Deadline for expiration

At buying a longer term option we have less risk, but this position will be less profitable if the market moves in our direction.

The fact, that the reduction in the cost of an option under the influence of time is maximized as the expiration date approaches. Ie. when opening a position in a longer-term option, our option becomes cheaper more slowly, than the shorter term option (because. more time before expiration date).

At buying a shorter-term option we have a greater negative influence of time on the position, but in the case of a BA trend in our direction, the option will rise in price faster, because. with a shorter time to expiration, there will be a higher probability of getting out into money, than in the case of a long-term option (naturally, with the same percentage of growth or decline in futures for both options).

Let's turn to the real options market.

BA – futures for a pair of US dollar - Russian ruble

We look forward to a decline in this instrument and decide to buy a central strike Put option.

Put (15.09) – 20 days before expiration - 798 rubles

Put (20.10) – 55 days before expiration - 1 429 rubles

Put (15.12) – 111 days before expiration - 2 296 rubles

Influence of time on selected options

Put (15.09) - for 1 day – 21 (777 – 798) ruble

Put (20.10) - for 1 day – 13 (1 416 – 1 429) rubles

Put (15.12) - for 1 day – 11 (2 285 – 2 296) rubles

As I already noted, a shorter-term option depreciates faster (more pronounced influence of time).

Profit with the same market decline

Put (15.09) - on 2 ruble +1 342 (2 140 – 798) ruble

Put (20.10) - on 2 ruble + 1 192 (2 621 – 1 429) ruble

Put (15.12) - on 2 ruble + 1 097 (3 393 – 2 296) rubles

What term to choose? Obviously, it all depends on your appetite for the market and financial goals. Choosing a shorter option is more risky, but also more profitable.

I would choose a longer term (October, or december), because. there is more time to implement the idea of reducing the market and, Besides, I “spend” less time value of the option while in this position. I can not know, how strong the trend will be and when will it start, and time in any case works against the position, so let at least this negative impact be less.

Strike

We have three options:

1. Options IT - not our option, lack of time value and liquidity. Easier to buy futures – profit will be about the same, as on a line instrument

2. Options ATM - if there is no definite target during the growth or decline of the market (specific level), then buy these options. Maximum nonlinearity of profit.

3. Options OTM - if there is a specific goal of market growth or decline, then you can choose a buy option strike near this target. For example, at the current USD futures price - 65 000 rubles and growth targets to 75 000 (75 rubles for $), you can choose Call strikes in the area 75 000. The problem is, what, if you made a mistake and the price went up, but did not reach the mark you selected, then your option on the expiration date will simply expire at zero value. That's why I recommend choosing a strike somewhere in the middle (strike 70 000) or 75% (strike 72 500) paths from the current futures price to your intended target. The further the selected strike is from the current BA price, the more his leverage and the greater the profitability (in %) on invested capital, if the market overcomes this strike.

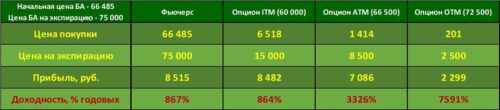

Profitability of buying expiry options depending on the strike

BA - US dollar futures - Russian ruble

Current BA price - 66 485

Expiration – across 55 days

BA price for expiration - 75 000

Therefore, it is more logical when buying options to choose strikes from the "central" to the intended target of the movement..

Buy far distant OTMs (so called, "Lottery tickets") don't see much point, because. the probability of the market entering these strikes is minimal. They, who loves lotteries, can try.