC Financial Services | PNC | 78 | 2,7% |

| Crown Castle | CCI | 86 | 2,7% |