The first important difference between options is non-linear nature of the instrument.

Most newbies, usually, come to the options market from the world of line instruments (stocks or futures). On these instruments, the size of the profit is equal to the size of the loss with the same increase or decrease in the price.. A rise in the share price by 10 rubles will give us 10 rubles profit from one share, reduction for the same 10 rubles will give us a similar loss. Everything is simple and obvious here.

For example, we decided to buy 100 Sberbank shares (or one futures on these shares). We have a long market position, if the share price rises, we make money, if it goes down, we lose. Notice, no matter how much the price goes up or down stock, we still have the same 100 Shares (or one futures) in the long.

It's easy enough to create a position in options, equivalent purchase 100 Shares, but it won't be linear. When the stock price rises or falls, it can be as large 100 Shares, and less than this amount:

- When the stock rises (futures) the option position will be equivalent to more shares (in this case more 100) And, respectively, bring us higher profits, than a line tool (100 stocks or one futures)

- With a decline in stock (futures) the option position will be equivalent to a smaller number of shares (in this case less 100) And, respectively, bring us less loss, than a line tool (100 stocks or one futures).

Wherein, mind you, you do not have to buy additional shares when the market rises or reduce their number when the market goes down - everything happens by itself. Just withAma option position will get longer (equivalent to more shares) with market growth And less long (equivalent to fewer shares) market position at market decline.

Let's demonstrate this idea with a real market example..

We have two traders. Both believe in further growth of the dollar against the Russian ruble.

One of them buys 10 futures per US dollar to ruble (10 000$), allowable, on 64 000 rubles. Its position is 10 000$ (1 futures - 1 000$) with any rise or fall of the currency.

The second one at the same time creates an equivalent position in options, buying 20 Call options strike 64 000by price 900 rubles. This position (20 options with this strike) at the current BA price, it will be fully equivalent to the futures position of the first trader. Why? In the next posts there will be a definite answer to this question., for now, you can take my word for it!

Currently, the positions of both traders are equivalent 10 futures or 1 000$ USA.

Let's compare the financial results for these two positions. (futures and options) with the rise and fall of the dollar.

Let's say the exchange rate against the ruble TODAY (on the day of opening a position) becomes more expensive.

Growth of the dollar against the ruble

65 000 ФЧС = +1 000 rub. (or 10 000 rub.) OPC = 1 497 – 900 = +597 rub. (or 11 940 rub.)

66 000 ФЧС = +2 000 rub. (or 20 000 rub.) OPC = 2 244 – 900 = +1 344 rub. (or 26 880 rub.)

67 000 ФЧС = +3 000 rub. (or 30 000 rub.) OPC = 3 107 – 900 = +2 207 rub. (or 44 140 rub.)

68 000 ФЧС = +4 000 rub. (or 40 000 rub.) OPC = 4 041 – 900 = +3 141 rub. (or 62 820 rub.)

The superiority of options over a linear instrument is visible. And, the more the exchange rate rises, the greater the difference in profit between options and futures portfolios. You may not believe and explain this effect., the, that there were more options initially, than futures.

In this case, with a decrease in the exchange rate, the loss on options (due to their greater number) should be higher. Let's check if it's true or not.

Now let's say the exchange rate against the ruble TODAY (on the day of opening a position) getting cheaper.

The depreciation of the dollar against the ruble

63 000 ФЧС = -1 000 rub. (or – 10 000 rub.) OPC = 484 – 900 = -416 rub. (or -8 320 rub.)

62 000 ФЧС = -2 000 rub. (or -20 000 rub.) OPC = 225 – 900 = -675 rub. (or -13 500 rub.)

61 000 ФЧС = -3 000 rub. (or -30 000 rub.) OPC = 89 – 900 = -811 rub. (or -16 220 rub.)

60 000 ФЧС = -4 000 rub. (or -40 000 rub.) OPC = 29 – 900 = -871 rub. (or -17 420 rub.)

As we see, and here the advantage of options is obvious. Options portfolio loses value to a lesser extent, than futures. Despite, that there were more options initially.

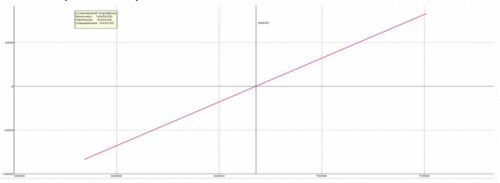

Let's compare charts profit and loss on these positions.

This graph illustrates the nonlinearity of the option in terms of profit and loss.