Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars. Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

This issue will be devoted to reporting reviews, since almost all companies in the US release their reports this week.

Coca-Cola (NYSE: KO) presented a report on revenue growth of forty-two percent, and profits increased by forty-nine percent, largely driven by non-core one-time gains. Basically, operating profit of the company increased by fifty-two percent. In addition, Coca-Cola improved its earnings-per-share growth forecast.: growth is expected this year from 13 up to fifteen percent, and before that, an increase of up to ten percent was implied.

Growth is likely, apart from everything else, and therefore, that the company was able to overcome the restrictions of quarantine time and increased the market share of sales of drinks as for drinking at home, as well as outside, which became likely largely due to the opening up of economies. So that, unless there is a new hard quarantine in the future, then we can expect better results.

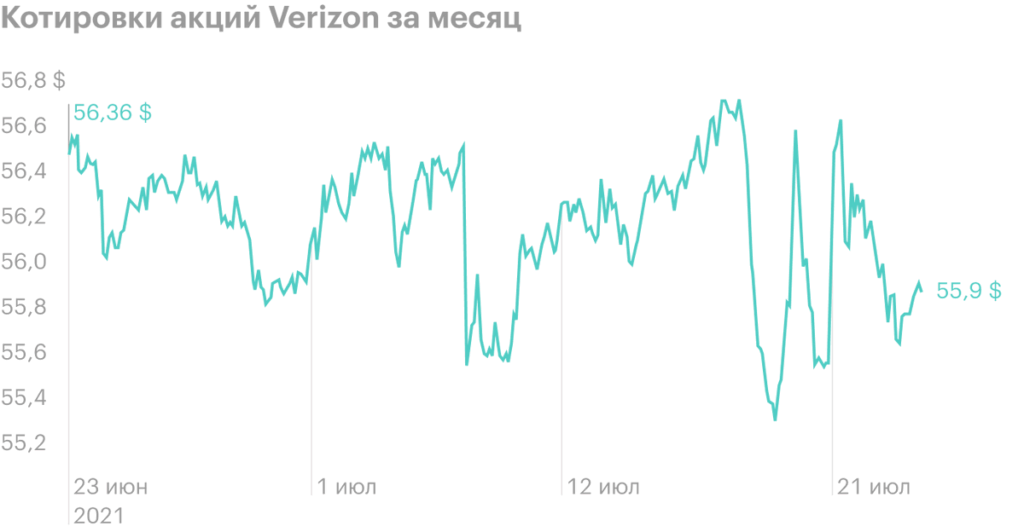

Verizon (NYSE: VZ) presented a report on revenue growth from 30.447 to 33.764 billion. Profit increased from 4.839 to 5.949 billion. Indicators turned out to be better than expected, the company also improved its forecast for the year: if profit was previously expected in the region of 5-5.15 $ per share, now it is expected about 5.25-5.35 $ per share.

Of the other key points of the report:

- the company plans to spend 19.5-21.5 billion on the renewal of fixed assets this year, which is noticeably higher, than in 2020 - 18.19 billion. This is good news for both telecommunications equipment and component suppliers., as well as for REIT, leasing space to telecom companies;

- advertising revenue increased by 50%. Understandably, what is recovery growth, but when compared with the same period 2019, then ad revenue increased by 13,1%, which is very good. This can be considered a positive signal for all issuers., working in traditional advertising.

AT&T (NYSE: T) increased revenue by 7,6%, profit increased from 1,2 up to 1.5 billion. Such a large profit was largely due to the sale of non-core assets. But investors should also note the growth in the number of subscribers to the company's services., including HBO Max streaming service. The results were better than expected.

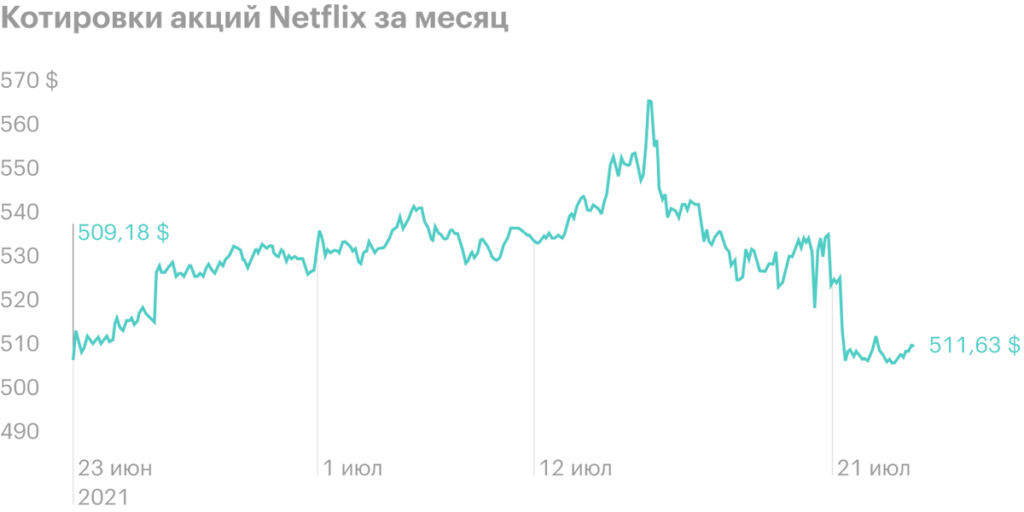

У Netflix (NASDAQ: NFLX) revenue increased by 19%, profit increased from 720.196 million to 1.353 billion. The number of subscribers grew by 1.51 million people, which is more than a million expected by the company.

It would seem that, this is a great result, but investors are worried, Netflix lost 400,000 subscribers in the US and Canada last quarter. For the next quarter, the company expects to add subscribers in the region of 3.5 million people - much less than the 5.6 million expected by analysts..

What happened to the company, what should have happened: coronavirus problems have led to a drop in the pace of content production, and this is, in its turn, led to the outflow of the most sophisticated and demanding audience of the company - that, what lives in North America. The proliferation of competing Apple services also played a role., Disney, HBO, Amazon. All these companies are actively increasing spending on content production., and users have more choice.

Texas Instruments (NASDAQ: TXN) reported an increase in revenue 41% and arrived at 40%. Taking into account the rush demand for semiconductors, further growth of the company's financial indicators can be expected.. But investors are disappointed with the company's guidance for the third quarter.: expected revenue in the range of 4.4-4.8 billion, which is not much more than the 4.4 billion expected by analysts. Although this is more of a stone in the garden of analysts, than companies.

У Intuitive Surgical (NASDAQ: ISRG) revenue increased from 1.292 to 1.464 billion, and profit - from 426.3 to 517.2 million. This was slightly helped by the company's non-core one-time income.. Now the company's business looks very serious, but it is necessary to take into account the fact, that in the US, many hospitals speak out against the company and accuse it of imposing on them the purchase of expensive parts and their services. And besides this, that there are cheaper options on the market.

Specifically, the ISRG is accused of, that she imposes harsh conditions on customers. For example, limited number of tool applications, even if they are in perfect condition. And in one case, the company turned off its surgical robot right during the operation.. All in all, the development of this story can have a very bad effect on quotes.

At Intel (NASDAQ: INTC) revenue slightly decreased - from 19.7 to 19.6 billion, and profit decreased by 1%. Surprisingly, this result turned out to be better than expected.

Abbott Laboratories (NYSE: ABT) increased revenue by 39,5%, and the profit increased by 121,5%.

У Danaher (NYSE: DHR) revenue increased from 5.297 to 7.218 billion, and profit - from 927 million to 1.785 billion.