US Securities and Exchange Commission (SEC) presented a number of conditions to certain organizations from China, that must be completed before entering the American stock exchange. One of the conditions is to inform financiers about the risks associated with VIE.

LIFE (variable interest entities) — the structure of relations between companies, helping?? Chinese companies to list overseas. Under VIE, the company makes an offshore organization, which later goes on a foreign exchange.

Organizations from China from some industries, such as the web, education, media and data processing, it is forbidden to directly attract foreign capital. But Chinese law does not restrict companies registered in offshore zones. This loophole is used by almost all Chinese tech companies., traded on foreign exchanges.

Now the SEC wants, so that before the IPO, the company knows the financiers about the shortcomings of VIE. "Please, describe, how this type of corporate structure can affect financiers and their investments, also how and why such agreements may be the least effective, than direct ownership, and what significant costs the company will incur to ensure the criteria for agreements”, - reported in one of the letters to the SEC, according to the media.

The Commission asked organizations from China to report, that "financiers can never directly have a share in a Chinese organization".

Yet, according to the source, SEC demanded to open data, associated with the risk of exposure of Chinese regulators to the company's activities. For example, Last month, the Chinese authorities banned the DiDi service from registering new users., and later restricted the operation of personal education companies.

The commission will also begin to closely monitor the reporting of companies., since China bans some from sharing accounting information.

Last month, SEC Chairman Gary Gensler called for a suspension of Chinese IPOs in the US.. And here's how the new requirements will affect already traded companies, not yet known. If the delisting of Chinese companies happens, not only retail investors will suffer.

According to Goldman Sachs, a third of US hedge funds hold Chinese ADR in their portfolios. ADR - American Depositary Receipts, that allow you to buy shares in foreign companies.

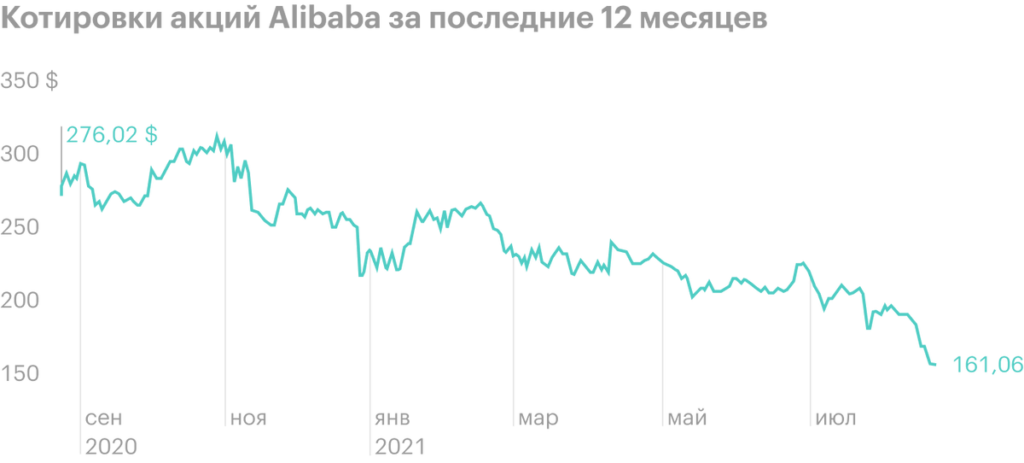

Due to regulatory risks, most funds suffer losses. As reported by Goldman Sachs, since February, the average Chinese ADR has fallen in price by more than 50%. “The drop in US-traded Chinese stocks in recent months has weighed on hedge fund returns. The popularity of Chinese ADRs was at its peak, what does it say, that hedge funds weren't ready for the change in regulation", Goldman Sachs analyst Ben Snyder said.

Alibaba's ADR is the most popular among funds. According to Goldman Sachs, retailer's papers 17 rank among the top ten popular ADRs for quarters in a row. Два других любимчика фондов — JD и Baidu.

Since the beginning of 2021 Alibaba paper, JD and Baidu on US exchanges fell by 29, 24 And 34% respectively.

The most popular Chinese ADRs among funds in the second quarter of 2021

| Ticker | Number of funds | |

|---|---|---|

| Alibaba | BABA | 122 |

| JD | JD | 72 |

| Baidu | START | 63 |

| DiDi | DIDI | 48 |

| Bilibili | BILI | 43 |

| Pinduoduo | PDD | 41 |

| NetEase | DETECTOR | 39 |

| New Oriental Education | EDU | 39 |

| Tencent Music | TME | 36 |

| Trip.com | TCOM | 35 |