27 May American chipmaker Nvidia (NASDAQ: NVDA) published financial results for the first quarter 2022 fiscal year. The company reported record revenue in 5,66 billion dollars - by 84% more, than a year earlier. Net profit increased by 109% and made 1,91 billion.

In the first quarter, the gaming segment added more than others: revenue increased by 106%, to 2,76 billion. This includes sales of GeForce RTX and GeForce GTX GPUs, Shield Gaming Devices and GeForce NOW Cloud Service Subscriptions.

Sales of GPUs for data centers increased by 79%, to 2,05 billion. “We had a fantastic neighborhood, in which strong demand for our products led to record sales", — said the founder and head of the company Jensen Huang.

In the second quarter, the company's management expects revenue of 6,3 billion dollars is 63% more, than a year earlier.

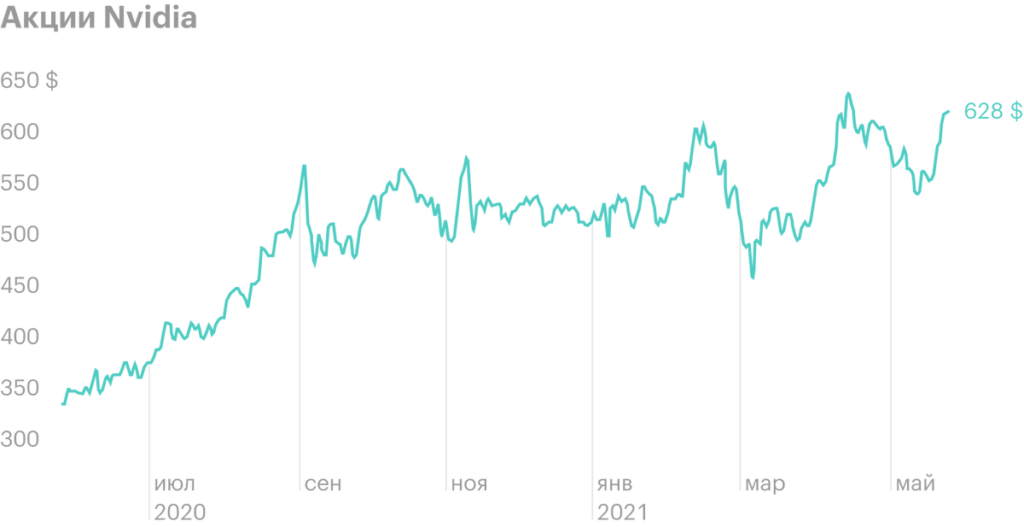

A few days before the presentation of the report, 21 May, Nvidia board of directors approved split company shares in the ratio 4:1. After the split, the number of shares will quadruple, and their price will decrease proportionally. The market capitalization of the company will not change. Nvidia securities will begin trading at new prices from 20 July. The final decision on the split will be made at the shareholders' meeting 3 June.

Nvidia's first quarter operating results, million dollars

| 2021 | 2022 | The change | |

|---|---|---|---|

| Revenue | 3080 | 5661 | 84% |

| Operating profit | 976 | 1956 | 100% |

| Net profit | 917 | 1912 | 109% |

Revenue 2021 3080 2022 5661 The change 84% Operating profit 2021 976 2022 1956 The change 100% Net profit 2021 917 2022 1912 The change 109%

Nvidia sales in the first quarter, million dollars

| 2021 | 2022 | The change | |

|---|---|---|---|

| Gaming | 1339 | 2760 | 106% |

| Data Center | 1141 | 2048 | 79% |

| Visualization | 307 | 372 | 21% |

| Auto | 155 | 154 | — |

| Rest | 138 | 327 | 137% |

| Total | 3080 | 5661 | 84% |

Gaming 2021 1339 2022 2760 The change 106% Data Center 2021 1141 2022 2048 The change 79% Visualization 2021 307 2022 372 The change 21% Auto 2021 155 2022 154 Change — Rest 2021 138 2022 327 The change 137% Total 2021 3080 2022 5661 The change 84%