We have already talked about VIE promotions, but decided to make a separate analysis, since this is an important topic. Many people invest in Chinese stocks and consider, that they are shareholders of these businesses - while they own a stake in an offshore shell. In this article, we will tell you, how the VIE stock scheme actually works and what to watch out for.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What is VIE

Variable interest entity (LIFE) can be translated into Russian approximately as "a legal entity with changing interests". But that doesn't reflect reality at all., therefore, let's clarify the meaning of the term.

VIE is a legal entity, which is created by another legal entity specifically for, to put this very VIE on the stock exchange. There it will represent the founding company for those wishing to invest..

VIE is not the same, as the company, which creates VIE. But VIE is the same shares, like all, what is on the market. Only these are shares of the VIE-company, not the parent company, which VIE represents.

How it works

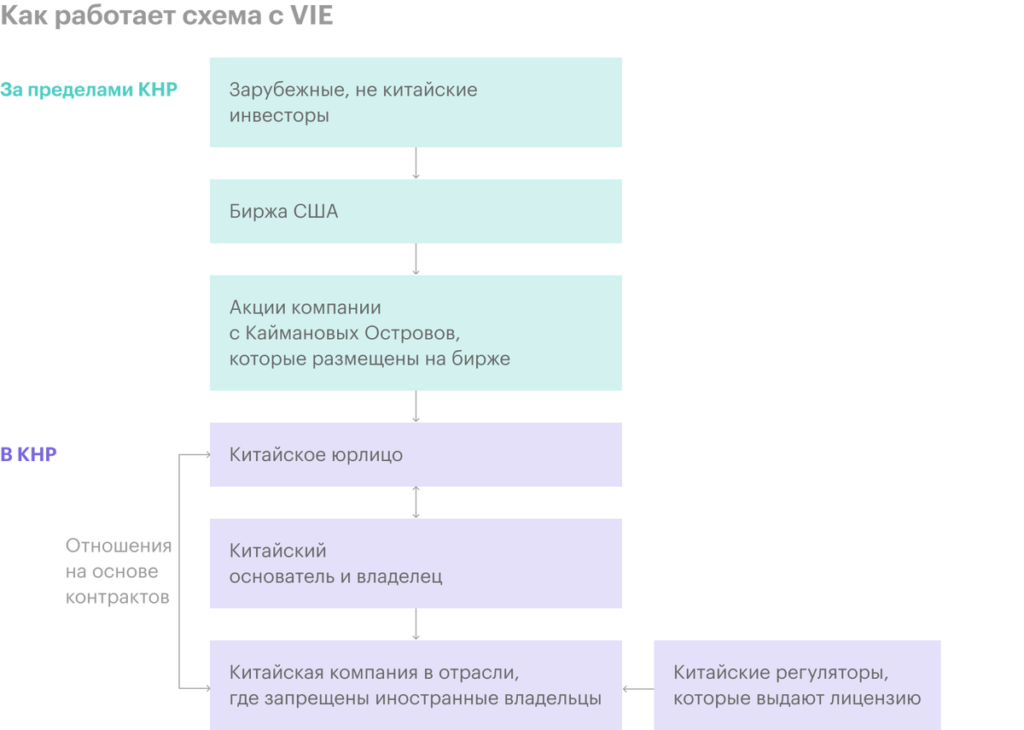

The company creates VIE, usually offshore like the Cayman Islands, and concludes an agreement with this VIE, which binds both legal entities with contractual obligations:

- Founding company gives VIE an interest-free loan, to capitalize a VIE company, and gets the right to 100% profits VIE.

- The parent company receives a call option, to be eligible to buy VIE shares at a predetermined price, usually for the amount of an interest-free loan.

- VIE gives the parent company the right to enter into transactions and negotiate on behalf of VIE, as well as other rights, shares related.

- The parties enter into an agreement on technical services. According to him, the founding company becomes the sole service provider for VIE. This is done, to legally justify the receipt by the founding company of profits from VIE's operations.

Then the founding company puts the shares of this VIE on the stock exchange - and the VIE reports record the situation in the founding company.

Someone prefers to consider VIE a division of the founding company, but in fact it is just a separate legal entity with contractual obligations.

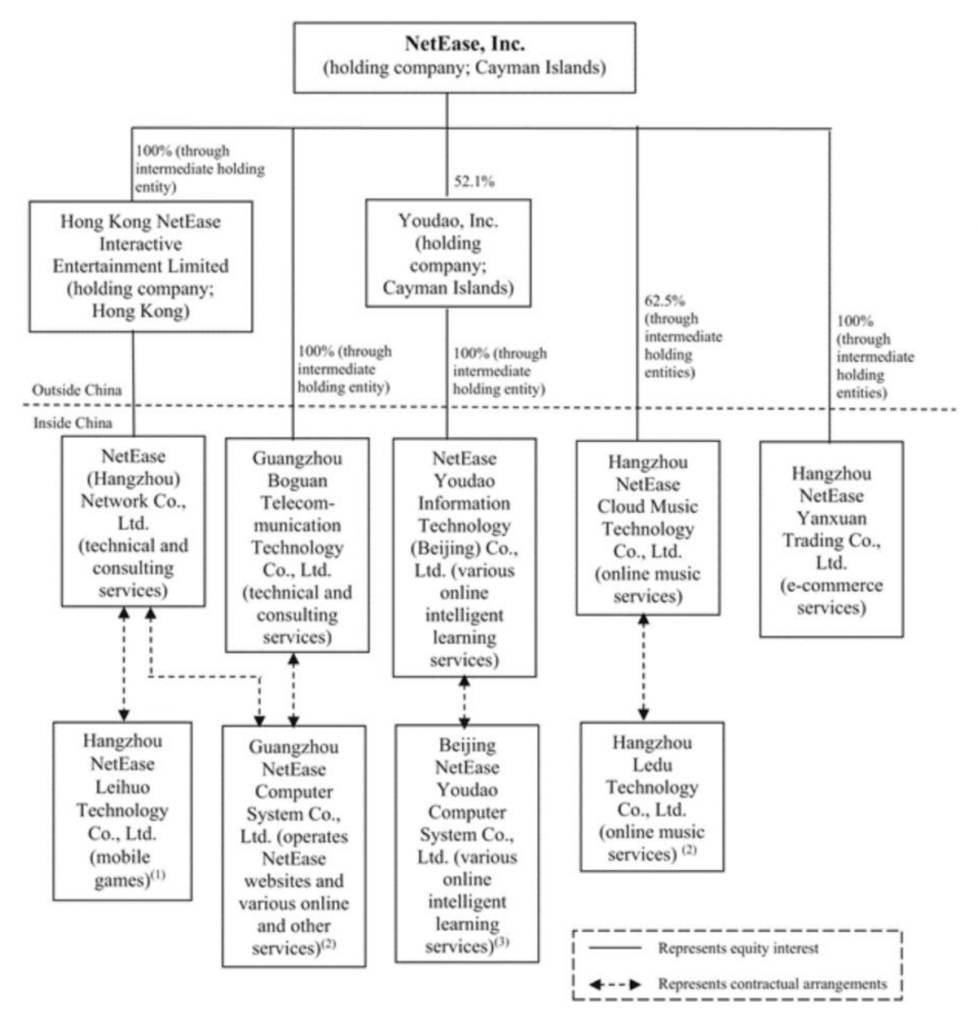

Take, for example, Chinese technology company Netease, VIE-shares of which are traded on the American stock exchange. The holders of these shares own a stake in a company from the Cayman Islands. And this company from the Cayman Islands owns a controlling stake in various enterprises, whose names correspond to the divisions of the Chinese Netease.

And these divisions are already contractually bound with real Chinese divisions of real Chinese Netease., who are doing business.

Does the VIE owner own a stake in the parent company?

The owner of VIE shares owns a stake in VIE. VIE owns nothing in the company she represents. Under the contract, she seems to manage the business of the founding company, only in fact it is not full possession.

VIE is just a shell company.

What stocks are classified as VIE

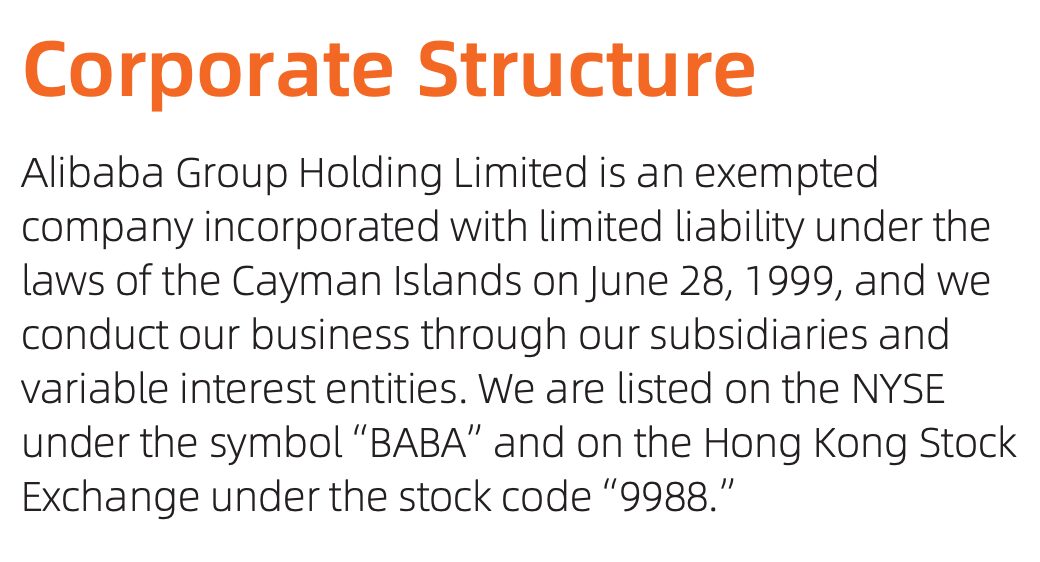

Most of those traded on the US market and, respectively, Russian stock exchanges of Chinese companies. For example, Alibaba.

Yes, 412 Alibaba's billion dollar capitalization isn't really the original Chinese internet giant, a simple company with Kaimanov, who has nothing in her soul.

Why do Chinese companies need such a muddy scheme at all?

Many Chinese companies, especially in the technology sector, it is prohibited to have foreign shareholders or the number of foreigners among shareholders is seriously limited. The list of "forbidden industries" in China is very wide.. But this does not reduce the desire to receive money from the Americans from the Chinese bosses.

When creating a VIE company offshore, Chinese companies do not seem to violate Chinese prohibitions - after all, investors do not buy shares of Chinese businesses themselves, and their VIE- "avatars". But at the same time, company owners receive real, non-virtual money of American investors during the IPO of these VIE companies.

Sounds like a legally dubious thing. That's just the way it is., how it sounds: VIE shares are positioned as full-fledged shares of companies, but in reality it is just a separate legal entity, behind which there is really nothing. The contract with the founder company may not be renewed or terminated - and VIE shares will turn into nothing. In the case of normal stocks, it’s not easy to deceive investors. But the main complaint against VIE is its legal structure..

Under Chinese law, VIE is a gray area at best. And at worst - just an illegal thing. That, what VIE gives "sort of control" over the enterprise, can be used by the Chinese government as an excuse to, to immediately nullify the shares of all VIE companies as contrary to Chinese law: this is the actual control of foreigners over the Chinese enterprise, which is prohibited by Chinese law in most areas.

Why does the Chinese authorities tolerate this?

because, as we understood from the history with Evergrande, great and abundant is the land of China, but there is no order. The Chinese authorities endured until then, as long as it doesn't bother them, but in theory they can invalidate a specific VIE company - or all at once. The excuse for this can be very simple.: VIE give the appearance of owning a Chinese company and therefore violate Chinese laws.

So far, there have been no cases of such “zeroing” of VIE companies, but it does not mean, that this will not happen in the future. Now Chinese regulators have begun to limit the listing of Chinese VIEs on the American exchange, what can serve as a signal of "tightening the screws" in this area.

What rights do holders of Chinese VIE shares have?

There is one inalienable right - to be silent in a rag. If a Chinese investor decides to nullify the shares of a VIE company or do something else bad, then the shareholders of VIE will not be able to do anything: registered company in the Caymans, but the assets are all in China. So if they go to the most humane Cayman court, then it won't lead to anything..

In the existing cases of non-Chinese investors litigating against "original" Chinese companies, non-Chinese investors lost. A decade ago, Alibaba executives spun off Alipay's financial division into a separate company — and Alibaba's Western investors, among which were Yahoo and Softbank, learned about it very late.

As a result, investors agreed with Alibaba, but it only happened because, that Alibaba was preparing for an IPO in the West and was not eager to spoil its reputation in the eyes of the Western community. And again, according to the terms of the agreement, investors would get three times less, what did they expect: they insisted, what will Alibaba receive 100% Alipay profits, but in the end the share was 37,5%.

How American Regulators Treat VIE Companies

Very bad, but so far there are no laws against this in the United States. Mainly regulators want, for Chinese VIE companies to educate investors about their true offshore nature. In theory, this could negatively affect the price of these shares - how the label "contains GMOs" negatively affects food sales.. Or maybe not affect: then, What are we talking about, no one was a secret.

Should You Invest in VIE Stocks?

You will have to decide for yourself, but keep in mind, that the risks of owning VIE shares are higher, than in the case of ordinary shares. Ordinary shares may be worthless in case of bankruptcy of the company, but in the case of VIE, they can turn into a donut hole simply because, that the founding company decided to do without shareholders, saving their money without losing your business.