The boom of IPOs of Russian companies continues: at the beginning of November on the New York and Moscow stock exchanges American depository shares of the Cypriot Cian - the holding of the online real estate service "Cyan", will start trading.

About company

"Cyan" (MCX, NYSE: CIAN) — one of the largest online services in Russia for the sale and rental of real estate. It includes sites cian.ru, n1.ru, emls.ru and mlsn.ru and their mobile applications.

They post ads for the sale and rental of apartments., houses and commercial real estate. In the first half of 2021, their number exceeded 2.1 million. But Cyan is not just bulletin boards, a set of services for finding realtors, real estate appraisal, making payments and many other tasks.

The company divides its audience into three groups:

- Users are the bulk of the people, viewing ads for the sale or rental of real estate. This category mainly uses the services for free. Monthly number of unique users (MAU) is constantly growing and in the first half of 2021 exceeded 20 million.

- Clients, posting ads, - this includes as individual property owners, and professional participants in this market: private realtors, agencies and developers.

- Third parties such as, banks and professional real estate market participants, promoting their brands and services to company users.

In terms of monetization, Cyan divides the business into five segments:

- Core business - it includes ad placement fees, Additional services, such as raising in the list and highlighting, professional tools for realtors, generating leads for real estate developers - that is, appeals of company users to them. This also includes the revenue from displaying ads on websites and mobile apps..

- Mortgage Marketplace - "Cyan" cooperates with several banks and receives a commission from them for promoting their products.

- Valuation and analytics - the company sells access to data and reports on the real estate market.

- Rent of C2C (customer-to-customer) — Cyan provides a complete solution for renting real estate online, including due diligence, digital agreements, online payments and insurance.

- Comprehensive solutions for real estate transactions: legal due diligence, notarial registration, storage of documents, tax refund.

Nearly 95% revenues of "Cyanu" are provided by the key business, two-thirds of it the company receives from the placement of ads and related services. This distribution of revenue by operating segments is largely due to, that the rest of the segments appeared relatively recently or have not even been fully launched yet.

For example, mortgage marketplace launched in 2019, and the first service of remote transactions with real estate in the secondary market "Cyan Deal" - only in mid-October 2021. Thus, the company implements its strategy to provide integrated solutions, which is to go beyond just bulletin boards.

But "Cyan" does not forget about the traditional business: subscription launched in 2020, which included the ability to place a number of ads and additional services. In the first half of 2021, more than 40% ads were placed as part of a subscription. New features for users are also added: for example, soon we plan to add a search for ads by photo. Regional expansion continues: at the end of December 2020 announced the purchase of a major regional competitor N1.ru.

The company's business performance is growing: The number of active monthly users has increased by 1.5 times compared to 2019, the number of ads and paid accounts also increased. Growth is shown by leads to agents and sellers, as well as the average revenue per ad, from a paid account and from a lead to developers. At the same time, the number of leads to developers decreased slightly compared to 2020..

Cyan leads by market share in the largest Russian regions: in Moscow, Moscow region, St. Petersburg, Leningrad region, Novosibirsk and Yekaterinburg. In general, the company ranks second in Russia, second only to Avito. Besides, according to Google Analytics и SimilarWeb, in terms of Internet traffic in September 2021, Cyan was among the top ten world leaders in its segment.

The structure of the company's revenue for 1 half year 2021

| Key business | 94,8% |

| Mortgage Marketplace | 4,4% |

| Evaluation and analytics | 0,8% |

| C2C lease | 0% |

| Comprehensive solutions for real estate transactions | 0% |

94,8%

Revenue structure of the Core business segment for 1 half year 2021

| Placement of ads | 66,2% |

| Lead generation | 23,2% |

| Advertising display | 10,4% |

| Other revenue | 0,2% |

66,2%

Number of active monthly users, ads and paid accounts by year, million

| Active monthly users | ads | Paid accounts | |

|---|---|---|---|

| 2019 | 13,4 | 1,9 | 0,097 |

| 2020 | 16,5 | 2,1 | 0,089 |

| 1п2021 | 20,3 | 2,1 | 0,104 |

Leads to agents and sellers, to developers by years, million pieces

| Leads to agents and sellers | Leads to developers | |

|---|---|---|

| 2019 | 6,9 | 0,18 |

| 2020 | 8,0 | 0,24 |

| 1п2021 | 9,1 | 0,11 |

Average daily revenue per ad, from a paid account, from lead to developer by years, rubles

| Average ad revenue | Average revenue from a paid account | Average revenue per lead to developer | |

|---|---|---|---|

| 2019 | 3,5 | 629 | 3470 |

| 2020 | 3,1 | 625 | 4046 |

| 1п2021 | 4,4 | 1139 | 5238 |

The number of real estate ads in major regions in April 2021 by online services, thousand pieces

| "Cyan" | «Avito» | "Domclick" | "Yula" | "Yandex-real estate" | |

|---|---|---|---|---|---|

| Moscow and Moscow region | 220 | 144 | 153 | 60 | 104 |

| St. Petersburg and Leningrad region | 104 | 94 | 90 | 17 | 70 |

| Ekaterinburg | 56 | 45 | 39 | 13 | 24 |

| Novosibirsk | 105 | 39 | 39 | 7 | 34 |

Financial indicators

Cyan's revenue is growing steadily, even despite the abolition of payment for ads in 2020, introduced during the lockdown. But with net income, things are worse.: the company constantly shows losses.

According to the results of the first half of 2021, they have significantly increased, but the company says, that this was largely influenced by the costs of the program of motivation of key employees - rewarding them with shares. And only such a peculiar metric, as Adjusted EBITDA, has been positive since 2020.

For the same reason, Cyan's debt has seriously increased - these are just obligations to employees under the motivation program. In general, the company has an interesting situation with debt - let's consider it in more detail.

In 2019, Cyan took a syndicated loan from Raiffeisenbank and Rosbank, which consisted of two tranches of 500 and 300 million rubles. Tranche rates are tied to the key rate of the Central Bank of the Russian Federation and exceed it by 3,35 And 3,8%. Tranche repayments were planned in 2022 and 2024.

But the loan agreements included covenants on the need to maintain positive net assets and on certain levels of revenue and EBITDA, which "Cyan" has broken. As a result, I had to pay off debts earlier, but, according to reporting, the company succeeds. In addition, according to the results of the first half of 2021, she has 810 million rubles in the form of money and their equivalents., which exceeds the amount of remaining borrowings to banks.

But the purchase of N1.ru for almost 1.8 billion rubles did without increasing debt: "Cyan" received from shareholders more than 2.2 billion rubles due to the redemption by them of an additional issue of shares of the company.

Revenue, net profit, adjusted EBITDA and debt of the company by years, billion rubles

| Revenue | Net profit | Adjusted EBITDA | Duty | |

|---|---|---|---|---|

| 2019 | 3,6 | −0,8 | −0,38 | 1,2 |

| 2020 | 4,0 | −0,6 | 0,18 | 2,2 |

| 1п2021 | 2,7 | −1,7 | 0,05 | 3,9 |

The structure of the company's liabilities for 1 half year 2021

| Obligations to employees under the motivation program | 53,6% |

| Borrowing | 13,8% |

| Trade and other payables | 12,6% |

| Contract obligations | 8,7% |

| Other short-term liabilities | 5,9% |

| long term duties | 5,4% |

53,6%

Dividends and dividend policy

Cyan has not paid and does not plan to pay dividends in the medium term, intending to invest all available funds in its development.

Besides, in the prospectus, the company indicates, that she has loan agreements, under which it is limited in the payment of dividends without the consent of the creditor. Also "Cyan" allows, that in the future it may enter into loan agreements with similar restrictions.

History and share capital

The forerunner of "Cyan" was the base of homeowners, wishing to rent it out. It began to be collected in the late 1990s in Moscow by businessman Dmitry Demin and his partner. In 2001, the cian.ru website appeared., since it was already difficult to support the base with “hands” due to its scale. In 2013, a controlling stake in the site was acquired by the Delovoy Mir Online holding., which is part of "Media3" billionaire brothers Ananiev.

As a result of the transaction, cian.ru merged with competitor realty.dmir.ru, and the head of "Media3" Maxim Melnikov was appointed CEO, which he remains to this day. After that, "Cyan" decided to pursue a policy of regional expansion, starting to conquer the market outside the Moscow region.

Among other things, this was achieved through the purchase of competitors: for example, acquired emls.ru in 2014, specializing in real estate ads in St. Petersburg and the Leningrad region. In 2015, the private equity fund Elbrus-Capital became a major shareholder of the company..

In the prospectus, Cyan indicates Elbrus Capital as its controlling shareholder, also among the major shareholders are the structures of the investment bank Goldman Sachs, founder of the company Dmitry Demin and head of the company Maxim Melnikov.

Share capital structure and beneficiaries of the company before the IPO

| Beneficiaries | share | |

|---|---|---|

| Elbrus-capital funds | Elbrus-capital | 65,3% |

| Goldman Sachs investment bank structures | Goldman Sachs | 14,1% |

| MPOC Technologies | Founder Dmitry Demin | 11,5% |

| CEO Maxim Melnikov | CEO Maxim Melnikov | 6,6% |

| Joox Limited | Sergey Osipov | 1,4% |

| Other shareholders | Other shareholders | 1,1% |

IPO scheme

At the end of October, the company announced an indicative price range for an American depositary share of 13.5-16 $. This corresponds to the capitalization of "Cyan" in the range of 0.93-1.1 billion dollars.

Most of the offer will be provided by existing shareholders - securities worth $190-220 million. If the organizers use option additional accommodation, then the amount attracted by shareholders may increase to $ 290-335 million. The company itself plans to sell new securities worth $55-65 million.

As a result of the IPO, Cyan will no longer have a shareholder with a controlling stake: the approximate share of Elbrus-Capital should be 44-47%. 26.3-30.3% of the company's capital may be in free float.

Why stocks may go up after an IPO

Demanded and hype field of activity. "Cyan" works in the real estate market - it's hard to imagine, that people will stop buying and renting it for the foreseeable future, which means, the company will last for a long time.

At the same time, the company is engaged in one of the most fashionable and hype activities from the point of view of modern investors - the digitalization of the traditional sector of the economy. This alone could create a stir in her stock., how, for example, almost a year ago it was with Ozon.

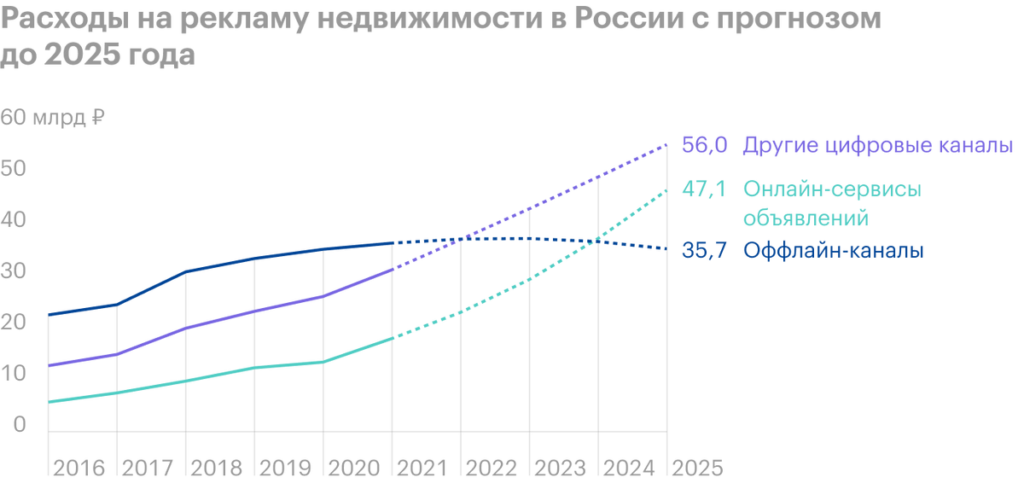

Growing company, transforming your business. Cyan expands its core business. According to Frost & Sullivan, the market is growing: as spending on real estate advertising in general, and the costs of developers on it. At the same time, part of the market, related to online classifieds services, growing faster.

Cyan is actively transforming from just a service with ads to a platform, where a person will be able to deal with such difficult tasks in terms of time and effort in one place, like real estate transactions. If the company can do it, it could be a game changer for the entire sector, and "Cyan" will be able to become the beneficiary of this and make good money.

Can buy. Despite the fact that Cyan announced the start of preparations for an IPO back in January 2021, in October it turned out, that the company was almost bought by its competitor - Avito. The deal was blocked by the antimonopoly service, as I counted, that the combined company will have too much market share, which will limit competition.

Maybe, in the future, one of the competitors of "Cyan", a large bank or a large developer decides to buy a company or a significant stake in it, from which the quotes of the securities of "Cyan" can take off.

Why stocks may fall after an IPO

Profitable and expensive. The company is unprofitable, so that the values of the multipliers P / E and ROE are meaningless. The only thing, what can you get hooked on, is to calculate the value of the multiplier "EV / Adjusted EBITDA". But this calculation can drive even more into melancholy: the values are obtained in four digits! Even public IT companies in the Russian market, which in themselves are valued dearly, the values of this multiplier are two-digit.

Big competition. Cyan has a lot of competitors, and in fact all of them are included in huge holdings, having significantly greater financial capabilities.

Avito is part of the South African holding Naspers, Domklik - to the Sber ecosystem, Yula to the VK Group ecosystem. Yandex is not only a competitor, but Internet traffic also depends on it, coming to "Cyan" from the corresponding search engine. Besides, the company ranks among the competitors in the field of rental announcements of such large international players, like Booking.com and Airbnb.

Ouroboros. Development can turn into topics for the company, that she will become an ouroboros - a snake, devouring its tail. After all, now "Cyan" mainly earns on professional participants in the real estate market - realtors.

If the company manages to implement its innovative online transaction services and they become popular, this may adversely affect the real estate business and, hence, on the earnings of "Cyan". But whether it will be possible to compensate for these losses with earnings from new services - and whether they will be profitable at all - is still a big question..

Increased inflation. In recent months in many countries, including in Russia and the USA, inflation has risen significantly, and while she is not going to subside. And in such conditions, the attractiveness of growth companies decreases., That, maybe, will be able to provide investors with cash flows from their activities only sometime in the future.

Besides, Rising inflation forces the Central Bank of the Russian Federation to raise rates: 25 October, she was promoted immediately to 0,75 - to 7,5%. And this is, in its turn, in some perspective should cause an increase in the cost of loans, including mortgage, which can negatively affect the demand for mortgages.

In addition, the company's reporting for 2021 so far includes only the period of preferential mortgage, which, although extended from 1 July for another year, but on less favorable terms. All this can negatively affect the demand for housing., Cyan's business may also be indirectly affected.

EV multiplier / EBITDA of Russian public IT companies in the first half of 2021

| «Yandex» | 35,0 |

| VK Group | 15,7 |

| HeadHunter | 32,2 |

| "Cyan" | 1387—1630 |

35,0

Eventually

Cyan is one of the market leaders in online real estate ads, which is trying to transform its business and plans to provide end-to-end real estate transaction solutions to users.

The company is actively growing both organically, as well as by acquiring competitors. Also, the advantages of "Cyan" include its belonging to the field of activity for the digitalization of the traditional sector of the economy.

At the same time, the company has a large number of competitors with great financial capabilities., and innovative new services could hurt its core business. In addition, Cyan goes to IPO unprofitable and quite expensive.