United States President Joseph Biden plans to implement a massive reform program in the United States. It will be necessary to pay for the implementation of these reforms as by issuing bonds, and new taxes. We decided to figure it out, what tax changes are expected by the United States and, the most basic, How will this affect finance?.

We don't usually review, what has not happened yet: everything can be exchanged and changes can mitigate or cancel in principle - who knows. However, the market reacts to all actions in advance: if everyone is convinced, that companies will earn less, there could be a massive correction in the market, in our view, this is a pretty harsh reason, to break the rules and look, what was Biden invented?, even if half of this is not realized.

Disclaimer: USA has a progressive taxation system: the more a person earns, the higher the percentage he pays. The low tax rate is ten percent - for those, who earns before 9875 $ in year; the largest - thirty-seven percent, for people with an annual income above 518 401 $. From time to time we will write "small" and "greatest" in the text - this is just about that. And since we're talking about the USA, then by default we mean dollars.

List of possible tax changes

Increase in personal income tax: at the moment in the USA the largest size NDFL - thirty seven percent. Biden plans to return the bet 39,6 %, Formerly?? before Donald Trump's tax reforms.

People with an income of more than 1 million per year, may be, have to pay tax 43,4 % on income from assets, also from the sale of shares - above today's highest 23,8 %.

May be, shareholders will have to pay tax, even if they didn't sell the asset, given that, that it has increased in value, - more precisely, not so that the owners, and to their relatives after the death of the owner. This is done to combat this phenomenon., like older people with a huge fortune in stocks, That, to avoid paying tax on income from the sale of shares, borrow on the security of these shares and live on them.

How it looks: human, buyer?? a $100,000 house a few years ago and currently lives in it, when the house is worth $ 1 million, after death leaves it to his heirs, who won't pay for it. However, if the tax plan is adopted in the form, as Biden wishes, then after the death of the owner of the house, the heirs will have to pay tax on 900 thousand dollars of "unrealized income".

I guess, that the proposal of "tax payments on unrealized assets, which have risen in value, Biden rapture, to push through all other provisions of your own change in a permanent form, sacrificing this specifically in the discussions, - it really looks like a cannibal.

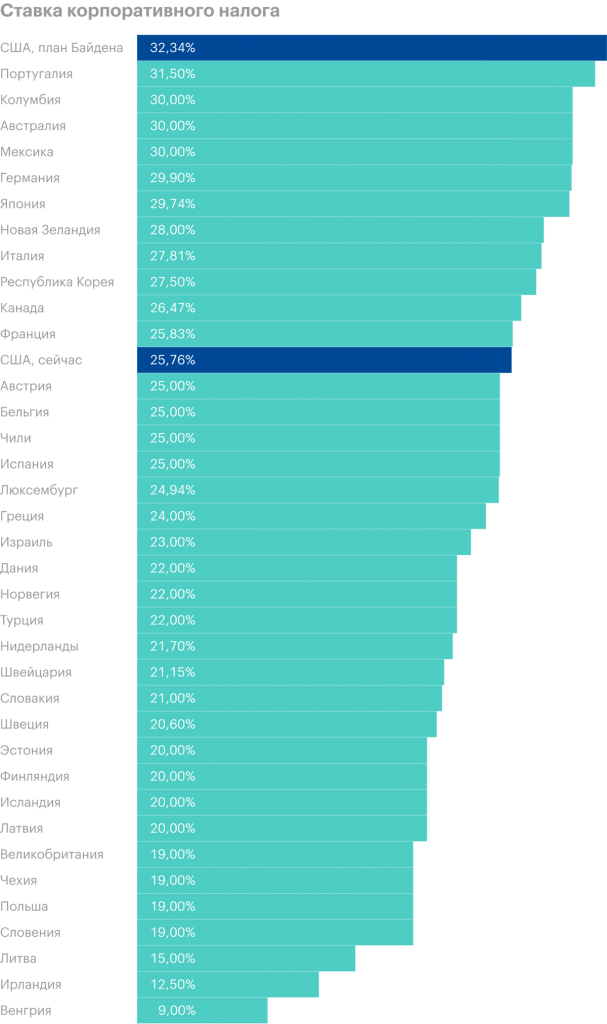

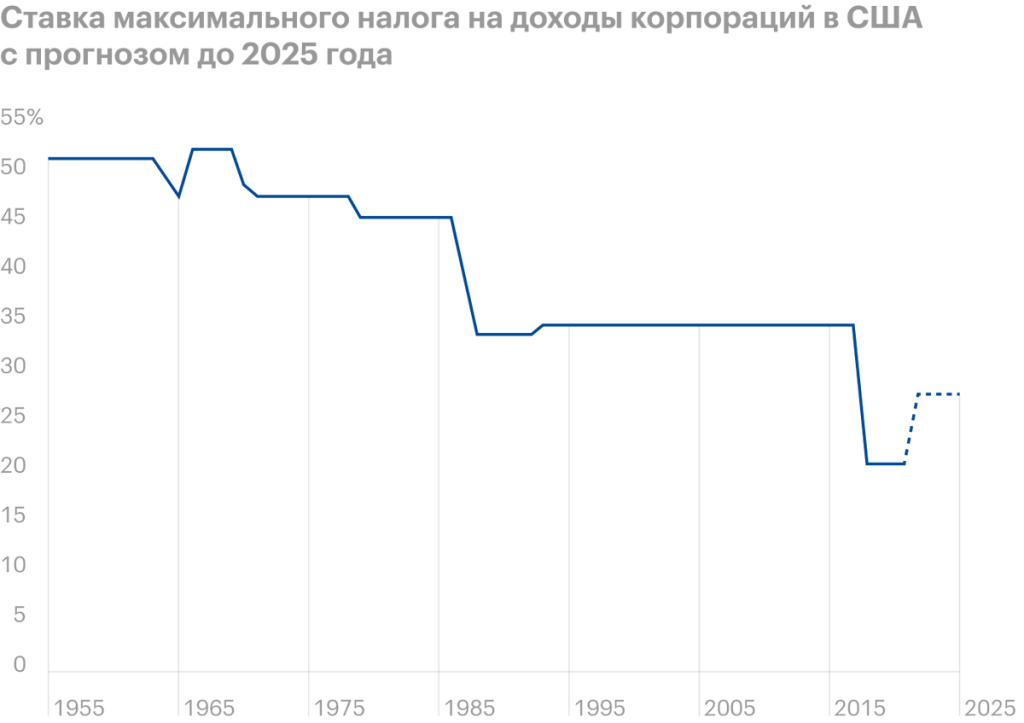

Increase in corporate income tax: from today 21 up to twenty eight percent.

Here Biden also plans to introduce a mandatory fifteen percent tax on companies., who earn over 2 billion a year, who, thanks to the system of tax deductions and legal scams, pay tax payments even less than they should or do not pay them at all.

Total in America 55 large profitable companies, who do not simply pay income tax, but by the method of various benefits, they eventually received 3497 billion from the treasury in 2020. Among them are Nike, Salesforce, FedEx and a host of other familiar names. For instance, Nike, making a profit last year, received a deduction for 109 million. Increase in tax payments, naturally, carried out not only because of such companies, and also because of them.

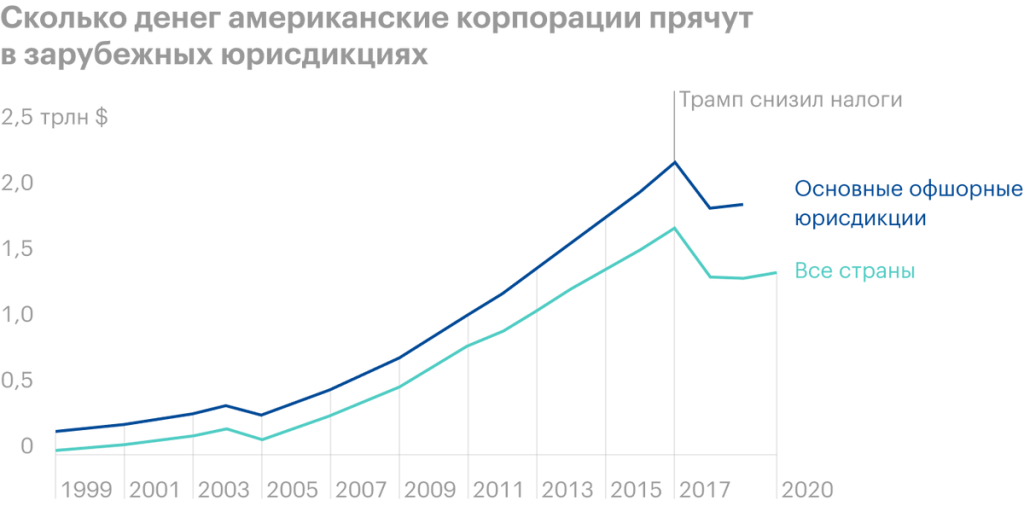

They also plan to increase income tax for companies, received abroad, up to twenty one percent. At the moment, almost all companies with large interstate transactions pay tax 8,8 % on their foreign profits, which is very less 15,8 %, which they paid back in 2017. There is an extremely large amount of funds accumulated in foreign divisions of organizations from the United States, so that Biden's undertaking can be understood.

Large organizations in the USA, not paying income tax

| Profit for three years, billion dollars | Real tax rate for three years | |

|---|---|---|

| Duke Energy | 7,9 | −15,5 % |

| FedEx | 6,9 | −12,08% |

| Dish Network | 6,6 | −0,2 % |

| American Electric Power | 5,9 | −3% |

| Morgan children | 4,9 | −0,9 % |

| Xcel Energy | 4,4 | −1,4 % |

| Nike | 4,1 | −18% |

| Salesforce.com | 4,1 | −0,1 % |

| DTE Energy | 4,1 | −11% |

| FirstEnergy | 3,7 | −1,2 % |

| Williams | 3,2 | −4,8 % |

| PPL | 2,9 | −1,3 % |

| CMS Energy | 2,5 | −5,3 % |

| Archer-Daniels-Midland | 2,1 | −0,1 % |

| Evergy | 2,1 | −6,4 % |

| Cabot Oil & Gas | 1,8 | −8,6 % |

| Westlake Chemical | 1,7 | −1,7 % |

| Advanced Micro Devices | 1,7 | −0,1 % |

| Textron | 1,5 | −3,1 % |

| Penske Automotive Group | 1,3 | −5,1 % |

| UGI | 1,1 | −3,2 % |

| Telephone & Data Systems | 0,7 | −22,8 % |

| Mohawk Industries | 0,6 | −3,3 % |

| Bali | 0,6 | −1,8 % |

| Howmet Aerospace | 0,4 | −0,5 % |

| Sanmina-SCI | 0,3 | −0,1 % |

Profit for 3 years, billion dollars

Duke Energy

7,9

FedEx

6,9

Dish Network

6,6

American Electric Power

5,9

Morgan children

4,9

Xcel Energy

4,4

Nike

4,1

Salesforce.com

4,1

DTE Energy

4,1

FirstEnergy

3,7

Williams

3,2

PPL

2,9

CMS Energy

2,5

Archer-Daniels-Midland

2,1

Evergy

2,1

Cabot Oil & Gas

1,8

Westlake Chemical

1,7

Advanced Micro Devices

1,7

Textron

1,5

Penske Automotive Group

1,3

UGI

1,1

Telephone & Data Systems

0,7

Mohawk Industries

0,6

Bali

0,6

Howmet Aerospace

0,4

Sanmina-SCI

0,3

Real tax rate for 3 years

Duke Energy

−15,5 %

FedEx

−12,08%

Dish Network

−0,2 %

American Electric Power

−3%

Morgan children

−0,9 %

Xcel Energy

−1,4 %

Nike

−18%

Salesforce.com

−0,1 %

DTE Energy

−11%

FirstEnergy

−1,2 %

Williams

−4,8 %

PPL

−1,3 %

CMS Energy

−5,3 %

Archer-Daniels-Midland

−0,1 %

Evergy

−6,4 %

Cabot Oil & Gas

−8,6 %

Westlake Chemical

−1,7 %

Advanced Micro Devices

−0,1 %

Textron

−3,1 %

Penske Automotive Group

−5,1 %

UGI

−3,2 %

Telephone & Data Systems

−22,8 %

Mohawk Industries

−3,3 %

Bali

−1,8 %

Howmet Aerospace

−0,5 %

Sanmina-SCI

−0,1 %

What does all this mean for companies, traded on the stock exchange

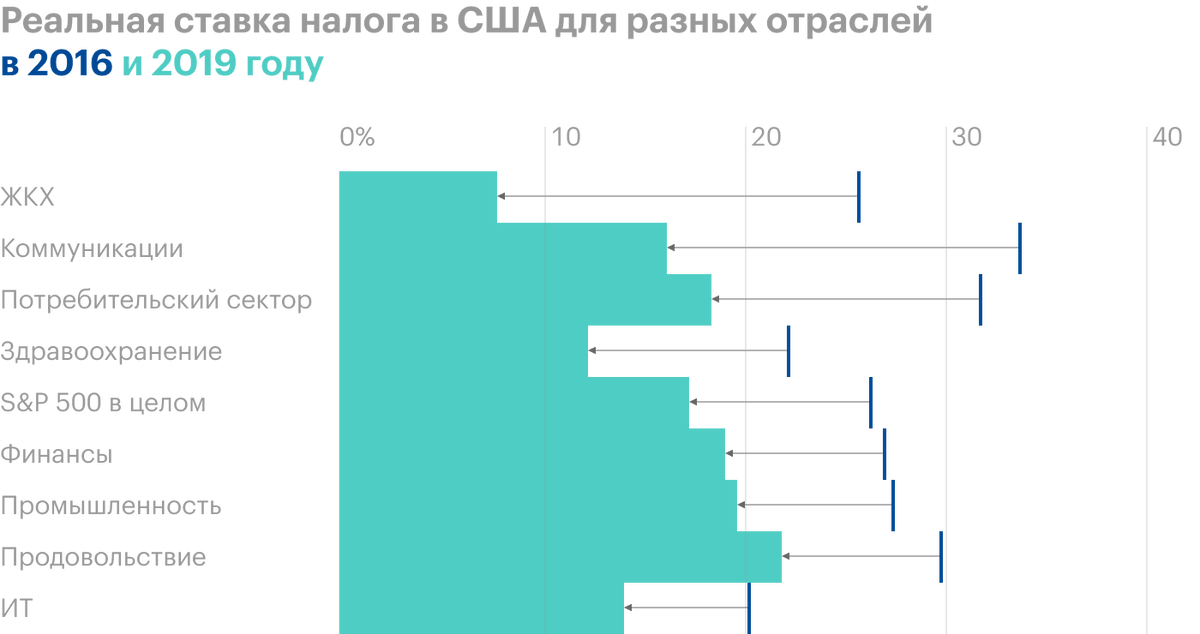

Nothing particularly bad. Almost all sectors have managed to increase profits due to lower tax payments under Donald Trump and will earn less if tax payments increase.

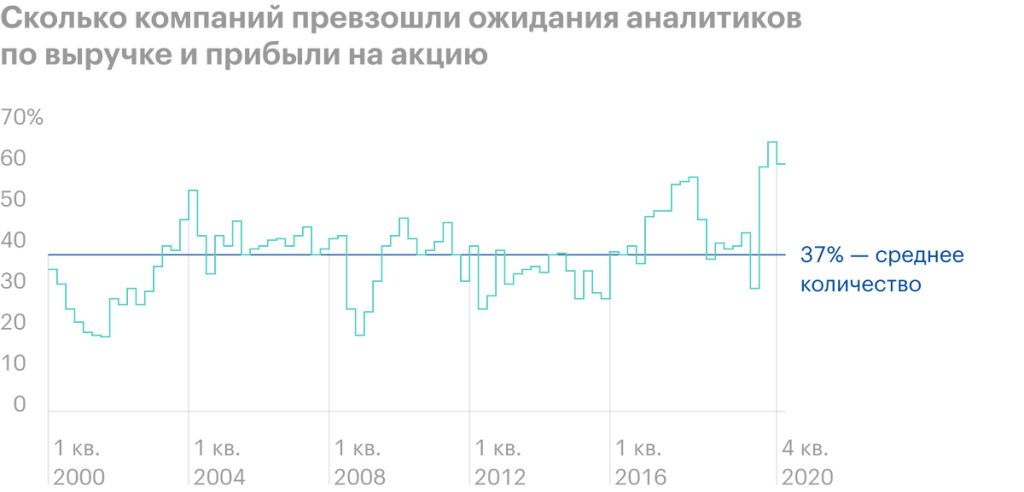

All this was "successfully" superimposed at the time of the economy's recovery from the coronavirus state and an increase in the profitability of companies., traded on the stock exchange.

Earnings per share S&P 500

| With inflated taxes | No tax payments | |

|---|---|---|

| 2020 | 140 $ | — |

| 2021 | 162 $ | 175 $ |

| 2022 | 188 $ | 202 $ |

With inflated taxes

2020

140 $

2021

162 $

2022

188 $

No tax payments

2020

—

2021

175 $

2022

202 $

What will this mean for stocks

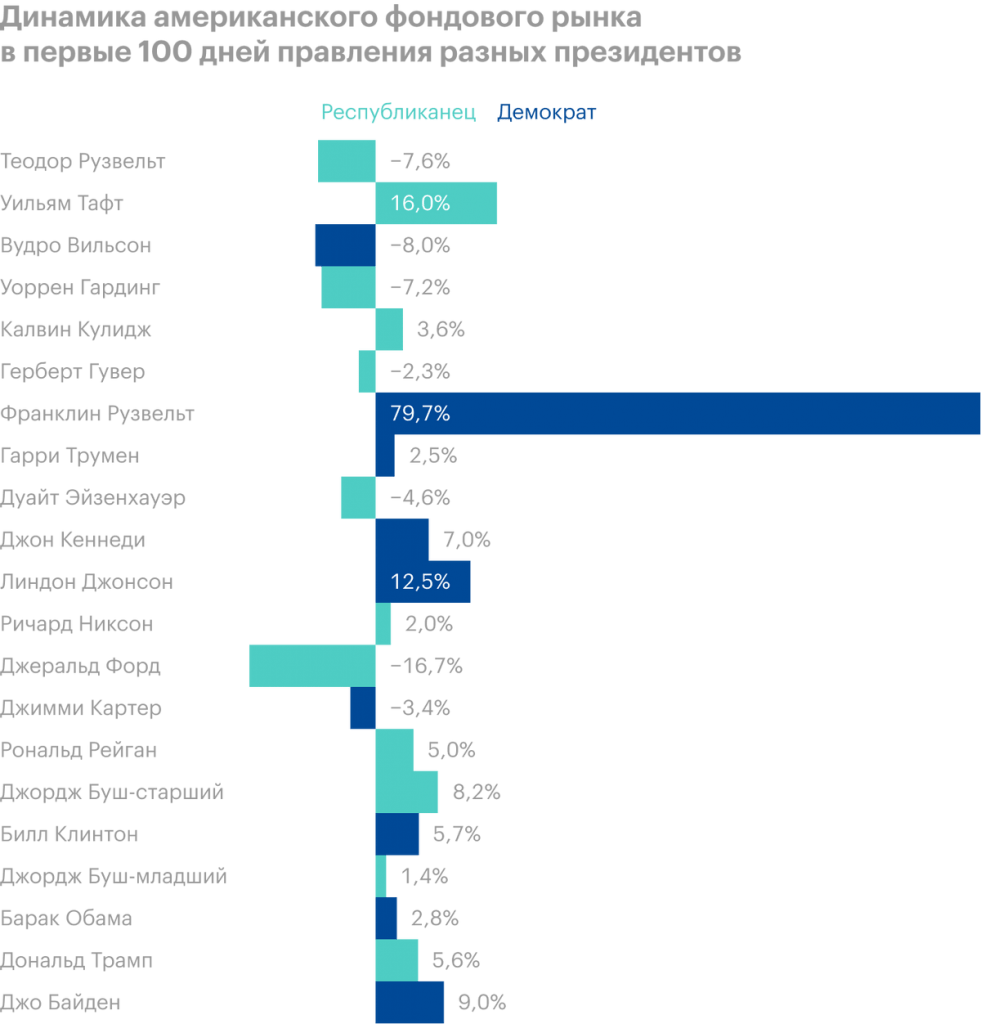

It's harder to answer here. It seems to be that circumstance, that US organizations will donate more funds to the cabinet, automatic should mean, that stocks will be least attractive to financiers. However, this is not completely trivial logic.: in 2020, despite the decline in economic performance and income of a number of companies, the stock market was still growing - and the prices of companies were growing, who lost their income. So with the likely increase in tax payments, everything can work out fine.. Moreover, in retrospect, Biden's expected likely increase in tax payments does not live up to the characteristics of the 1950s - and in the 1950s the market grew.

You should also be aware, that funds in the US are going to be spent on the real economy: we are talking about 2 trillion spending over eight years. By an indirect method, companies can still make great money in a similar position., even if they pay more tax payments, because this massive spending program will have an effect on virtually all industries: the level of expenses of residents will increase, and the lion's share of organizations from the USA, traded on the stock exchange, earn the main funds specifically in the USA.

If comparisons can be considered acceptable in this case, then the first 100 days of Franklin Roosevelt's tenure as the head of state of the United States, the American securities market met with tremendous growth, however, it was clear to everyone, that along with the program of investments in the economy, Roosevelt will bring huge tax payments. Perchance, and Biden's tax payments the market will also hospitably meet.

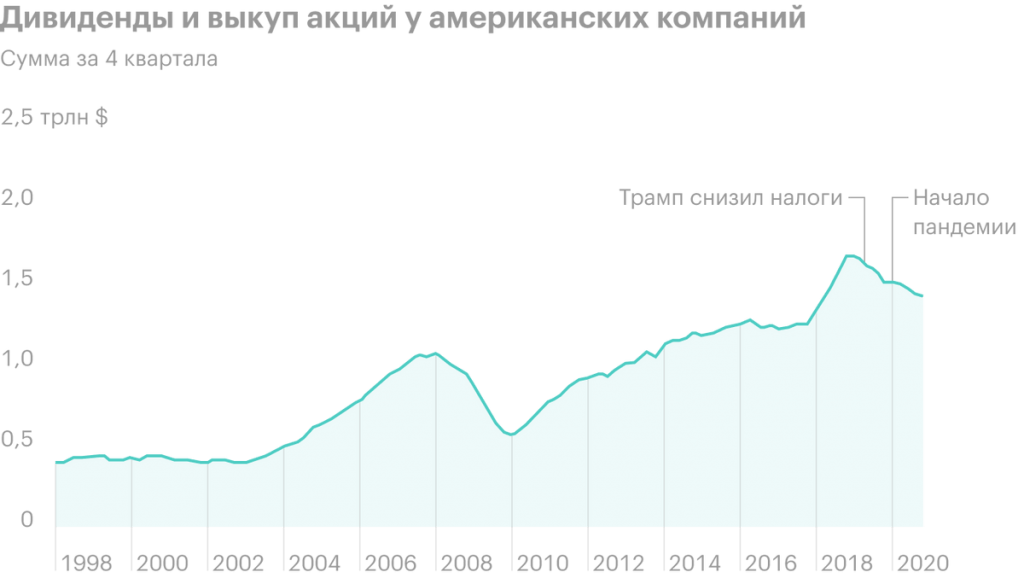

Potentially higher tax payments will force companies to spend less money on share purchases and income from securities. This can potentially make the stock market the least attractive to invest., but the size of deductions and redemptions already fell during a strong epidemic - and somehow the attractiveness of the securities market did not decrease from this. Because directly so I wouldn't bother at all: from the acquisition and dividends, and so in particular there was no sense.

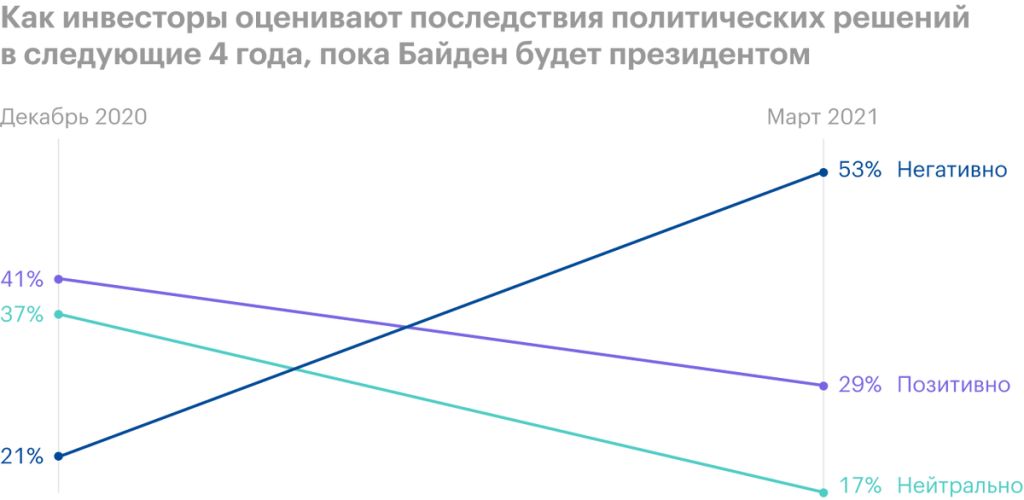

From the other side, fundamentally take into account the mood of financiers, Regarding??, that from an increase in tax payments there will be a fall in the market, - as we know very well, such confidence is a self-fulfilling prediction: everyone is waiting for the fall and start the stock sale campaign, thereby leading the market to fall.

Approximately 75% all shares, traded in the USA, are traded in automatic mode - everyone is now placing stop losses and more. Therefore inform, that such sentiments spread on the stock exchange like wildfire, it would be an understatement - the fall happens instantly.

Taking into account, that Biden is expected to increase tax payments not only for companies, yes for individuals, it would be entirely reasonable to wait, that the financiers will decide to sell shares and fix profits before the implementation of the bill, to pay less tax payments later. This makes sense for a number of reasons..

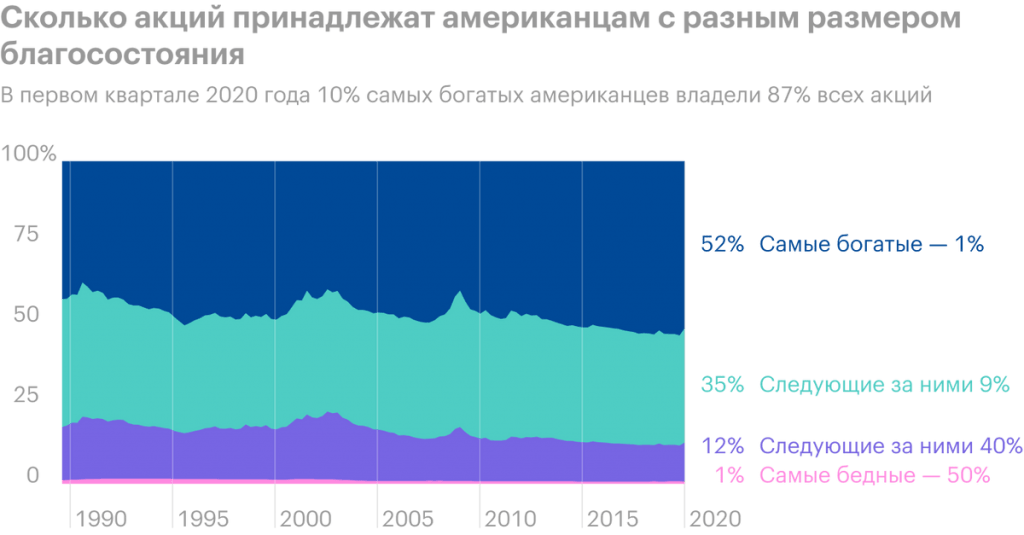

In-1-x, the richest, who will potentially pay more tax, own most of the shares. It's in their interest to have a big sale at the moment.. So selling in order to lock in profits before large tax payments is more than a natural option..

In-2-x, the share of the securities market in the number of investments of American private households has reached a maximum for an extremely long time. Based on the beliefs of almost all asset managers, it would be wise to decide, that it's time to take profit at the moment, not to pay more high tax payments later.

Who will suffer more than everyone

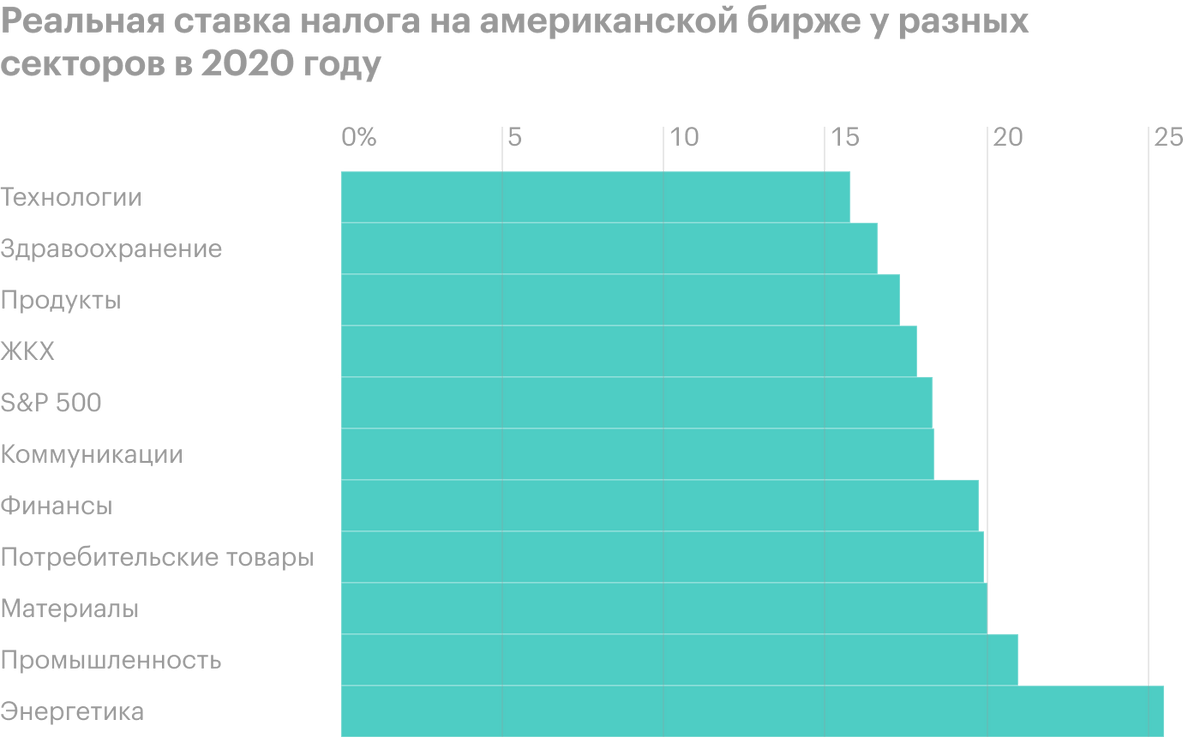

Since IT companies pay the least tax payments, then they will suffer more than everyone from the increase in tax payments. Pharmaceutical companies are right behind them..

Low tax payments for IT companies and "big pharma" because, that they generate a huge portion of income from intangible assets, because for them the increase in tax payments will be extremely painful.

The effect of tax payments on earnings per share of various sectors S&P 500 in 2022

| All in all | Corporate tax | Tax with a reduced rate on global intangible assets | |

|---|---|---|---|

| Technologies | −8,9 % | −4,8 % | −4,2 % |

| Public health protection | −8,9 % | −5,4 % | −3,5 % |

| Consumer Products | −8% | −6,6 % | −1,3 % |

| The money | −7,3 % | −6,1 % | −1,2 % |

| Industry | −7,2 % | −5,3 % | −1,8 % |

| Communications | −6% | −4,2 % | −1,8 % |

| Materials (edit) | −5,1 % | −3,4 % | −1,7 % |

| Goods | −4,7 % | −3,5 % | −1,2 % |

| Energy | −1,4 % | −1,4 % | −0% |

| The property | −1,3 % | −0,6 % | −0,7 % |

| S&P500 | −7,1 % | −4,8 % | −2,3 % |

Generally

Technologies

−8,9 %

Public health protection

−8,9 %

Consumer Products

−8%

The money

−7,3 %

Industry

−7,2 %

Communications

−6%

Materials (edit)

−5,1 %

Goods

−4,7 %

Energy

−1,4 %

The property

−1,3 %

S&P 500

−7,1 %

Corporate tax

Technologies

−4,8 %

Public health protection

−5,4 %

Consumer Products

−6,6 %

The money

−6,1 %

Industry

−5,3 %

Communications

−4,2 %

Materials (edit)

−3,4 %

Goods

−3,5 %

Energy

−1,4 %

The property

−0,6 %

S&P 500

−4,8 %

Tax with a reduced rate on global intangible assets

Technologies

−4,2 %

Public health protection

−3,5 %

Consumer Products

−1,3 %

The money

−1,2 %

Industry

−1,8 %

Communications

−1,8 %

Materials (edit)

−1,7 %

Goods

−1,2 %

Energy

−0%

The property

−0,7 %

S&P 500

−2,3 %

As an example, we can take such companies, as the Alphabet, Apple, J&J and Microsoft: all of them paid not a lot of tax payments, and before the Trump downgrade in 2017, they don’t pay much at the moment. However, the introduction of a small mandatory tax of twenty-one percent on income for all, who has a spotless profit from 2 billion, will definitely affect the money.. And an increase in the mandatory tax on foreign profits will make hiding from the US tax in remote offshores the least profitable for these companies..

Taking into account, that these companies hold a gigantic stake in S&P 500, I would be afraid of the stock sale of these stocks, which will lead to fluctuations in the index, what, from my side, thanks to trading automation, which we talked about above, will lead to a massive adjustment. In other words, everyday trading robots will see, that "the market is falling", so that the disproportionately huge Apple and Alfabet will fall, and the general stock sales.