Companies are required to solve everything with the support of AI. American doctors are shrinking for good and bad for telemedicine companies. Bangladesh helps out clothing brands. Impure hydrogen threatens to ruin stocks of green businesses - and everyone else. There will be new laws in China - and financiers will not like them. KPMG points out, that fintech and crypto are a currency business.

Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars. Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

More AI needed

Axios website gets early access to yet-to-be-released report from IT consultancy Cognizant, which was dedicated to the use of artificial intelligence by the corporate sector. The most fascinating thing in the report is the results of a survey of 1000 top-level managers about, how they use AI to make business decisions. As found, only twenty percent of companies use this technology to its fullest. According to Cognizant, they, who doesn't use AI a lot, experience the fate of falling behind rivals, who use AI.

Basically, something from Cognizant was worth the wait: the company is engaged in high-tech consulting and it is in its interests to produce analysis, which tells, how is it fundamental to take on arms AI, - or what they are writing about now.

Fanning hysteria in the areas discussed has a positive effect on company revenues, as far from IT managers of organizations eventually come to the company and demand to help them in the difficult task of receiving new technology. However, it must be emphasized, that hysteria blows up well enough: there is already a consensus among large organizations on the introduction of AI, complex algorithms and calculations in the life of the enterprise. The question here is only in the speed of adoption of these technologies..

In practical terms, this means, that all IT companies, working in the field of AI, can get a lot of attention from investors. This and companies in the field of machine learning, and just businesses, who began to master this technology before others and now trumpet it everywhere.

Fewer medical practices needed

American NGO "Institute for the Protection of Physicians" (Physicians Advocacy Institute) выпустила исследование COVID-19’s Impact On Acquisitions of Physician Practices and Physician Employment 2019—2020, about changes in the medical services market in the USA as a result of the pandemic.

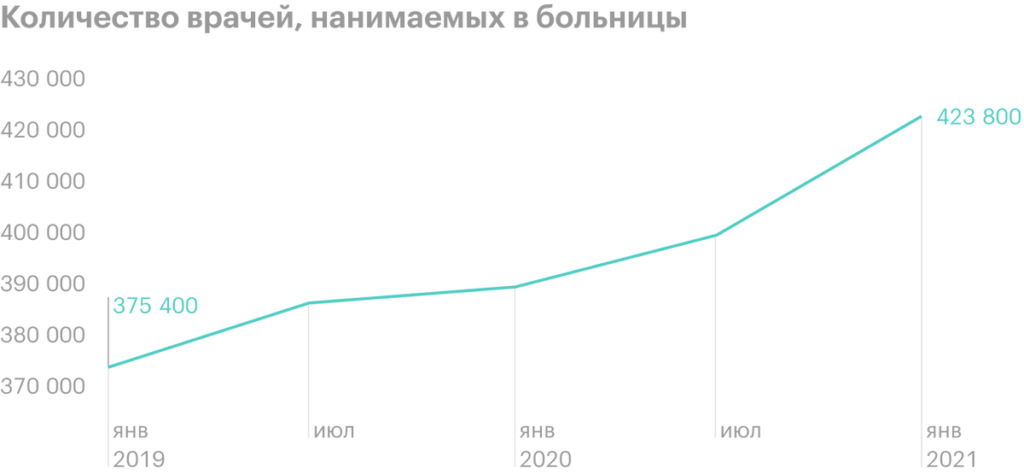

According to the research, 48 thousands of American doctors from January 2019 to January 2021 closed their private practice and switched to work in large hospitals. This trend existed even before the coronavirus crisis.. But a pandemic, which significantly limited the mobility of the population in the United States and reduced visits to doctors, led to this, that the content of their own practice became too expensive for many doctors and they were forced to go to work in large medical institutions.

The report does not make any major predictions., but, according to him, the trend towards industry consolidation around large hospitals and hospital chains in the US is very strong, because working conditions for independent medical practitioners have been very difficult before, and now it has become very difficult for small practitioners.

For telemedicine companies, this can have ambiguous implications.. On the one side, this greatly increases the bargaining power of companies: the remaining and still numerous independent practitioners could be subject to less favorable terms, taking advantage of their desperate situation.

On the other hand, the exodus of doctors to major hospitals will eventually lead these telemedicine companies to communicate with hospitals. And hospitals in such a situation can negotiate better conditions for themselves compared to those, claimed by small independent practitioners. Or worse, large networks will start developing their own telemedicine platforms.. However, it can also have a positive effect.: a sufficiently large network of hospitals can afford to buy a telemedicine company, provided, that it will be more or less cost-effective for the network buyer.

However, it's all a hypothesis - what will happen next, we will see in the coming years.

Need more openings and fabrics

Bangladesh government opened up most of the economy, including textile factories, despite the rise in cases and deaths from the coronavirus. This is good news for all clothing brands without exception.: the country is the center of the textile industry of the whole world. Opening up Bangladesh will allow apparel manufacturers to curb rising costs and, may be, even cut them down a lot.

However, an increase in mortality can lead to disruption of the work of textile factories even without quarantine - but is it so, we can only see in the future.

Less hydrogen needed

How Green is Blue Hydrogen came out last week, dedicated to the environmental friendliness of hydrogen, which is considered a clean fuel.

The study authors calculated, that hydrogen ultimately turns out to be not quite an environmentally friendly type of fuel: hydrogen needs to be extracted from natural gas and it takes so much energy to produce it, that the result eliminates the entire environmental effect from the further use of hydrogen as a fuel. Gas production releases methane into the atmosphere, and the hydrogen production process itself generates a large amount of carbon emissions. Is there some more, Really, green hydrogen, but many years will pass, until it can be fully used.

Revelations about the non-environmental nature of hydrogen are bad news for all issuers, developing in this area. Investors are buying stocks in droves in anticipation of, that hydrogen will be the fuel of the future, - and suddenly it turns out, that "the king is not real".

Looking wider, then the example of this study can be used by interested organizations in the future. Mainly for that, to promote the idea of deindustrialization of the economy and voluntary contraction of the economy under the pretext of, that “since there can be no eco-friendly growth of the economy, then there is no need for economic growth”.

This idea was prompted by a research note from the financial company Jeffries. The author of the note seriously discusses the need to reduce consumption and slow down economic growth for environmental reasons and explains to investors, why ecology should be paramount in their investment decisions. Understandably, that this is a radical view, but the fact, that such ideas are seriously expressed by people, claiming to manage large volumes of financial flows, leads to certain thoughts. In practical terms, this could mean, what, probably, the market is waiting for a new wave of ESG activity with a boycott of non-environmentally friendly companies and at least the withdrawal of funds from the markets of developing countries. The latter is extremely logical within the framework of stopping growth and reversing it “for the sake of the environment”. In developing countries, economic growth in 100% cases means monstrous damage to the environment.

Need more government regulation

Chinese government publishes five-year plan for the development of the country's legal system. Actually, the plan itself implies the development of the “rule of law” in the PRC. This is a very ambitious task for the country., where the richest people can suddenly disappear for a long time after a quarrel with the government, to then suddenly appear without explaining the reasons. But as for the implications for the exchange, then everything is rather bad: the plan talks about the fight against monopolies and increased regulation of the technology sector. Top Chinese issuers are just monopolies, What does increased regulation look like?, we could recently see in the example of TAL. In this regard, I would expect the appearance of news, which will be negative for the shares of Chinese companies. All this is happening in the context of the escalation of the conflict between China and the United States., so, I think, tightening the screws on Chinese regulators is more or less a long-term trend.

Less cash needed

Auditing company KPMG has released a report Pulse of Fintech H1’21, dedicated to the situation in fintech in the first half of 2021. There's a lot of interesting stuff there., but especially for you highlight the main points.

The volume of investments in fintech companies reached $98 billion in the first half of the year. This is very good news for all fintech companies with a capitalization of up to 10 billion: against such a background, their purchase by someone larger becomes a very likely option. And in principle, the interest of big capital in fintech startups can indirectly lead to an increase in investor attention to all fintech companies on the stock exchange. The vast majority of investors do not have physical access to investments in startups at an early stage, but some Visa or Square are quite available for investment here and now.

The volume of investments in cryptocurrencies and blockchain has already exceeded the level of 2020 twice, reaching $ 8.7 billion, even though 2021 isn't even over yet. This is important for two reasons.

Firstly, it's good for those issuers, who work directly with cryptocurrencies, since the interest of large investors in this area is obvious. For example, Coinbase is seen as a prominent beneficiary. By the way,, the company plans to focus on servicing institutional clients, which already account for ⅔ of trades on its platform.

Secondly, this can break off all those companies, who plans to somehow develop this technology or even just talks about it, - how can you not remember the history of Kodak. However, news about, that the AMC cinema chain will accept bitcoin as payment, did not help AMC shares rise. So that, maybe, I overestimate the degree of interest of the retail investor masses in this technology.