Aerospace startup Virgin Galactic (NYSE: SPCE) reported for the first quarter of 2021 after the close of the trading session on Monday. In a year operating loss increased from 61 million to 81 million dollars. Adjusted EBITDA loss increased from $53 million to $56 million. Still no revenue. On the postmarket, the issuer's shares fell by 9% - to 16,3 $, and in the afternoon the St. Petersburg Exchange stopped trading in Virgin Galactic securities for half an hour after 14% - to 13,9 $.

Virgin Galactic has not announced a date for the next flight test, which were due in May, - this is the main reason for the frustration of investors. Prior to this, the company has already postponed the test, because, according to the leadership, more time is needed for technical checks. First commercial flight with tourists scheduled for early 2022.

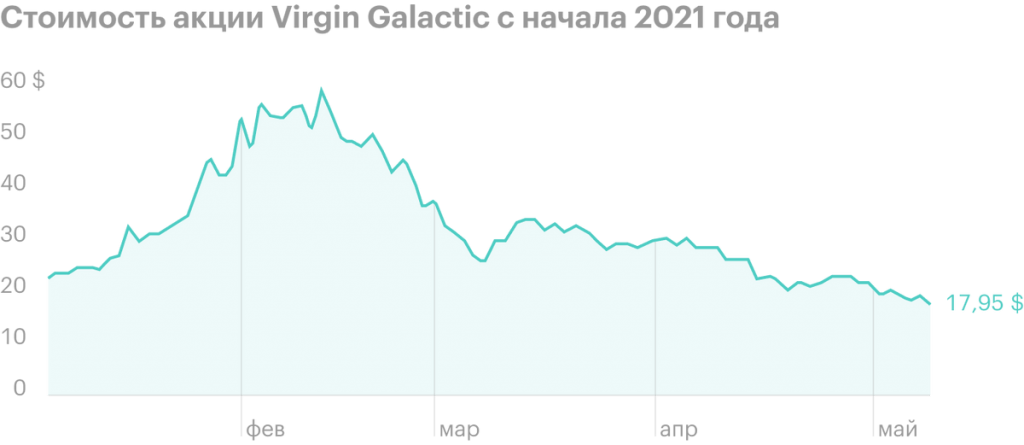

Now the company's shares are traded on 74% below their February highs in 62,8 $. Virgin Galactic is unprofitable and does not earn anything. Shares of such issuers are highly volatile and depend on the news background.

So, Virgin shares fell in February after flight test postponement; in April - on the news about, that the founder of the company, Richard Branson, sold part of his shares, and Ark Invest CEO Cathy Wood cut Virgin Galactic's stake in ARKQ and ARKX funds.

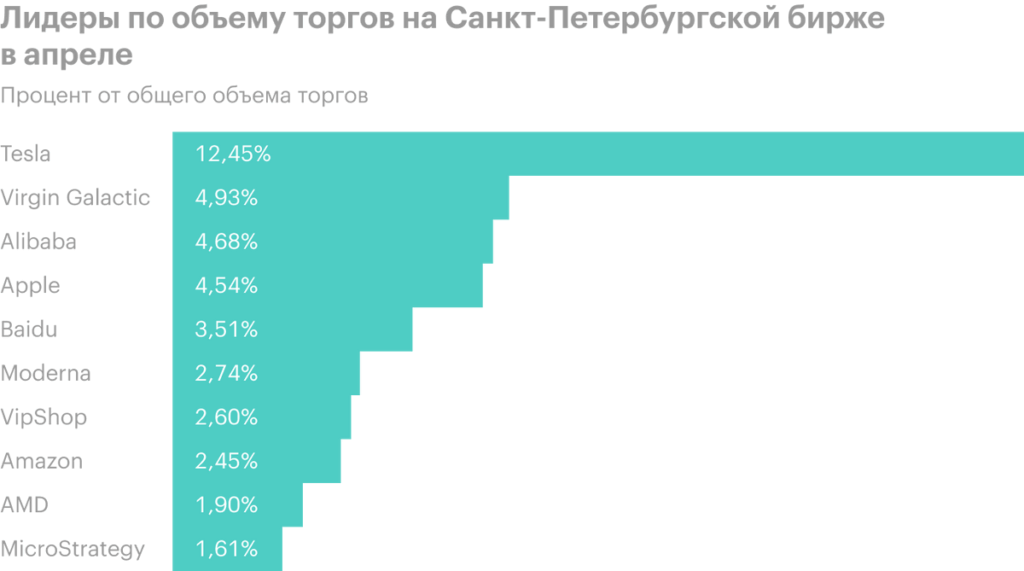

Volatility and high risks do not scare Russian investors. According to the St. Petersburg Stock Exchange, Virgin Galactic shares were among the most popular in April. Probably, traders and investors, inspired by Tesla results, hope to get their super profit.

Given the long fall in Virgin stock, it is appropriate to recall the advice of the famous manager Peter Lynch, who recommended avoiding "hot" stocks in "hot" industries.

Virgin Galactic Financial Results, million dollars

| Revenue | Operating profit | |

|---|---|---|

| 1 kV. 2020 | 0,24 | −61 |

| 2 kV. 2020 | 0 | −63 |

| 3 kV. 2020 | 0 | −77 |

| 4 kV. 2020 | 0 | −74 |

| 1 kV. 2021 | 0 | −81 |

Revenue

1 kV. 2020

0,24

2 kV. 2020

0

3 kV. 2020

0

4 kV. 2020

0

1 kV. 2021

0

Operating profit

1 kV. 2020

−61

2 kV. 2020

−63

3 kV. 2020

−77

4 kV. 2020

−74

1 kV. 2021

−81