Now we have a uniformly speculative thought: take the shares of the German manufacturer of high-tech products Infineon Technologies (ETR: IFX), to earn income by increasing the purchasing power of his products.

Growth potential and duration : 16,5 % behind 17 Months; eleven percent a year for ten years. All excluding dividends.

Why stocks can go up: demand for the company's products is constantly burning.

How do we act: we take shares on 34,32 €.

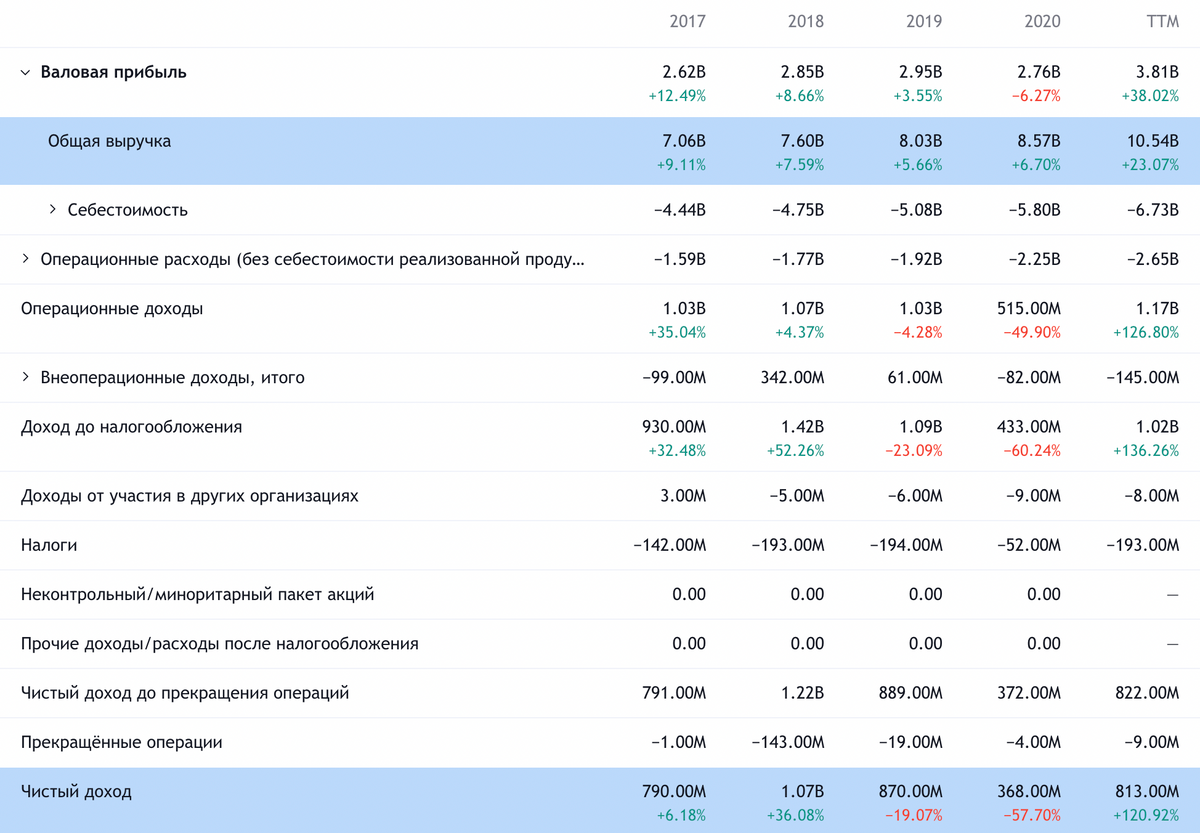

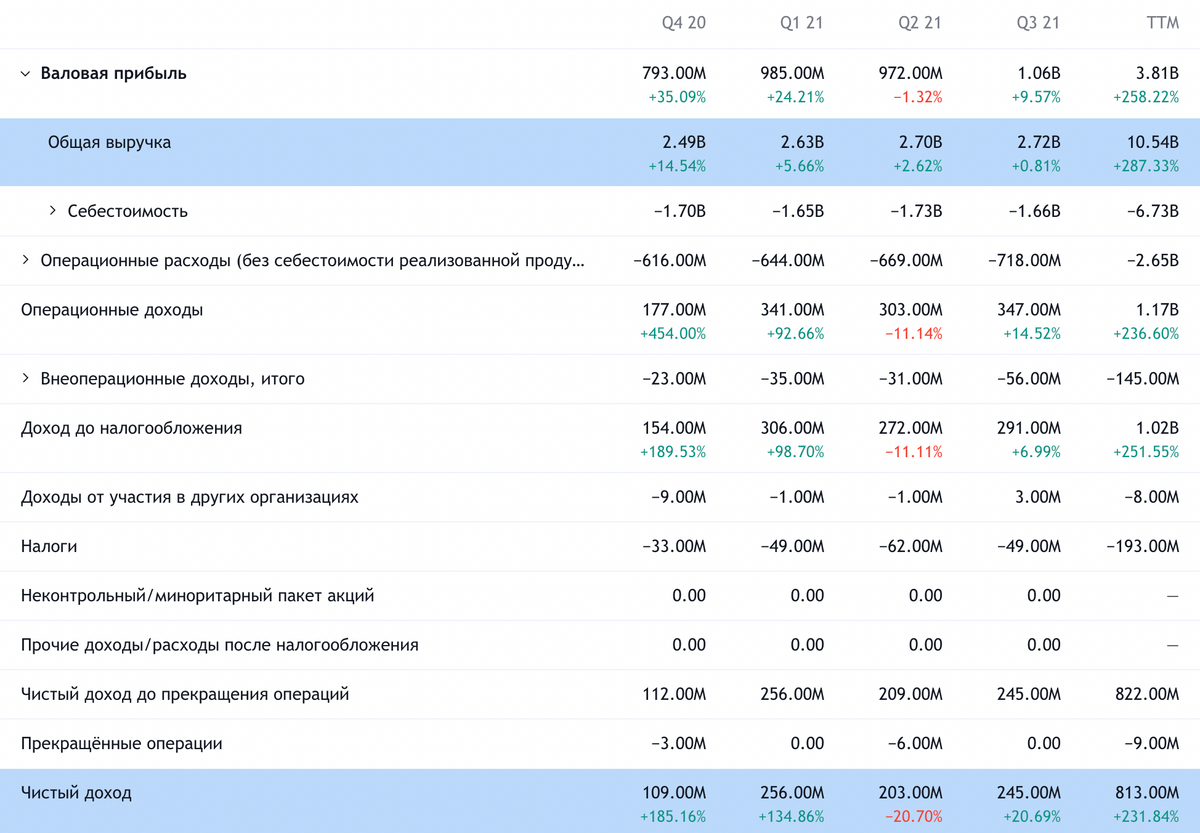

What the company makes money on

And you already understand that: at the beginning of the year, we posted a detailed analysis of this business. We will not repeat ourselves here and immediately move on to the essence - the arguments for and against.

Arguments in favor of the company

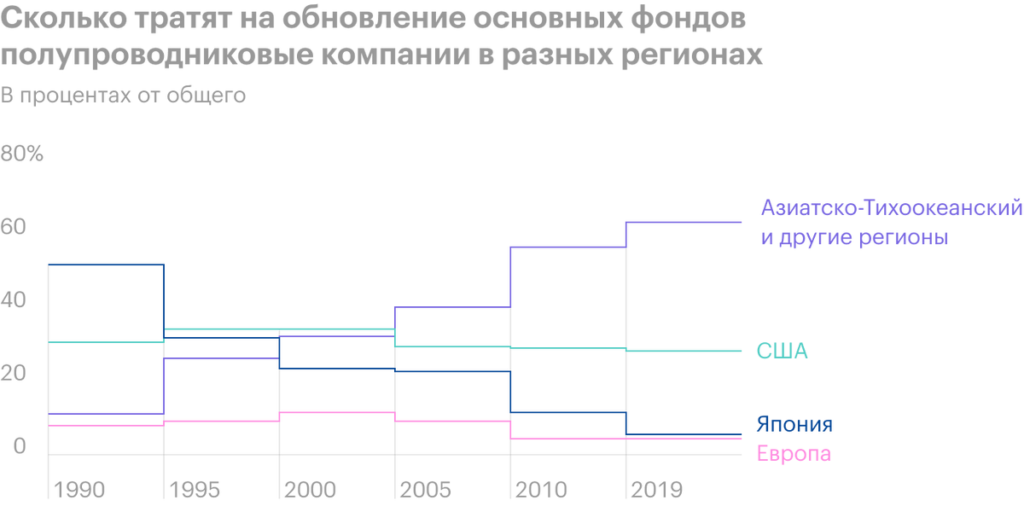

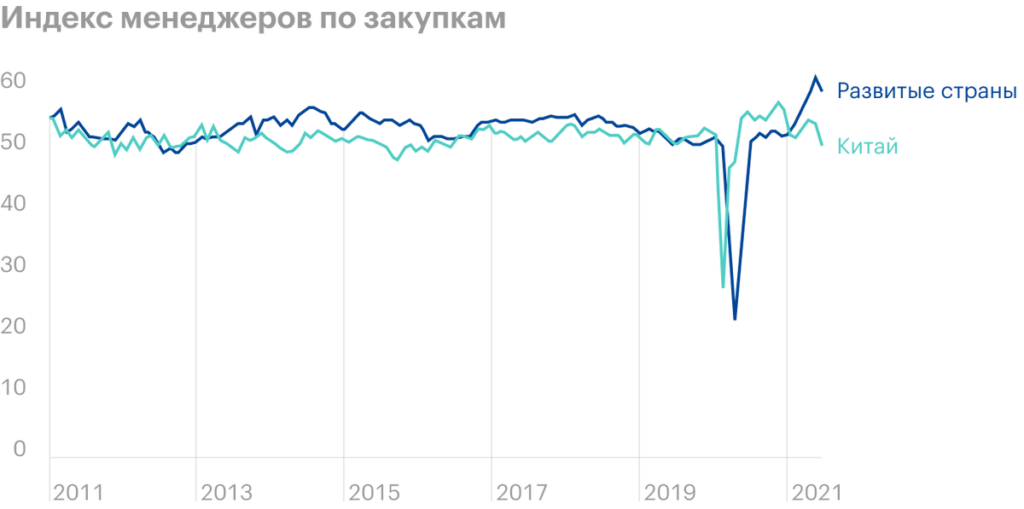

Demand. The main conditions for business growth are the same for the company, the same as the US organization Keysight Technologies, - production growth, which entails an increase in the investment activity of manufacturing companies. Infineon, in this case, is bound to succeed to a large extent due to its own hyper-technological orientation..

For instance, in Asia - and this is the main region for Infineon - the pace of investment in the creation of semiconductors is growing. In the US, investment in computing outstrips investment in conventional industrial equipment. And all this is as relevant as right now, and long distances. Infineon consistently ranks among the top five microcontroller manufacturers, discrete semiconductors and similar products, of critical importance for the modern economy - that in a recession, what with an economic boom. So this idea is also suitable for speculators, and long term investors.

Burger factor. Given the German residence, the company should benefit from the expected mass exodus of German investors on the German stock exchange, which we wrote about in the Deutsche Börse review. Infineon shares have good potential for growth only due to the influx of retail investors into these shares.

The fact, that german stock market is at about the same level of development, as Russian: this is a dreary swamp with a minimum of emitters and very little choice. Large German companies, listed on the stock exchange, - it's mostly a boring auto industry, insurers and industrial conglomerates. Infineon against this background looks like a very advanced company, operating "at the forefront of the new industrial revolution". Inexperienced investors are usually susceptible to such stories and are ready to pump up high-tech companies simply for reasons of, what is "cool".

What can get in the way

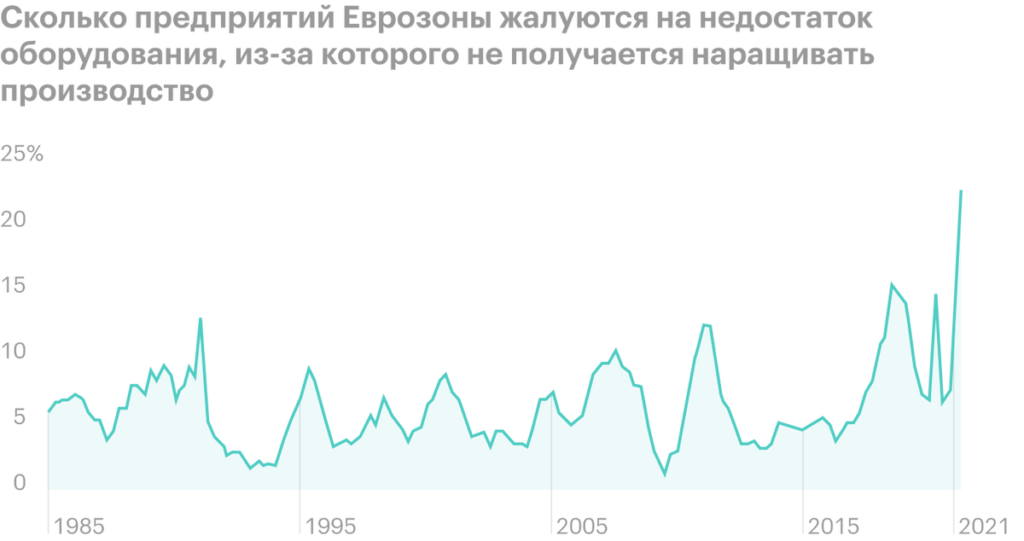

If not enough. Lack of components, faced by many businesses, leads to lack of equipment. This issue has already spoiled Infineon with a couple of reports., and you have to be mentally prepared, that it will happen again. Today 22,8% of companies in the eurozone countries complain about the lack of equipment, which limits their performance. Very possible, that Infineon is already suffering from this shortage.

China. Manufacturing in China slows down, which could have a negative impact on the company's financial statements.. China is an important market for her, more than a quarter of Infineon sales are made on it.

Too fast to live, too young to die. Company P / E — 57,26, which is quite a lot. So stocks can storm.

Wrecked. The company pays penny dividends with a yield 0,6% per annum. It takes her 286 million euros a year to do this.. More than enough money at the disposal of the company, but this year the payments have already been cut. And dividends, who cut at least once, can cut two or four more times - in principle, so many times, how much the company will decide. In the case of an American company, I would doubt, that cuts to such paltry payouts could send stocks down. But, taking into account the German specifics, - and in Germany there are already deposits with a negative rate, that is, customers pay for the right to keep money in the bank - I think, what 0,6% per annum, local investors consider very good money and will be very upset, if these payments decrease.

What's the bottom line?

You can take shares now by 34,32 €. And then there are two options.:

- wait 40 €. Think, that we will reach this level in the next 17 Months;

- keep shares next 10 years, to see, How Infineon Realizes Its Potential.