Levi Strauss: The company's revenue increased by 156% for the year, shares - on 125%, financial results

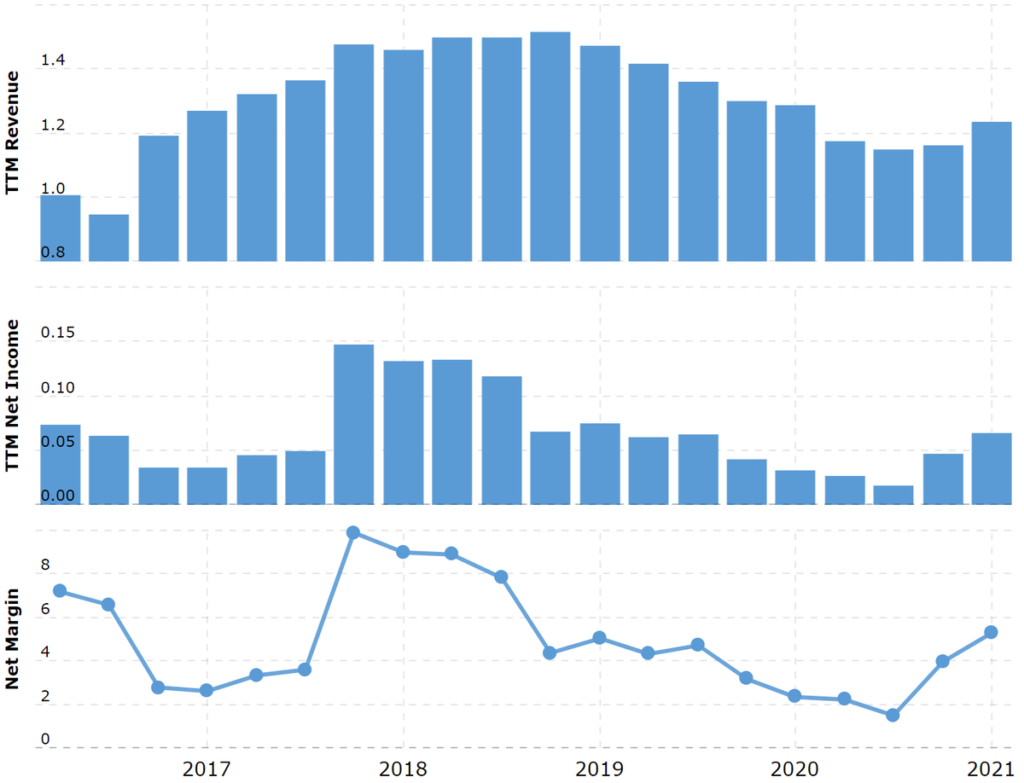

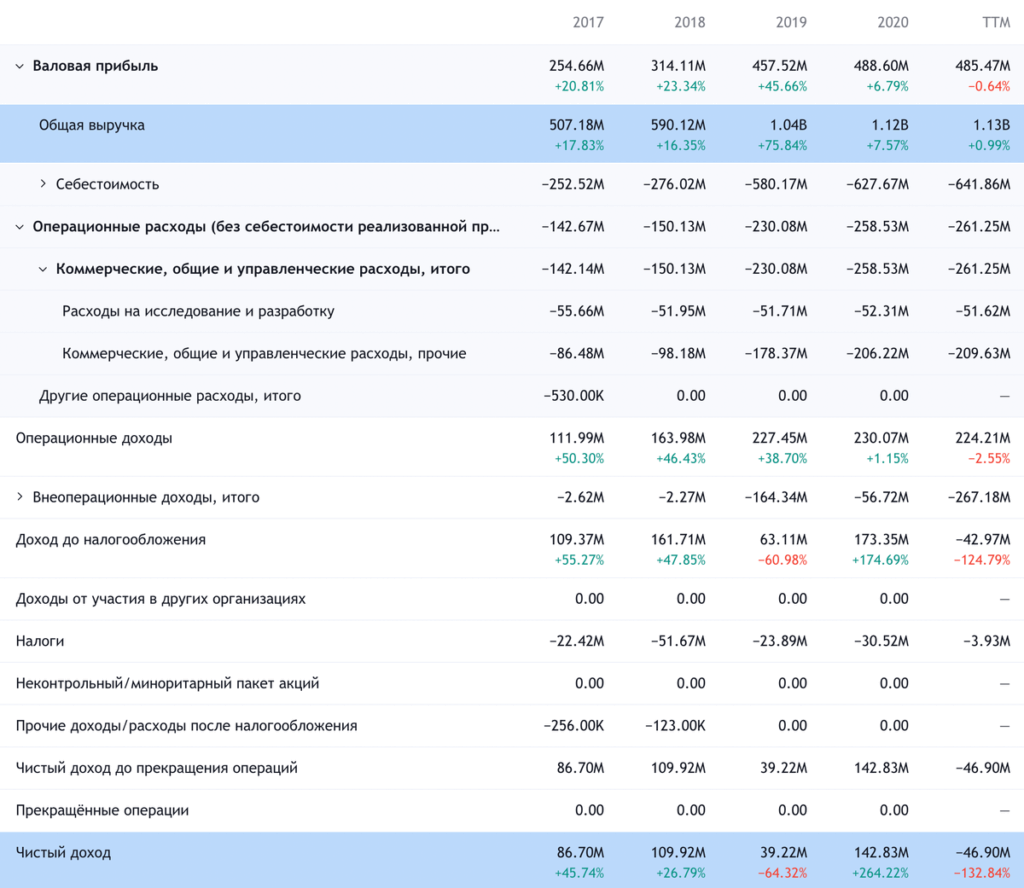

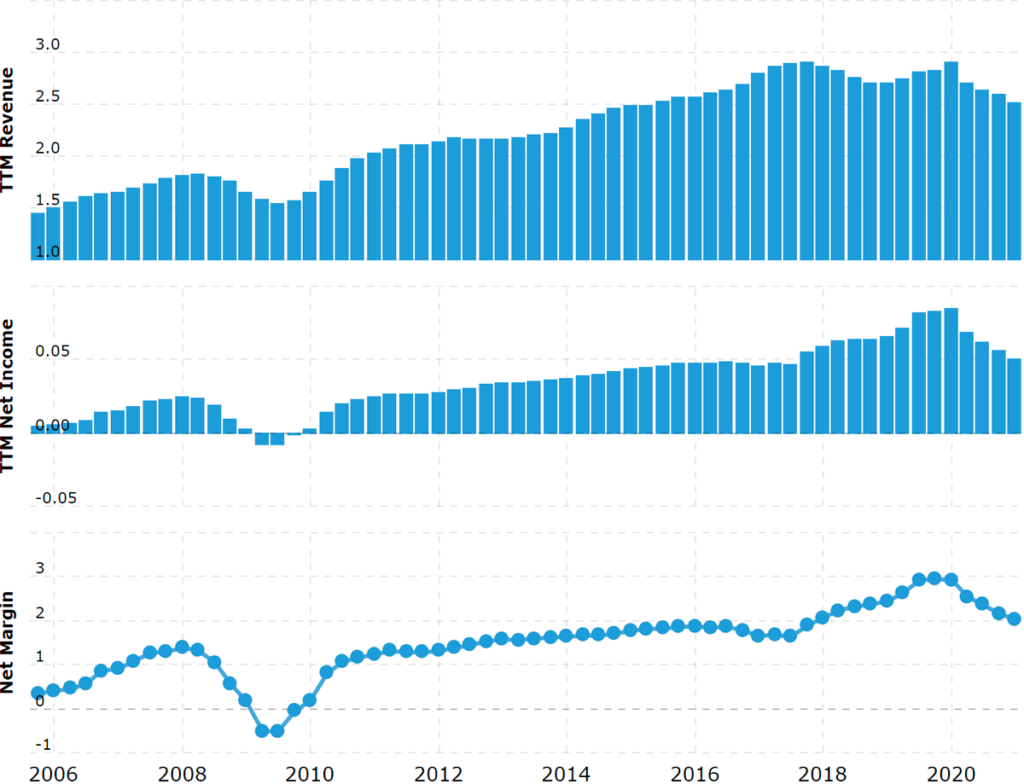

Denim clothing manufacturer Levi Strauss& Co (NYSE: LEVI) published financial results for the second quarter of 2021: revenue increased by 156%, to $1.3 billion; wholesale sales increased by 167%, retail — by 141%; online sales grew by 75% and accounted for 23% of total revenue; operating and net profit rose to 106 and 65 million - against a loss of 448 and 364 million a year earlier. Sales increased relative to 2020 ... Levi Strauss's revenue grew by more than 100% in each region. The company's total sales grew 2.5 times largely due to the low base effect.: a year ago, during the quarantine, some stores had to be closed. The company notes, that a third of stores in Europe and 17% of stores worldwide remained closed during the last quarter. Now, according to the company, 92% of retail outlets are open. "We significantly exceeded our revenue expectations., adjusted gross margin and adjusted EBIT. Sales in most markets recover faster, than expected, and we are emerging from the pandemic with a sustainable and improved economy.", said the company's CFO Harmit Singh. ... But remained below the level 2019 Year Compared to 2019, Levi Strauss' total revenue fell by 3%, and in the Americas, it grew by 3%. Wholesale sales in the region added 4%, and online — 61%. Sales in Europe relative to 2019 fell by 8% largely due to closed stores. Wholesale sales increased by 4%, online sales – more than 100%. Revenue in Asia compared to 2019 fell by 12%. First of all, due to the recession in the large market of India, where a large number of COVID-19 diseases are recorded. Online sales in the region added 83%. Папины джинсы По мнению руководства Levi Strauss, во втором полугодии 2021 финансового года продажи компании вырастут на 28—29% относительно 2020 года …