Google Finance - financial information provider, owned by Google Inc.

History

Google Finance service provides access to financial information about most multinational companies. Information on quotations and ratings of securities is available, press releases and financial statements of companies. For each company, aggregator results from Google News and Google Blog Search are displayed. Historical data is available in the form of graphs, implemented using Adobe Flash technology.

The site offers a number of services for managing personal financial information.

Google Inc.. opened the Google Finance service 21 Martha 2006 of the year .

12 December 2006 year, a significant change was made to the home page and content of the service. In particular, information on currencies and various market sectors became available.. Added Google Trends tool. Added historical data on securities quotes for more than 40 years.

In June 2008 year, the current quotations of securities became available from NASDAQ and the New York Stock Exchange under partnerships with Google.

18 november 2008 years on the project pages began to show ads.

In August-September 2009 the leading indicator for investors was launched - Google Domestic Trends, based on the analysis of search queries.

Google Finance: your personal financial assistant

Google Finance is a financial service, providing comprehensive information about corporations, listed on North American exchanges, about the quotes of their shares. Unlike many Google services, this one is not localized yet. So Russian users will have to deal with the English-language interface..

To use the service, you must have a Google Account. After that, the first time you log into Google Finance, you will find a lot of business information - business news, reports from stock exchanges, data about, which sectors of the economy (healthcare, energetics, transport, technology, etc.) rose, video plots, etc..

Once you add company stocks to your virtual portfolio, which you plan to follow, the picture will change significantly - with each subsequent visit to Google Finance, you will also see news on these companies of interest.

In general, Google Finance is ideal for two tasks - finding information about companies, whose shares are listed on the stock markets, and tracking changes in the value of shares of corporations, in which you invested your funds.

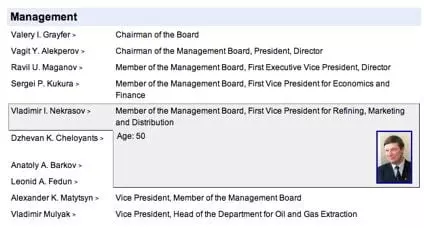

When you type in the search bar, for example, Avtovaz, Google Finance will offer several options during typing., trying “predict”, what exactly are you interested in. Let it be “Volzhsky automobile plant”, therefore, we will choose from the proposed options AVTOVAZ OAO (AVAZ). Google Finance will inform you almost immediately, what does the company do (for example, “AvtoVAZ” according to Google, in addition to car production, it is active in sectors such as insurance, banks, finance), where it exports its products, how many employees, what is the legal address and telephone number. Furthermore, you will even get information about the management of the company - who and what position, what is their age. The only thing, what, in my opinion, is missing - these are links opposite the names for searching on the Internet (to find out, for example, former place of work).

When, if you are interested in a western company, the amount of information will be even more. You will not just be informed, who runs the company, but they will also give links to the biographies of managers, will show their photos. If the company has a corporate blog, you will be given his address.

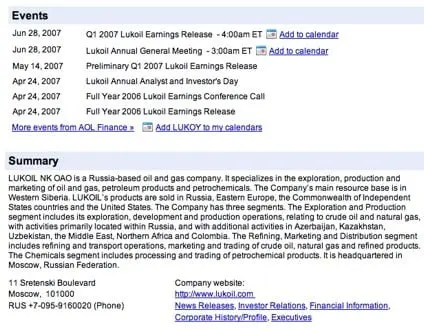

When you study information about a certain company, pay attention to the Related Companies section, in which similar companies are represented. Although this list is not compiled by hand, he's pretty accurate. For “Lukoil” Only Russian companies are listed as Related Companies.

The statistics of the company's performance is quite detailed and has about 20 positions (the figure fluctuates depending on the amount of data provided).

Any information can be useful when deciding whether to buy or sell shares.. Google Finance displays more than news headlines, but also excerpts from blog posts. So for the sake of completeness, you can familiarize yourself with them.. If you subscribe to the RSS news feed of the corporation of interest, you will read it in your favorite RSS reader. In Google Finance, you can create discussion groups for each company to discuss news and events.

A distinctive feature of Google Finance is integration with other services of the search giant. If a listed company provides data on the schedule and plans for holding meetings, advice, conferences, etc., they can be imported to Google Calendar. And then you won't miss,for example, Lukoil Earnings Conference Call.

Google Finance also has tools for visual presentation of information.. In particular, the service displays convenient charts changes in stock prices. You can define time intervals for viewing, and also make comparisons with shares of other companies. Let's say, you are a Google and Yahoo shareholder! Interesting to know, which corporation turned out to be more profitable for you? It's easy with Google Finance.

Conveniently organized management of stock portfolios. Firstly, you can create as many portfolios, how much will it take (say, one with shares of energy companies, the other is technological, third - pharmaceutical, etc.). Secondly, within the portfolio, you can specify transactions (purchase-sale, Commission, explanatory note). Thirdly, all data can be saved in a CSV file for further work in a financial program or a familiar spreadsheet processor.

Interesting, that Google Finance did not follow the Web20 fashion and did not develop collaboration tools - only those who know your username and password to Google Account can view and edit stock portfolios.

The disadvantages of Google Finance include the lack of notifications by e-mail or SMS about changes in the value of shares.. As a result, you will not recognize, when the stock price of the company you are interested in dropped to the required level or, on the contrary, did not rise to the expected value.

Summarizing, I will note, that my impressions of using Google Finance are extremely positive. It is a powerful and user-friendly service., focused not on professional brokers (it probably won't suit them), but for ordinary users, private investors, of people, who want to keep their savings.

Regarding the usefulness of Google Finance for Russians, then this question is difficult. We are not used to keeping money in stocks yet, besides, GF only tracks those companies, what are represented in the North American markets. But, On the other hand, more and more domestic corporations are placing shares on foreign exchanges. Besides, Google Finance is also a great guide to companies, so it's never too late to follow in Ingebor Motz's footsteps..

How to read a company profile on Google Finance

On the example of Intel Corp. (NASDAQ:INTC).

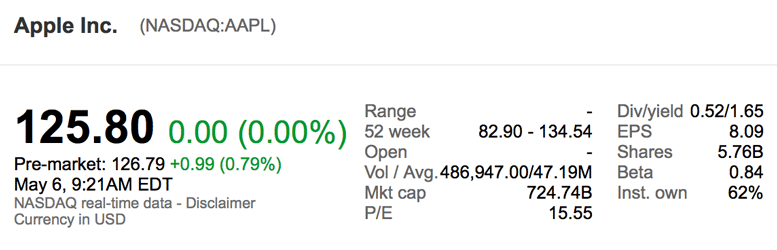

1. Company name (Stock Exchange: Ticker).

2. Current value of a share on the stock exchange in US dollars.

3. Range 52 week - 52-week share price change (min.- Max. values).

4. Vol / Avg. (Volume / Average volume) - the volume of daily trading of the stock / average share trading volume per 30 days.

5. Mkt cap (Market Сapitalization) - the size of the market capitalization of the company.

6. R / E (Price/Earnings) - Price / Profit - coefficient, used by investors to assess whether, how soon will their investment pay off.

7. Div/yield (Dividend/Yield) - size of annual dividends per share and current dividend yield.

9. Beta - coefficient, reflecting the degree of risk of a stock and the volatility of its price relative to the market.

10. Shares (Shares Outstanding) - shares in circulation (all shares issued and owned by investors).

11. Inst. own (Institutional Ownership) - the proportion of shares, held by institutional investors (pension and mutual funds, investment and insurance companies).

12. Comparison of stock price dynamics with stock indices (Dow Jones, S&P 500, Nasdaq) and / or other companies.

13. Selecting the period for displaying data on the chart.

14. Share Dividend History (if available), their size and frequency.

15. Latest news and analytical reviews for the selected company.

16. Dynamics of the trading volume of a stock on the chart (published with a delay in 15 min.).

Getting real-time data from Google Finance

There is a class of algorithms, based on the correlation of asset prices in different markets. For that, to investigate such correlations, for example, between the American and Russian markets, it is necessary to have access to real-time data from Western exchanges, the supply of which is offered by special providers for a fairly substantial fee., it is possible to use parsing of real-time data from the Google Finance website instead of a paid data feed. On such data, a high-frequency strategy, certainly, don't build, but for slower strategies, this method is fine.. However, at high frequencies there is no strong correlation with the Americans for a long time, and HFT algorithms do not work with this idea, but for long periods of time there is a very wide field for research. How to get data from Google Finance discussed in the blog Pawel Lachowicz, the translation of which is presented below.

In this post we will cover, how to get real time data, broadcast on the Google Finance website, to use them as initial backtest data or in a real trading application. This data can be used for intraday trading systems.. The title of the post shows an example of displaying Apple quotes on Google Finance.

The core of our code, written in Python, is a small function, for a specific company ticker on a Google site, it parses data directly from the site, getting the last current price of the asset:

For the program to work correctly, you need to make sure, that the ticker is written correctly (as below). Further, display the local current time on the screen and then replace it with New York (exchange) time. We doing this, since we will get stock prices, traded on NYSE или NASDAQ. If you want to get the values of the English index FTSE100, then you need to change the time to universal (London):

By doing this, apply a third party function combine to put all read data into a Python list variable:

At the entrance, we submit the ticker of the company of interest to us from the Google website:

for which we open a new text file, where we will save all requests in real time:

Next, we create the final cycle for the entire trading day.. In our example, we get the latest data in 16:00:59 New York time. Key parameter of the program – variable freq, where we set the frequency of intraday data slicing (in seconds). The author has identified, that the optimal value would be 600 sec (10 min), since with more frequent requests, Google Finance can record high activity from your IP and consider it a flood. However, you can find the smallest value for your IP.

To check, how the program works in practice, the author launched it 9 January 2014 years New York time 03:31:19. The received data was written to a file in the following form:

It is important to note, what time, which we write down and try to associate with the time of the received quote, is the local computer time, so don't expect equal time spacing between values and great commit precision. However, in our case, when we want to assess correlation over fairly long periods, the accuracy of timing is not so important, as is the case with high frequency strategies. Let's pay attention , what if the internet connection is unstable, gaps in the data may appear, as seen in the above example.

The presented code can be easily modified., if you want to receive data on several assets at once. Just replace some of the code of the above program, starting with the definition of the ticker variable, with the following code:

Recording quotes in real time turned out like this:

where we can see the values of the current prices for 6 shares and one exchange-traded fund ETF every 10 minutes.

In custody, add on my own, that it would be interesting to investigate the correlation between American and Russian commodity companies, there may be a good temporary gap.

TIKR.ru - Russian analogue of Google Finance

Tikr.ru is a free Russian service for analyzing stock quotes, exchange rates and financial news, positioning himself, as an analogue of Western resources Google Finance and Yahoo! Finance. Because. Russian project, is he, unlike American older brothers, focused on company shares, traded on the largest Russian stock exchange - MICEX. The site presents various services from analyzing changes in stock indices to investment calculators.

The project is quite young and a significant part of the declared functionality is still under development, but, resource is developing. It's not overwhelmed with press releases today., financial statements of companies, publications of analysts and is quite convenient for analyzing stock quotes of Russian companies on the MICEX.

GOOGLE FINANCE

Helps to get current or archived data about securities from the service “Google Finance”.

Examples of using

GOOGLEFINANCE(“GOOG”; “price”; DATE(2014;1;1); DATE(2014;12;31); “DAILY”)

GOOGLEFINANCE(“GOOG”; “price”; TODAY()-30; TODAY())

GOOGLEFINANCE(code; [attribute]; [the date of the beginning]; [expiration date|amount of days]; [interval])

code - unique identification code for securities (ticker).

Note. RIC codes (Reuters Instrument Codes) no longer supported. Examples: 123.TO и XYZ.AX. Use TSE instead:123 or ASX:XYZ.

Advice. To get more accurate results, indicate the name of the exchange. For example, instead of GOOG enter NASDAQ:GOOG. If the exchange is not listed, when using the GOOGLEFINANCE function, the best option will be selected automatically.

attribute (not necessary, default price ) - attribute, the value of which you want to get from Google Finance. Required, if date is given.

The attribute parameter takes one of the following values for real-time data:

“price” (price) - real-time price quotation. Possible delay up to 20 minutes.

“priceopen” (opening_price) - price at the moment of trading opening.

“high” (max_price) - the highest price for the current day.

“low” (min_price) - the lowest price for the current day.

“volume” (volume) - trading volume for the current day.

“marketcap” (capitalization) - market capitalization of shares.

“tradetime” (time_transaction) - time of the last deal.

“datadelay” (delay) - the amount of delay when receiving data.

“volumeavg” (average_volume) - average daily trading volume.

“on” (price_profit) - price / profit ratio.

“eps” (profit_ per share) - earnings per share.

“high52” (max_price_52) - maximum price for 52 weeks.

“low52” (min_price_52) - minimum price for 52 weeks.

“change” (the change) - price change since the close of the previous trading day.

“beta” (beta) - value “beta”.

“changepct” (change_percentage) - percentage change in price since the close of the previous trading day.

“closeyest” (closing_price) - price at the close of the previous day.

“shares” (stock) - number of shares in circulation.

“currency” (currency) - currency, in which the value of the security is declared. Currencies do not have trading periods, so the argument will not receive open values , low , high и volume .

The attribute parameter takes one of the following values for historical data:

“open” (opening_price) - the opening price for the specified dates.

“close” (closing_price) - the closing price for the specified dates.

“high” (max_price) - the maximum price for the specified dates.

“low” (min_price) - minimum price for the specified dates.

“volume” (volume) - volume for specified dates.

“all” (all) - all of the above.

The attribute parameter takes one of the following values for mutual fund data:

“closeyest” (closing_price) - price at the close of the previous day.

“date” (date) - date, when the net asset value became known.

“returnytd” (profit_for_year) - profit for the year before the current date.

“netassets” (net_assets) - net assets.

“change” (the change) - the last and penultimate change in the value of net assets, which became known.

“changepct” (change_percentage) - percentage change in the value of net assets.

“yieldpct” (yield_percentage) - the sum of the distribution of income for the last 12 Months (from dividends on shares and interest payments with fixed income) and income from net asset value, divided by the previous month's net asset value.

“returnday” (income_for_day) - total income for one day.

“return1” (income_1) - total income for one week.

“return4” (income_4) - total income for four weeks.

“return13” (income_13) - total income for thirteen weeks.

“return52” (income_52) - total income for 52 weeks (1 year).

“return156” (income_156) - total income for 156 weeks (3 of the year).

“return260” (income_260) - total income for 260 weeks (5 years).

“incomedividend” (distributed_funds) - the volume of the last distribution of funds.

“incomedividenddate” (distribution_date) - date of the last distribution of funds.

“capitalgain” (equity_allocation) - the volume of the last distribution of capital gains.

“morningstarrating” (rating_morning_star) - Morningstar rating.

“expenseratio” (expense_ ratio) - fund expense ratio.

start_date (the date of the beginning) – [ NOT NECESSARY ] - start date when sampling historical data.

- If start_date is specified and end_date is not specified|amount of days , only one day's data is returned.

end_date|num_days (expiration date|amount of days) – [ NOT NECESSARY ] - the end date for downloading historical data or the number of days from the start date ( start_date ), for which you want to load data.

interval – [ NOT NECESSARY ] - frequency of data loading; can take values “DAILY” or “WEEKLY”.

- The spacing parameter can also be specified using numbers. 1 or 7 . Other numerical values are not allowed.

Notes (edit)

All function parameters must be enclosed in quotes or be cell references, containing text, except in cases, when the interval parameter is specified using numbers or when the end_date parameter|number_days is set as the number of days.

Real-time data is returned as values, located in one cell. Flashback data is always returned as an expanded array with column headings.

Some attributes may not show results for all characters.

The GOOGLEFINANCE feature is only available in English and does not work with most international exchanges.

Statistics cannot be downloaded and viewed, using Sheets API or Apps script. When you try to follow these steps, you will see the # N / A error in the corresponding cells.

The quotes may be delayed up to 20 minutes. Information is provided on the basis of “as it is” for informational purposes only and is not intended to be used in bidding or for consultation.

Dates, given for the function GOOGLEFINANCE , are considered to be relative to noon UTC (UTC). If the exchange closes earlier, her data may move one day.

Getting information from Google Finance about the state of financial markets.

List of commonly used attributes.

Retrospective information from Google Finance about the state of financial markets.

List of commonly used attributes for mutual funds.

Using the GOOGLEFINANCE function in a cell, you can create a chart, showing trends in the currency exchange market over the past 30 days.