Investidea: MKS Instruments, because the factories are humming

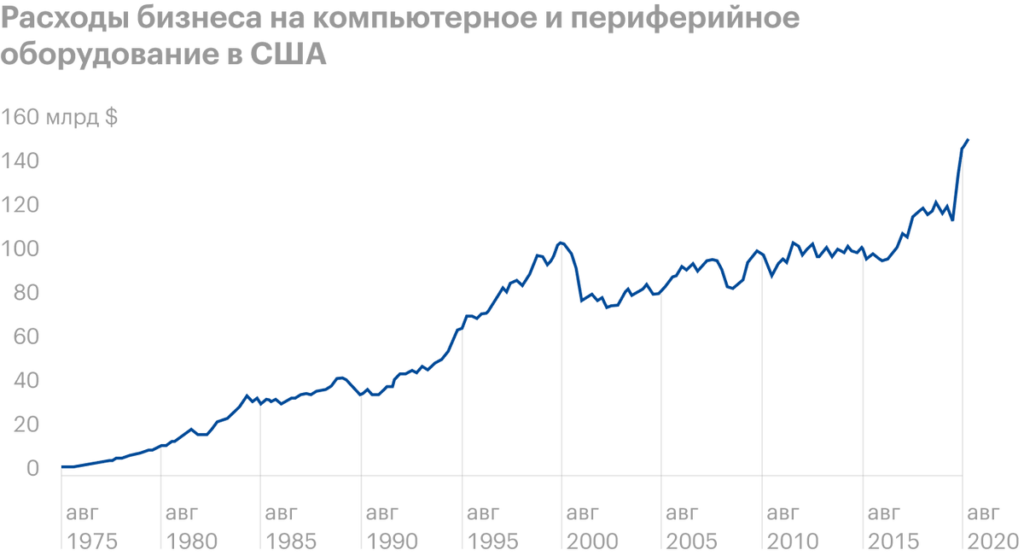

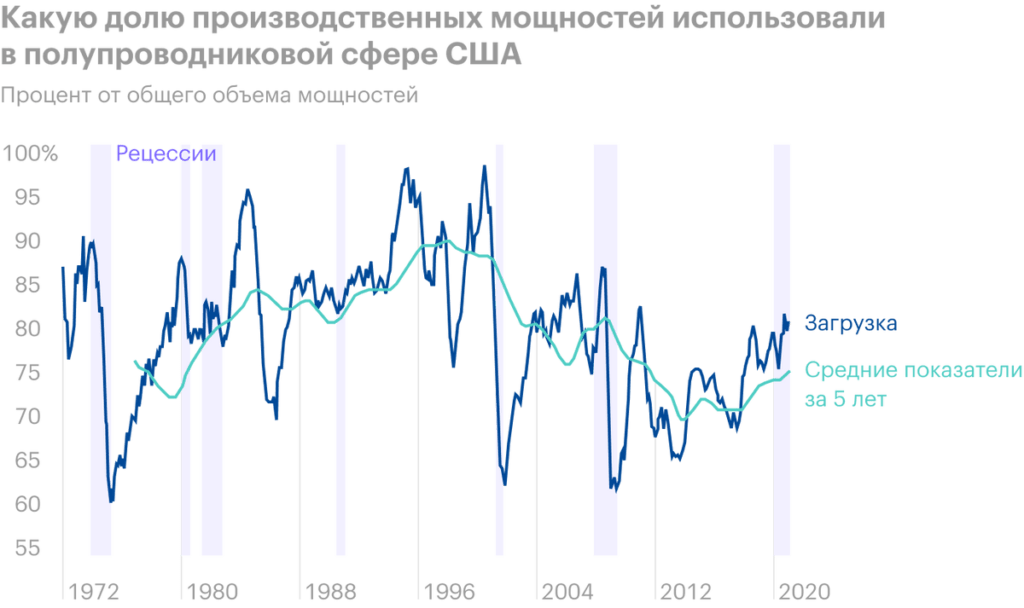

Today we have a moderately speculative idea.: take shares of MKS Instruments (NASDAQ: MKSI), to capitalize on the industrial boom in the US and the world. Growth potential and validity: 12% behind 12 months excluding dividends; 10% per year for 7 years including dividends.