Today we have a moderately speculative and even somewhat conservative idea: take stock of the German battery manufacturer Varta (ETR: VAR1), in order to earn on the growth of company orders.

Growth potential and validity: 14,5% behind 14 months excluding dividends; 18% behind 3 years excluding dividends; 7% per annum during 10 years including dividends.

Why stocks can go up: industrial rise in the world stimulates the company's business.

How do we act: we take shares now by 124,7 €.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

The company makes batteries - and I'm sure, that there is no one among our readers, who would not have seen these same batteries at least once. According to the company's annual report, 99,77% proceeds give goods, and 0,23% - services.

Revenue is broken down into segments as follows::

- Micro batteries — 52,01%. Components for industry - for the production of high-tech electronics. Segment Adjusted EBITDA margin - 39,8% from its proceeds.

- Nutrition and energy - 9,33%. The segment includes sales of solutions to ensure the energy supply of enterprises. Segment Adjusted EBITDA margin - 8,3% from its proceeds.

- Batteries for the consumer segment - 38,66%. Legendary Varta batteries. Segment Adjusted EBITDA margin - 16,1% from its proceeds.

Revenue by country and region:

- Europe - 53,28%, Germany gives companies 21,67% all proceeds.

- Asia - 38,09%.

- North America - 6,25%.

- Other regions — 2,38% other regions.

Unfortunately, there is no information for other countries in the report.

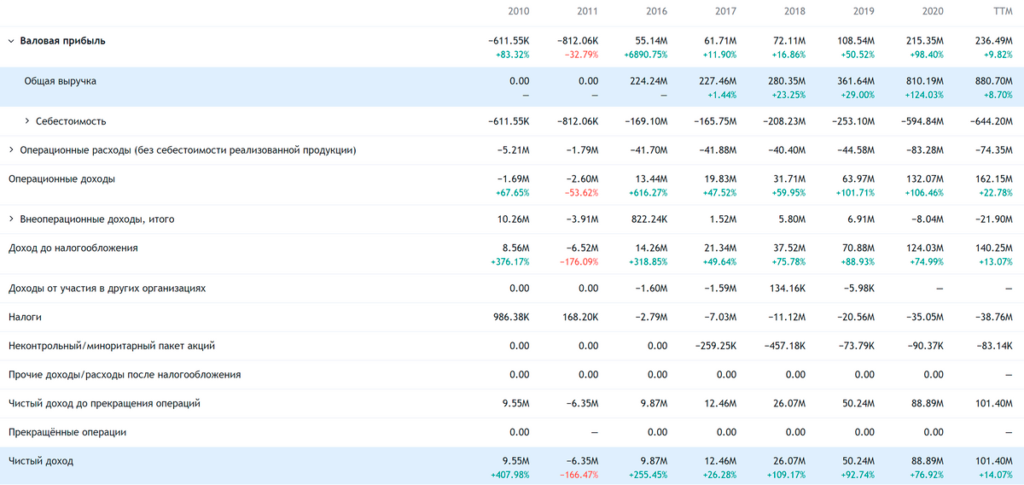

The sharp jump in revenue in 2020 is due to, that the company has consolidated control over several subsidiaries, - as a result, revenue increased by 140% in reporting. But if we consider only organic growth - revenue only from the company's business that already existed at that time, without taking into account the accession of "daughters", - then she grew up on 50%.

Arguments in favor of the company

And today, and tomorrow. In Germany and Europe as a whole, the industrial boom, so we have reason to hope, that this quarter will be positive for Varta.

But even without this, we can expect a gradual improvement in the company's financial performance.: it produces an important resource, which modern civilization cannot do without. Certainly, in theory possible, that power in developed countries will soon be seized by bloodthirsty maniacs from among the "green", which will radically solve the problem of increasing energy consumption, banning all electronics in general and sending residents from cities to "live in the forest and pray to the wheel". But so far there are no such preconditions.

Dividends. The company pays 2,48 € dividend per share per year, which gives approximately 1,98% per annum. By German standards, this is a very high dividend yield - so I would expect, that supporters of the idea “money should work” will crowd into Varta’s shares.

German registration. Varta is a strong and well-known brand. Therefore, the company's quotes may well be pumped up by German retail investors., the mass exodus of which to the stock exchange was mentioned in a number of ideas on German issuers, for example in the idea for Infineon.

Can buy. In absolute terms, the company is inexpensive: its capitalization is approximately 5 billion euros. So it is possible, that some large American industrial conglomerate will try to buy it.

What can get in the way

Concentration. According to the annual report, one large unnamed client gives the company 26,15% her proceeds. A change in relations with him may adversely affect the company's financial statements..

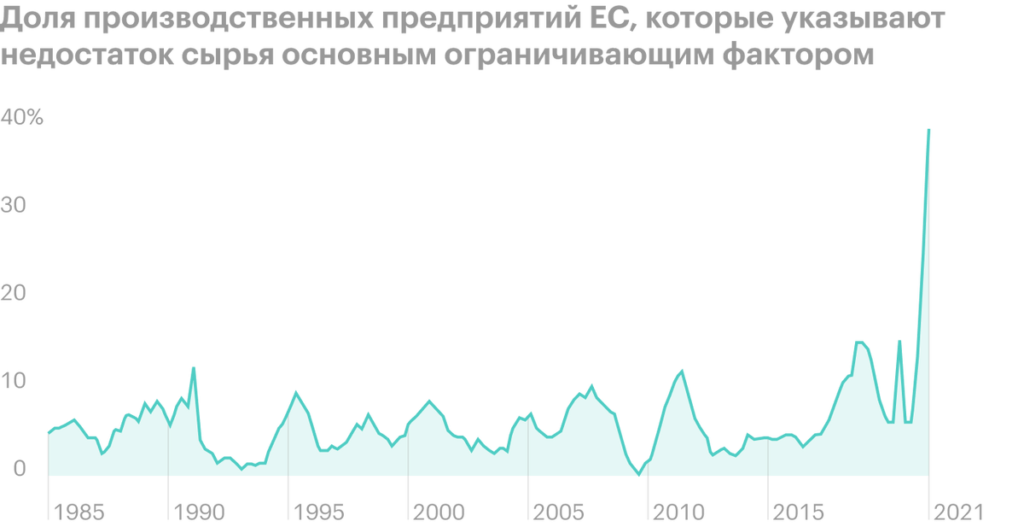

"A caravan is coming from Iran". European industrial enterprises are now suffering from a shortage of components and equipment - I think, and Varta this cup has not passed. You should also be prepared for the growth of the company's logistics costs.. And there are bad signals.: Eurozone exports fall.

Maybe, lack of raw materials and equipment, as well as logistical troubles this quarter will lead to, that Varta will earn less, than it could, simply because, that she is physically unable to fulfill orders. And of course, there is always a threat of a new large-scale quarantine.

Lithium. A huge, but it is not known exactly what, part of the company's revenue comes from lithium batteries. The problem with lithium is, that prices for this resource can be very volatile due to the extreme opacity of the pricing mechanism. So you have to be mentally prepared, that a rise in prices for this resource could negatively affect the company's reporting.

Dividends. The company spends 100 million euros on payments per year - almost 98,61% from her profits for the past 12 Months. According to the latest report, Varta has 48.586 million euros in its accounts, and there is also the amount of debts of the company's counterparties, which is 129.485 million. At the same time, the amount of debts of the company itself is 772.279 million, of which 446 million must be repaid within a year. If the company has force majeure, then payments may well cut - and then the shares will fall.

Price. P / E is rather big for the company - almost 50. That's quite a lot, so there is a chance, that the stock will shake. Especially if the report disappoints investors.

What's the bottom line?

Take the shares now for 124,7 €. And then there are several options:

- keep shares up to the level 143 €. Think, we will reach it in the next 14 Months;

- keep them to the historical maximum 160 €, which the company achieved in August this year;

- keep shares next 10 years and receive dividends.