Now we have a uniformly speculative thought: take shares in PC Connection, a dealer in computer equipment and services (Nasdaq: CNXN), to receive income on a positive situation for the company.

Growth potential and duration : twelve percent in 12 months.

Why stocks can go up: because the situation for the company is not the worst.

How do we act: we take at the moment 44,35 $.

No guarantees

And what is there with the author's forecasts

What the company makes money on

PC Connection is a provider of IT services and products, is a reseller and service center. According to company report, its revenue is divided into the following product and service categories:

- Laptops and mobile solutions - thirty-two percent.

- Stationary computers - ten percent.

- software - eleven percent.

- Servers and storage - eight percent.

- Services, that are related to the operation of websites, - eight percent.

- Monitors and sound - eight percent.

- Devices - fourteen percent.

- Other devices/services - nine percent.

According to the structure of customers, the company's revenue is divided as follows::

- Small and medium companies - 37,3 %. The operating margin of this category of clients is 3,34 % from proceeds.

- Large Fortune 1000 Organizations - 43,1 %. Operating margin — 5,32 % from proceeds.

- Government and educational organizations - 19,6 %. Operating margin negative - -0.54 % from proceeds.

In fact, the company makes all realizations in the USA, and only two percent of sales come from unspecified other states.

Arguments in favor of the company

Time. In the UiPath review, I detailed, that companies in the US are now motivated to put the most emphasis on technology in capital renewal estimates. Attention is paid to both "hardware", as well as software, to compensate for the damage to the business from the lack and high cost of labor. PC Connection will also drop here, since the bulk of buyers is characterized by a low level of expertise. In such matters, the help of intermediaries is extremely necessary for them - especially when the issue needs to be resolved urgently..

The shortage of semiconductors in the world and the resulting lack of technology can also spur the company's business - that part of it., which is associated with the resale of devices. As practice shows, expertise and connections of resellers allow customers to find what, what they need, in an extreme shortage, but at a rather high price - to the benefit of resellers.

The cost. According to company estimates, the size of its target market is about 200 billion dollars a year, and the share of PC Connection is 1.26%. With a capitalization of 1.16 billion, the company stands as 0,58% from the target market, therefore it can be considered underestimated. P / E of the company is not very large - 22,87. So there is good potential for speculative growth..

Diversification. According to company report, no client gives her more than 5% of revenue. It's good, because it strengthens her negotiating position.

Purchase opportunity. The company has two major competitors: huge CDW Corporation and Insight Enterprises. Although it carries certain risks, but given the positive aspects, this increases the likelihood of buying a PC Connection.

What can get in the way

Competitors. The big competitors mentioned above can strain themselves and start squeezing the company out of the market., to then buy it much cheaper than the current price.

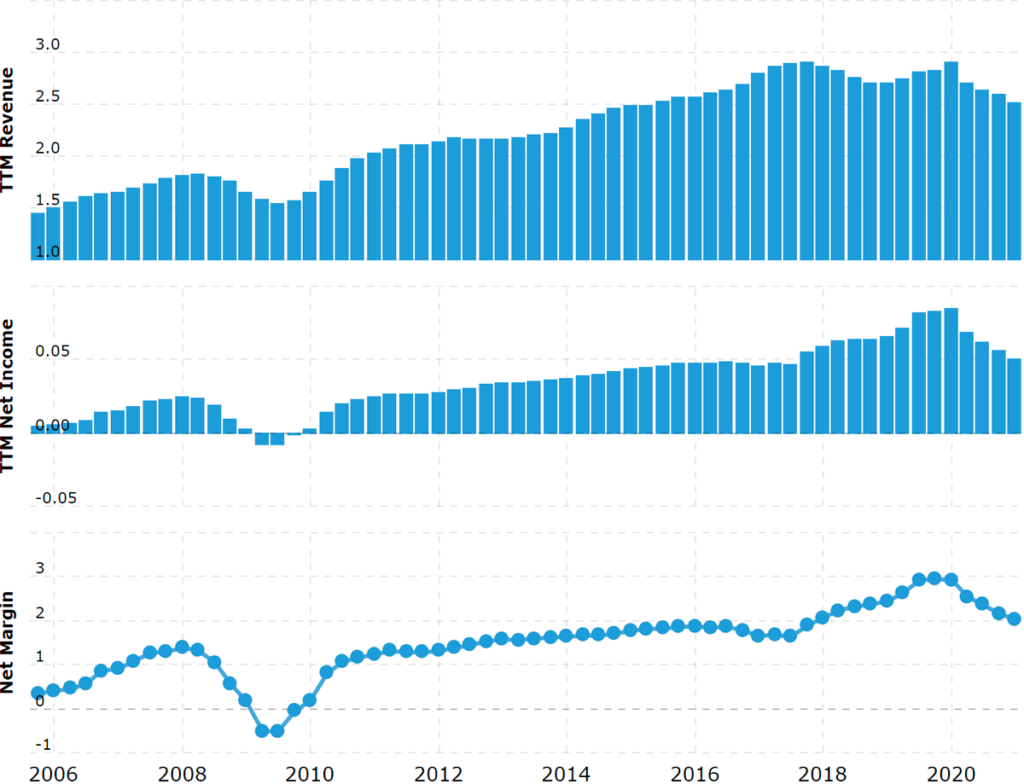

Mediation. The specifics of the company is its main problem. Here I would say about the low final margin of PC Connection - only 2% of revenue, but the main difficulty of the company's resale business is, that many of the company's suppliers are its competitors, in particular Apple, Dell, HP и Lenovo. If any of them decide, that PC Connection is no longer needed as a sales channel, it could be very bad for her business. This threat is more theoretical., intermediaries like PC Connection are still an important sales channel, but it's worth keeping in mind.

Who would have thought, but the pandemic is not good. Corona crisis severely spoiled sales companies. So you should be ready for it, that the negative development of the situation with new strains will affect the reporting. And the lower the US will be in the Normality Index, so much the worse for PC Connection.

The target audience. A significant share of the company's sales comes from small and medium-sized businesses. At the moment, the number of small businesses opened in the United States by 44,2% below, than before the pandemic. Actually, this is the reason for the company's sales decline following the coronacrisis. Probably, the worst is behind us and the reopening of the US economy will naturally boost PC Connection sales. But you should still be prepared for unpleasant surprises..

What's the bottom line?

We take shares now by 44,35 $. It would be perfectly reasonable to expect them to return to price. 50 $ within the next 12 months.