Today we have a speculative idea: take stock of the packaging paper manufacturer Graphic Packaging (NYSE: GPK), in order to capitalize on the growth of company orders during the holidays and the pandemic.

Growth potential and validity: 13% behind 14 months without dividends; 8% per year for 10 years with dividends.

Why stocks can go up: there is a demand for the company's products.

How do we act: we take shares now by 20,34 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

GPK makes paper. According to the company's annual report, segment revenue is divided as follows.

Wrapping paper — 15,06%. This is unbleached kraft wrapping paper, hard bleached sulphate and coated recycled board. This is where Graphic Packaging products are sold to companies, papermakers, as well as intermediaries.

Segment operating margin in 2020 was negative - minus 11,12% from its proceeds - due to the loss of the value of assets. But in 2019 the segment was profitable: the operating margin was 3,02% from its proceeds. However, the segment's operating margin in the first 9 months of 2021 was negative and amounted to minus 4.23% of its revenue.

Packing Cardboard for Americas — 70,88%. These are food storage solutions for food service and consumer product packers in the Western Hemisphere.. Segment operating margin — 13,7% from its proceeds.

Packaging cardboard for Europe — 11,65%. The same, as the second segment, - only, em, for Europe. Segment operating margin — 8,61% from its proceeds.

Intra-corporate settlements — 2,41% proceeds. This also includes revenue from customers in Australia and the Pacific Rim.

Revenue by country and region:

- USA - 79,26%.

- Other, unnamed countries - 20,74%.

Arguments in favor of the company

Holidays time. In the US, sales records are expected for the November-December holiday season. Therefore, it makes sense to invest in these stocks with an eye on exactly that., that GPK will be the beneficiary of these processes. Also important, that investors will think so - and pump up packaging businesses.

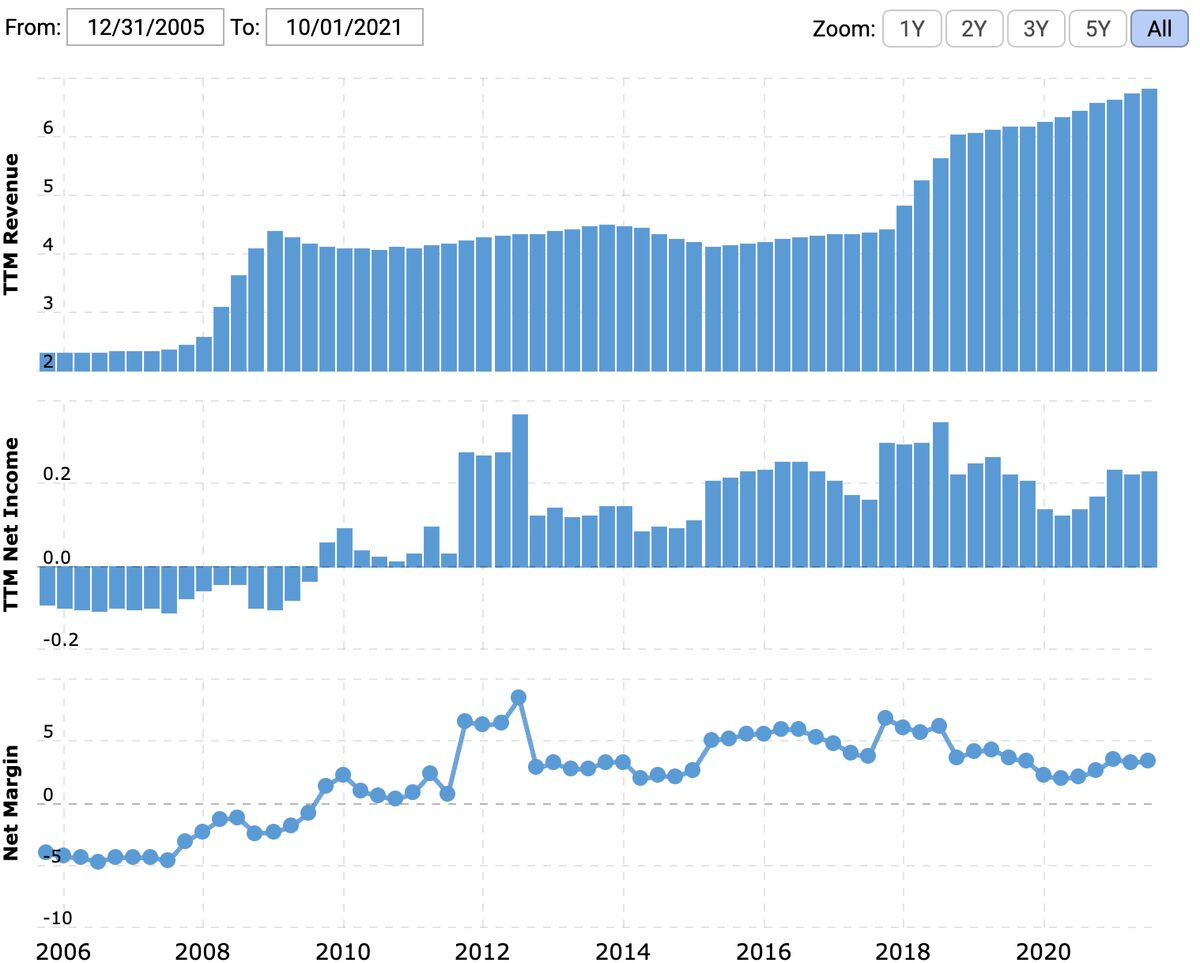

No time for holidays. However, according to the schedule with the company's revenue and profit, you can see, that things are going well for her. The pandemic has given impetus to the field of delivery as goods, as well as food, which has generated a great demand for packaging materials. No reason to count, that the pandemic will end in the coming years, and if it ends, then, probably, only to be replaced by a new pandemic a little later.

Top for your money. GPK may well buy. At all, Anyone can be a buyer, for example, one of the larger competitors of a company such as International Paper or Packaging Corp of America. But the most likely purchaser of GPK would be Amazon.

Amazon with tenacity, worthy of a better use, develops its extremely low-margin retail business and, seems to be, not going to stop. Buying a GPK in this context is a very logical step, Amazon has a lot of money.

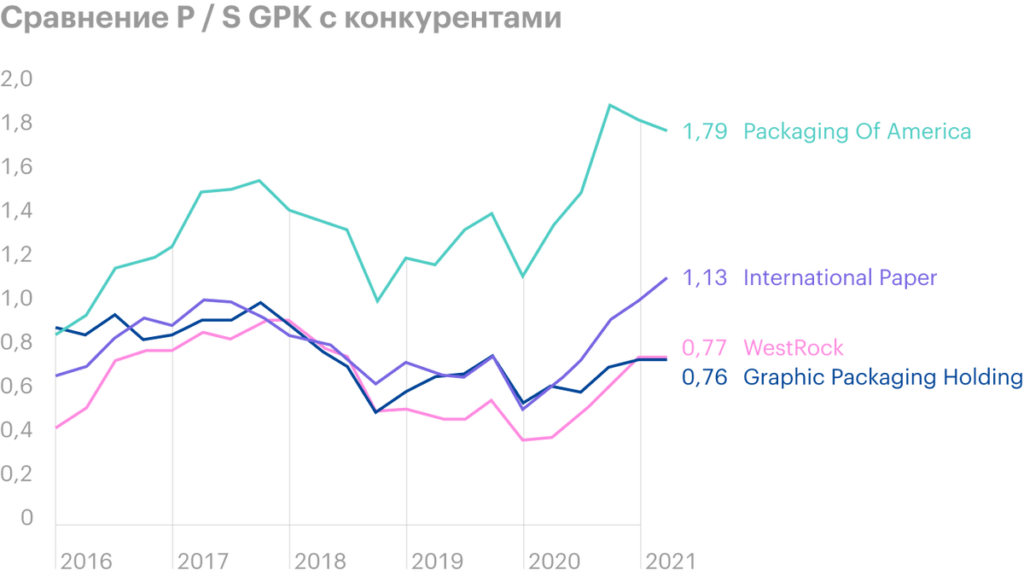

P / S at GPK is less, than many competitors, and capitalization in the region of 6.25 billion dollars. It would be a feasible and reasonable - within the current logic of Amazon's development - a purchase for her.. But I repeat: anyone can buy GPK.

ESG. Almost all of the company's cardboard is a recycled product.. GPK is trumpeting its energy efficiency and waste reduction goals to the world - so, I think, the company's shares may well be pumped up by environmental lovers, of which a huge number are now divorced on the stock exchange.

What can get in the way

Not so cheap. P / E at the company 23,47 - slightly above the industry average in 20,6. The company is also trading near all-time highs.. So stocks can storm.

Everything is bad. The company's total margin is 3,36% from revenue is very little. Problems with logistics and cost of raw materials, about which all American enterprises complain, can have an extremely negative impact on its profitability even in the face of growing demand for its products.

Here take, for example, such categories of raw materials used by GPK, like starch, natural gas, caustic soda and polyethylene: prices for these resources have increased significantly over the year. So you have to be mentally prepared, that the growth of expenses will spoil the reporting of GPK.

Accounting. The company has debts of $ 6.43 billion - and it needs to pay $ 1.499 billion within a year.. Little money at her disposal: 67 million on accounts and 643 million debts of counterparties, - so that the required amount will have to be borrowed or engaged in an additional issue of shares. By itself, such debt in anticipation of raising rates and rising prices for loans can scare off potential investors..

On top of that, the company pays 30 cents of dividends per share per year - as much 1,47% per annum, what it takes about 90 million a year, or 39,1% from her profits for the past 12 Months. Dividends are not big enough to, to attract fans of passive income into stocks, - but they can also be cut, which will cause stocks to fall.

The company is also investing heavily in updating its factories and expanding production - which contributes to a further increase in the debt burden..

What's the bottom line?

Shares can be taken now by 20,34 $. And then there are a couple of options.:

- I think, what during 14 months, the above positive factors will lead to an increase in shares to 23 $;

- you can keep the following shares 10 years, to see, how the company's investment in its production will start to rebound and it will become the beneficiary of new waves of new pandemics.

And periodically look at the news section on the company's website - in order to have time to sell shares on the St. Petersburg stock exchange before they fall, if payments are cut.