Today we have a moderately speculative idea.: take stock of the manufacturer of products for high-tech industries CMC Materials (NASDAQ: CCMP), in order to capitalize on the growth in demand for its products.

Growth potential and validity: 15% behind 14 Months; 36% behind 3 of the year.

Why stocks can go up: semiconductor shortage in the world.

How do we act: take now 142,86 $.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

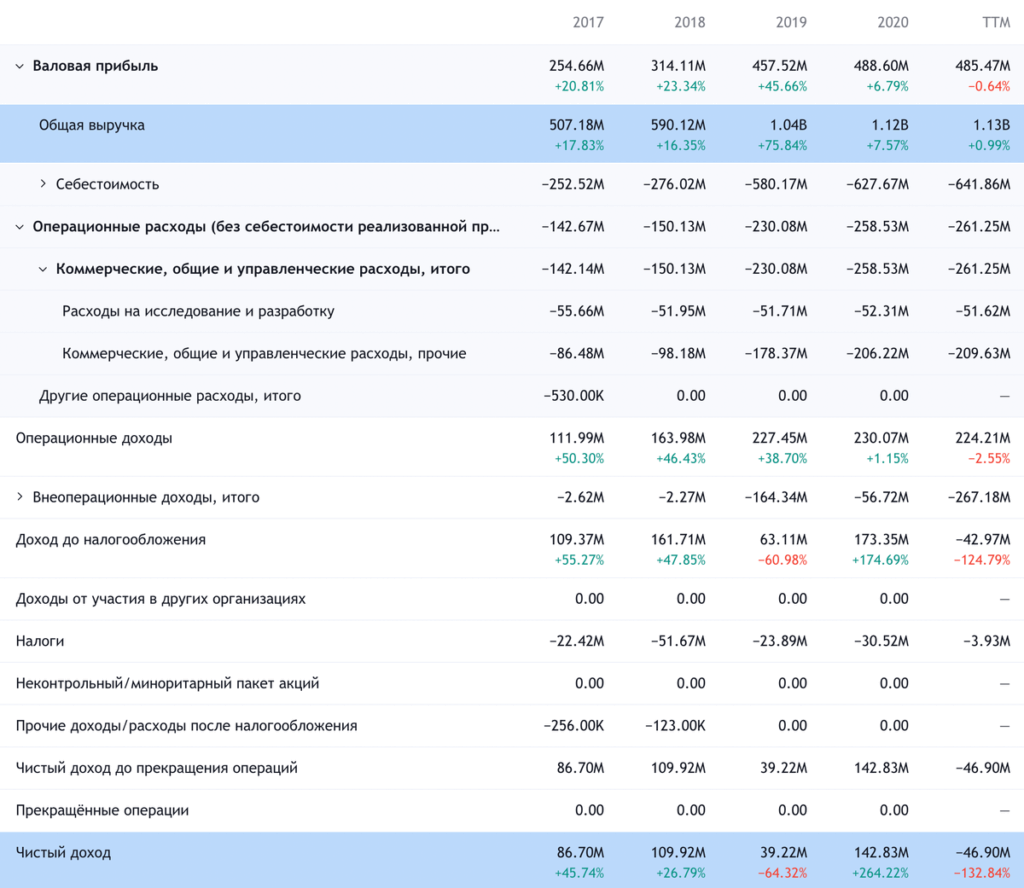

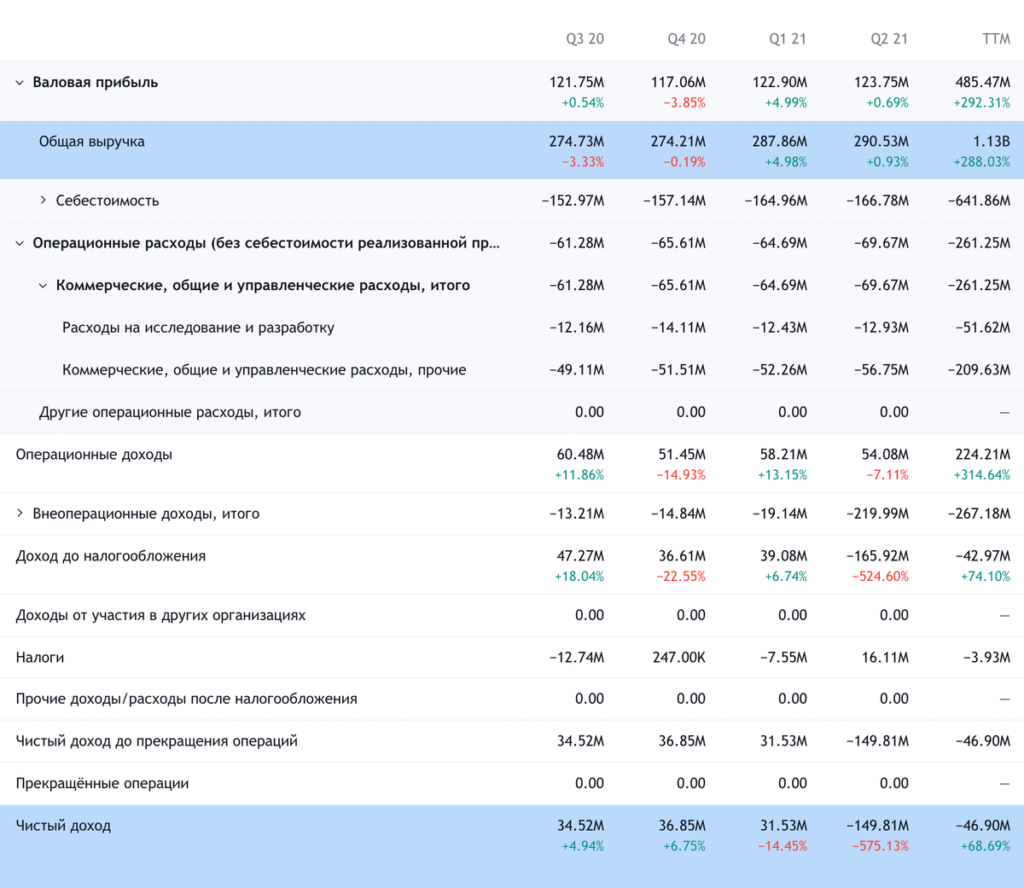

This is a manufacturing plant, which does different things and provides services in related areas. According to the annual report, The company's revenue is divided into the following segments.

Materials for the electronics industry — 79,08%. If you generalize, then that's all, what the company does for semiconductor manufacturers. Segment Adjusted EBITDA margin - 33,9% from its proceeds. Segment revenue is broken down into the following types of goods:

- Sludge — 54,44%. From tungsten and copper for chemical-mechanical planarization - removing irregularities from the surface of the manufactured semiconductor wafer.

- Chemicals for the electronics industry — 35,82%. Miscellaneous acids and compounds, used in semiconductor manufacturing.

- Polishing pads for chemical-mechanical planarization — 9,74%.

Materials for production — 20,92%. Segment Adjusted EBITDA margin - 45,7% from its proceeds. Segment revenue is broken down into the following types of goods:

- Materials for pipelines and industry — 60,61%. Various lubricants and cleaners, means for reducing resistance to flow. The main consumers are oil and gas companies.

- Working with wood - 26,83%. These are materials for the protection and strengthening of wooden structures in the housing and communal services sector..

- Optics manufacturing — 12,56%. Optical precision measurement products - lens manufacturing, prisms. Consumers: from semiconductors and medicine to aerospace and defense.

The largest markets in Asia for the company:

- South Korea - 11,46%;

- Taiwan - 11,91%;

- PRC - 10,17%.

The company as a whole is profitable, but in the past quarter, it suffered a large loss due to the write-off of the value of assets in the "Materials for work" segment.

Company revenue by regions

| North America | 35,83% |

| Asia | 48,99% |

| Europe, Middle East and Africa | 15,14% |

| South America | 0,4% |

North America

35,83%

Asia

48,99%

Europe, Middle East and Africa

15,14%

South America

0,4%

Arguments in favor of the company

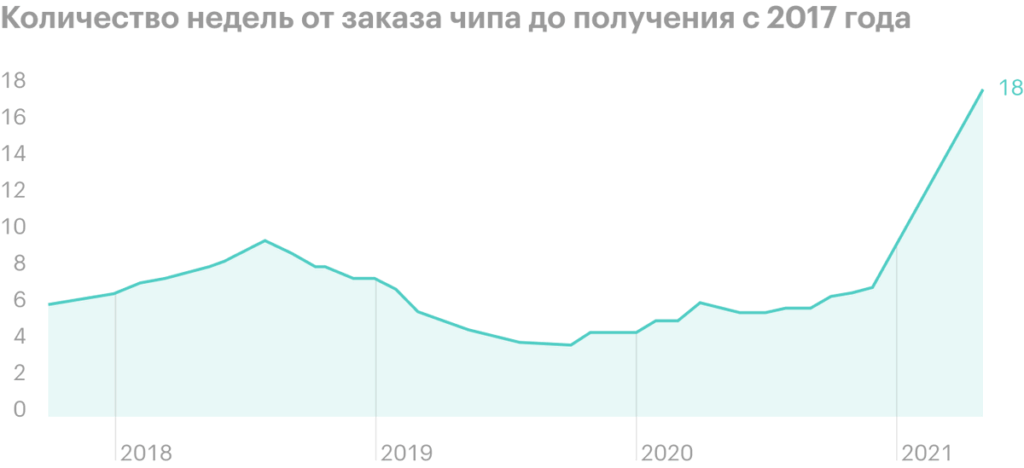

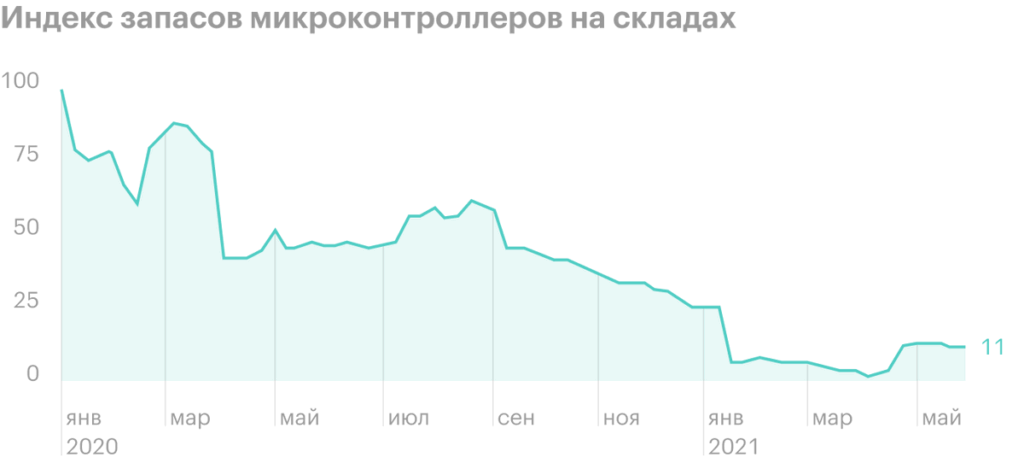

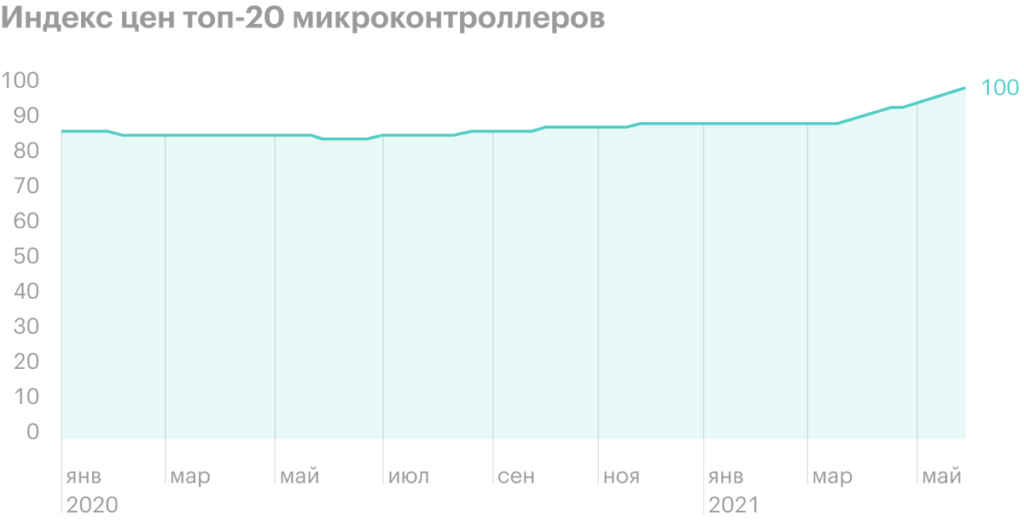

Looking for the police, looking for firefighters. Semiconductors are badly needed by factories around the world., but they are not: from ordering to receiving the chips you have to wait on average 18 weeks, and there are very few necessary components in warehouses. All this leads to an increase in prices for semiconductors and increases the profitability of their production.. So,, CMC products and services will be in high demand, as its customers like TSMC ramp up production.

Price. The company is inexpensive in relative and absolute terms: future P / E she has 17,7, and capitalization - 4.18 billion dollars. This will help attract retail investors interested in the topic of semiconductors., and increase the likelihood of buying a company by someone larger. Given the hype surrounding the production of semiconductors, I would not be very surprised, having learned, that the company was bought by one of its major clients.

What can get in the way

Concentration. According to the report, the company has a number of large clients:

- Intel — 15% of total revenue;

- Samsung — 11%;

- TSMC — approx 10%;

- SK Hynix — approx 10%.

A change in relationship with one of them could negatively impact CMC's reporting.

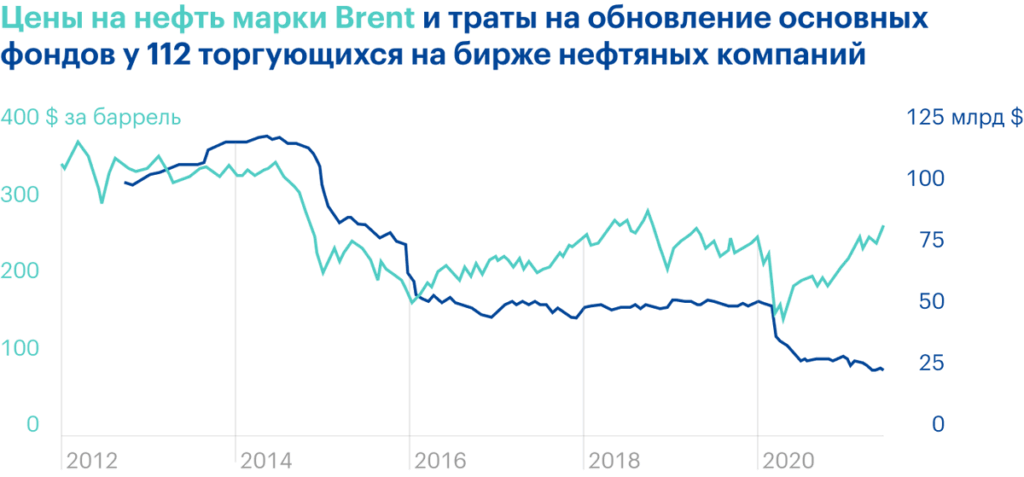

Dumbbell on my feet. Oil and gas sector, giving about half of the revenue of the segment "Materials for production", now brings the company some grief. Even taking into account the growth of orders in other areas of this segment, it is experiencing a decline in financial performance due to a drop in demand from oil and gas companies. Considering, what, despite rising oil prices, indicators of spending on the renewal of fixed assets of oil and gas companies remain at a very low level, do not expect a serious improvement in the situation for CMC in this area.

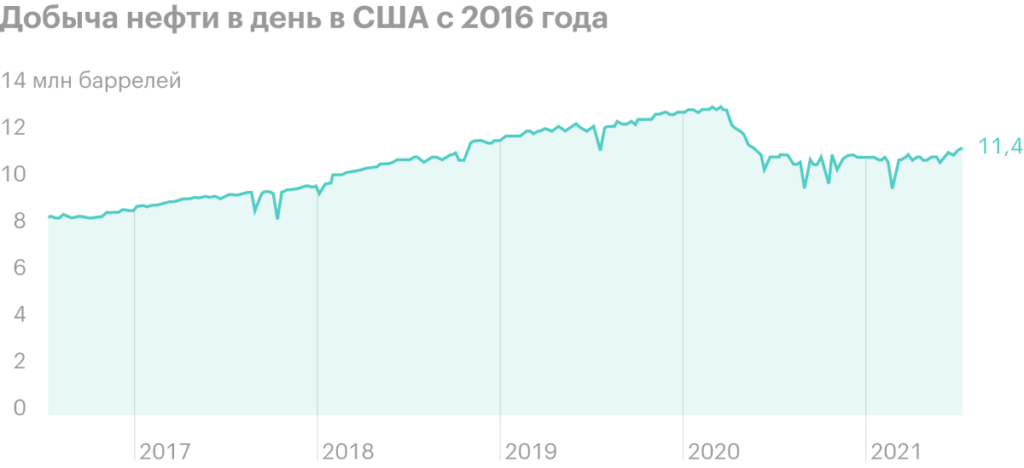

While U.S. oil production is on the rise, this could signal that, that in this quarter the business of the segment, if not rapidly improving, at least it won't get much worse. But you have to be ready for it, that the situation in the field of oil and gas production can spoil the company's reporting.

Wrecked. The company pays 1,84 $ dividend per share per year, which gives approximately 1,29% per annum - quite a bit and will hardly attract fans of "divas" to the shares. This costs CMC $ 53.36 million a year - about 37% from her profits in a normal year. But now the amount of payments is greater than the company's profit for the last 12 Months.

The company does not have an exorbitant amount of debt: 1,267 billion dollars, of which only 187.352 million need to be repaid during the year. She has more than enough money.: 324,836 million on accounts and 146.238 million debts of counterparties. The main business of the company is profitable, so risks of dividend cut seem low. But they still exist - and if payments are cut, for example, for the sake of spending on expanding production, then the stock may fall..

What's the bottom line?

We take shares now by 142,86 $. Think, what are the next 14 months we can wait for the price 165 $, who asked for shares back in May this year.

You can also hold shares for the next three years: maybe, the lack of semiconductors will not end soon and during this time the company will be able to make good money on this and, may be, even find a buyer for your business. In this case, I would count on the quotes return to the level 195 $, who asked for shares back in April of this year.