Earnings Season (Reporting season ) provides us with most of the opportunities for profitable trades. This is our final series of games. It looks like Opening, repeated every day for six weeks and four times a year. Every day is new. Every day is special. Every day is delicious. Every day offers tremendous opportunities. This is our favorite time to trade. Below are some suggestions for, to help you maximize these opportunities during this Earnings .

Earnings Season - calendar period, during which US public companies publish their financial results for the quarter / half year / year. In a narrower sense - four months a year, which follow the calendar quarters - January, April, July and October. At this time, dozens of reports are published every day., whose results have a strong influence on the dynamics of the markets.

Historically filed, aluminum giant Alcoa is the first to publish its financial statements (NYSE: AA).

For private traders, who are engaged in active intraday speculation in the American market, reporting season is the most important trading period, since volatility rises sharply at this time, And, respectively, there are more opportunities for earning.

In Russia, the concept of "reporting season" has not yet been adopted in its full sense, since not all of our public companies adhere to the American schedule.

The season of reports is the time during which companies and corporations provide data on their activities.. Each company or corporation issues four quarterly reports that reflect data on the current income of the company, its revenue and EPS.

Every intraday trader who understands how to trade active securities earns most of his profit during the reporting season. For a large number of intraday traders, it is the seasons of the reports that provide the bulk of the profit from trading in the stock market.. This is related to, that the day trader gets a big advantage, when large institutional investors, funds and other large equity holders begin evaluating and reorganizing their portfolios. At this time, there are strong movements in the shares of reporting companies., since major players are selling shares of companies, which give negative returns, securities of promising companies are being bought, which are undervalued by the market or have fallen in price due to the release of bad reports, and the profit is recorded on the securities of the companies, who have already given projected profit after the release of a good report.

14 useful tips

1) Spend a little more time preparing

Read the briefing at night and in the morning. It should become a daily habit for you.. During the Earnings Season , after Closing you need to read all profit statements, and choose the most suitable stocks for you. During the Earnings Season, preparation should take place in two stages:

- preparation at night

- preparation in the morning

At night, you have to develop several trading ideas and prepare them completely - so, as if it happens in the morning. You must build a plan for each of these ideas.. You must be sure, that you have great ideas and you know, how will you make money tomorrow.

2) Share your best trading ideas with others

When you spot an important level in a stock, which you trade, share this information with the group.

3) Take a rest

These are our final series of games. Take care of yourself and be ready to take part in them.

4) The most common orders to buy and sell

During the Earnings Season , stocks make huge up and down moves. And these movements can be higher or lower than that, what do you expect. Purchase requisitions may seem unlimited, and the sell orders are endless. Share opened in growth 5%, may take more 10%. At the start of the Earnings Season , you can have a mental attitude during the offseason. You need to realize, that you have entered a different period and the movements may be stronger, longer and cooler.

5) "In Game" promotions can be "in play" all day long

During the Earnings Season , In Play stocks can provide excellent reward-to-risk ratios in all-day trades. You often have to be careful in the middle of the day.. The best trading opportunities appear at the Opening, but during the Earnings Season , the promotion can be "in play" all day. And so the statement, what's in the stock, which has just been reported, we in the middle of the day can't have the advantage, wrong.

6) Promotions can be "in play" for several days

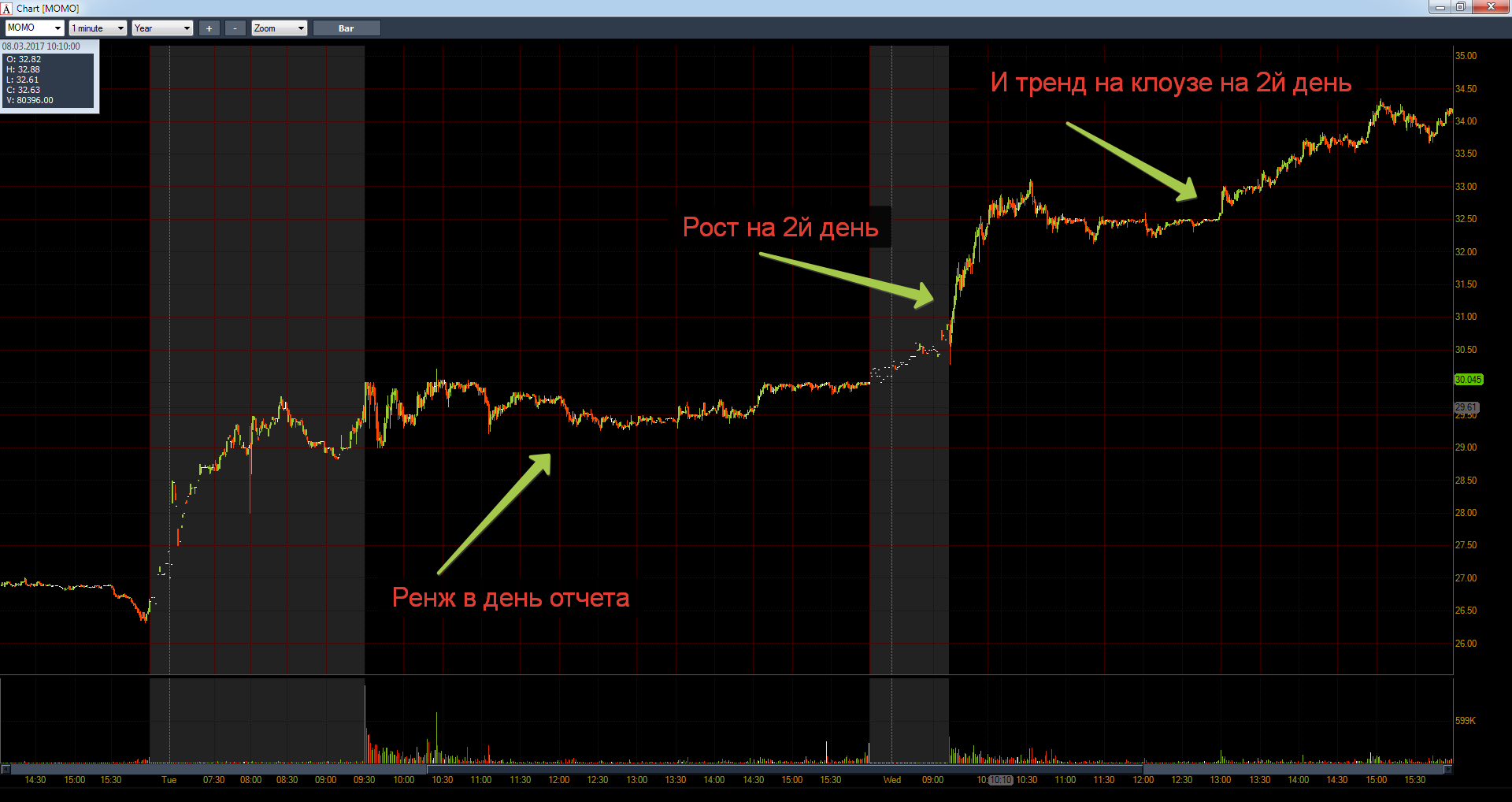

First, Day 2 and Day 3 can provide great trading opportunities for the stock., which has recently been reported. On Day One, set alerts for important stock levels. And trade from these levels. Some people prefer to trade stocks on the second and third days. Volumes below, and the tape is easier to read. But they determine these levels on the First Day, and get profit from them all the following days.

7) Not too much spray.

During the Earnings Season, a huge number of opportunities are provided. But you should only focus on a few. If you try to follow too many stocks, then you will expose yourself to the risk of ineffective work on this large number of shares, instead of, to work effectively on multiple stocks.

8) Premarket and Postmarket levels are very important

Follow that, how shares are traded. look, can you see the points of change in the behavior of the stock - inflection points. Also, watch that, how the stock behaves immediately after, how the numbers are voiced in the reports. Sometimes a stock can panic at first, and then return to the place. This panic may be an indication that, that there are short-term speculators in the stock, especially, if significant volume is present during the downward movement. That's why, if the next day you see weakness, you can expect an unusually strong downward movement.

- Notice, how the stock was traded on the postmarket. If in Premarket it trades higher, than in the postmarket, then this is a bullish signal. If in Premarket it is traded below, than in the postmarket, then this is a bearish signal.

- Notice, where in the Premarket passes the most volume. For instance, a stock can show most of its volume at the level 30.50. Use this level. If the stock is trading above it, then open to long. If lower - short.

Recognize Premarket and Postmarket levels in your promotions. If AAPL cannot trade above 93.50, use it as a resistance level. If AAPL Can't Bid Below 92.60, use it as a support level. For instance, open short on AAPL and stay in it until then, while she keeps below 93.50, and if AAPL breaks 92.60, then ask yourself, is AAPL going to start breaking down.

9) Recognize patterns during each Earnings Season

Patterns evolve during each Earnings Season . pay attention, do stocks with negative earnings tend to close at lows, or do bounces. note, will a firmly managed stock end the year at its highs?. note, are these, stocks that tend to trade well, at the closing. Models will appear. Each Earnings Season of Earnings is unique. Work on that, to recognize these patterns.

10) Do not enter a position during a conference call

If you are studying a share, which was reported, find out, when the company has, holding this share, there will be a conference call. If you enter a position right before or during a company conference call, then you will not imagine the real risk.

11) Know, when will a report be given on your promotion?

In the afternoon, check which shares will be reported. If you are trading ADM before the Close, and after Closing a report will be given on it, she may make some weird moves before Closing. Traders can start positioning themselves before the report. If you do not have this information and are trading a stock, you may not be ready for these strange and abrupt movements.

12) Zoom in size deal

More liquidity during the Earnings Season. You can increase your lot size. Entering and exiting promotions will be easier.

13) Focus

Unfortunately, the market does not care about your personal problems. Earnings Season is our best opportunity to make money. This is the business of the end result. Stay in the workplace as long as possible, concentrate as long as possible. Take care of yourself and don't get sick. Get ready to participate in deals.

14) Volume

Stock with an average daily volume of $3 million. can give $20 million. after the release of the report on it. The sudden increase in volume can affect your ability to read the tape. Think, whether your share will be too large, even if she is on average in your comfort zone.

A LITTLE OF THEORY

When evaluating a company, any investor looks at the fundamental indicators - profit, revenue, debts, etc., therefore, the report always remains the most important news for the company, accordingly causes both the strongest reaction and stock movements, therefore, trading reports is always a priority for us. Statistics say the same, almost all the best months for most traders fall on the report seasons with very rare exceptions. Yet 10 years ago, when I first started trading, we were immediately taught, what traders should earn 4 once a year - during the reporting season, it was, is and, I guess, will always, it happens because, that all publicly listed companies are required to 4 publish a quarterly report once a year. Report seasons run in January-February, April-May, July-August and October-November.

Traditionally, the start of the reporting season was considered the day, when Alcoa released its report, but now this company has long since lost ground, was excluded from the Dow Jones, and has recently released a report in the middle of the season., therefore, the day is now considered the opening of the season, when the first largest JPMorgan banks report, Wells Fargo и Citigroup. The season usually lasts 3-4 weeks, but the winter season is an exception - it stretches for almost a month and a half.

The report document is provided in SEC (Security Exchange Comission) and is called Form 10-Q for a quarterly report and 10-K for an annual report. The company is obliged to provide it within 45 days after the end of the quarter – it is a large document with several tens of pages, containing a huge amount of text and numbers, US, of course, no need to delve into all these details, but there are some of the most important indicators, such as EPS and Revenue.

EPS (Earnings per share) - financial indicator, equal to the ratio of the company's net profit, available for distribution, to the average annual number of ordinary shares, that is how much the company earned per share.

Revenue - revenue from sales from the main activities of the company for the reporting period.

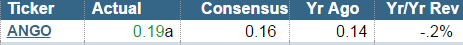

By themselves, these numbers say little., the main thing is, to what extent these figures coincided with the consensus of analysts' expectations, and even if, for example, revenue increased, but was still below analysts' expectations, then the reaction to such a report is likely to be negative, therefore, we are most interested in situations where the largest discrepancies between actual figures and expectations are where the strongest movements are possible.. But don't get too carried away with these numbers., there will be a lot of reports, very little time, therefore, if you also delve into reading these reports, then nothing will be possible to be in time.

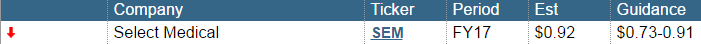

Another very important point, this is Guidance - the forecast of the company itself, they can give it as together with the report, so on any other day. Guidance is often even more important, than the report itself, because it says, what the company expects in the future, and the report reflects the events, which have already happened.

RESEARCH IN SEASON OF REPORTS

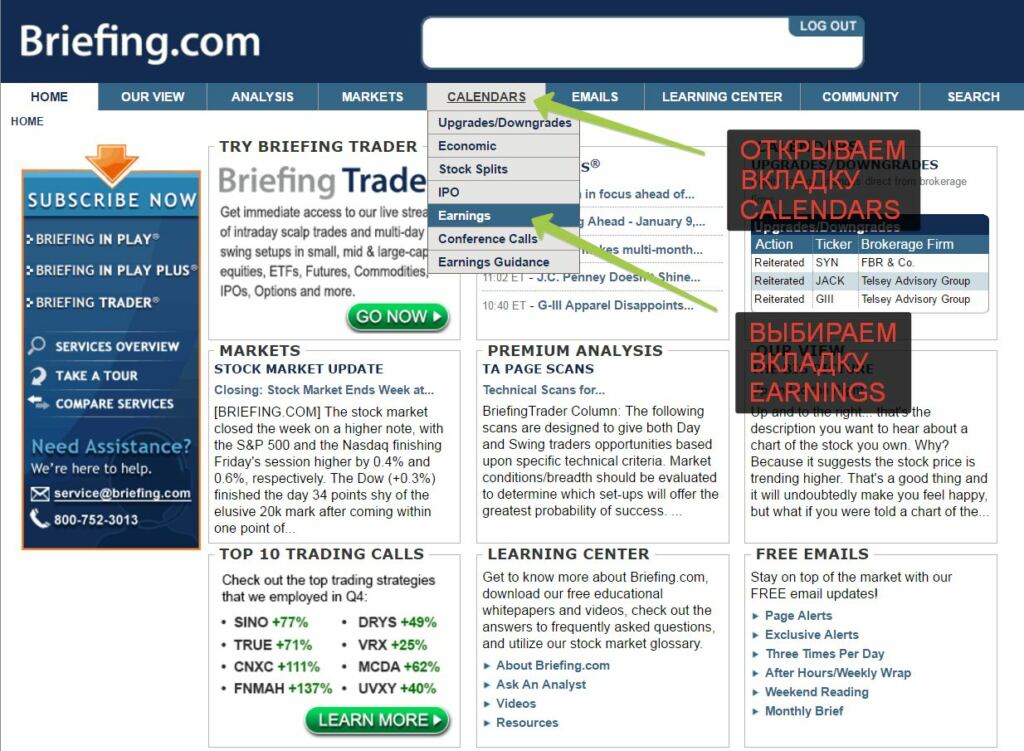

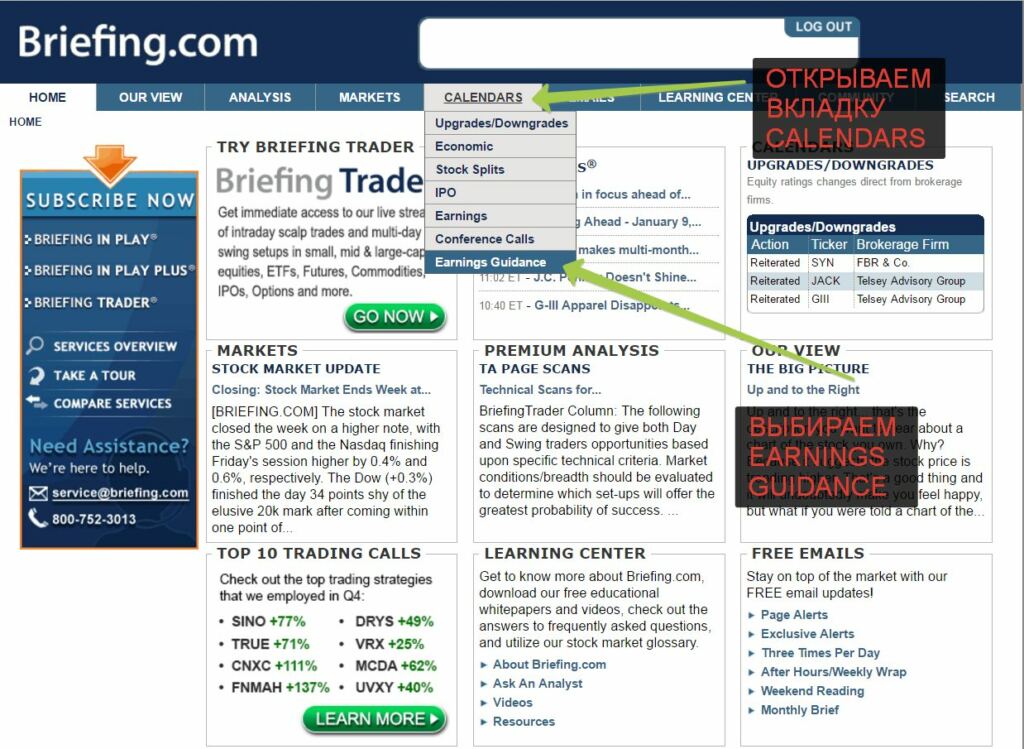

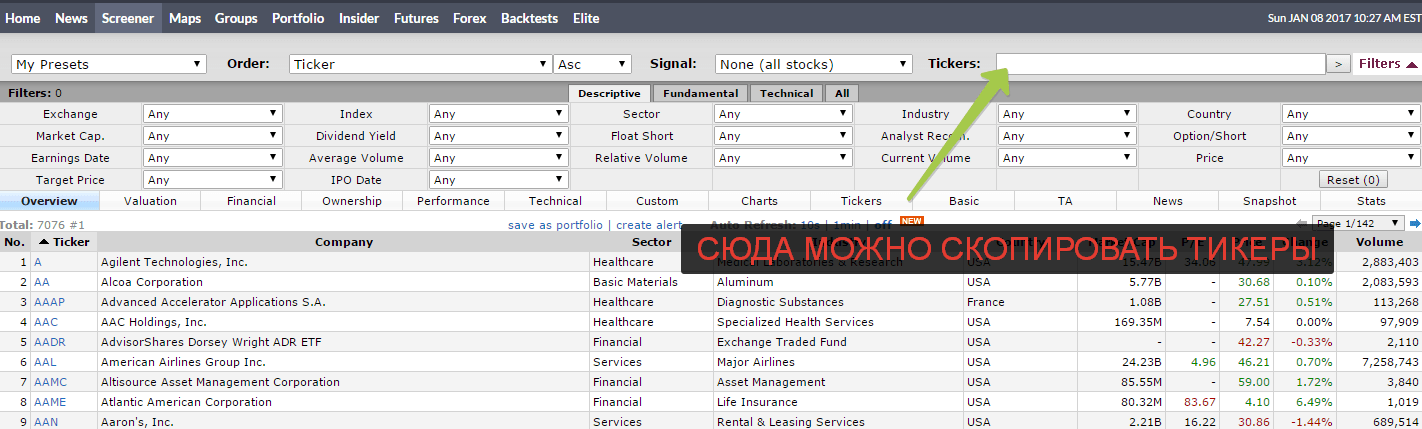

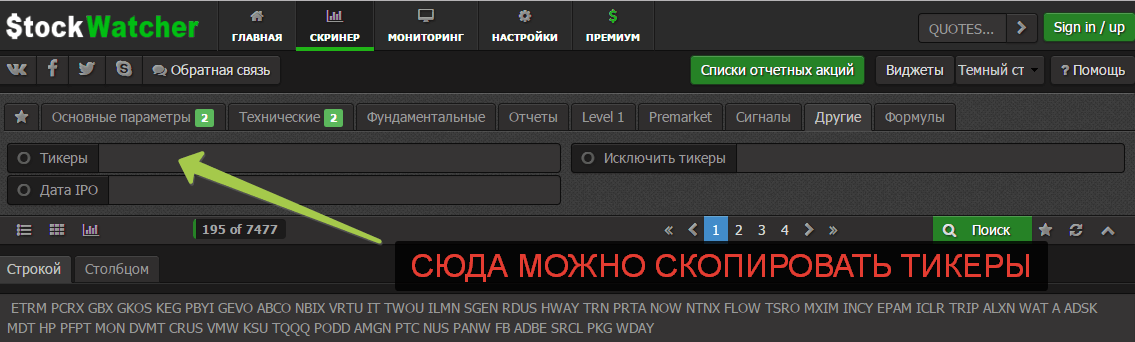

Research we usually do on the Briefing website, in the section Earnings calendar. To view calendars, you need to register, it is free. Be sure to watch today's reports., and yesterday's after the close - after all, the main volumes pass during the main session, and accordingly those reports, that were released yesterday after closing, most traders will trade today. For convenience, you can copy the list of tickers from the site directly to the watchlist (press ctrl and select the list of tickers, available only in the Mozilla Firefox browser), you can also copy and run them through the screeners Finviz или Stock-watcher, with customized filters, to immediately weed out something, what is not suitable for you for trading, and from there already copy to the terminal, so as not to look at all the trash, pennistaki, illiquid and tp.

The main thing we look at before the opening is the reaction to the aftermarket and premarket sessions, as well as key levels on daily charts.

SPECIFICITY OF WORK PER SEASON

Trading in the report season is very interesting, the probability of earning is much higher, there are a lot of in play shares, levels are worked out much better, more patterns.

First you need to say about, that you should be on full alert for the reporting season, in good spirits and full of energy, that's why, desirable, do not have protracted unprofitable series, big disadvantages, but ideally you need to have some kind of pillow, because it has a very strong effect on confidence, so be very careful in terms of risks in the offseason, do not dig yourself a hole, from which you will need to get out. Fighting off is always much more difficult., how to earn, trader, profitable trader, or in the red are two different traders.

Reporting season structure

Each report season can be roughly divided into 3 parts. First comes, one might say, warm-up, this period takes about a week and a half, when not many companies are reporting yet and mostly, not very interesting for trading, such as large banks. This period must be passed with caution., because many traders think so, that once the season has begun, you need to push and earn, but it's not, it's time for that, to try to pick up a small pillow with small pluses, so that by the main part of the season we have the opportunity to increase risks, limits and volumes, but it's hard to do, if this pillow is not there.

And the main efforts should be directed to the next, the most active part of the season, somewhere in a week and a half after the report of the largest banks, when the largest number of these same reports begins to appear in slightly smaller companies. On the hottest days we will see 200-300 reports, Research will take a huge amount of time, there is so much movement on days like this, that you can find stocks and patterns for every taste, and there will be practically no time to rest.

And then the most dangerous period of the reporting season begins, its end, when there are still quite a few of these reports, but there is more and more garbage, small-caps, illiquidity. A plus, the closer the end of the reporting season, the more information investors have on the reports that have already been released, that's why, probably, many expectations will already be in the price. It is very important to notice this moment., when you need to sharply reduce the speed, it's like going off the big autobahn onto a country road, if you don't slow down in time, you can plant a lot of money, especially if you made good money, don't throw money away, they will still be very useful.

Risks in the reporting season

As already mentioned, in the early stages of the reporting season, you need to start very carefully, do not press and try to fill some kind of pillow, trading with your usual limit.

In the main part of the season, it is very important to try to maximize, increase the topic limit, who has such an opportunity and take large, than usual, positions, but not everyone has this opportunity, that's why, if you cannot raise your limit, or the results do not allow – try to reinvest profit for the day, a little plus - increase the size of positions in good trades, but, naturally, within reasonable limits, if you usually trade 100 stocks - take 200-300, trade 300 - take 500-600 etc. Report season doesn't mean it, what you need to shove and trade everything, this means, that you need to work harder, view more promotions, but you still need to wait for understandable, the right situations and be prepared for, that there will be many more, than in the offseason.

Volatility in stocks increases dramatically during the season, so try to raise the profit bar, if on a normal day it is good for you to pick up 40-60 cents from a share, then in the season you need to be ready, that stocks can move in dollars, therefore you need to try to incubate large movements, but not forgetting to fix a part of the profit, it would be good to leave part of the position, to get bonus movement, which are much more frequent during the season.

As soon as the main part of the season ends, you see less and less interesting stocks, situations, patterns, feel, that making money is getting harder - this is the time when you need to slow down sharply, reduce the limit and size of positions to your normal size, but ideally this normal size should now be a little larger for you, what was before the start of the season, but here everything can be individual depending on your results.

In our risk monitors and office, I see the results of many traders, therefore, you can more or less objectively assess the quality of the market and will always help you with this in our broadcast, I will prompt, when to push, when to slow down.

What do we trade

If in the off-season we trade all the news, upgrade/downgrade, mergers / acquisitions, rearrangements in the leadership, fda approval, technique, etc., then in the reporting season, you need to focus almost exclusively on reports and guidance. Many traders, dreading this volatility, start looking for "safe" trades with little risk, and trade absolutely uninteresting stocks with weak movements, but after all, all the money of speculators goes exactly to reporting shares, that's why money is made there, so you need to overcome yourself and take a little less shares, slightly less trades, but trade those stacks, where there is good volatility.

Also, be sure to look at the shares on the second day after the report., because often on the first day, a stock can be traded in a very dirty way, hard, shaking everyone out of there, and the next day often, when traders' attention turned to other news, becomes much more technical and cleaner, so do not forget about them and be sure to leave them in your watchlists. The main criterion for the selection of such stocks is the close near yesterday's highs and lows., as well as breaking through important levels on daily charts

A couple of examples, why it is worth leaving yesterday's reports:

Timing

Many traders combine work with trading, but if there is such a possibility, be sure to try to devote maximum time to trading during the reporting season, it might even be worth taking a vacation for this time, because in the offseason we know, that the main movements take place sutra and at the closing, and at lunchtime, most often it is calm, in the reporting season, everything is very unpredictable and changeable, stocks can move at any time, on some day the whole movement happens sutra, but nothing on the close, some day on the contrary, and there can be good moves at lunchtime, therefore you need to try to stay behind monitors all day, making only small pauses and always be ready. Also don't forget, that there are a lot of reports, therefore, you need to start the working day early, to have time to prepare well.

Conference Withall

Conference call, where the company's management comments on its financial performance, talks about plans and periodically gives guidance. Naturally, it can give very powerful impulses in stocks, and besides, often such movements can return back, therefore, reversal patterns work very well there. If you are sitting in a position, that is, it makes sense to look at what time the conference call takes place all on the same Briefing site, so as not to get into a sharp takeaway.

Anticipation Move

Many large traders and funds, lay their expectations on, what indicators will be published in the report and are betting on it, plus insiders, who know what report will be released, take positions even before the report is released, what can give strong movements on the day before the report. If you don't have enough stocks to trade, during the day you can see what shares are reporting today after closing or tomorrow before opening, And, seeing there increased volumes and signs of a trend formation, we can join this movement.

Intraday reports

It happens sometimes, what is the information leak, and the data of the report becomes known before the official publication, this happens rarely, but you need to watch out for this, because there might be a good deal opportunity, while the market has not yet had time to evaluate the report. Such promotions will appear on filters, in twitter or our chat.

Correlations

During the reporting season, especially in its early stages, you need to try to watch shares from sectors, where some large company reported, market-mover, because they can pull the whole sector with them, and often happens, that companies from his sector are trading cleaner and more interesting, than the reporting company itself. You can see the stocks and the sector on the Finviz website. There are also just very correlated pairs with very similar charts., which are often traded almost identically, for example - LH and DGX, RCL и CCL.

"Feature" of the season

Almost every season of reports, from the very beginning, you need to try to find some kind of general pattern, specific to the current season, may be specific pattern, or some kind of repetitive situation, what are the situations on the daily chart, maybe timing. For example, if we notice, that day after day they drain gepaps on good reports, then we can pay close attention to them the next day and the rest of the season, if it continues to work and make very good money on it, so analyze the charts every day if possible, your notes and look for such a "chip", the sooner you find her, the better results you can achieve.

WHAT TO DO, IF DOESN'T WORK

Unfortunately, sometimes it happens, need to be ready, that even in the reporting season, someone may not succeed, and it can be very unpleasant psychologically, but you must understand, that it happens periodically for everyone, and that doesn't mean, that everything is gone, you are a bad trader, etc.. When volatility rises like this, a lot of movement, then the risk of cramming where not necessary increases, trying to catch up with something, do not miss the trade, these many bad habits creep out even more and you need to try to keep a cool head, despite, that everything is moving, growing, falls, everyone earns. Don't take the season as your last opportunity to make money, now or never, and in no case try to make up for the "under earned", especially at the end of the season, otherwise, you run the risk of starting to press at the most inopportune moment and in a bad mood. There will be many seasons, various events on the market occur regularly and there will still be opportunities to make money, so even if you fail, do not torment, don't beat yourself up, draw conclusions, analyze trades, patterns, mistakes, send deals for analysis and everything will work out!

Why is it easier to make money in the reporting season?

Price movements, which are caused by the actions of major players during the reporting season, amplified by inexperienced investors, prone to making trading decisions under the influence of emotions from euphoria to panic. This is most often due to the fact, that they do not understand that the price movement in 5, and sometimes 10 percent of the share price, on the report, this is quite normal and emotions begin to govern their trade.

It is the heightened interest in that lil another paper, as well as high volatility allow you to make good money in reporting paper. It often happens like this, that the reporting paper easily breaks through strong support or resistance levels, which lasted for more than one week or a month. On the report, the paper can easily update the annual, or even an absolute price extremum. However, the main advantage of the shares of the reported companies is that, what is most often missing in them correlation with major market indices.

How to select reporting papers?

At the height of the reporting season, the number of companies publishing data on their activities can be very large and it will be simply impossible to keep track of all of them.. But keeping track of a huge amount of securities is not at all necessary., as for a good profit, within one trading session, a few good entries are enough, the trader needs to select the best stocks and follow only them.

In order for the best securities of the reporting companies to appear on the trader's main sheet, it is necessary to perform several actions:

- View stocks of those companies in the calendar of reports, which reported after the close of yesterday's trading session and copy them for further evaluation. The report calendar can be found on almost any information resource for traders.. The most popular are foreign: Finviz, Briefing, Streetinsider and Domestic Stocksinplay.

- Stocks copied in the report calendar need to be assessed. To do this, paste the copied tickers into “watch list” need to evaluate them charts.

- The main point to which you should pay attention in the first place is the presence of an active postmarket in the action. . If the paper was not traded on the postmarket, then most likely it will not be of any interest to the intraday trader in the upcoming trading session.

- After promotions “filtered out” according to the active premarket, you should evaluate the stock by the presence of a trend. This must be done because, what's in the promotions, which have been in a narrow price range for a long time, no major players, and it follows from this, that the probability of good movement in them tends to zero.

- The next step is to evaluate how the paper went on previous reports.. The important points here are the presence of a trend and the traded volume.. These parameters can be used to assess the possible interest in the paper on the part of major players and the approximate potential of the upcoming movement.. Then decide whether the stock is suitable for the trader's trading system and whether the expected movement will be enough to comply with the risk / reward ratio in the future trading position.

- After evaluating the charts, you can proceed to the evaluation of fundamental data. To do this, on specialized services, you need to evaluate the report itself on paper. To do this, you need to pay attention to the expectations of company leaders or some negative forecasts.. You need to see how much the stock has fallen in price or has risen in price over the past quarter and how many shortists are in the stock (short float parameter). It will not be superfluous to have information about, what does the reporting company do, where it is in relation to other companies in its sector and the correlation of its price movements with the sector as a whole.

After the selection of shares on the postmarket and premarket (the selection of shares at the premarket is carried out in the same way as the selection at the postmarket half an hour before the opening of the main trading session) you need to determine the best papers (most often their number will not exceed 5-7) and put them on “main sheet”. Selection of the best securities is carried out when determining strong levels, to which the price is likely to react, and the greatest potential for possible price movement. The rest of the shares are carried over to “additional sheet” in order to return to it if the papers of the main sheet become uninteresting or work out trading ideas, since the papers of the main sheet usually give good entry points during the first hour of the trading session.

How to trade stocks during the reporting season?

When trading reportable securities, one should understand, what are these so-called papers “in play” (in Game). Trading such securities requires special care and compliance with risks.. Promotions “in Game” can give good money, but they can also significantly reduce the deposit of a novice trader. It's all about sharp impulse movements, which most often occur in the first half hour after the opening of the trading session. The set stop orders may not be saved from these movements, as a result of which “slippage” (worst order execution) can reach several tens of cents. Therefore, when trading news papers, beginners should be extremely careful and try to stay out of the market for the first half hour after the opening of the trading session.. You should not give in to emotions and try to follow the trend in a well-growing or falling paper just because of thoughts about, that the potential profit is now going away. Regardless of how this or that stock moves, you must always wait for your entry point and only after that enter the deal.