Home Depot (NYSE: HD), Lowe’s (NYSE: LOW) And Toll Brothers (NYSE: TOL) are major players in the US construction sector. Not so long ago, all three companies made public their financial statements for the last quarter.. We believe, that this is a good opportunity to talk about the prospects and difficulties of the American construction industry.

What do they earn

We already had investment ideas and reviews on these issuers. In this material, we will designate only the main. Home Depot and Lowe's sell building materials, and Toll Brothers - specifically the construction of residential buildings.

Reporting

Home Depot's revenue increased by 32,7 %, and profit - by 84,6 %, mainly due to operational activity. Lowe's revenue increased by 25,9 %, and profit - by 73,59 %. Toll Brothers posted revenue growth of 24,59 %, and profit increased by 68,97 %.

According to these results, it is perfectly possible to see, that companies have been able to unrivaled revenue by increasing the purchasing power of real estate in the United States, which has been going on for over one year. Let's figure it out, should they wait for the "continuation of the banquet".

Home Depot financials in billions of dollars, final margin in percent

| Revenue | Profit | Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 38,05 | 4,33 | 11,38% |

| 3 neighborhood 2020 | 33,54 | 3,43 | 10,23% |

| 4 neighborhood 2020 | 32,26 | 2,86 | 8,86% |

| 1 neighborhood 2021 | 37,50 | 4,14 | 11,05% |

Earnings per share of Home Depot in dollars

| Current | Forecast | |

|---|---|---|

| 2 neighborhood 2020 | 4,02 | 3,68 |

| 3 neighborhood 2020 | 3,18 | 3,05 |

| 4 neighborhood 2020 | 2,65 | 2,63 |

| 1 neighborhood 2021 | 3,86 | 3,08 |

| 2 neighborhood 2021 | — | 4,34 |

Lowe's financials in billions of dollars, final margin in percent

| Revenue | Profit | Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 27,30 | 2,82 | 10,31% |

| 3 neighborhood 2020 | 22,31 | 0,689 | 3,09% |

| 4 neighborhood 2020 | 20,31 | 0,973 | 4,79% |

| 1 neighborhood 2021 | 24,42 | 2,31 | 9,47% |

Earnings per share of Lowe's in dollars

| Current | Forecast | |

|---|---|---|

| 2 neighborhood 2020 | 3,75 | 2,92 |

| 3 neighborhood 2020 | 1,98 | 1,98 |

| 4 neighborhood 2020 | 1,33 | 1,21 |

| 1 neighborhood 2021 | 3,21 | 2,61 |

| 2 neighborhood 2021 | — | 3,92 |

Revenue in billions and profit in millions of dollars, final margin in percent

| Revenue | Profit | Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 1,65 | 114,76 | 6,95% |

| 3 neighborhood 2020 | 2,55 | 199,32 | 7,83% |

| 4 neighborhood 2020 | 1,56 | 96,50 | 6,17% |

| 1 neighborhood 2021 | 1,93 | 127,87 | 6,62% |

Earnings per share of Toll Brothers in dollars

| Current | Forecast | |

|---|---|---|

| 2 neighborhood 2020 | 0,90 | 0,69 |

| 3 neighborhood 2020 | 1,55 | 1,24 |

| 4 neighborhood 2020 | 0,76 | 0,47 |

| 1 neighborhood 2021 | 1,01 | 0,80 |

| 2 neighborhood 2021 | — | 1,55 |

Conjuncture

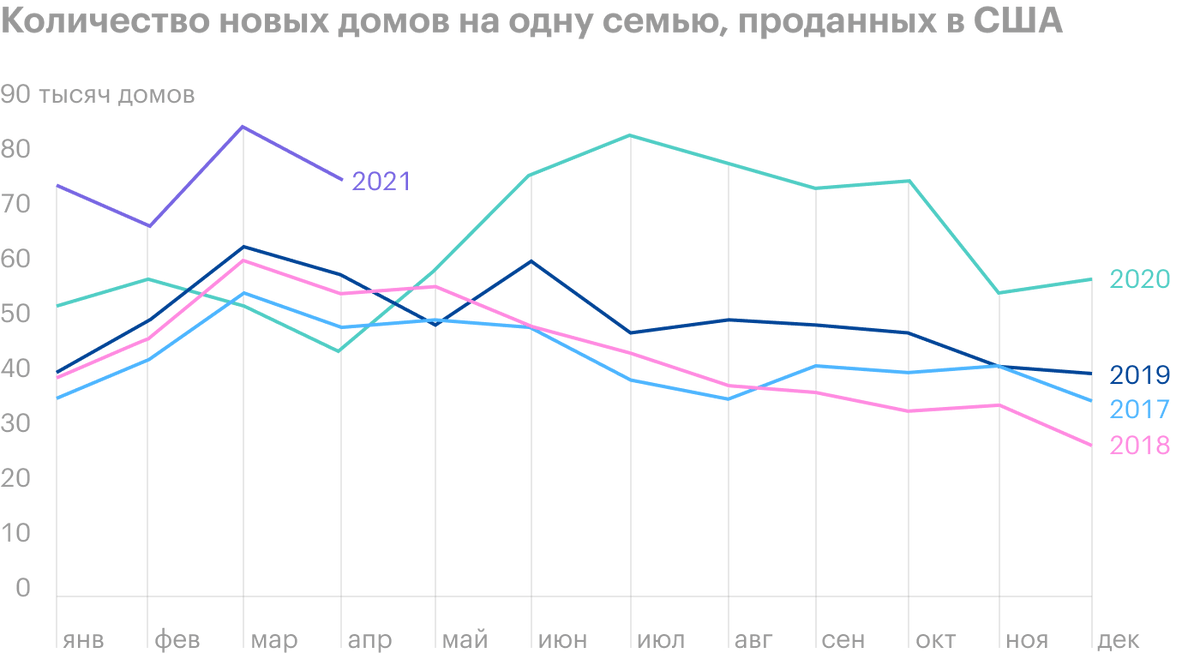

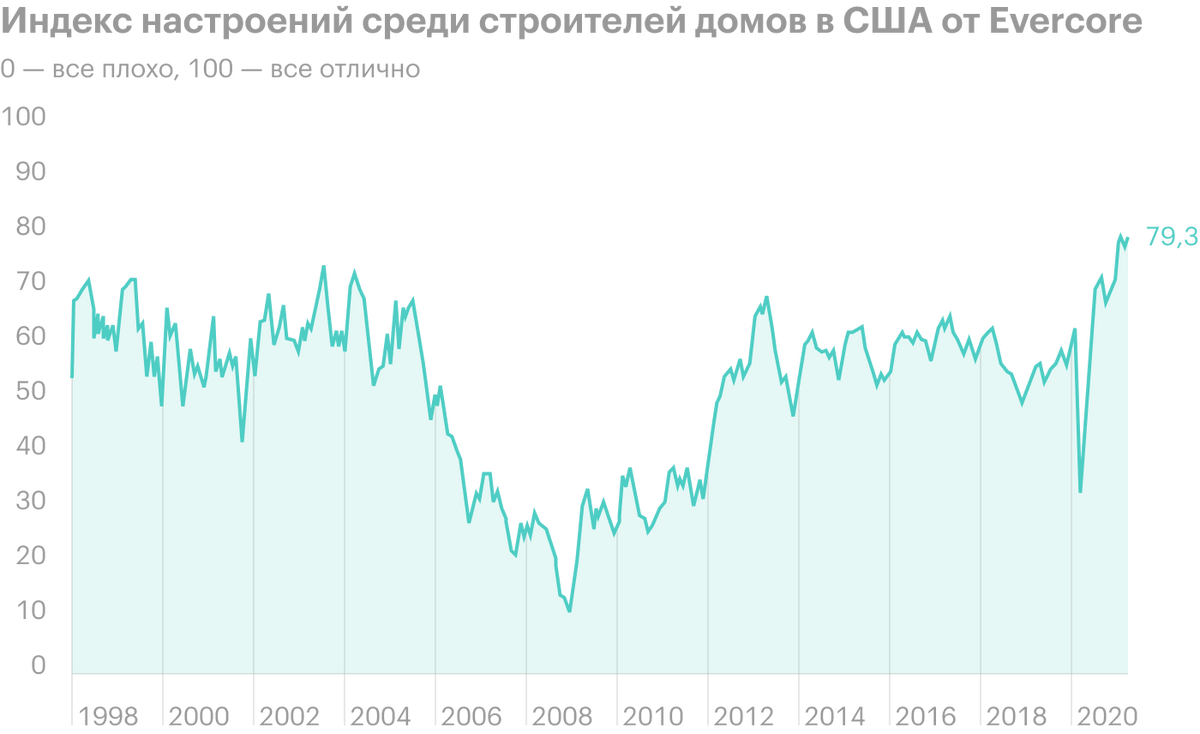

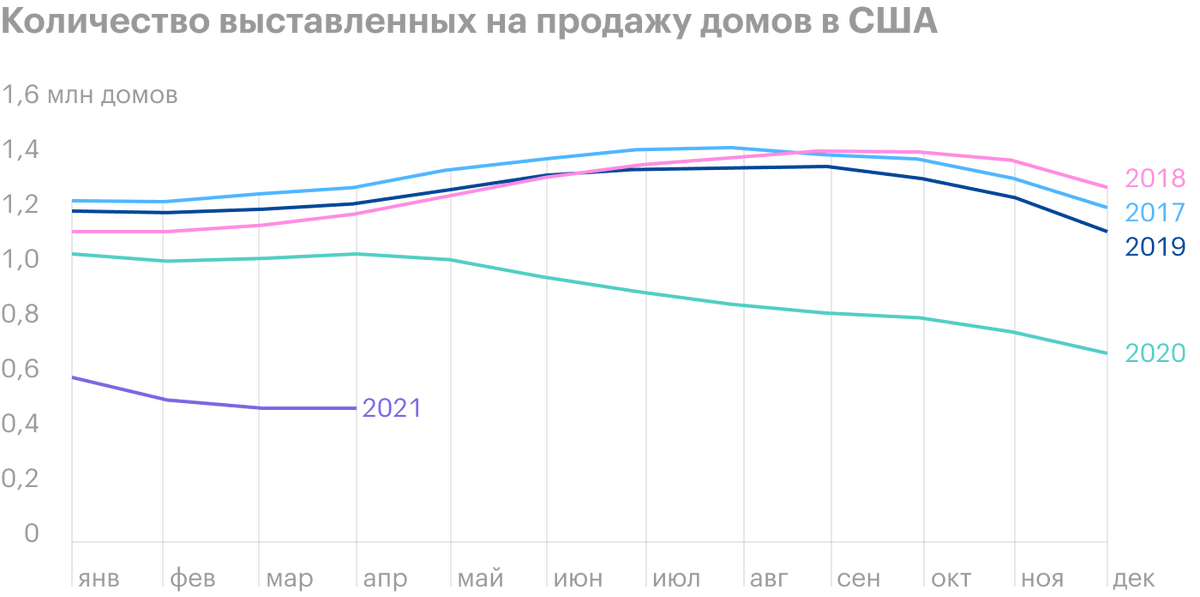

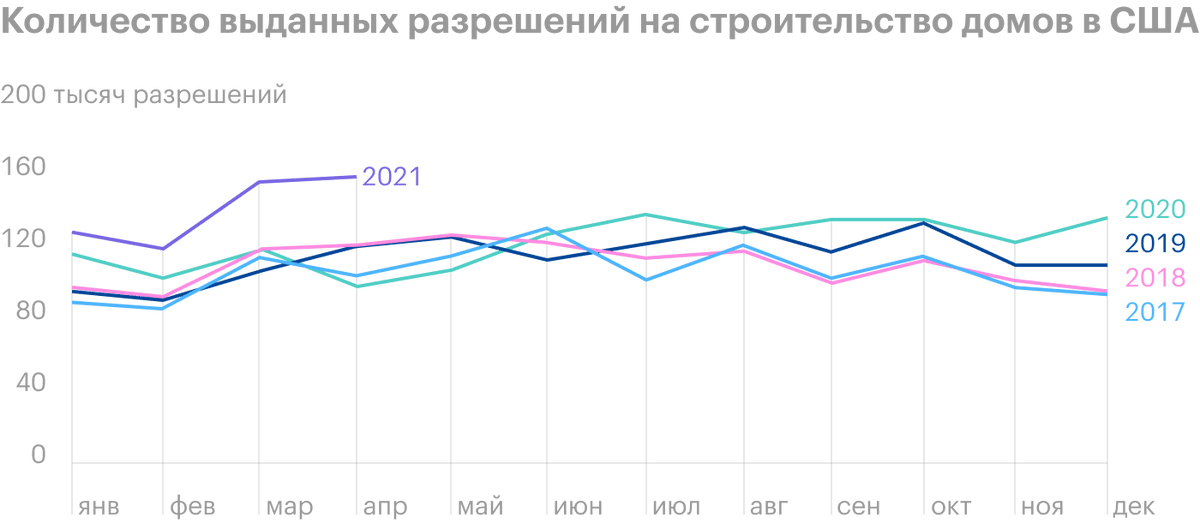

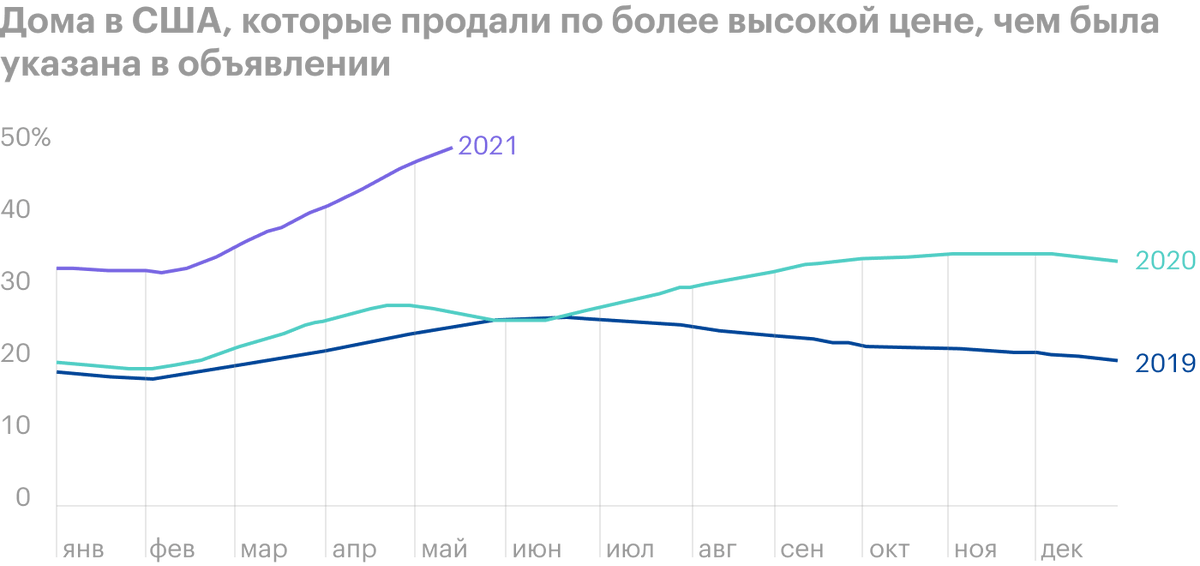

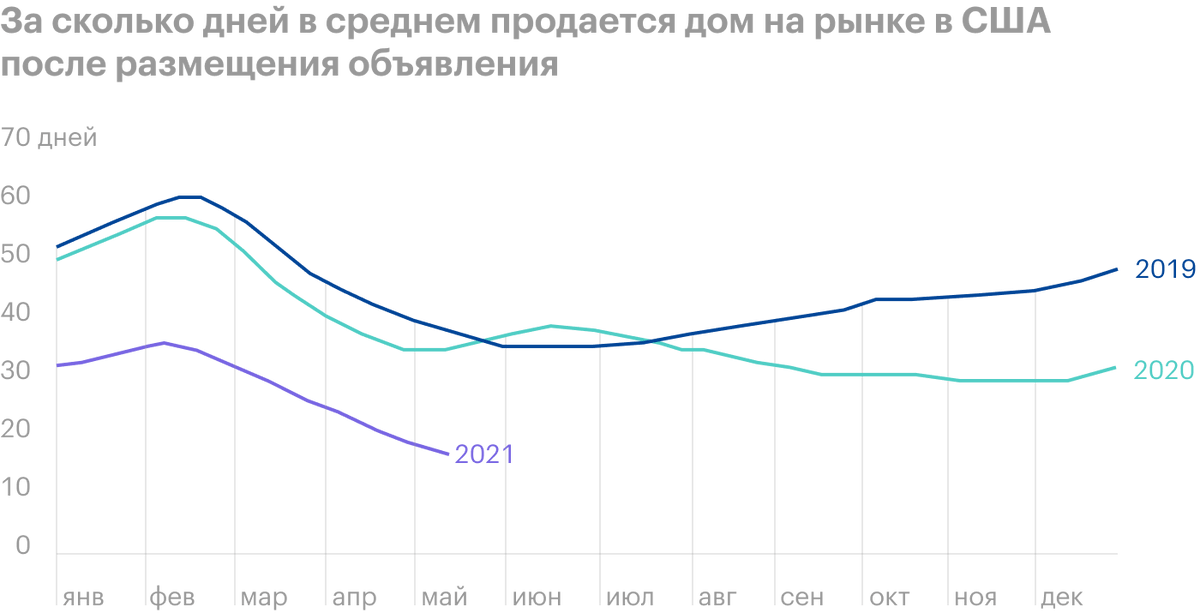

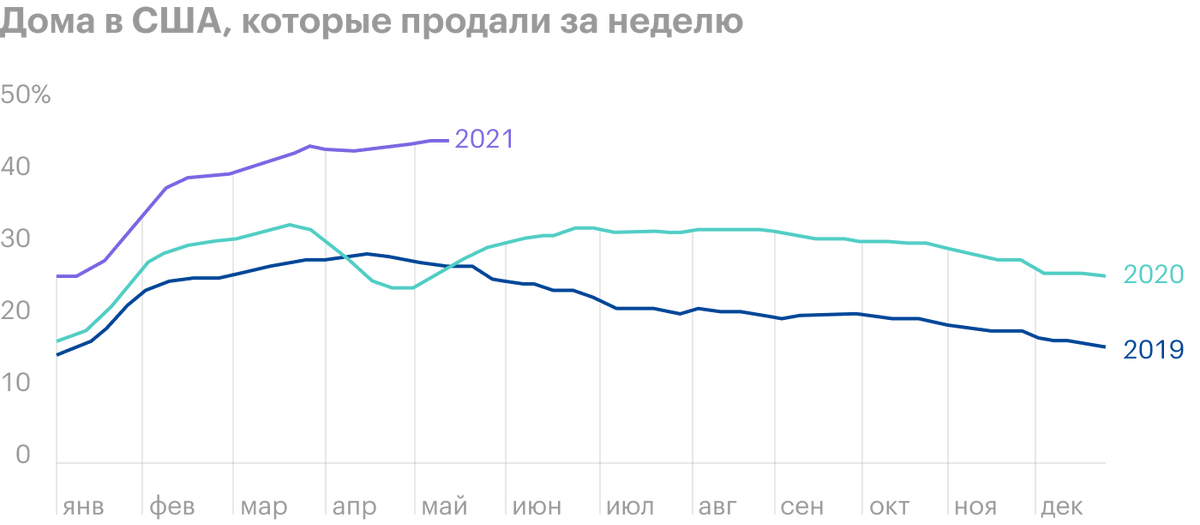

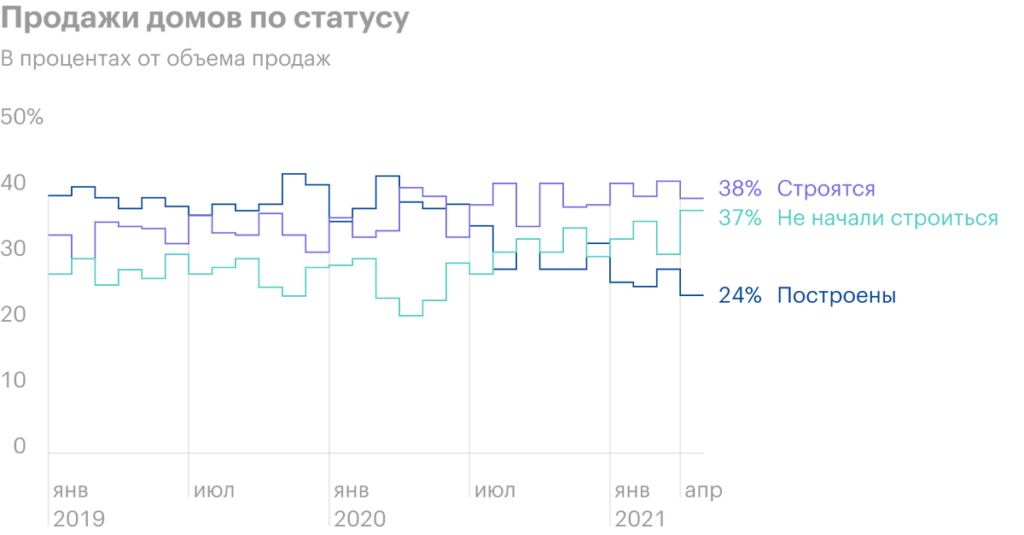

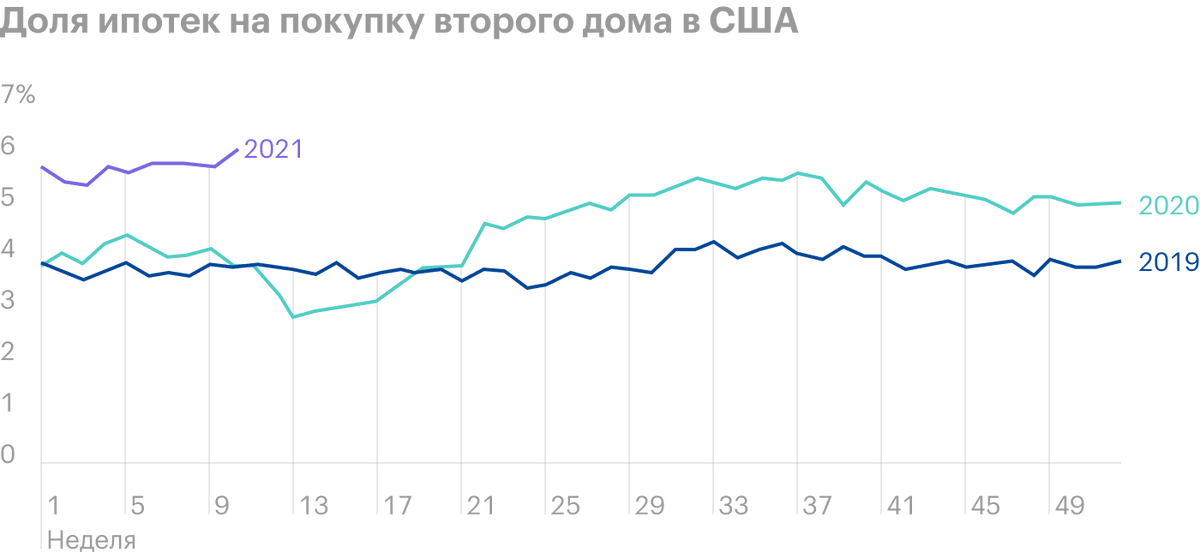

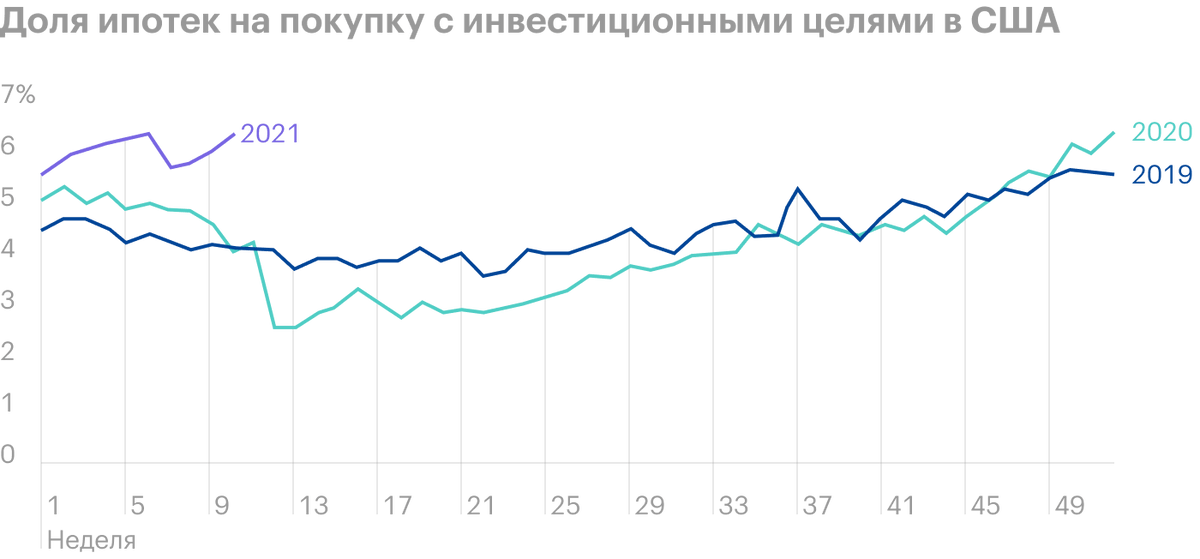

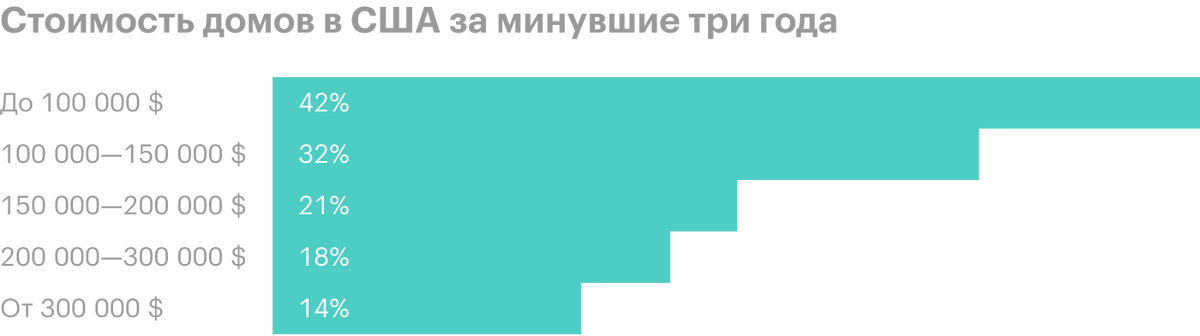

In general, the situation on the market for these companies is very positive.. In the US, there is a huge demand for real estate - houses are selling like hot cakes. Already in March 2021 year, the market set a kind of record: number of realtors 40% outnumbered houses, available for sale. At the same time, there are very few houses for sale in the USA., what with such demand means an increase in demand for building materials and services of builders.

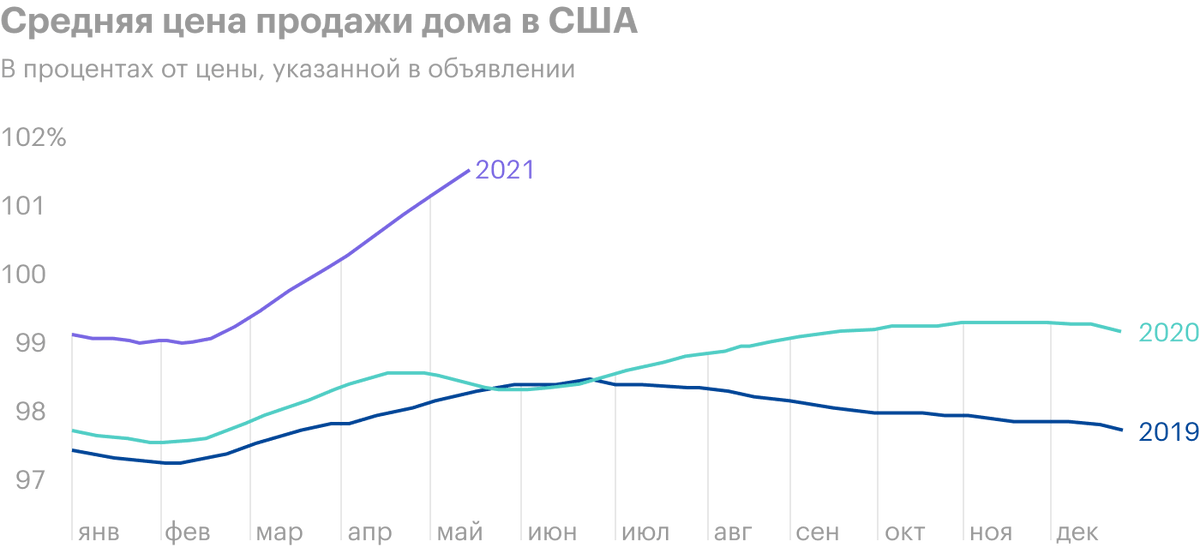

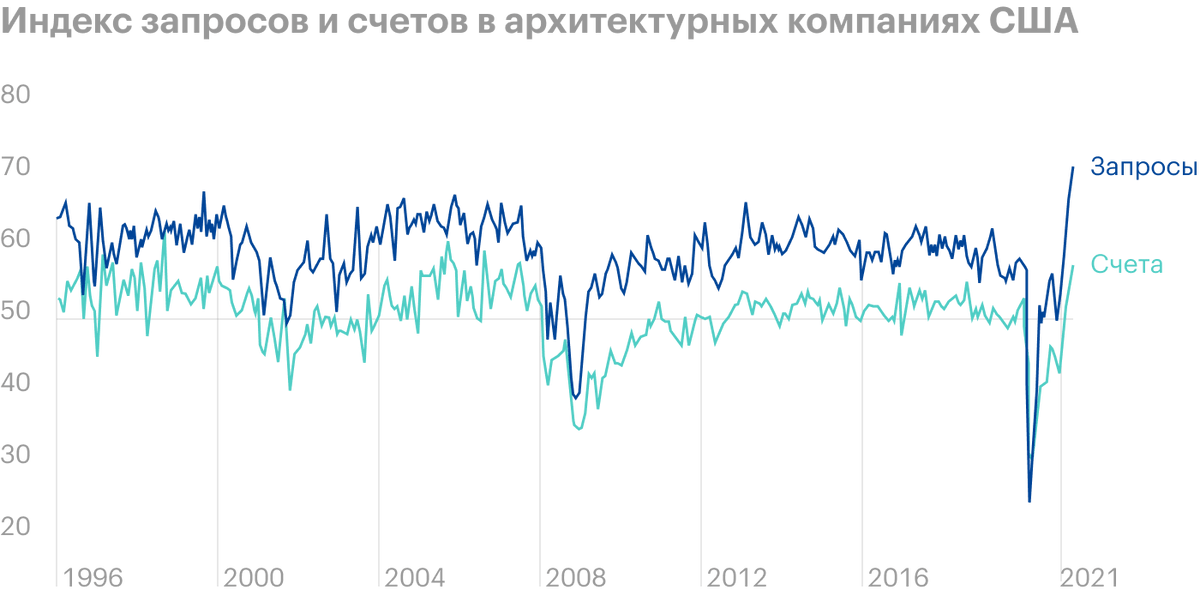

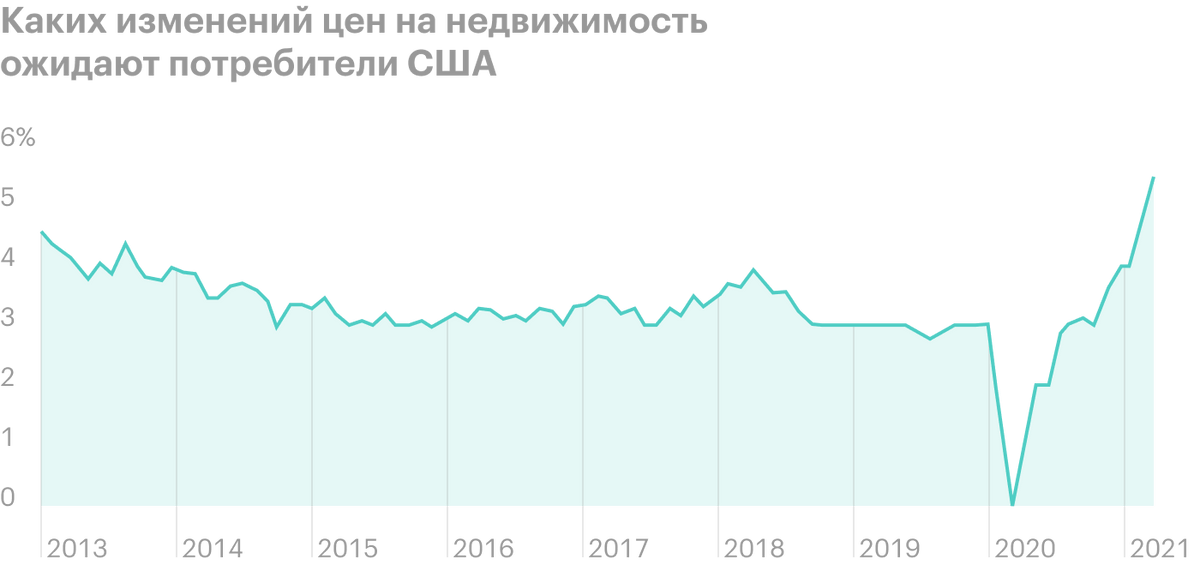

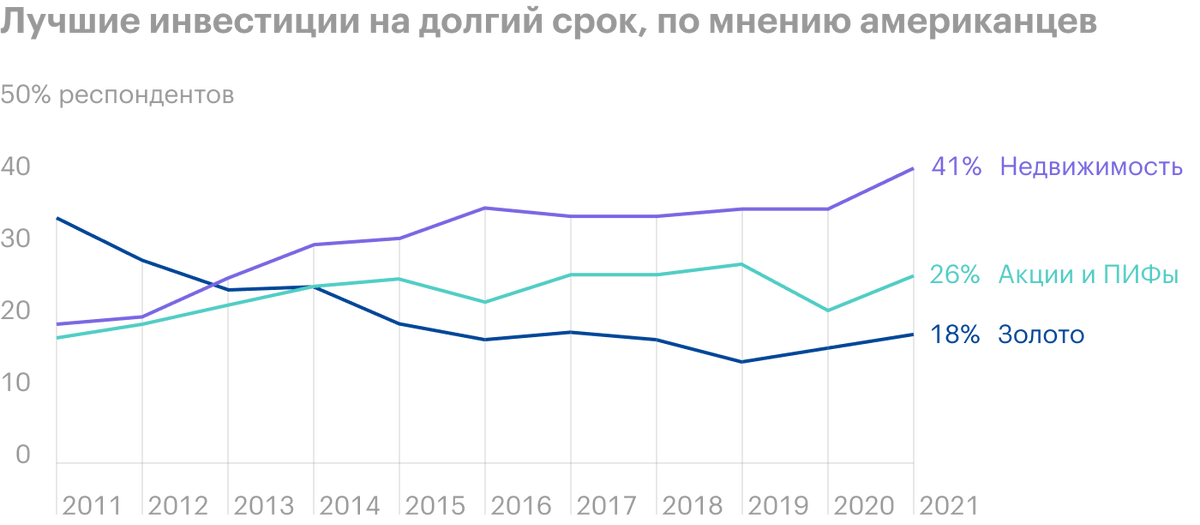

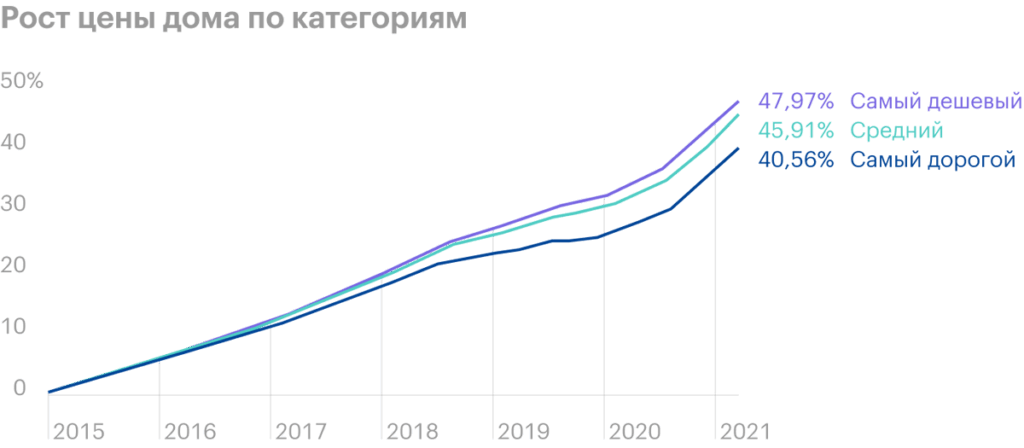

All this naturally leads to an increase in real estate prices - and an increase in the investment attractiveness of real estate.. Thanks to this, the demand for real estate will grow even more due to those, who invest in houses for purely investment purposes: for rent or for sale.

Yes, but...

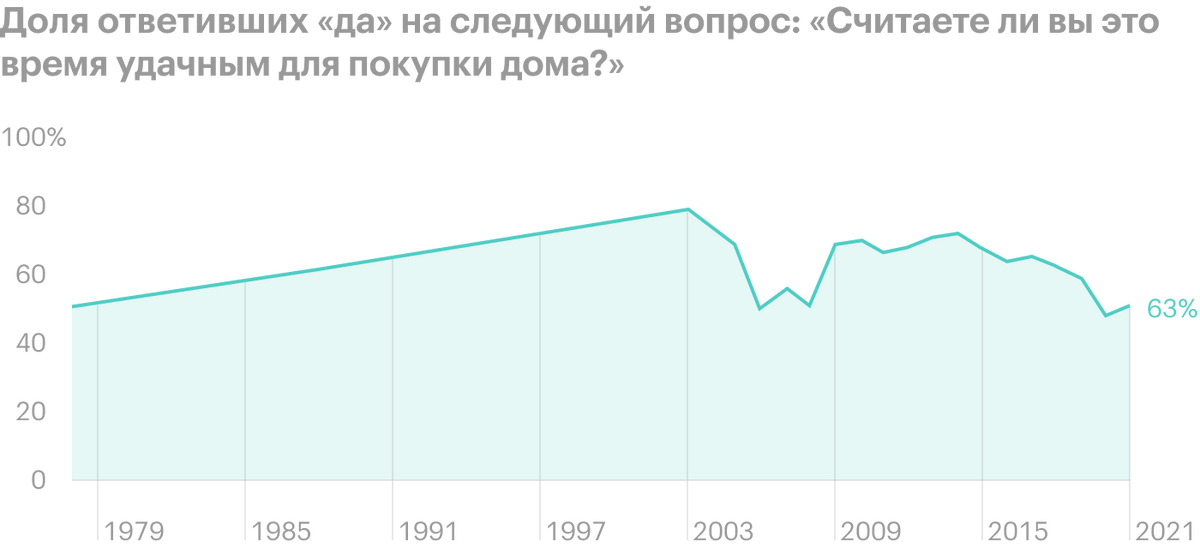

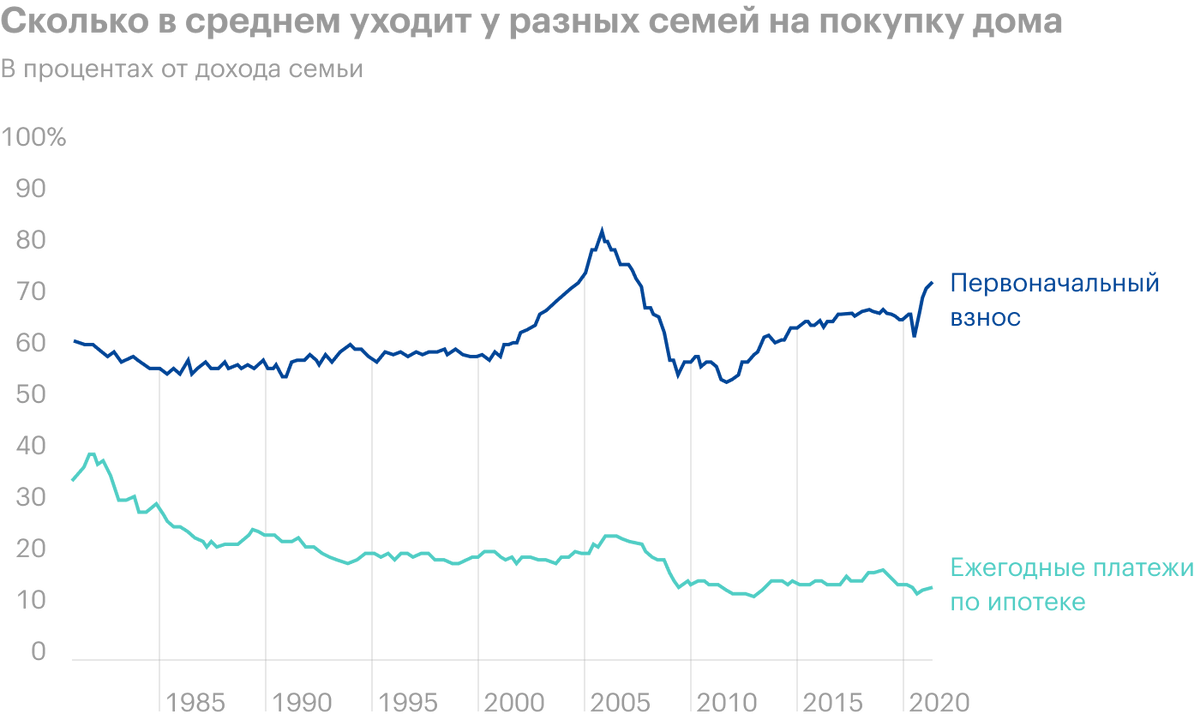

Real estate prices are rising too fast, and buyers in the US are becoming more cautious about buying homes.

Inflated prices scare off many potential buyers. So in theory, home sales could fall, which will not be good for our issuers. Certainly, can be objected to, that, by historical standards, real estate is not such an unaffordable luxury, but you should be prepared for a decrease in buying activity.

Problems for the construction business according to the owners

| October | December | April | May | |

|---|---|---|---|---|

| No problems | 38% | 30% | 24% | 21% |

| Houses do not reach the desired value | 28% | 42% | 50% | 46% |

| Buyers are not verified | 19% | 19% | 11% | 19% |

| Buyers hesitate | 19% | 18% | 19% | 40% |

| Other reasons | 8% | 5% | 12% | 10% |

| Theme competition, who resells | 7% | 6% | 2% | 3% |

How the rise in prices for building materials affected consumers

| Home renovation postponed due to finance | 44% |

| Not going to delay repairs | 56% |

Home renovation postponed due to finance 44% Not going to delay repairs 56%

Like a log

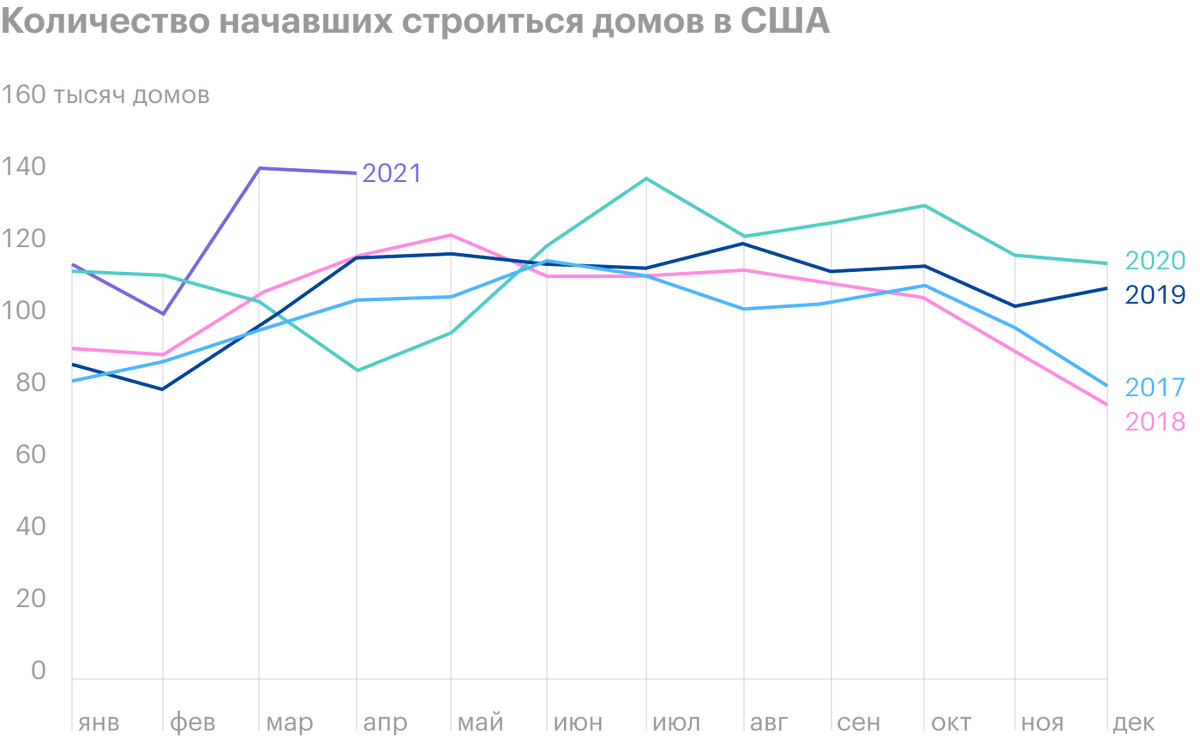

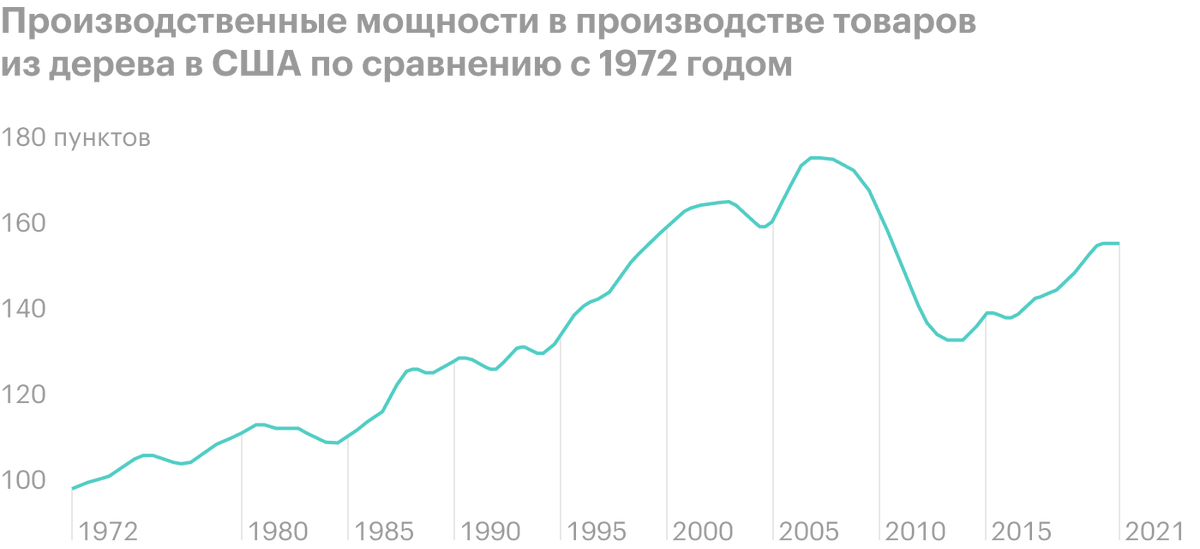

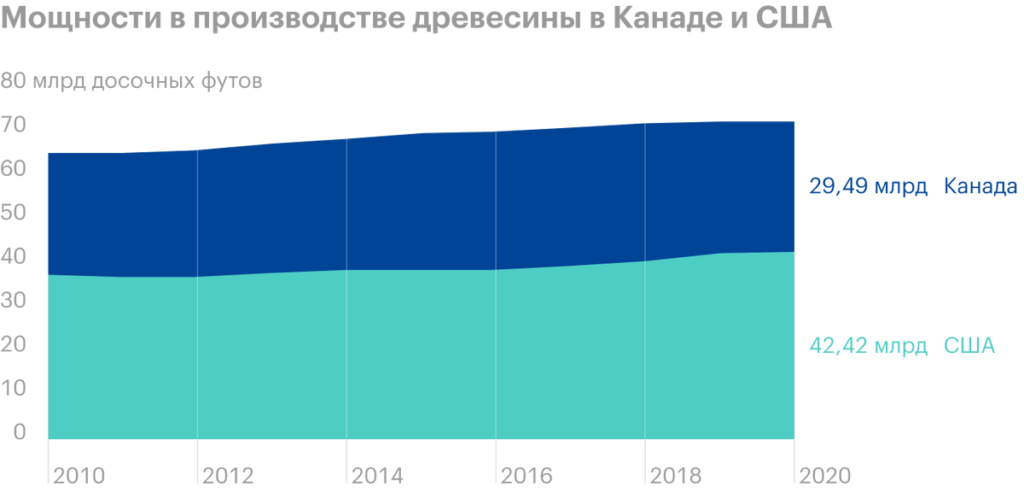

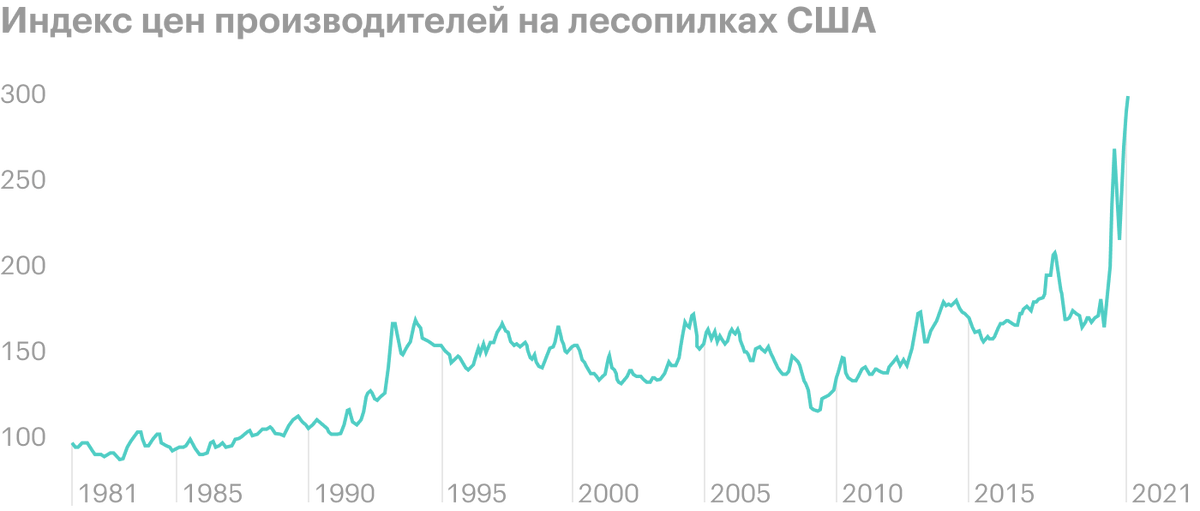

There is another problem. For many years in the US and North America, sawmills have invested little in capacity expansion.. As a result, with the beginning of the boom in demand for real estate in the United States, wood prices rose sharply due to a lack of goods with high demand..

Many builders can feel these changes in concrete numbers.: if back in May 2020 on 50 000 $ it was possible to buy enough wood to build about ten houses, now this money is only enough for two houses.

In other words, house builders are experiencing a huge increase in costs - perhaps, that the margins of their business will drop dramatically because of this.

How many houses can be built for a given cost of wood

| price for 1000 board feet, Doll. | The total amount of purchased wood, thousand. board feet | Number of houses built | |

|---|---|---|---|

| 2010 | 270 | 185 185 | 12,77 |

| 2015 | 234 | 213 675 | 14,74 |

| 2020 | 343 | 145 773 | 10,05 |

| 2021 | 1635 | 30 581 | 2,11 |

Resume

All mentioned issuers look like a very good option for, to cash in on rising demand for real estate in the US. All companies cost quite moderately., and positive market conditions are conducive to an increase in demand for their goods and services.

However, one should still keep in mind the problem of the rising cost of building materials and the theoretical possibility of a decrease in demand due to the growing inaccessibility of real estate prices.. Here, Really, Toll Brothers is in a better position, than Lowe's and Home Depot: the company builds luxury houses, and the rich in the United States have no problems with the inaccessibility of houses and are not yet expected.