Today we have an extremely speculative idea.: take stock of online commerce software manufacturer BigCommerce Holdings (NASDAQ: BIGC), in order to capitalize on the growth of interest in this sector.

Growth potential and validity: 27% behind 16 Months; 56% behind 4 of the year; 15% per annum during 15 years.

Why stocks can go up: the sector is considered very promising and stocks can be pumped up by ignorant investors. There are also prospects for the company's business growth.

How do we act: we take shares now by 44,86 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

BIGC makes cloud software, which allows businesses to create their own online stores and sell products online. How it works, can be viewed in video on YouTube.

According to the annual report, the company's revenue is divided as follows.

Subscription — 68,06%. Users pay BIGC to use its software.

Partners and Services — 31,94%. Profit, which the company receives from its partners for the integration of their software extensions into the programs of the BIGC itself. BIGC also provides software optimization and customer training services..

Revenue by country and region:

- USA - 79,36%.

- Other, unnamed countries in the Western Hemisphere - 3,52%.

- Europe, Middle East and Africa - 8,13%.

- Asian-Pacific area - 8,99%.

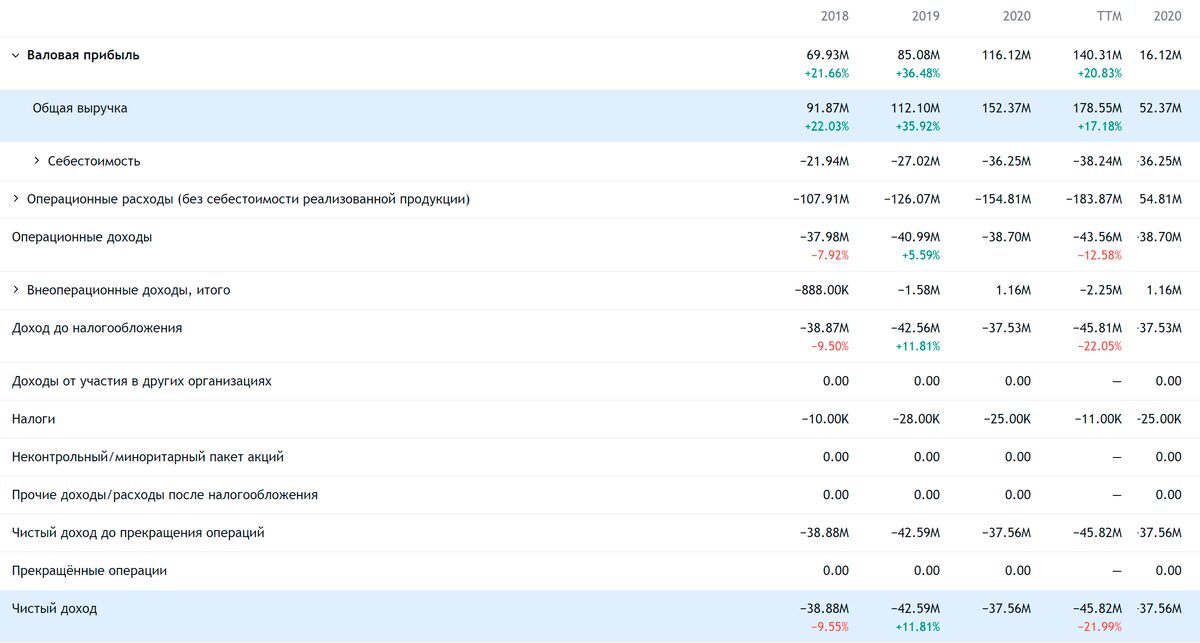

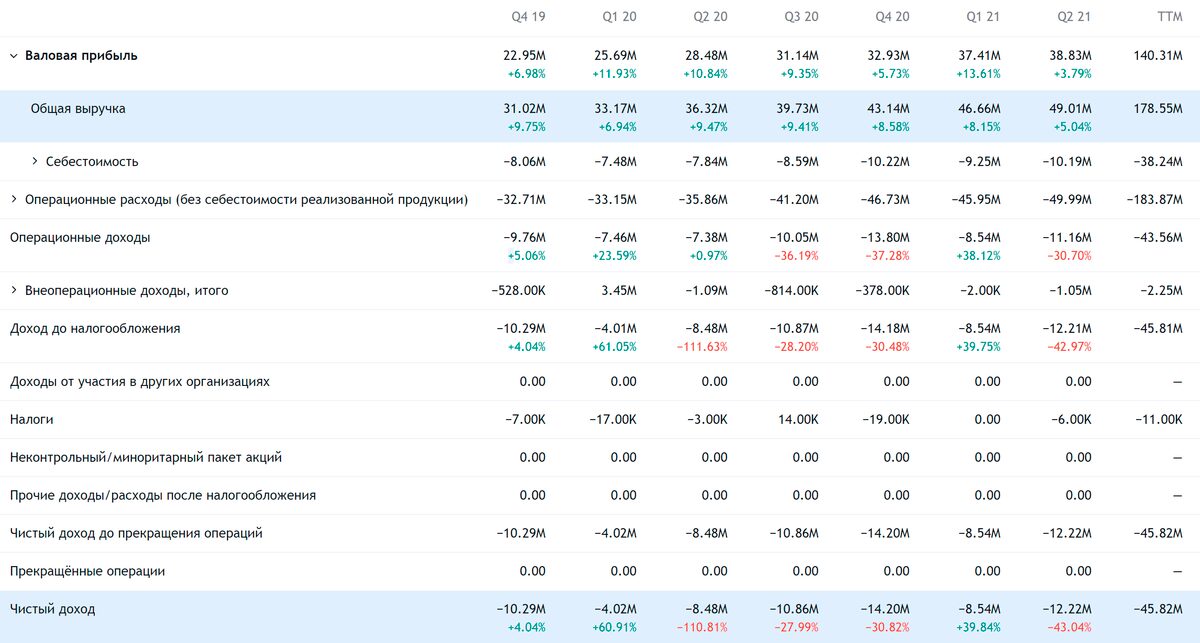

The company is unprofitable.

Arguments in favor of the company

Fell down. From August 2020 highs to 130,98 $ The company's shares fell by 65,75% - to 44,86 $. So we can hope for a rebound.

“We started making better money”. The company is gradually improving its performance not only in terms of revenue. Over the past year and a half, its final margin has improved from minus 36 to minus 24,02% from proceeds. Yes, still far from reaching self-sufficiency, but by the standards of IT, the progress is very significant. Nice to see, that BIGC is being corrected. Based on this, we can assume, that stocks will bounce, when will investors appreciate the progress of BIGC.

Today and tomorrow. The BIGC business itself has good prospects. In the short term, the holiday season in the United States during the period November - December plays into the hands of the company 2021: experts believe, that retail will demonstrate a record level of sales, and the greatest growth will be in online commerce.

In the long term, the growth of the online commerce sector will help the company: more and more businesses will set up online stores. A pandemic, certainly, spurred this process, but it would have happened without the coronacrisis.

Diversification. None of BIGC's clients give her more 5% from its revenue, which strengthens her negotiating position. It is also good for, that the departure of one of the clients will not greatly spoil the overall reporting.

A little. BIGC has a capitalization of $3.19 billion. This is very small and gives hope, What Shares Will Be Pumped By Retail Investors, who decided, that online commerce is fashionable and promising.

Relatively clean bookkeeping. With current loss rates and very low debt levels, BIGC has enough cash at its disposal for several years of operation..

Can buy. BIGC's closest competitors are major Adobe companies, Shopify and Salesforce all provide similar solutions. Given their size, positive developments in BIGC business and general positive background of the online commerce theme, they may well buy BIGC. In absolute terms, BIGC is inexpensive - quite a feasible amount for the same Shopify.

What can get in the way

Unprofitableness. Unprofitable companies are a priori volatile, and the threat of bankruptcy is always near. This needs to be understood and accepted..

Expensive. Now the company stands as almost 18 annual proceeds. It's cheaper, what it cost before - 30 and more proceeds, but still very expensive. Combined with the unprofitability of the business, this fact will contribute to the volatility of quotes..

In the case of company reporting, only a little, tenths of a percent, fail to meet investor expectations - and this can lead to a serious drop in stocks, by tens of percent per trading session.

Competitors. BIGC competes with big companies. Instead of buying BIGC here and now, its competitors can afford to dump, to bring BIGC to the brink of bankruptcy and buy it at a price much lower than the current. This is a very likely scenario..

What's the bottom line?

We take shares now by 44,86 $. And then we have a whole fan of possibilities:

- wait for the price 57 $, who asked for shares back in September of this year. Think, we can reach this level in the following 16 Months;

- wait 70 $. Think, here you have to wait until 4 years;

- press stocks to your heart and keep them there 15 years, to see, how BIGC will become a beneficiary of online commerce development. Or go bankrupt in the process of achieving fame.

In any case, the idea is very volatile, so don't even get close to these promotions, if you're not ready for it, what quotes will shake.