Just a week after the IPO, Renaissance Insurance plans to become a public IT provider Softline. Roughly 27 October, the global depositary receipts of the Cypriot-based Softline Holding Limited will start trading on two exchanges at once: London and Moscow.

About company

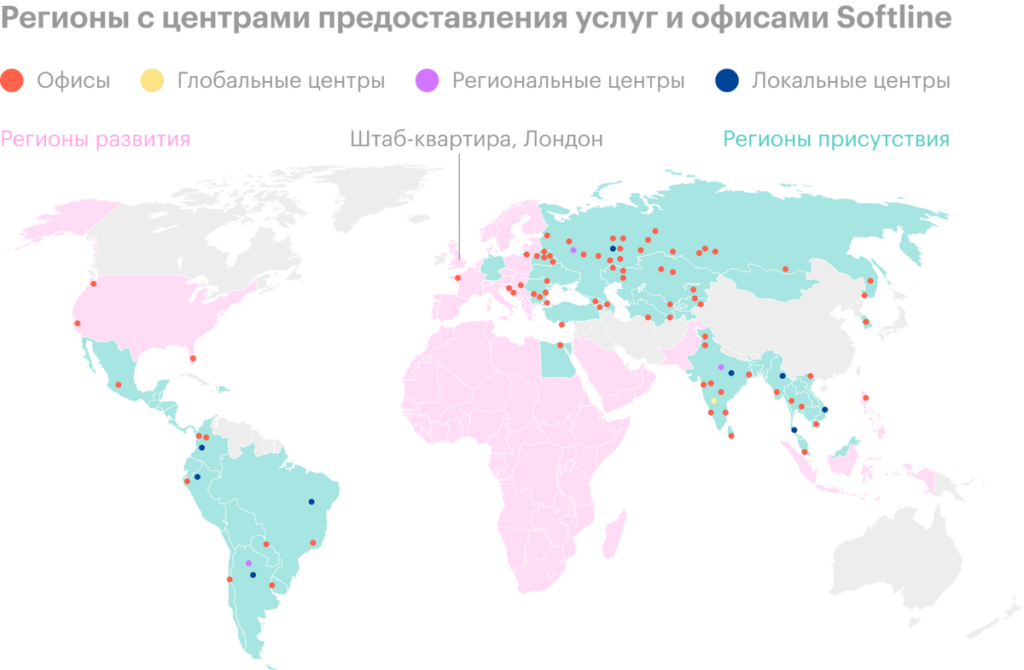

Softline (MCX, LSE: SFTL) - a large international provider of goods and services in the field of IT. The company operates in more than 50 countries of the world, mainly focusing on developing countries. Softline identifies three product lines.

Software and cloud technologies. The company sells software and cloud technologies to over 3,000 vendors as a reseller, and offers comprehensive solutions. Within their framework, the company provides technical support, is engaged in IT consulting, system integration. For example, Softline provides its own digital platform CloudMaster for multi-cloud management.

The company offers two models for using its software:

- Licensing model: the software is installed on a certain number of devices.

- Subscription model: rights to use the software are allocated for a certain period of time.

The company combines its own digital platforms E-Store and ActivePlatform under the name Softline Digital Platform (SDP) and calls it its unique advantage over competitors.

Hardware. The company supplies hardware to approximately 200 vendors: Computers, Laptops, thin clients, monitors, printers, scanners and more. Softline not only sells products from other suppliers, but also consulting his clients, Selection, equipment setup and maintenance. The company also provides an opportunity not only to buy hardware, but also lease it, use a subscription model.

Services. Softline provides services to its clients and subdivides them into several sub-segments:

- Professional and Managed Services: creation and support of modern workplaces and IT infrastructure, taking into account the requirements of cybersecurity, digital services using artificial intelligence and the Internet of things, multiple cloud management services.

- Software management.

- Teaching Customer IT staff.

- Custom software development.

- Cloud and cybersecurity services.

Nearly 85% of the company's turnover falls on software and cloud technologies, about 11% - for hardware, the rest is provided by services. If you look at the structure of turnover in a geographical context, then more than half is in Russia, 20% — to the Asia-Pacific region, 10% - to Latin America, the rest of the regions give a total 15%.

In total, Softline has more than 150 thousand B2B clients and more than 6 thousand suppliers. A significant part of the company's customers purchase its solutions through online channels. The number of users of the SDP digital platform is seriously growing year by year. Clients include large companies, like samsung, Coca Cola, Citibank, Gazprom.

Suppliers also include many well-known companies: Apple, Cisco, Oracle, IBM. Microsoft takes a special place: cooperation between the companies has been going on for almost 30 years, Softline is among 10 global partners of the IT giant, one of the top three sellers of Microsoft products in Chile, India, Vietnam, Malaysia. In Russia, Softline ranks first among Microsoft partners with a share of 43%. In general, sales of Microsoft products are 48% in Softline's turnover at the end of the fiscal year, ended 31 March 2021.

The company is guided by a three-pronged growth strategy:

- Geographic expansion: Softline plans to expand its presence with 50 to 80 countries. In particular, in the Middle East and Africa.

- Portfolio expansion: the company plans to offer an increasing number of services to customers in the field of cloud computing and cybersecurity.

- Expansion of sales channels.

In recent years, Softline has been quite actively concluding M&A: since 2016 the company has concluded 16 such transactions in Russia, Brazil, India, Egypt and other countries, in the future, the company is considering even more 30 shopping.

Structure of the turnover of companies by product ambulances for the year

| Software and cloud technologies | 84,4% |

| Hardware | 11,2% |

| Services | 4,4% |

84,4%

The structure of the company's turnover by suppliers and types for 2021

| Microsoft Cloud Services | 26% |

| Local Microsoft products | 22% |

| Products and services from other top 9 vendors | 11% |

| Services | 4% |

| Products and services of other providers | 37% |

26%

The structure of the company's client base

| Customers and buyers through the online trading channel | 124 000 |

| Medium and small business | 22 000 |

| Clients via indirect channel | 3800 |

| Direct corporate clients | 2600 |

124 000

The number of users of the SDP digital platform by years

| 2019 | 44 000 |

| 2020 | 69 000 |

| 2021 | 100 000 |

44 000

The structure of the company's turnover by regions for the year

| Russia | 55% |

| Asian-Pacific area | 20% |

| Latin America | 10% |

| Europe, Middle East and Africa | 8% |

| Rest of Eurasia | 7% |

55%

Company share and place among suppliers of Microsoft products in some countries for 2021

| Russia | 43% | 1 |

| Chile | 33% | 2 |

| India | 18% | 2 |

| Colombia | 15% | 3 |

| Vietnam | 9% | 3 |

| Malaysia | 7% | 3 |

| Brazil | 4% | 3—4 |

Financial indicators

A feature of Softline reporting is that the company's financial year does not end at the end of December, and at the end of March.

The company's turnover and revenue are growing steadily, net profit was also growing, but for the year, ended 31 March 2021, there was a loss. Worth considering, that the loss was due to one-time expenses: the company had to pay extra taxes for 2014-2016 in the amount of more than 12 million dollars. If the net profit is adjusted, then it will be more, than the previous year, meaning.

Softline's debt is also gradually growing - this is largely due to the company's active behavior in the field of M&A.

Turnover, revenue, net profit and debt of the company by years, million dollars

| Turnover | Revenue | Net profit | Duty | |

|---|---|---|---|---|

| 2019 | 1352 | 1129 | 0,4 | 313 |

| 2020 | 1611 | 1362 | 9,5 | 346 |

| 2021 | 1788 | 1517 | −2,2 | 539 |

| 3м2021 | 503 | 444 | 1,3 | 659 |

Dividends and dividend policy

At the end of the year, ended 31 March 2021, the company paid a dividend of $10.2 million. The company has not paid dividends in the previous two years..

After Softline becomes public, the company plans to pay dividends in the amount of 25% net income under IFRS, but not at once: the first dividends are planned to be paid at the end of the year, which will end 31 Martha 2023.

History and share capital

Softline was founded in 1993 by Igor Borovikov, current chairman of the board of directors of the company. Since 2001, Softline entered the international arena, starting to open offices first in the CIS countries, and then in foreign countries. In 2016, the company attracted investments from Da Vinci Capital, a large private equity fund. In 2020, the company opened a new headquarters in London.

In the registration document, the company indicates among the major shareholders of the structure of the founder of the company Igor Borovikov, Sergey Popov's Da Vinci Capital and Broadreach Capital funds. At the same time, it was mentioned, that in September 2021 the shares, belonging to the latter, купили Softline Group, Da Vinci Capital and the Belarusian private equity fund Zubr Capital are approximately proportional to their stakes in Softline.

Equity structure and beneficiaries of the company by 30 September 2021

| Softline Group | Igor Borovikov | 78,8% |

| Several Da Vinci Capital funds | Da Vinci Capital | 11,4% |

| Broadreach Capital | Sergey Popov | 5,4% |

| Other shareholders | Other shareholders | 4,4% |

IPO scheme

Softline has announced an indicative price range for a global depositary receipt of 7.5-10.5 $. This corresponds to the capitalization of the entire company in the range of 1.49-1.93 billion dollars.. Softline plans to raise about $400 million from the sale of new securities and use them for deals M&A, investments in organic business growth and corporate-wide goals.

It is also assumed, что Softline Group, funds Da Vinci Capital and Zubr Capital can sell their existing securities to the company up to 15% from placement through option additional placement.

Company, selling shareholders and other shareholders plan to commit not to sell the securities for 180 days after the IPO, company management - within 360 days.

Why stocks may go up after an IPO

Fashion sector. IT sector - perhaps, most popular with investors in recent years. Many companies in this sector trade extremely high on value multiples.: for example, P / E "Yandex" - about 100. And for many IT companies, investors even forgive unprofitableness: for example, GitLab shares soar after recent IPO.

Quite possibly, that many will want to invest in Softline precisely because they belong to IT and the abundance of such words in materials for investors, as a "digital transformation", Cybersecurity, "cloud technologies".

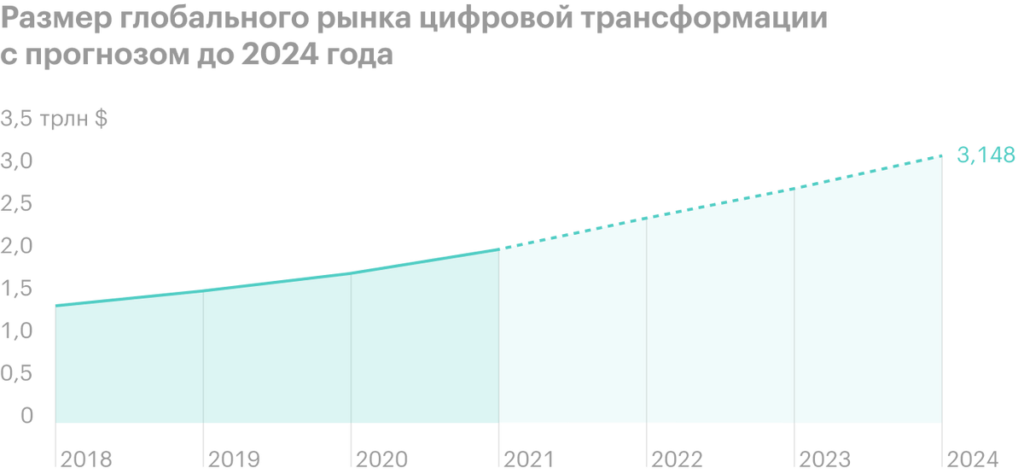

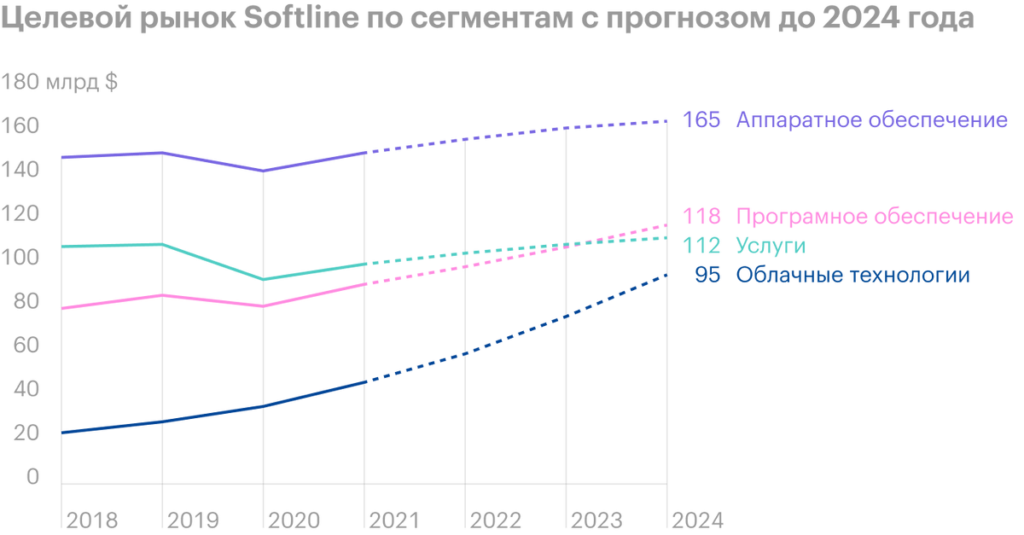

But investors love the IT sector for a reason, and therefore, that he is growing quite actively. In documents for investors, Softline provides data from a study by AMR International. According to them, global investment in digital transformation will grow at a compound annual growth rate (CAGR) in 16% and will reach $ 3.1 trillion by 2024. And the company's target market over the same period will grow from $352 billion to $490 billion with a CAGR of about 9%. At the same time, the fastest growing segment, according to forecasts, there will be cloud technologies: they will grow until 2024 with CAGR 28% and reach $ 95 billion.

A growing company with a diversified business. Softline is actively expanding its business in all areas: creates new solutions, buys competitors, expands geographic presence. At the same time, the growth of the business translates into the growth of financial indicators - and this is the most important basis for the growth of the company's stock quotes.. Well, a good business diversification helps to reduce country risks and those, that relate to relationships with specific suppliers or customers.

Profitable company. Unlike many IT companies, Softline regularly shows profits and even plans to pay dividends in the medium term, which is generally quite rare in this sector. If the company really manages to combine business growth, profitability and dividend payout, it will be very attractive for investors.

Why stocks may fall after an IPO

Dear estimate. The company is highly valued by the multiple P / E: based on the net profit of one quarter and with the calculation, that a similar profit will be in other quarters, - it turns out somewhere in the region of 280-370.

Even if you apply mathematical sleight of hand and adjust the net income for the year, ended 31 March 2021, including one-time payment of taxes, then the value of P / E turns out to be no less 150. Even for the American market, it is extremely expensive., and even more so for the Russian. Yandex, which has been very expensive lately, is even cheaper. Softline's ROE multiplier value is also not very impressive.

And that's exactly IT.? Softline develops complex solutions for clients and provides technical support, but still the basis of the business is the resale of solutions from other vendors. In a way you can say, that Softline is more of a retailer, than an IT company. And retailers usually have significantly lower margins., and by value multipliers they are usually priced cheaper.

Import substitution. Import substitution strategy declared at the highest level in Russia, among other things, in the field of IT. And although this process is not very fast, its failure to comply causes dissatisfaction with the authorities, even large state-owned companies. Yes, Softline is actively diversifying its business geographically, but still Russia is the largest market for the company, so import substitution can negatively affect its business.

With diversification, everything is ambiguous. Despite the generally good business diversification, Softline has a very large bias towards one supplier - Microsoft. If the relationship between companies does not change for the better, then Softline's business may be seriously affected.

Multipliers of public Russian companies in the field of IT according to the results of the quarter, ended 30 June 2021

| P / E | ROE | |

|---|---|---|

| «Yandex» | 102,5 | 5,2% |

| Mail.ru Group | Lesion | Lesion |

| HeadHunter | 49,5 | 118,7% |

| Softline | 287—371 | 9% |

Eventually

Softline is a major provider of IT products and services with international, sufficiently diversified business. But the company is highly dependent on its main partner - Microsoft.. Softline is actively developing, makes deals M&A and plans to continue intensive and extensive business growth.

Unlike many IT companies, Softline periodically shows profit. This is a plus, and minus: after all, with a profit, you can calculate the value of the multiplier P / E, but it is three-digit and can scare off investors.