Now we have an extremely speculative thought: take shares of the website for the sale of automotive parts CarParts.com (Nasdaq: PRTS), to generate income by increasing the purchasing power of auto parts in the USA.

Growth potential and duration : twenty one percent for 15 Months,12 % per year for fifteen years.

Why stocks can go up: there will be a great demand for automotive components!

How do we act: we take at the moment 16,43 $.

No guarantees

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

And what is there with the author's forecasts

What the company makes money on

This is a website for the sale of automotive parts. Part of the product, in general, distributed through offline car dealers. According to the report, by product category, revenue is divided as follows:

- spare parts for the exterior of the car - seventy-two percent;

- mechanical and electrical spare parts - twenty-three percent;

- products for tuning the appearance of the car and its operation - five percent.

The lion's share of products - eighty-nine percent, - sold on the company's website, are brands, belonging to her, but they are created by other organizations.

CarParts.com has operations outside the US, but the company does not know, what is their share in the total revenue structure. well, then we will think, that she is not big.

The company is unprofitable.

Annual revenue and profit of the company, million dollars

| Revenue | Profit | |

|---|---|---|

| 2017 | 303,37 | 24,02 |

| 2018 | 289,47 | −4,89 |

| 2019 | 280,66 | −31,55 |

| 2020 | 443,88 | −1,51 |

Revenue

2017

303,37

2018

289,47

2019

280,66

2020

443,88

Profit

2017

24,02

2018

−4,89

2019

−31,55

2020

−1,51

Company quarterly revenue and profit, million dollars

| Revenue | Profit | |

|---|---|---|

| 2 neighborhood 2020 | 118,93 | 1,57 |

| 3 neighborhood 2020 | 117,41 | 1,39 |

| 4 neighborhood 2020 | 119,73 | −3,49 |

| 1 neighborhood 2021 | 144,80 | −2,72 |

Revenue

2 neighborhood 2020

118,93

3 neighborhood 2020

117,41

4 neighborhood 2020

119,73

1 neighborhood 2021

144,80

Profit

2 neighborhood 2020

1,57

3 neighborhood 2020

1,39

4 neighborhood 2020

−3,49

1 neighborhood 2021

−2,72

Arguments in favor of the company

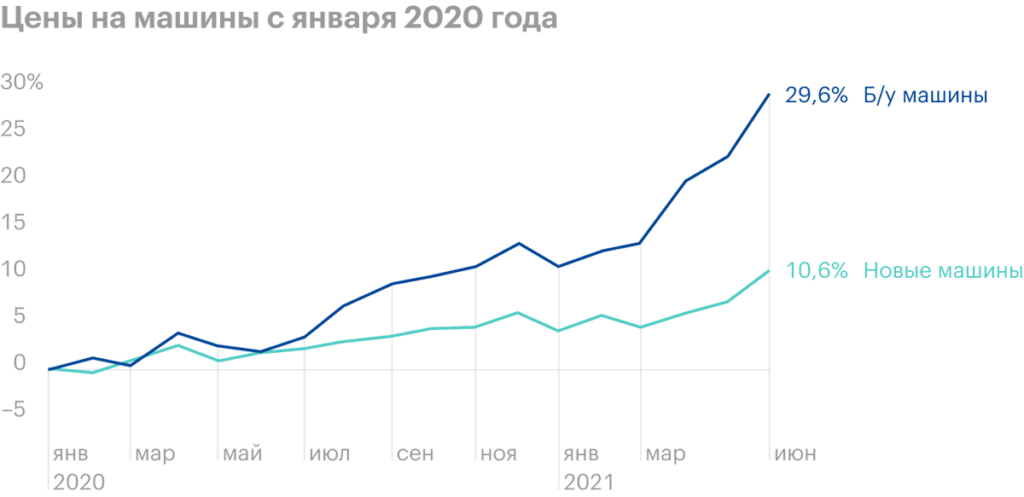

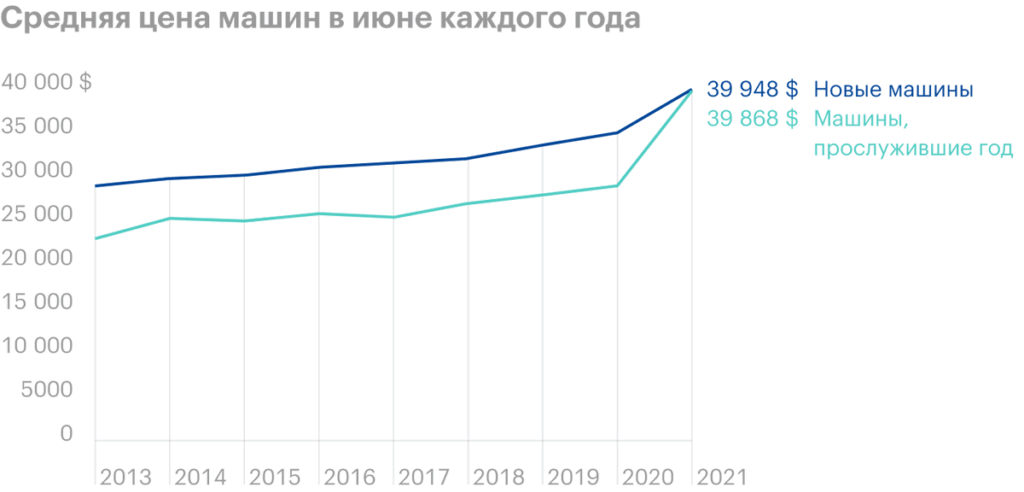

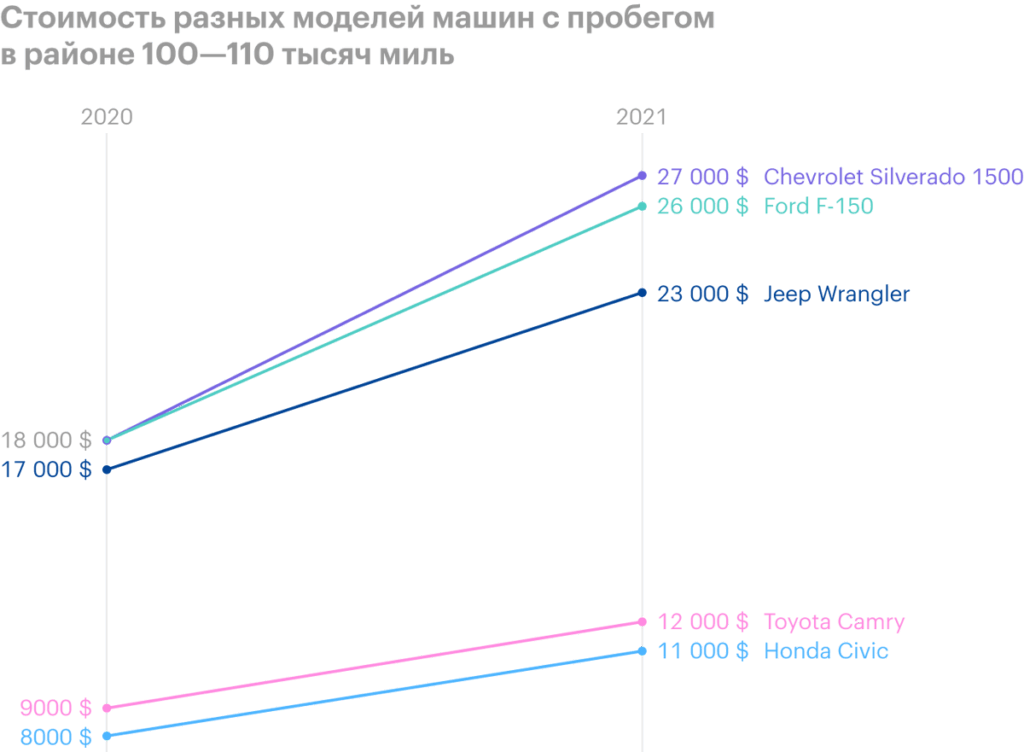

Auto boom in the US. There is a huge demand for cars in the USA. At the same time, the demand given is so strong, that most of all the cost grows on a used car - due to a lack of cars. This is all due to a lack of semiconductors.. At the moment, Americans are buying even brand new cars at mystical prices.: cars with over 100 thousand miles on average are now sold at a price of 30% above, than in 2020.

All this in general creates a favorable environment for CarParts.com. Used cars are demanding to maintain, and consumers over time will take parts for them, so the company can count on revenue growth.

With a small cap of $ 790M, the company's stock will be easy to pump up to a handful of Reddit users., who have subtracted somewhere, that “cars and spare parts are now a promising topic”.

The company may well be bought by an established large car dealer. This industry suffers from insufficient digitalization, and the sale of auto parts is a segment of the car market, which is great for, to transfer all sales in it online. After all, the spare parts are typical, no need for a test drive.

CarParts.com is not very unprofitable: negative margin is 0,3% from proceeds, capitalization is also modest, so that in the caring hands of the new owner, the business will be able to sparkle with new colors. Maybe, it will even be bought by some Amazon.

What can get in the way

Unprofitableness. For many years of operation, the company has not become consistently profitable - a fact, which negatively affects its reputation. Losing stocks are, by definition, volatile, and the threat of bankruptcy is always nearby. The company is not in a good position in accounting: 127,3 million dollars in arrears, of which 95.94 million must be repaid during the year. There is not much money at the disposal of CarParts.com: 45,896 million on accounts and 9.735 million debts of counterparties. So she is dependent on low interest rates on loans - this is bad in anticipation of an increase in rates..

All in all, CarParts.com is highly motivated to issue new shares, to finance its operations, and quotes can suffer from this.

Court cases. The company "by inheritance" got court cases from a company it previously bought - we are talking about the use of asbestos. So that, maybe, she will have to pay a large fine. Or maybe, and no. In any case, this moment must be taken into account - and it will not be possible to prepare for it., such news always comes unexpectedly, like the spanish inquisition.

What's the bottom line?

We take shares now by 16,43 $. And then there are a couple of options.:

- wait for them to return to 20 $, who asked for them back in February of this year. Think, that we can wait for it within the next 15 Months;

- fasten your seat belts and keep the stock next 15 years, so that the company can fulfill its potential or go bankrupt. However, over longer distances, it is more likely that the company will be bought by someone larger.