Hello, dear friends! In previous articles, we examined in detail investments in company shares.. Attentive readers will remember, that at the same time I was talking about such a concept as Dividends. Noted, that not everyone pays them, but this a good source of additional income. Today we'll talk in more detail about, how to get dividends on shares and we will understand all the subtleties related to this.

Looking ahead, I will note, that this type of income should be considered as addition to profit, obtained by increasing the value of shares. Balance is important, pick up assets like this, so that the annual payment of "divas" does not lead to a slowdown in the growth of the company's securities. Otherwise, your profit will grow more slowly..

Content:

- What are dividends

- What is dividend yield and how payments change over the years

- Dates, which an investor should know

- Payment of dividends and share value

- Methods of receiving dividends and their types

- Types

- Methods of obtaining

- Websites useful for the investor

- Investing

- Etfdb

- E-disclosure center

- MOEX

- Dohod.ru

- BCS Express

- Justetf.com

- How much money is needed to buy stocks

- taxes and other costs

- Examples of generous companies

- Summing up

What are dividends

It's more convenient to consider on a specific example:

- Imagine, that you are the owner of the company, leasing equipment;

- Based on the results of a certain period, net profit in $100 million. Initially, you indicated in the documentation, what at least 10% of net proceeds is used to pay dividends to shareholders;

- You can send at least everything for payment $100 million, but in this case there will be nothing left for the development and modernization of the enterprise. You can limit yourself to the minimum $10 million. or pay on your own initiative $20-$30 million;

- If money hadn't been paid, then you would send the proceeds to the development of the enterprise, purchase of new equipment, share repurchase. If this path is chosen, then the balance of net income drops abruptly.

In simple words, dividends can be called a part of the profit, which the company is ready to pay to the holders of the securities. It doesn't matter., when did you buy the shares, main, so that by the time of the cutoff (closing the register) they were your property. Payment conditions, in particular, what share of the proceeds the company will use to remunerate shareholders, are indicated on the official sites.

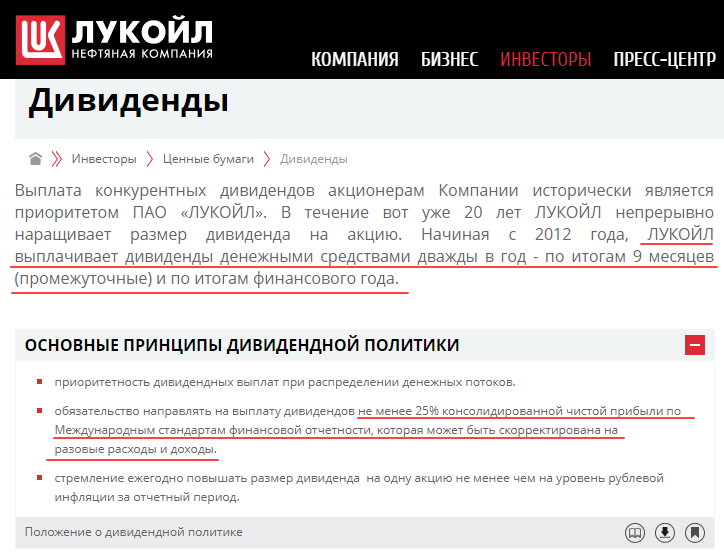

Above– example dividend policy from Lukoil. There are also more complex calculation methods., when the amount of the payment is tied to various financial indicators of the company.

Payment of "divas" - the decision of the company itself. No law, who would oblige her to do it. Expediency depends on the specific situation:

- For example, if the business is at its peak, no need for additional investment, it makes sense to pay dividends, to increase shareholder loyalty. Spraying funds into new directions will not give results;

- If a new promising direction is being mastered, it is more expedient not to pay dividends and direct all efforts to development and consolidation in a new area.

These are simple examples. I brought them for a better understanding of, which cannot be said unequivocally about the harm or positive impact of payments on the development of the company.

On video Below is a good analysis of the features of the stocks, on which dividends are paid.

What is dividend yield and how payments change over the years

In question, how to calculate dividends, It is more convenient to use an indicator in the form of pay-to-share ratio at the time of cut-off. We get the number as a percentage. It is convenient to navigate by it when assessing the yield of securities.

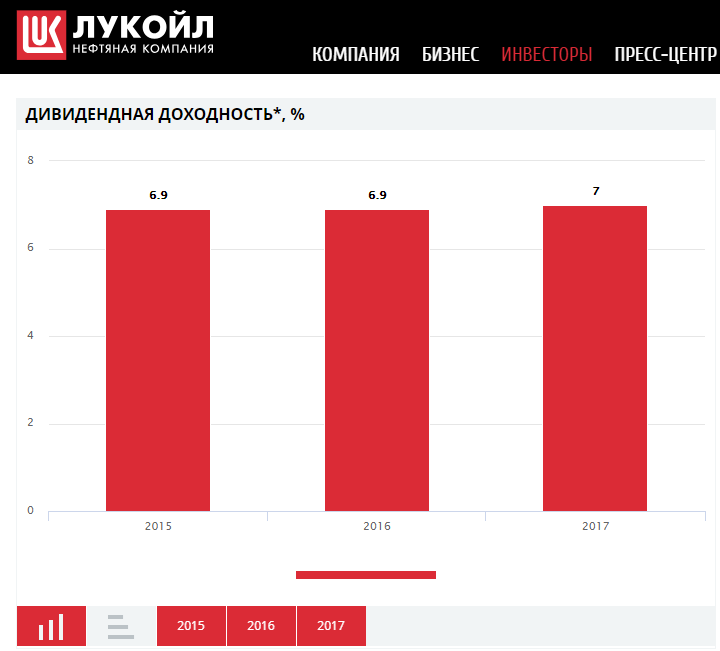

The dynamics of changes in dividend yield can be tracked either on specialized sites (we'll talk about them later), or on the portals of the companies themselves. The figure above shows the change in the company's dividend yield for the latest 3 of the year.

For example, Total Circulation 1 million. Shares, And the company decided to use it for payment $10 million. This means that for each paper there is $10, which its owner will receive. If, at the same time, the value of the share itself at the time of cutoff was equal to $100, then the dividend yield will be 10%.

Payment of dividends on shares may differ from year to year depending on financial results:

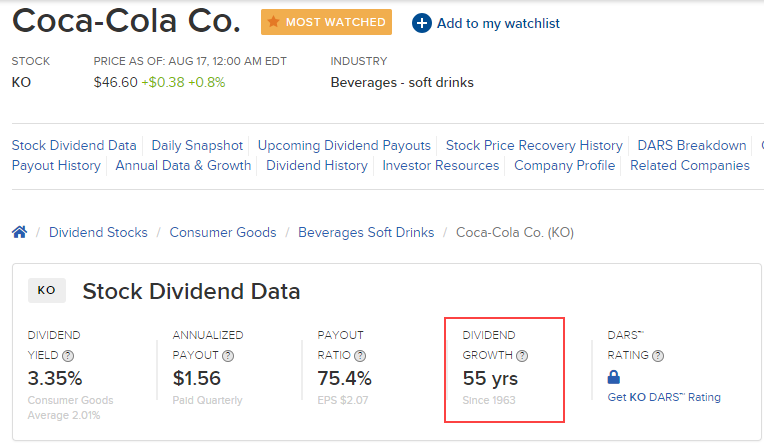

- There are companies, increasing payments for decades. Coca Cola, for example, recent 53 increases the amount, aimed at dividends. In some periods, it takes to 50-60% net profit companies;

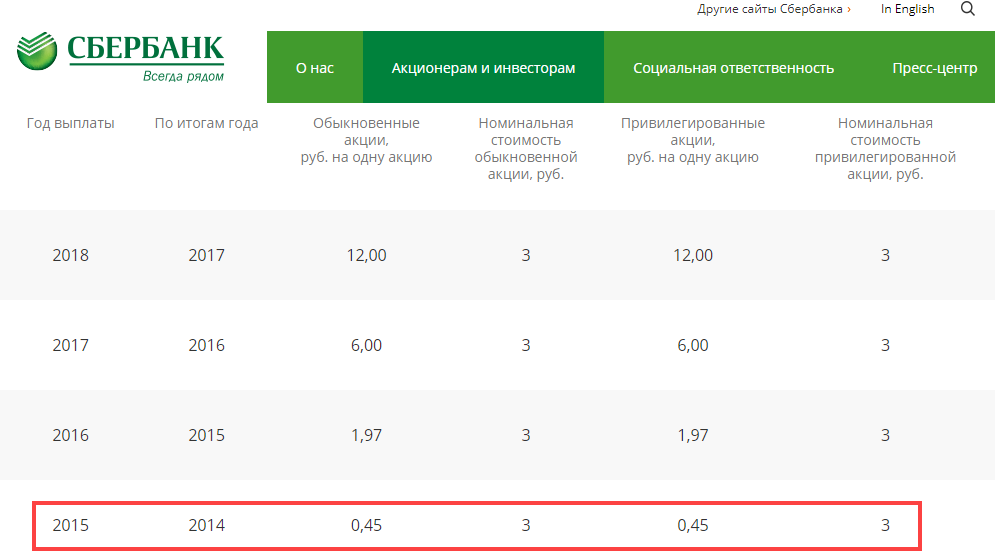

- Below is an example of Sberbank. 2014 the year turned out to be not the best for him in terms of financial performance, therefore, the payout per share fell to 0,45 rubles. But already at the end 2017 G. she Grew to 12 rub., i.e in 26,67 once.

And don't forget, that there are many companies, Those who do not pay dividends at all. They direct all the money they earn into development.. This approach also has a right to exist..

Dates, which an investor should know

This critical point, I will dwell on it in more detail. First, let's figure out the main dates.:

- Closing date of registers – Shares are often bought and sold, not everyone buys them and keeps them for years. A certain date is assigned, and they, who by this day was the owner of the company's securities, will receive dividends. The same, who bought shares even a day later will be able to receive payments only in the next reporting period;

- Segment date "That day, after which the buyers of the shares lose the right to receive dividends.

At the moment, in Russia, bidding is carried out according to the scheme T + 2. That is, if you enter into a deal to buy securities, for example, Monday, then you will actually become their owner only on Wednesday. Beginners often fall into this trap.:

- Imagine the situation - the cutoff date is set for 28 august (Tuesday), a newbie makes a deal on Monday, and is waiting for dividends;

- As a result, he becomes the real owner of the securities only on wednesday, that is, after the cutoff date. Little of, that does not receive the expected income, it also loses on the fall in the value of shares.

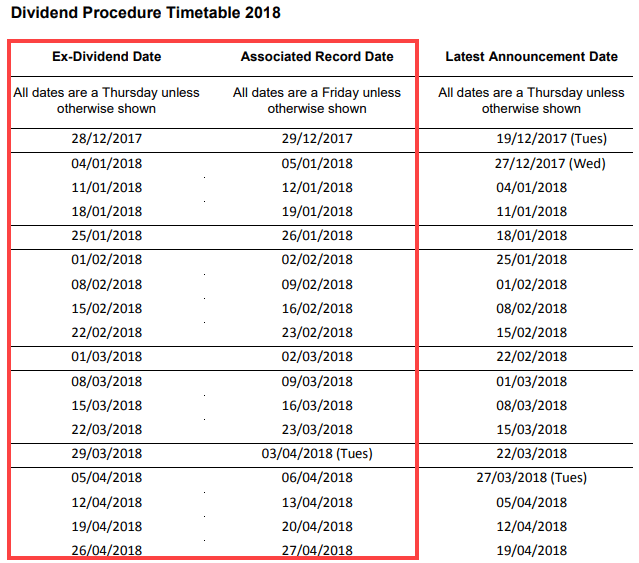

So that the payment deadline is not kept in mind, calendars specifically indicate dates, when securities can be purchased with the expectation of receiving dividends. In the picture above, I have highlighted a couple of examples, where the gap between the cut-off date and the day of the register closing is greater 2 days. This is related to, that the day of purchase falls on either Thursday, either on friday. In this case, by the deadline Added yet 2 Weekend.

To 2 September 2013 G. trades were conducted in order book T0, that is, there was no time gap between the date of the transaction and the delivery of securities to the buyer. Cup T0 was closed on the MICEX on that day.

The transition was gradual, with 25 March of that year TOP-15 securities were traded immediately in T0 order books, T + 2. With 8 July the list was expanded to TOP-30 Papers. In autumn, the trading finally switched to the T + 2 mode..

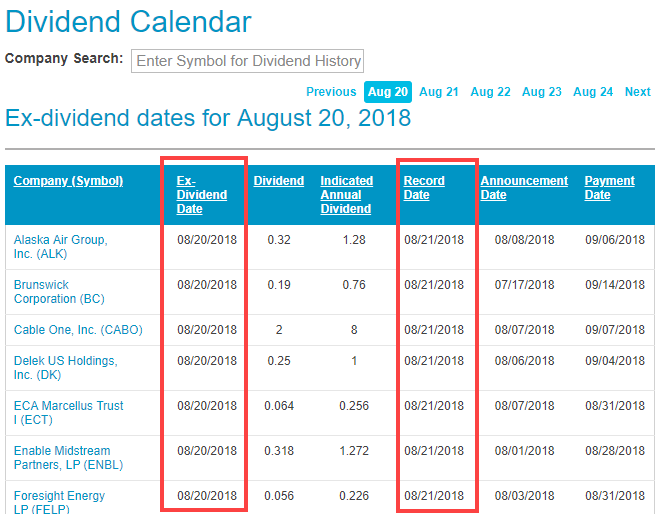

In the United States, By the way, trading is carried out in a similar mode. You can verify this if you go to the calendar of any American exchange and see the cutoff and closing dates of the register.. The picture above shows the dividend calendar from the website NASDAQ.with. It is seen, that the gap between Ex-Dividend Date And Record Date – 1 day.

Under Ex-Dividend Date Understood as a day of trading, when the seller still has the right to receive the dividend. That is, you need to buy the day before this date..

In Europe, the same picture. We are convinced of this, having studied the terms of dividend payments, listed on the website of the London Stock Exchange.

There is another minor difference in the order of payments., adopted in Russia, and in other markets:

- In RF Dividends are transferred to persons, eligible to receive them not later 25 days from the date the register was closed;

- In Europe and the USA This period is equal to 30 Days.

Payment of dividends and share value

I have already said above, that the accrual of dividends is carried out by all, who owned the company's securities by the cut-off date. Logically, that by this date there is a serious interest in the securities, more and more buyers appear, them the cost rises.

But after the cut-off date there are no buyers, there is a drop in quotations. Let's look at an example Severstal:

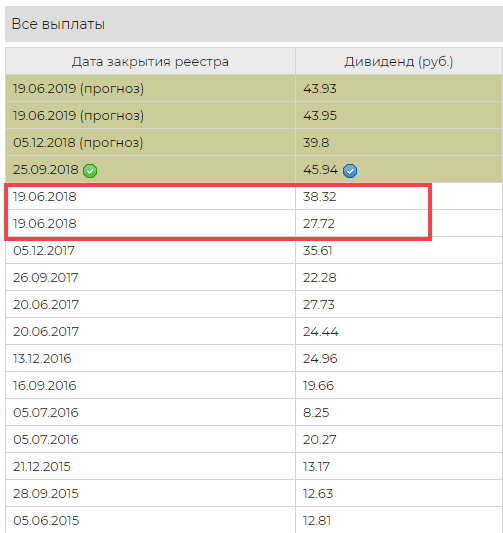

- In the calendar we see, that the last payment date falls on 19 June 2018 G. After this date, it is logical to expect a fall in value, Moving on to schedule;

- 19 June fell on Tuesday, Taking into account the trading mode T + 2 Buy shares on Monday, and you could no longer receive payments. See, that there is a solid gap on the chart, this is due precisely to the payment of "divas", there were no other reasons for the fall at that moment.

Looks impressive, but the percentage decrease was not so catastrophic. The stock price fell by 6,67%. Recovery occurs over time. Knowing this pattern, It is possible to develop a pair of Strategies:

- Hold shares immediately prior to dividend payment, then buy them with a view to recovering the rate. This is how you kill 2 hares - get a fixed income + profit from the growth of securities in general. Consider only, that recovery may not be quick. In the example with Severstal at the end of August, the gap has not yet been closed. As of 20 in August, when buying shares at the end of the payout day, an investor could make a profit due to an increase in the order 83 rubles from one share. Add to this the fixed payment in 27,72 ruble;

- Knowing, how dividends are paid, you can dump securities at a better price and then buy them after the gap down. As a result, you will be able to buy more shares for the same amount or later acquire the same amount., as before sale, and the rest of the money will be your income;

- You can just type the papers right after the cut. The subsequent recovery will allow you to make good money.

For those, Those who trade actively in both directions recommend always consider the date of the closing of the register of owners and the day of the cut-off. In question, when can you sell shares, to receive dividends is the only tough condition.

Methods of receiving dividends and their types

Let's take a quick look at the classification.

Types

Dividends are:

- Intermediate –those, which are distributed before the end of the fiscal year;

- Final – are paid after the end of this period.

Depending on whether, what exactly the remuneration is paid by, allocate:

- Money is the most common type. Shareholders receive remuneration in foreign currency;

- Property – instead of money, the payment is made in shares of the same company. This is stipulated in the company's dividend policy..

By timing Highlighted:

- Annual payment;

- Quarterly;

- Periodicity semiannually, 9 Months.

The division can be made and depending on, on schedule or not Money is paid:

- Regular – distributed according to a schedule;

- Unscheduled or additional – Occasionally, in case of particularly good results and the formation of an excessive amount of funds, companies pay money outside the established schedule;

- Liquidation – if the company has ceased to exist, all the money, who can be bailed out when selling property, distributed among shareholders.

Methods of obtaining

As for that, how Dividends are paid to Russian companies (and everyone else too), then the following options are available:

- If you work through a broker, then they will be enrolled to your account. Conveniently, that in this case the company will immediately deduct the tax, it takes several weeks to wait for the receipt of funds;

- It is possible to get money through a bank branch, to a card account and even by post. In this case, you will have to think about taxes yourself..

Immediately after, how will the cut-off date go, money will not come to you. This is assigned to 25 days, Usually you have to wait 2-3 weeks.

Websites useful for the investor

Think, so far everything looks not very complicated, but the question remains, where to get information By company, paying dividends, when the payment takes place and other nuances. Below I will give a selection of sites useful for an investor., I recommend adding them to your bookmarks.

Investing

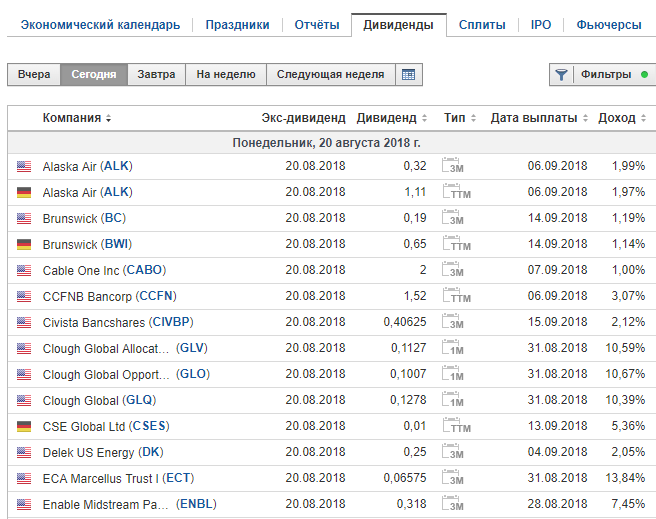

This link Calendar available for investing.com. No dividend cutoff is indicated, and the date ex-dividend (what is it - discussed above). Information on the type of payments is also displayed, Date, when it will happen and what income is expected.

Don't confuse this calendar with a screener. There is no abundance of filters here, in the settings you can only select the sector, in which the company operates, Country, weight.

I recommend using the Investing calendar for keeping track of important dates., nothing more.

Detailed information is available for the selected instrument, including statistics on dividends for previous reporting periods. The figure above shows the indicators for Johnson & Johnson.

Etfdb

Every investor should be familiar with this service.. The site has material about investments in ETF, it discusses the principle of working with etfdb.com in more detail. There is a screener with a mass of filters, in addition, our own ratings of the best companies are published, paying dividends, making it easier to find.

As the name suggests, The site is dedicated to Exchange traded funds. Also here you can get the most detailed information on the funds of the USA and the rest of the world.. In the ETF researchthere is a separate item, dedicated to investment funds, paying dividends.

There is an item in the local screener, concerning dividends. You can specify the range of desired values and select the regularity of payments, set time period, when profits should be distributed among investors.

Examples of ETFs and stocks for a dividend portfolio can be viewed in a separate article.. I will not dwell on this now.

E-disclosure center

Detailed database, which collects information on Russian companies. Again– no convenient screener, On the other hand, they are displayed All news on the Russian stock market.

The registration address is displayed for each company, contacts, Full name of the head, and under this window is a list of news. Here the data is not only related to the distribution of dividends, but in general all the information, related to her work.

In the picture above, I have highlighted the item, concerning dividend payments. If you work with the Russian market, then the Disclosure Center can be recommended for work.

The principle of operation is simple - enter the name of the company in the search bar, choose the one you need and work with the news.

MOEX

Moscow Exchange website It is also suitable for monitoring information on Russian companies. Separate screener, to filter companies by dividends no, but I would advise you to consider the MICEX as a source of information on the companies you are interested in.

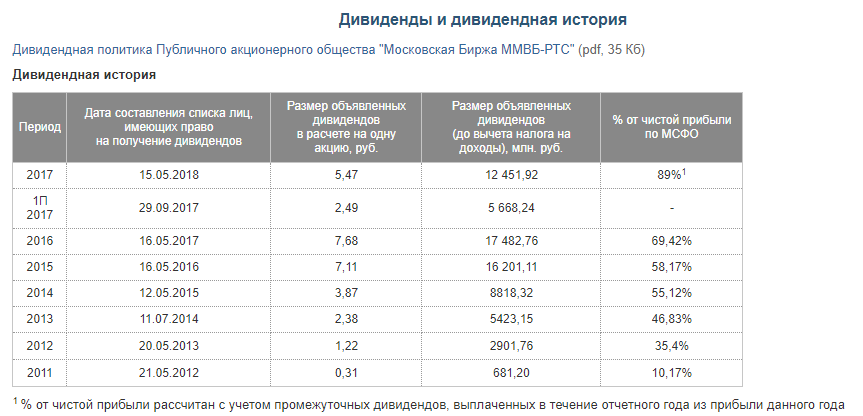

Please note, what MICEX itself pays dividends, I have given her policy in this matter in the picture above.

The site displays information not only on the stock market, but also in currency, urgent, Commercial. There is information here not only on stocks, but also on bonds: when and how much was released, is the issue planned in the future.

If you are a beginner and still "swim" in these terms, I recommend that you familiarize yourself with other materials on the site. It is advisable to read the post about, What's the difference stock from bonds and other articles for beginners.

Dohod.ru

This link Available section, where you can work with Russian companies. They can be filtered by:

- Sector, where work is being done;

- Payment period;

- Capitalization;

- You can also set up displaying only securities with stable dividends, with a certain amount of aggregate payments for the year and recommended charges.

If you click on the sign "+»Next to the company, a window with basic statistics will open.

If you go to the section with detailed information on it, then you can also get acquainted with history of payments in past. Everything is very clear, conveniently, there is data in the form of a graph, so I use dohod.ru almost always when working with the Russian market. The possibilities of the service are not limited to this., but we'll talk about it in more detail another time.

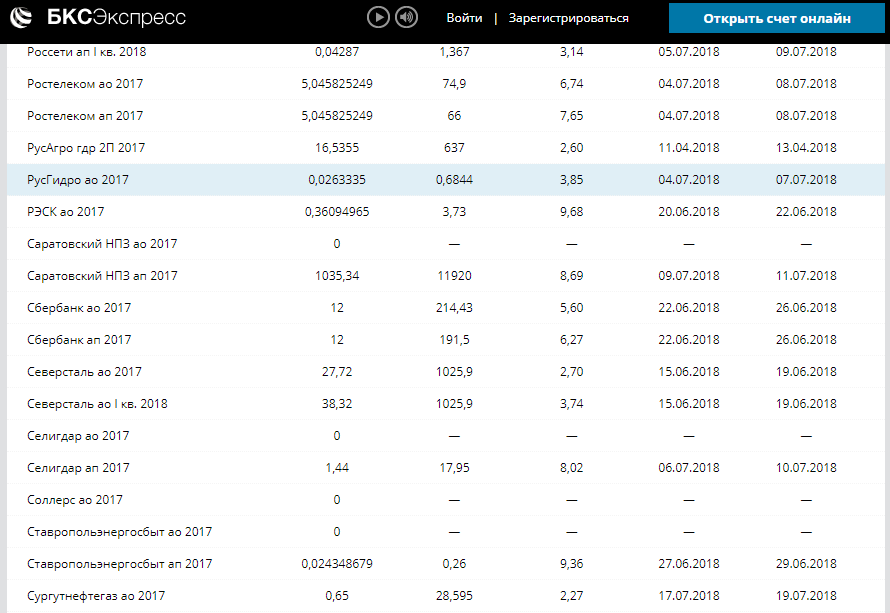

BCS Express

Broker BCS has its own dividend payment calendar. It can be used, If you need to quickly Evaluate the dates and decide, do you manage to buy paper before the cut-off date or not. You can get acquainted with the calendar here.

If, for example, necessary to find out, when Sberbank pays dividends in 2018 year, just look in the calendar for the name of the company and look at the closing dates of the register, cutoffs and planning purchases.

Justetf.com

The name shows, what is the resource of ETF funds devoted to?. Outwardly, it looks a bit like Etfdb, but there are fewer positions in the screener. This site will suit those, who works closely with European Market.

As with Etfdb, Here are the parameters for searching for funds on the left side. Item, concerning dividends, is located in the tab Use of Profit.

Otherwise, everything is standard - we get a list of ETFs, matching our criteria. By clicking on the name of the fund, go to information about him. There is also statistics on dividend payments..

In addition, I recommend subscribing to the news LSE (London stock exchange). This is useful when dealing with Russian stocks..

How much money is needed to buy stocks

Let's work with a specific example. Initial data:

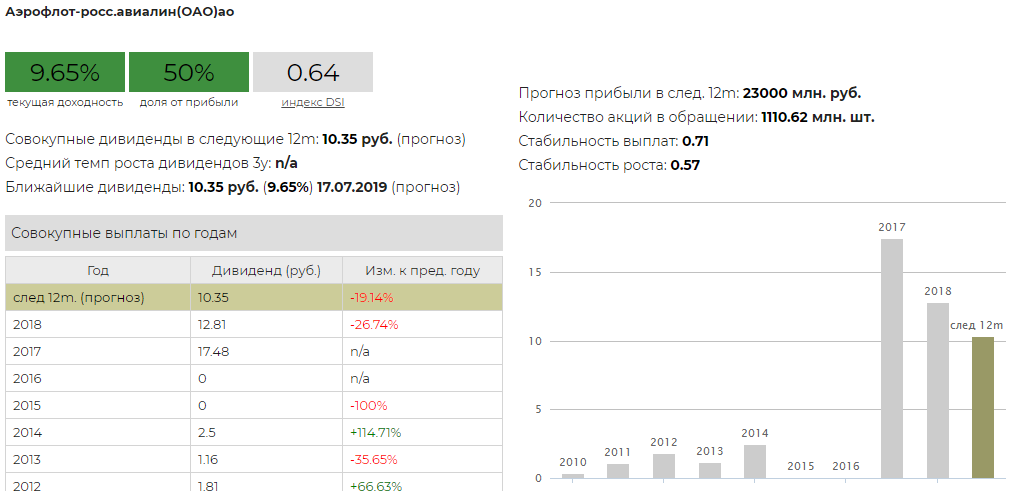

- Company Income Aeroflot will be 23 billion. rubles at the end of the year, goes to dividends 50% from net income;

- Quantity Simple Papers is 1,11062 billion. Let's complicate the task a little and imagine, that Aeroflot has 100 million. preferred shares, According to them, the income is equal to 20% of that amount, which is distributed among shareholders.

We own 100 thousand. plain papers And 25 thousand. Privileged, you need to calculate the payment at the end of the year. If you don't know, how to buy shares, Read my educational program – stock trading for beginners. Let's move on to solving the problem:

- Let's start with Privileged Papers. Total shareholders will be paid 0,5 X 23 = 11,5 billion. rubles;

- Preferred shares will go 0,2 X 11,5 = 2,3 billion. rubles. On 1 paper will be credited 23 ruble. Our income will be 25000 X 23 = 575 thousand. rubles;

- Now we perform the calculation for Conventional Shares. They account for 9,2 billion. rubles, and on 1 paper - by 8,28 rub. We're going to get 828 thousand;

- Total expected income – 828 + 575 = 1,403 million. rubles.

In the example above, the following were taken from the Real Aeroflot's performance, I only added preferred securities for clarity of calculations. Now let's work with smaller amounts. Let's calculate, how much money you need, to get income in 360 thousand. in year (30 000 rubles per month) for the same Aeroflot. Now let's drop the privileged papers, and we will perform the calculation based on the real statistics of the company:

- Expected income per 1 paper will be 10,35 rubles;

- Our goal is to make a profit in 360 thousand. rub. in year, that is, we must acquire 360000/10,35 = 34782,6 Shares;

- Lot can't include less than 100 Shares, round off the resulting number, need to buy 34800 papers, or 348 lots, Everyone is worth it 10900 rubles;

- Total will have to be spent 348 X 10900 = 3,793 million. rubles. Please note - you can buy company securities before the cut-off date, receive dividends, wait for their value to recover and sell, returning the amount in a couple of months.

Using the same scheme, you yourself can estimate your expenses when working with American securities, European companies. It's simple math.

With regard to the purchase of shares directly, then you can work through:

- Interactive brokers. A reliable choice for World markets;

- BCS. The best choice for Russian market.

Taxes and other costs

It is better not to try to circumvent the income tax on dividends, On the other hand, you can minimize Its size. Below I will list the features of taxation in this case:

- If dividends are paid in shares, then you pay nothing at all, until you exchange them for Fiat And you won't take it out;

- Broker - tax agent, so if you work through it, then all fees automatically will be paid at the time of withdrawal;

- The tax is levied on the final result for the year, so if the losses offset your gains, then you owe nothing to the state. If the tax has already been paid before, it will be returned to the investor;

- When investing in American securities, you avoid double taxation. The United States levies a flat tax 10%, it is paid by the IRS. Since in the Russian Federation the rate is accepted in 13%, The only thing left to do is pay the difference;

- The exception is investments in REIT and a narrow range of papers, for which the tax is 30%;

- You can use investment accounts. Along IIS 1-it type tax deduction is up to 52 thousand. rubles (13% of the maximum deposited amount in 400 thousand. rubles per year.). IIS type 2exempts from paying income tax, but it becomes more profitable than the first type with the profit from 1 300 000 rubles per year.

Completely avoid having to pay 13% NDFL it is forbidden. Small amounts may be overlooked, but I do not recommend saving on this. There is a risk of future problems.

Examples of generous companies

I will give a list of some of the most "generous" companies in the Russian Federation and the USA:

- Lukoil – is expected by the end of the year to be about 240 rub. per share. On average for the last 3 years dividends grew by 17,48%;

- Norilsk Nickel – pay more per share 500 rubles, Divas are also growing, although the company warns, what can reduce them in the future;

- Child's world – all profits are directed to dividends. Order yield 9-10%, pay for each share 6-8 rubles;

- Gazprom – with a yield of the order of 5,7% and dividends in 16,51% profit does not apply to leaders. I mentioned him because of the Reliability. At least because of this, Gazprom should be included in the portfolio.

From foreign I'd like to highlight Euromoney, WS Atkins, Spectris, PZ Cussons, Burberry, Sage, Reckitt Benckiser.

Summing up

If you are interested in earning income from dividends, I recommend adhering to the following rules:

- Try to buy stocks at Minimum price;

- The backbone of the briefcase must be reliable companies;

- Ideally, the company should constantly increase dividends, have a stable, reliable business strategy. Example– Coca Cola, which with 1963 G. increases payments annually;

- Diversify your risks.

AND constantly Track, how the financial performance of companies is changing. It is a variable, so there are no guarantees, that future payments will be as high, like a year ago. You need to keep your finger on the pulse.

Most likely, you still have questions after reading this material. You can ask them in the comments., I am always happy to share my own experience, so don't hesitate. And don't forget, by subscribing to my blog updates, you will always be notified when new content is released. I recommend not to miss them. On this I say goodbye to you, All the best and wish you profitable investments!

Original article : https://guide-investor.com/fondovyj-rynok/dividends/