NLMK is a large vertically embedded holding, we specialize?? in the production and sale of metal products. The company's factories are located in the Russian Federation, Europe and the United States and allow the creation of up to 18.5 million tons of steel per year.

13 In July, the company made public the operating indicators of its own work for the 2nd quarter and 1st half of 2021. In the conditions of a suitable price environment, the holding increased the share of steel production for the 1st 6 months of this year, also increased sales volumes of finished products with a higher added price.

Market situation

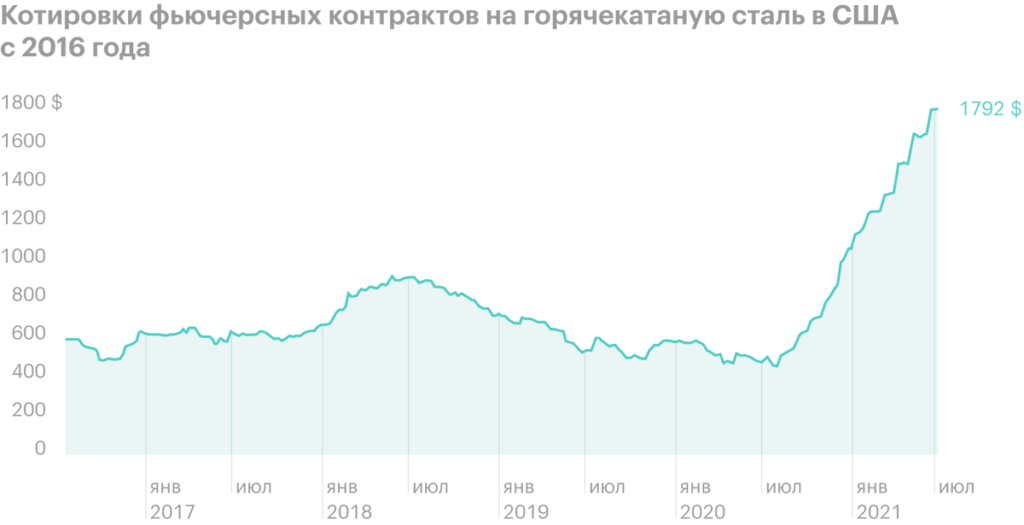

1-The first half of the year was marked by a sharp increase in prices for dark metallurgy products on the global market due to demand. This made it possible for steelmakers to quickly return sales to pre-crisis levels and earn income on high prices for their products..

However, the highest prices for steel attracted the attention of the Russian authorities., That, On the one side, trying to find a method to keep prices and inflation under control, and on the other hand, they are interested in increasing budget revenues., in addition to everything else and due to the increased incomes of steel producers.

As a result, the government in June approved temporary rates for the export of metals from 1 August to 31 December 2021.

The fee will consist of 2 components: base rate of fifteen percent and additional deductions, Expect?? in dollars per ton and depend on certain products.

Additional rates for the export of metal products

| Product type | Small bet size |

|---|---|

| Ore concentrate | 54 $ |

| Thin hot rolled products | 115 $ |

| Cold rolled products | 133 $ |

| Stainless steel | 150 $ |

Product type

Minimum Fee

Ore concentrate

54 $

Flat hot rolled steel

115 $

Cold rolled products

133 $

Stainless steel

150 $

This hits the export business of large domestic steel producers.. So, NLMK, who has assets in the U.S., may even face double taxation within the framework of sales within the company: first when exporting products from Russia, and then when imported into the U.S., where since 2018 there are restrictive duties on the import of steel products.

Production indicators

Steel production increased by 11% - up to 8.83 million tons - c 1 half of 2021 compared to the same period last year. This was a consequence of the commissioning of the converter production after reconstruction against the background of strong demand for steel products during this period..

Production capacities were loaded on 95%, What's on 2 percentage points more, than in the first half of 2020.

Coke production for the first 6 months decreased by 4% year-on-year - up to 2.78 million tonnes, - what was the result of a drop in output at the Altai-koks production site in the Altai Territory.

Iron ore production increased by 5% year-on-year - to a record 9.91 million tonnes - amid an increase in iron ore concentrate output by 3%, pellets - on 3% and sintering ore - on 15% to the same period last year.

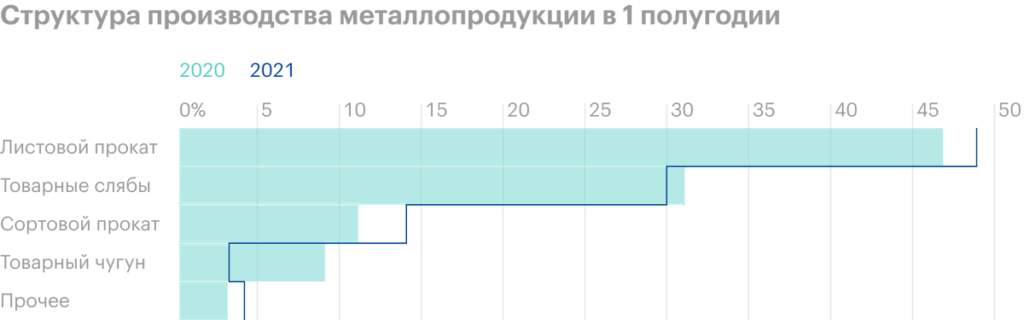

Production of metal products decreased by 6% year-on-year - up to 8.5 million tonnes, — but in the structure of production the share of products with higher added value has increased, what should increase the marginality of the business. The production of long products and metal products increased by 20%, at the same time, the production of commercial slabs decreased by 9%, and pig iron production fell by 68%, returning to pre-crisis levels.

Let me remind you, what in 1 half of last year, demand for steel was weak amid the coronavirus pandemic and general uncertainty in the iron and steel market. Because of this, manufacturers were forced to sell surplus semi-finished products - commercial cast iron and slabs., – instead of using them to create products with high added value. Of course, this had a negative impact on the revenues and profitability of the business.

This year the situation is reversed.: high demand and prices allow to increase the output of finished products, reducing the share of semi-finished products in the sales structure.

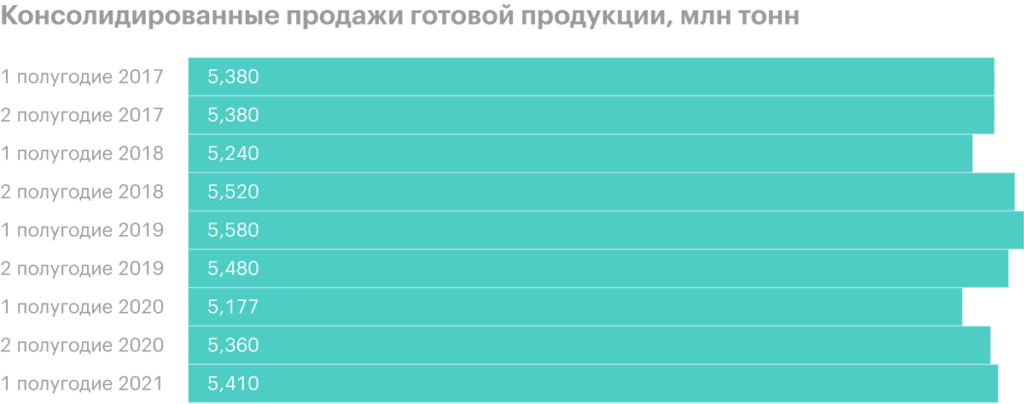

What about sales

Consolidated sales in January - June fell compared to 1 half of 2020 at 7% - up to 8.24 million tons. Sales of finished goods for the same period increased by 5% - up to 5.41 million tons. The reason: demand and prices in the market allowed the business to increase the share of semi-finished products, which are used to produce finished products, and not for sales to third parties.

The main driver of sales growth was the products of long products and metal products, natural sales of which increased by 29% - up to 1.31 million tons. At the same time, sales of flat products decreased by 2%: with 4,16 up to 4.1 million tons.

In Russia, which remains the main home market for businesses, sales in kind increased by 9% - up to 3.49 million tons - against the backdrop of a favorable market environment and increased demand from the construction industry.

In the United States NLMK segment sales increased by 8% - up to 0.93 million tons - due to the low base of the last year.

In the EU, which is also considered the home market of the company, sales continued to fall. For the first 6 months of this year, sales volumes collapsed by 15% to 1 half of 2020 - up to 1.08 million tons, what has become the minimum of recent years.

Sales volume in export markets collapsed on 23% - up to 2.61 million tons, which is mainly due to last year's high base, when the company was forced to reorient sales to external destinations due to weak demand in domestic markets - a consequence of the coronavirus pandemic and the introduction of strict restrictive measures.

Share of sales in home markets: Russia, THE US and the EU - in January - June 2021 reached 68%. Compare this with 61% in 1 half of 2020.

What's the bottom line?

NLMK's business recovers quickly from the coronavirus crisis. The company increased production and sales of finished goods with higher added value and increased its share of sales in priority home markets. All this, taking into account high prices for steel products, bodes well for strong financial results. 1 half of 2021, including revenue growth and return on sales.

The company itself notes in its press release the high demand for steel in key markets, low stocks of steel products , all against the backdrop of high prices for NLMK's key products. In Russia, flat steel prices in dollar terms increased by 114% year to year, in the USA - on 179%, in the EU 155%, updating the record since 2008.

The introduction of temporary duties on the export of metallurgical products from Russia is, undoubtedly, negative news for the company and its shareholders. Additional fees will reduce profits for domestic steel producers, will weaken the position of domestic players in foreign markets, and may increase competition and adjust prices in the domestic market in the short term.

But metallurgists have time until 1 august, before the government decree comes into force. Probably, manufacturers will take advantage of this period, to increase the stocks of their products abroad, which will help reduce the effect of the introduction of restrictive duties by the end of the year.